-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Geo-Political Risk Remains High

EXECUTIVE SUMMARY

- MNI BRIEF: US-EU In G7 Split On Aug 31 Afghanistan Exit Date

- HOUSE DEMOCRATS AGREE ON PATH TO ADVANCE BUDGET, INFRASTRUCTURE, Bbg

- BIDEN TO STAY WITH AUG. 31 AFGHANISTAN WITHDRAWAL DATE: REUTERS

- SEC TO DEMAND ALL CHINESE FIRMS SAY MORE ABOUT INVESTOR RISKS, Bbg

- SEC REQUIREMENT TO APPLY TO FIRMS ALREADY TRADING IN U.S., Bbg

US

US/AFGHANISTAN: US Pres Biden Will Stick To 31 Aug Afghan Withdrawal Deadline, Bbg

- Jennifer Jacobs at BBG tweets: "NEW: Biden will follow the Pentagon's recommendation and will withdraw US troops from Afghanistan by the Aug. 31 deadline, per admin official."

- The decision, if confirmed, does not come as a surprise, with the gov'ts of European leaders who sought to change the US president's mind downplaying expectations before this afternoon's G7 call on the situation in Afghanistan.

- The EU president said that "safe passageways" needed to be secured so that Afghan refugees could leave the country after the deadline agreed with the Taliban government. Von der Leyen underlined that the EU had some influence on the new Afghan government, given the country's need for development aid and officials 'shouldn't underestimate' that. For more see MNI Policy main wire at 1248ET.

OVERNIGHT DATA

- US JUL NEW HOME SALES +1% TO 0.708M SAAR

- US JUN NEW HOME SALES REVISED TO 0.701M SAAR

Richmond Fed: Yet Another Big Aug Survey Miss: The Richmond Fed's August reading of 9 was well below expectations (24) and a sharp drop from July's reading (27). Apart from the pandemic, that 18 point drop (27 to 9) from July to August was the biggest one-month fall) in the Richmond survey since 1996.

- All three component indices (shipments, new order, and employment) remained positive but decreased in August. Notably, the wage index hit a record high amid continued labor shortages.

- The Richmond Fed index is not a major data point in isolation, but it adds to a growing list of August survey readings that have disappointed vs expectations (eg UMichigan Survey, Empire State, Philly Fed).

- The sharp drop-off is partly of reflection of very strong early summer conditions, and the reading still suggests expansion. But the addition of yet another survey-based indication of economic slowdown in mid-Q3 (just as the Delta COVID variant has become a major concern for US confidence).

MARKET SNAPSHOT

Key late session market levels

- DJIA up 88.21 points (0.25%) at 35423.9

- S&P E-Mini Future up 12.75 points (0.28%) at 4488.25

- Nasdaq up 86.5 points (0.6%) at 15029.19

- US 10-Yr yield is up 3.5 bps at 1.2868%

- US Sep 10Y are down 7/32 at 134-0

- EURUSD up 0.001 (0.09%) at 1.1756

- USDJPY down 0.02 (-0.02%) at 109.68

- WTI Crude Oil (front-month) up $2.06 (3.14%) at $67.69

- Gold is up $0.53 (0.03%) at $1805.97

- EuroStoxx 50 up 1.66 points (0.04%) at 4178.08

- FTSE 100 up 16.76 points (0.24%) at 7125.78

- German DAX up 53.06 points (0.33%) at 15905.85

- French CAC 40 down 18.79 points (-0.28%) at 6664.31

US TSYS: Afghan Pullout Deadline Set for Aug 31

Tsys trading weaker after the bell, aside from a large 10k FVU block sale at 123-31.5, rates were under pressure all session with a cautious risk-on tone as equities made new all time highs (ESU1 4491.75).

- Little direction from mixed data: Richmond Fed's August reading of 9 was well below expectations (24) and a sharp drop from July's reading (27). New home sales were better than expected: +1% TO 0.708M SAAR.

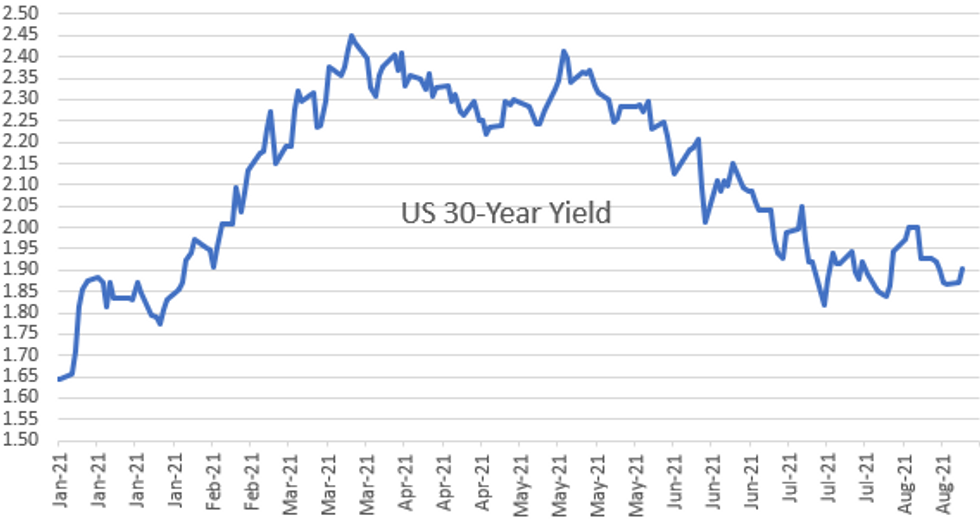

- Take away the heavy Sep/Dec roll volume and trade was rather muted -- typical for late summer trade. Tsy 10YY climbed to 1.2902% high in late trade, 30YY 1.9079% high. Underlying risk factors remain mixed: deadline for US/Allied pull-out from Afghanistan appears to be Aug 31 as hopes for an extension dashed by Taliban officials. Closer to home: HOUSE DEMOCRATS AGREE ON PATH TO ADVANCE BUDGET, INFRASTRUCTURE, Bbg

- Meanwhile, the 2Y note sale saw second consecutive stop -- Tsy futures bounced off lows following strong $60B 2Y (91282CCU3) note draws 0.242% vs. 0.252% WI. Bid-to-cover was 2.65x well over 5 month average of 2.53x. Indirect take-up climbs to 60.54% from 52.76% in July (50.94% 5M avg); direct bidder take-up of 21.18% continues to outpace 5M avg of 18.77%; primary dealer take-up falls to 18.28% vs. 5-month average of 30.29%.

- The 2-Yr yield is up 0bps at 0.2243%, 5-Yr is up 2.3bps at 0.7917%, 10-Yr is up 3.5bps at 1.2868%, and 30-Yr is up 3.4bps at 1.9046%.

US TSY FUTURES CLOSE

- 3M10Y +3.43, 123.78 (L: 118.909 / H: 123.948)

- 2Y10Y +3.67, 106.214 (L: 102.458 / H: 106.382)

- 2Y30Y +3.493, 167.954 (L: 164.508 / H: 168.09)

- 5Y30Y +1.293, 111.262 (L: 109.948 / H: 111.885)

- Current futures levels:

- Sep 2Y down 0.25/32 at 110-8 (L: 110-07.5 / H: 110-08.25)

- Sep 5Y down 3.5/32 at 123-31.5 (L: 123-31 / H: 124-03.5)

- Sep 10Y down 7.5/32 at 133-31.5 (L: 133-30.5 / H: 134-07.5)

- Sep 30Y down 25/32 at 165-1 (L: 164-31 / H: 165-25)

- Sep Ultra 30Y down 1-11/32 at 199-25 (L: 199-22 / H: 201-04)

US TSY FUTURES: Quarterly Futures Roll Update

Late session Sep/Dec roll update: heavy across the curve and expected to remain that way as percentage complete near s25% with first notice a week away (Dec futures take lead quarterly position). Current roll markets:

- TUU/TUZ 325,300 from 5.125 to 5.5, 5.12 last; 24% complete

- FVU/FVZ 452,700 from 14.5-15.25, 14.5 last; 21% complete

- TYU/TYZ 551,500 from 17.75 to 18.5, 18.0 last; 17% complete

- UXYU/UXYZ 183,100, 1-28 last; 27% complete

- USU/USZ 145,300 from 1-17.25 to 1-17.75, 1-17.5 last; 21% complete

- WNU/WNZ 118,800, 1-23 last; 21% complete

US EURODOLLAR FUTURES CLOSE

- Sep 21 steady at 99.870

- Dec 21 steady at 99.805

- Mar 22 -0.010 at 99.830

- Jun 22 -0.005 at 99.795

- Red Pack (Sep 22-Jun 23) -0.015 to -0.01

- Green Pack (Sep 23-Jun 24) -0.035 to -0.02

- Blue Pack (Sep 24-Jun 25) -0.04 to -0.035

- Gold Pack (Sep 25-Jun 26) -0.045 to -0.035

Short Term Rates

US DOLLAR LIBOR: Latest Settles

- O/N -0.00012 at 0.07763% (+0.00025/wk)

- 1 Month +0.00450 to 0.08888% (+0.00300/wk)

- 3 Month -0.00750 to 0.12175% (-0.00662/wk) ** (Record Low: 0.11800% on 6/14)

- 6 Month +0.00500 to 0.15800% (+0.00537/wk)

- 1 Year -0.00012 to 0.23688% (+0.00025/wk)

- Daily Effective Fed Funds Rate: 0.09% volume: $67B

- Daily Overnight Bank Funding Rate: 0.08% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.05%, $899B

- Broad General Collateral Rate (BGCR): 0.05%, $373B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $356B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $2.001B accepted vs. $3.791B submission

- Next scheduled purchases

- Wed 8/25 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 8/26 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 8/27 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage slips to 1,129.737B from 77 counter-parties vs. Monday's record $1,135.697B. Prior record high of $1,115.656B set Wednesday, Aug 18.

PIPELINE: $3B EIB Priced, Nordea Launched

- Date $MM Issuer (Priced *, Launch #)

- 08/24 $3B *EIB WNG +5Y -1

- 08/24 $1B MUNIFIN WNG 5Y +4a

- 08/24 $1B #Nordea Bank perp 9/29 3.75%

- 08/24 $Benchmark Schwab 10Y +95a

- 08/24 $Benchmark ABC Int Holdings 3Y +70a, 5Y +85a

EGBs-GILTS CASH CLOSE: Decent Supply, But Little Direction

European FI failed to find decisive direction Tuesday. Yields rose sharply at the London open, then fell to session lows mid-morning before drifting higher again - finishing largely unchanged.

- Periphery spreads clawed back some ground vs Monday's widening.

- In supply, the GBP3bln 5Y auction was weak (earlier, DMO consultation minutes for 3Q issuance were largely in line with MNI's expectations) Finland sold E3bln 5Y RFGB via syndication, and Germany auctioned 4bln 7Y Bund.

- We also saw a lot of downside buying in Bunds via options.

- In data: German 2Q GDP was revised a little higher, but no market impact.

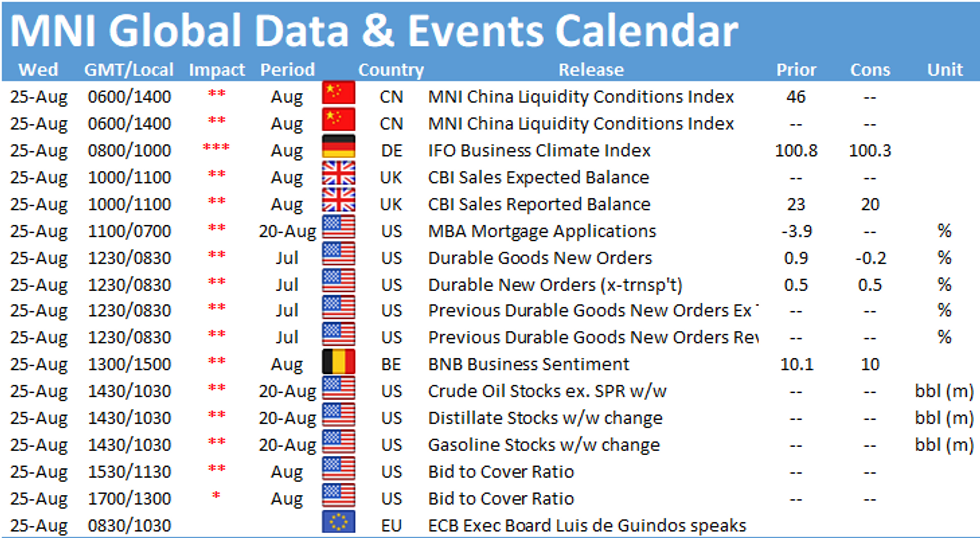

- Wednesday's calendar includes German IFO data and an appearance by ECB's de Guindos.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: 2-Yr yield is up 0.3bps at -0.744%, 5-Yr is up 0.5bps at -0.737%, 10-Yr is up 0.3bps at -0.478%, and 30-Yr is up 0.3bps at -0.028%.

- UK: 2-Yr yield is up 1bps at 0.125%, 5-Yr is up 1bps at 0.27%, 10-Yr is up 0.3bps at 0.538%, and 30-Yr is up 0.2bps at 0.947%.

- Italian BTP spread down 1.4bps at 104.8bps / Spanish up 0.1bps at 71.3bps

FOREX: Commodity-Tied FX Extends Gains, Greenback Consolidates

- The Norwegian Krone was top of the pile for a second day as oil extended its recovery into a second day and negated the entirety of last weeks drawdown. NOK firmed just under 1% on Tuesday.

- Antipodean FX was close behind, consolidating gains made during APAC trade and enjoying the relief rally in risk assets.

- EUR, JPY, GBP and CNH were broadly unchanged, trading in narrow ranges ahead of Jackson Hole later this week. As such EUR crosses suffered with EURNZD printing briefly below .169 after topping out at 1.7166 on Monday.

- The dollar index briefly extended its decline in the lead up to the WMR fix. However, with limited catalysts to prompt any momentum selling, a steady bounce to unchanged ceased the action for the day but indices held on to the week's declines.

- USDCAD (-0.45%) confirmed a short-term reversal pattern by extending past the 20-day EMA and now may target 1.2509, the 50-day EMA, with the additional 3% rally in crude a clear CAD tailwind.

- Emerging market currencies saw slightly more action with notable moves in high beta plays such as BRL and ZAR, with the latter slipping back below the 15.00 handle having traded at 15.40 on Friday.

- NZ Trade Balance overnight will be followed by German IFO data out of Europe. US Durable Goods Orders and Crude Oil Inventories will round of Wednesday's calendar.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.