-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN - Mester Warns On Inflation Expectations

Executive Summary:

- Fed's Mester Keeps Employment Outlook Despite Delta

- Upside Risk To 2021 Growth Forecast -EU's Gentiloni

- EU Debt Rules Need Strengthening - DNB's Knot

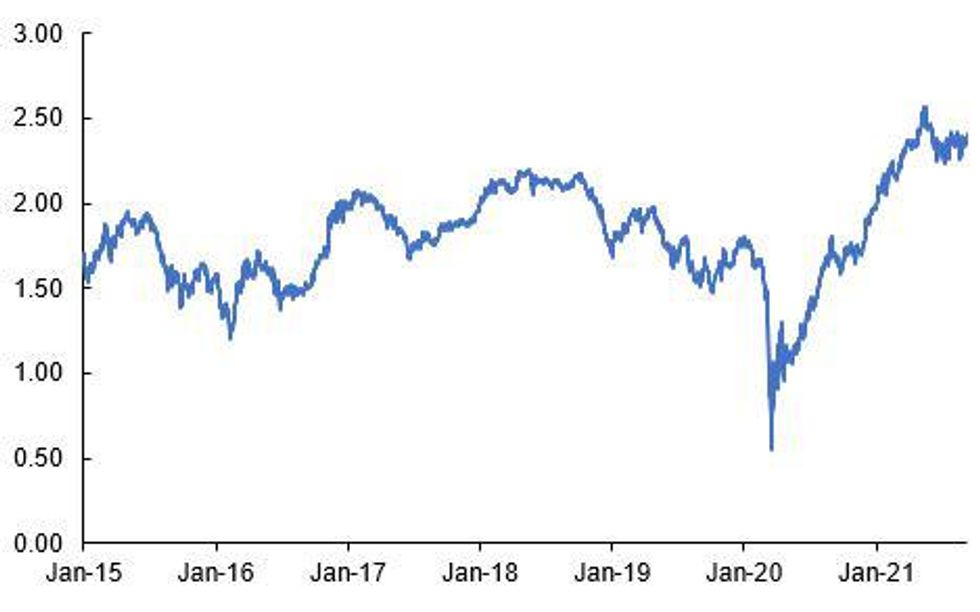

Fig 1. US 10-Year Breakeven Rate, %

Source: MNI, Bloomberg

NORTH AMERICAN NEWSFLOW:

MNI BRIEF: Fed's Mester Keeps Employment Outlook Despite Delta

Federal Reserve Bank of Cleveland President Loretta Mester expects U.S. employment and the overall workforce to continue rising over the rest of the year, despite restaurants and other "high-touch" service sector firms reporting a slowdown as the Delta variant surges.

MNI BRIEF: Fed's Mester: Inflation Could Pressure Expectations

Federal Reserve Bank of Cleveland President Loretta Mester on Friday warned high prices could cause longer-run inflation expectations to rise above the Fed's 2% target, especially if monetary policy was too loose.

MNI INTERVIEW:Central Banks To Be Trapped by Neutral Rate Drop

The Fed, ECB and BOE may not escape the low-for-long world as weak investment and population growth this decade pull down the global neutral interest rate by 75 basis points, according to Adrien Auclert, a former BOE economist who has presented at over a dozen regional Fed conferences.

MNI INTERVIEW: BOC's QE Roadmap A Hawkish Rate Signal

The Bank of Canada's pledge Thursday to place scaling back QE on a separate track from raising interest rates suggests Governor Tiff Macklem wants to be a little more aggressive in hiking the record low 0.25% benchmark next year, former BOC official and Scotiabank chief economist Jean-Francois Perrault told MNI.

EUROPE NEWS

MNI INTERVIEW: EU Debt Rules Should Be Stricter-Germany's FDP

The deputy chairwoman of Germany's Free Democrats, which could play a key role in forming the country's next government after Sept. 26 elections, told MNI European rules on public borrowing should be toughened and penalties against member states which exceed debt limits increased.

MNI BRIEF: Upside Risk To 2021 Growth Forecast -EU's Gentiloni

Recent positive economic data point to an upside risk to the EU's 2021 growth forecast, EU Economic Affairs Commissioner Paolo Gentiloni. "What we see is that vaccinations have enabled us to continue with the reopening of our economies, with growth in Q2 exceeding our last forecast and survey data pointing to ongoing strength over the summer. All of this means there is an upside risk to our growth forecast for 2021 as a whole," Gentiloni said at a press conference following the Eurogroup meeting this morning in Slovenia.

MNI BRIEF: EU Debt Rules Need Strengthening - DNB's Knot

Europe's Stability and Growth Pact should be reformed to give it more built-in room for countercyclical fiscal policy, the head of the Dutch central bank said in a speech Friday, with the European Commission set to relaunch its review of the bloc's fiscal rules after Germany's general election on September 26.

DATA

MNI: US JUL WHOLESALE INV 0.6%; SALES 2%

DATA REACT: PPI In Line, Food And Retail Margins Driving Headline

August PPI final demand M/M a touch stronger than expected (+0.7% vs +0.6% expected) but more or less in line.

* Despite an all-time Y/Y record (+8.3%), that was expected (+8.2%), so not a report that significantly changes the narrative of pipeline price pressures and unsurprisingly little reaction in Treasuries or USD.

* Final demand goods +1.0% M/M: "In August, half of the broad-based advance can be attributed to a 2.9-percent rise in prices for final demand foods... About a quarter of the August advance in prices for final demand goods can be attributed to an 8.5-percent rise in the index for meats."

* Final demand services +0.7% M/M: "Two-thirds of the broad-based increase in August can be traced to the index for final demand trade services, which rose 1.5 percent. (Trade indexes measure changes in margins received by wholesalers and retailers.)... Over 30 percent of the August increase in prices for final demand services can be traced to a 7.8-percent rise in margins for health, beauty, and optical goods retailing"

MNI BRIEF: Canada Aug Jobs Rise More Than Expected

Canada added a greater-than-expected 90,200 jobs in August to bring total employment within 156,000 of where it was before the pandemic, a sign the economy is rebounding in the second half of the year as the central bank predicts.

The gain beat the 60,000 new jobs economists predicted, and the unemployment rate also fell to 7.1% from 7.5%, the lowest since the pandemic and better than the expected 7.3%.

MNI BRIEF: China End-Aug M2 Slows To 3-Month Low

China's M2 money supply growth slowed to 8.2% y/y in August, a three-month low, data released by the People's Bank of China on Friday showed, decelerating from July's 8.3% y/y, missing the median forecast of 8.4% growth. Among the key metrics, M1 growth slowed to 4.2% y/y from the previous 4.9% gain, while M0 rose 6.3% y/y, quickening from the 6.1% gain in July. Aggregate financing more than doubled to CNY2.96 trillion from the previous CNY1.06 trillion, beating the median forecast of CNY2.8 trillion. On an annual basis, it grew 10.3%, slower than the 10.7% growth last month.

US TSYS SUMMARY: Bear Steepening

TSY futures have pushed lower through the session and the curve has bear steepened alongside a weak session for stocks.

- UST cash yields are 1-4bp higher across much of the curve with the 2s20s spread 4bp wider on the day.

- TYZ1 trades at 133-05, near the bottom of the day's range (L: 133-02 / H: 133-16).

- The Fed's Mester indicated a preference for tapering this year, stressing "I don't think the August employment report has changed my view that we've made substantial further progress".

- Headline PPI data for August was a touch better than expected.

- Next week sees the release of CPI and retail sales data for August, as well as the preliminary September update of the University of Michigan Consumer Confidence report.

EGBs-GILTS CASH CLOSE: Weak Weekly Close

After trading sideways for most of the session, Gilts and Bunds weakened into Friday's cash close on a broader global move that appeared US Treasury-led.

- No apparent headline catalysts, but potentially positions being unwound in a combination of post-ECB profit-taking and a huge supply schedule next week.

- Periphery spreads unwound a promising start; 10Y BTP spreads rose from a 3-week low of 101.7bp to end unchanged at 103.1bp. Greece outperformed.

- Next week sees E36B of gross nominal issuance (vs E12.4bln this week), including Italy, Germany, Spain, France, and the Netherlands.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.7bps at -0.704%, 5-Yr is up 2.3bps at -0.638%, 10-Yr is up 3.1bps at -0.33%, and 30-Yr is up 3bps at 0.158%.

- UK: The 2-Yr yield is up 0.9bps at 0.233%, 5-Yr is up 0.9bps at 0.42%, 10-Yr is up 2.2bps at 0.758%, and 30-Yr is up 1.5bps at 1.078%.

- Italian BTP spread unchanged at 103.1bps /Spanish down 0.1bps at 66.3bps

FOREX: USD Finishes Week On Front Foot, CAD Reverses Post Strong Jobs Data

- G10 currencies were subdued on Friday, with little news or event risk to garner significant market interest. Despite the narrow ranges, the greenback trades in marginally firmer territory capping off a positive week for the dollar index, rising around 0.6%.

- Headlines surrounding the Biden administration weighing a new investigation into Chinese subsidies and their damage to the U.S. economy as a way to pressure Beijing on trade prompted a small spike in USDCNH. The pair rose from around 6.43 to 6.44 before consolidating thereafter.

- The Canadian dollar traded well in the lead up to Canadian employment data. The figures surprised to the upside, posting a 90k increase in the net change for August and a lower unemployment rate of 7.1%. Similar price action to the bank of Canada where initial CAD optimism dissipated almost immediately, causing a path of least resistance short squeeze in USDCAD. Equity weakness exacerbated this bounce with USDCAD reversing the entirety of the days move from 1.2583 lows back to 1.2660, broadly unchanged on the day.

- Little in the way of meaningful price action elsewhere, however, EURUSD has traded with a heavy tone, slipping to the lowest levels of the day, just 10 pips shy of the weeks lows and what has been defined as a key short-term support and bear trigger at 1.1802.

- For Friday, NZD (+0.28%) and NOK (+0.21) topped the G10 pile while the Japanese Yen (-0.2%) actually underperformed despite the softer US indices.

- A quiet Monday data docket before the market focus turns to the week's key US CPI data scheduled on Tuesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.