-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: FI Markets Expected Even Weaker Retail Sales?

EXECUTIVE SUMMARY

- Fed Chairman Powell on Economic Education Townhall

- Palm Beach County, FL Declares State of Emergency due to Covid spread

- TALIBAN HOLDS FIRST PRESS CONFERENCE AFTER AFGHAN FALL, Bbg

- TALIBAN: 'WE HAVE LIBERATED THE NATION FROM THE OCCUPATION', Bbg

- TALIBAN SAY THEY'VE PARDONED ALL WHO FOUGHT AGAINST THEM .. WILL ASSURE SECURITY OF KABUL, Bbg

US

FED: Fed Chair Powell discussing importance of economic education and role of the Federal Reserve with students and educators at today's townhall meeting.

- Powell touched upon jobs market: "public-facing jobs in the service sector as I mentioned, travel, leisure, hospitality, those are disproportionately held by women, by lower-waged earners and by people of color."

- "It may be that some of these people will have a harder time finding their way back into the workforce without more education and training and, you know, we think it is important that we continue to support those people as they find their way back into the workforce."

- The "financial system, payments, all of that, most people's financial lives, they're fully digital. Most of that digital finance, it takes the form of a bank account. You interact with the bank account digitally, of course it is ensured up to $250,000 the with deposit insurance and more and more payments are taking place digitally and less and less in the form of digital currency.

- Powell said "that's why central banks all over the world are looking at the question of should they create a digital form of currency because right now we provide -- we only provide digital currency for interbank transactions in the form of reserve, we provide physical cash for the public."

- However, "we don't actually provide a digital currency for the public and it is a very interesting and challenging question whether we should, of course, there are many, many, you mentioned a number of credit cards, debit cards, bank accounts, all of those things that amount to digital forms of private money. That's something we're looking at now."

US TSY SUMMARY: Buy Rumor/Sell Fact on Weaker Than Expected Retail Sales?

Rates trade weaker after the bell, off first half lows to near middle of session range. Decent overall volumes for a summer session (TYU1>1.2M), rates moved off lows as equities traded weaker in the second half (tech and autos weighing).- Early rates sell off after weaker than estimated Retail Sales (-1.1% vs. -0.3% est) had desks scrambling to come up with viable reasons for the move. Buy the rumor/sell the fact?

- Though retail sales prior month revised slightly higher (1.6% from 1.3%), unlikely driver given the broad miss on current read. Some desks posited market had anticipated an even greater miss due to effect of Delta-variant.

- Two-way swap tied flow amid better paying as spds forge directionally wider with Tsy yields. That said, corporate issuance has been lagging this week compared to last week's $40B in first three days. Some pre-auction short setting reported ahead Wed's $27B 20Y bond auction.

- Strong IP, Cap-U underscored first half weakness: Tsys extend sell-off through early evening levels following stronger than expected Industrial Production (+0.9% vs. 0.5% est; June uprev), Capacity Utilization (76.1% vs. 75.7% est). Latest 10YY 1.2717% high, 30YY 1.9352% high. * Additional flow includes option-tied hedging weighing on 5s-10s, dealer selling 10s-30s.

- The 2-Yr yield is up 0.2bps at 0.2113%, 5-Yr is up 0.2bps at 0.7635%, 10-Yr is down 0.7bps at 1.2583%, and 30-Yr is down 0.8bps at 1.9189%.

OVERNIGHT DATA

- US JUL RETAIL SALES -1.1%; EX-MOTOR VEH -0.4%

- US JUN RETAIL SALES REVISED +0.7%; EX-MV +1.6%

- US JUL RET SALES EX GAS & MTR VEH & PARTS DEALERS -0.7% V JUN +1.3%

- US JUL RET SALES EX MTR VEH & PARTS DEALERS -0.4% V US JUL +1.6%

- US JUL RET SALES EX AUTO, BLDG MATL & GAS -0.6% V JUN +1.5%

- US JUN BUSINESS INVENTORIES +0.8%; SALES +1.4%

- US JUN RETAIL INVENTORIES +0.3%

- US NAHB HOUSING MARKET INDEX 75 IN AUG

- US NAHB AUG SINGLE FAMILY SALES INDEX 81; NEXT 6-MO 81

- FOREIGN HOLDINGS OF CANADA SECURITIES +19.6B CAD IN JUN

- CANADIAN HOLDINGS OF FOREIGN SECURITIES +28.1B CAD IN JUN

- CANADA JULY HOME STARTS -3.2% TO 272,176 ANNUALIZED PACE

- ECONOMIST MEDIAN WAS FOR 279K PACE OF STARTS IN CMHC REPORT

MARKET SNAPSHOT

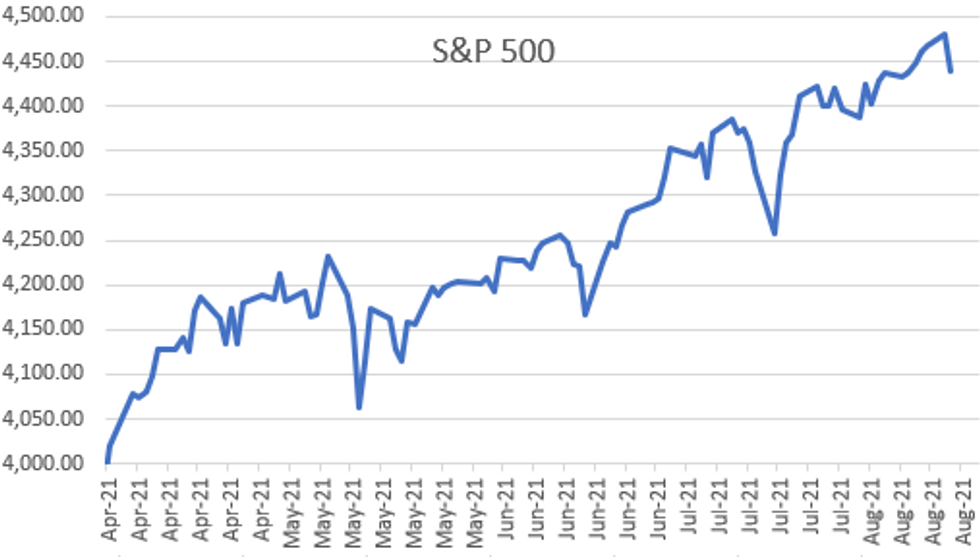

Key late session market levels:- DJIA down 325.01 points (-0.91%) at 35304.5

- S&P E-Mini Future down 37 points (-0.83%) at 4437.5

- Nasdaq down 145.4 points (-1%) at 14649.11

- US 10-Yr yield is down 0.7 bps at 1.2583%

- US Sep 10Y are down 2.5/32 at 134-8

- EURUSD down 0.0066 (-0.56%) at 1.1712

- USDJPY up 0.33 (0.3%) at 109.57

- WTI Crude Oil (front-month) down $0.66 (-0.98%) at $66.61

- Gold is down $4.81 (-0.27%) at $1782.64

- EuroStoxx 50 down 6.04 points (-0.14%) at 4196.4

- FTSE 100 up 27.13 points (0.38%) at 7181.11

- German DAX down 3.78 points (-0.02%) at 15921.95

- French CAC 40 down 18.93 points (-0.28%) at 6819.84

US TSY FUTURES CLOSE

- 3M10Y -0.755, 118.649 (L: 114.397 / H: 120.412)

- 2Y10Y -0.513, 104.669 (L: 101.175 / H: 105.538)

- 2Y30Y -0.762, 170.622 (L: 167.702 / H: 172.049)

- 5Y30Y -1.081, 115.277 (L: 114.954 / H: 117.146)

- Current futures levels:

- Sep 2Y down 0.625/32 at 110-8.375 (L: 110-08.125 / H: 110-09.25)

- Sep 5Y down 2.5/32 at 124-4 (L: 124-02.25 / H: 124-10.5)

- Sep 10Y down 3/32 at 134-7.5 (L: 134-05 / H: 134-19.5)

- Sep 30Y down 2/32 at 165-2 (L: 164-23 / H: 165-31)

- Sep Ultra 30Y steady at at 199-11 (L: 198-25 / H: 200-27)

US EURODOLLAR FUTURES CLOSE

- Sep 21 -0.003 at 99.873

- Dec 21 -0.005 at 99.815

- Mar 22 +0.005 at 99.850

- Jun 22 -0.005 at 99.80

- Red Pack (Sep 22-Jun 23) -0.03 to -0.01

- Green Pack (Sep 23-Jun 24) -0.025 to -0.015

- Blue Pack (Sep 24-Jun 25) -0.01 to -0.005

- Gold Pack (Sep 25-Jun 26) -0.01 to -0.005

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00037 at 0.07788% (+0.00025/wk)

- 1 Month -0.00200 to 0.08650% (-0.00625/wk)

- 3 Month +0.00275 to 0.12725% (+0.00300/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00087 to 0.15625% (-0.00038/wk)

- 1 Year -0.00125 to 0.23550% (-0.00325/wk)

- Daily Effective Fed Funds Rate: 0.10% volume: $66B

- Daily Overnight Bank Funding Rate: 0.08% volume: $252B

- Secured Overnight Financing Rate (SOFR): 0.05%, $906B

- Broad General Collateral Rate (BGCR): 0.05%, $377B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $362B

- (rate, volume levels reflect prior session)

- TIPS 7.5Y-30Y, $1.201B accepted vs. $2.780B submission

- Next scheduled purchases

- Wed 8/18 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Thu 8/19 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

- Fri 8/20 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION, Holding Above $1T

NY Fed reverse repo usage climbs to $1,053.454B from 70 counterparties vs. 1,036.418B on Monday. Record: $1,087.342B on Thursday, Aug 12.

PIELINE: Baidu US$ Roadshow

Baidu US$ roadshow about the only thing of note Tuesday, issuers plying sidelines after much better placement last week: $40B from Mon-Wed.

- Date $MM Issuer (Priced *, Launch #)

- 04/17 $Benchmark Baidu roadshow

- $4.05B Priced Monday

- 04/16 $1.25B *Athene Global Funding $550M 3Y +50, $350M 3Y FRN/SOFR+56, $350M 7Y +95

- 04/16 $1.2B *Southwest Energy 8.5NC3.5 5.37

- 04/16 $1B *Pfizer 10Y +53

- 04/16 $600m *Norfolk Southern 30Y +103

- 04/16 $Benchmark HDFC Bank inaugural 5Y roadshow

EGBs-GILTS CASH CLOSE: Afternoon Reversal

Yields reversed higher in afternoon trade, nullifying strength in the morning and leaving Gilts and Bunds largely unchanged Tuesday.

- European FI largely followed Treasuries in the afternoon - counterintuitively, weaker-than-expected US retail sales data saw Global core bonds sell off, with dollar strength.

- Gilts outperformed with bull flattening in the UK curve, while periphery spreads ended marginally wider.

- Strong auctions: UK sold GBP2.0bln of 25-year gilt, Germany E6bbln of Schatz.

- UK employment and Eurozone GDP data were in line with expectations.

- Wednesday's highlights: UK July inflation data and 30Yr Bund supply.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.3bps at -0.736%, 5-Yr is down 0.2bps at -0.729%, 10-Yr is down 0.1bps at -0.47%, and 30-Yr is unchanged at -0.02%.

- UK: The 2-Yr yield is up 0.8bps at 0.152%, 5-Yr is unchanged at 0.302%, 10-Yr is down 0.8bps at 0.565%, and 30-Yr is down 1.5bps at 0.946%.

- Italian BTP spread up 0.9bps at 104.3bps / Spanish up 0.6bps at 69.9bps

FOREX: Sustained Weakness in Antipodean FX, EURUSD Approaching Key Support

- The New Zealand Dollar retreated aggressively on Tuesday, with markets swiftly paring rate hike expectations as New Zealand re-enters lockdown.

- With a fresh 3-day nationwide lockdown (and a 7-day lockdown in Auckland and surrounding areas), a number of sell-side analysts have revised their calls for a 25bps rate hike from the RBNZ. Their decision and statement will be published overnight.

- NZDUSD consolidated losses throughout US hours with the pair trading in close proximity to the 0.6900 lows. A break of key support and the bear trigger at 0.6881 would confirm a resumption of a bearish cycle that started late February with notable supports below: 0.6798 Sep 18, 2020 high and 0.6703, 38.2% of the Mar '20 - Feb bull run.

- Broad greenback strength helped AUDUSD play catch up to the move, extending weakness through the year's lows at 0.7290. Settling around the 0.7250 mark, the pair dipped 1.2% for the day.

- With global macro developments continuing to weigh on risk sentiment/equity indices, the US dollar garnered strong support overall. GBP and NOK were other notable losers, falling around 0.75% with other haven currencies such as JPY and CHF subsiding by a more modest 0.25%.

- With recent weak US data points unable to prompt a sustained bounce in EURUSD, major support at 1.1704/06 looks increasingly vulnerable.

- A break below would leave the single currency at the lowest levels since November 2020 and may target 1.1603, low Nov 4, 2020. Below here, the immediate post pandemic highs at 1.1495 would likely act as strong psychological and pivot support, matching closely with the 50% retracement of the March 2020-Jan 2021 price swing.

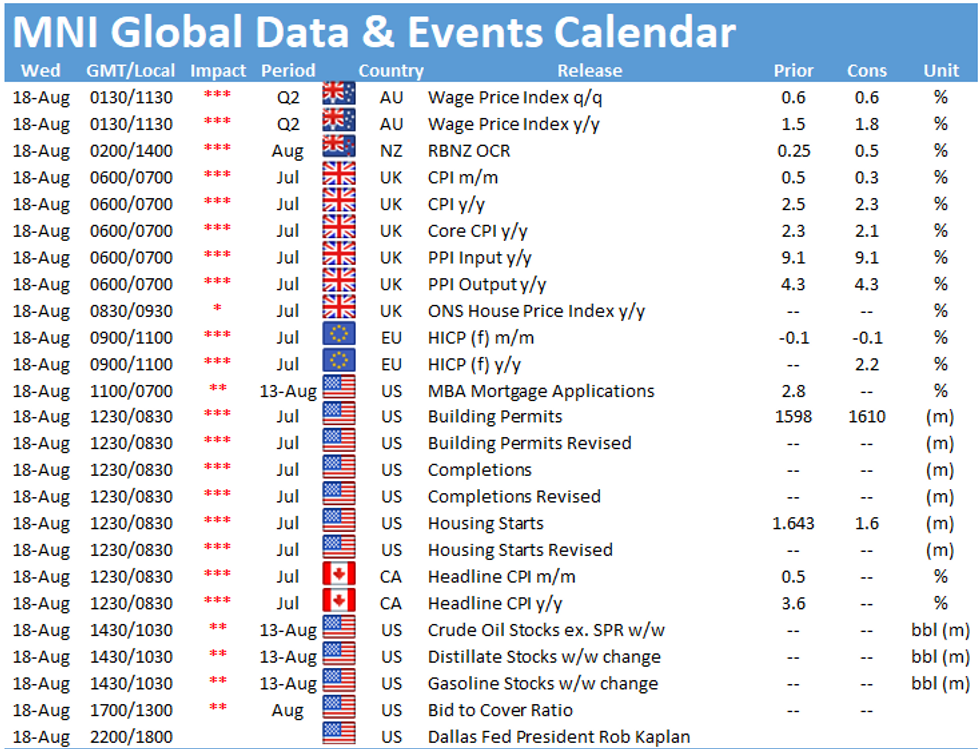

- Aside from the anticipated RBNZ meeting, Wednesday will see CPI prints for both the UK and Canada.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.