-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Transitory in Transit

EXECUTIVE SUMMARY

- MNI REALITY CHECK: US August Sales Fall on Storms, Covid Surge

- MNI BRIEF: Four in Ten US Workers Fear Covid Exposure At Work

- BOJ'S KURODA- SEES INFLATION PICKING UP THROUGH 2023

- KURODA REITERATES WILLING TO DO MORE IF NEEDED TO MEET GOALS

US

US: The pace of retail sales slipped again in August as the spread of the Delta variant of Covid-19 eroded consumer confidence and severe storms capped mobility in parts of the country, industry experts told MNI.

- "It will be an important release," to determine the impact that surging Covid cases and things like school reopenings will have on spending in the near term, said Jack Kleinhenz, chief economist at the National Retail Federation.

- "We are all wondering about the degree to which the Delta variant has affected household behavior," he added. "That's probably on the forefront of everybody's mind." For more see MNI Policy main wire at 1328ET.

- "With headlines about the rise of the Delta variant, breakthrough cases among the vaccinated, and an overburdened healthcare system in much of the country, Covid-19 concerns that were subsiding just two months ago have risen," Rebecca Ray, the board's executive vice president of human capital, said in a statement.

OVERNIGHT DATA

- US AUG IMPORT PRICES -0.3%

- US AUG EXPORT PRICES +0.4%; NON-AG +0.2%; AGRICULTURE +1.1%

- US AUG INDUSTRIAL PROD +0.4%; CAP UTIL 76.4%

- US JUL IP REV TO +0.8%; CAP UTIL REV 76.2%

- US MBA: MARKET COMPOSITE +0.3% SA THRU SEP 10 WK

- US MBA: REFIS -3% SA; PURCH INDEX +8% SA THRU SEP 10 WK

- US MBA: UNADJ PURCHASE INDEX -12% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE UNCHANGED AT 3.03%

- CANADIAN AUG CONSUMER PRICE INDEX INFLATION +4.1% YOY

- CANADA MOM CPI INFLATION WAS +0.2% IN AUG

- CANADIAN AUG HOME SALES -0.5% MOM, -14% YOY - CREA

- CANADIAN AUGUST AVERAGE HOME SALES PRICE +13% YOY

MARKET SNAPSHOT

Key late session market levels

- DJIA up 224.38 points (0.65%) at 34800.46

- S&P E-Mini Future up 32.75 points (0.74%) at 4467

- Nasdaq up 102.1 points (0.7%) at 15139.81

- US 10-Yr yield is up 1.9 bps at 1.3022%

- US Dec 10Y are down 7/32 at 133-12.5

- EURUSD up 0.0005 (0.04%) at 1.1808

- USDJPY down 0.28 (-0.26%) at 109.41

- WTI Crude Oil (front-month) up $2.19 (3.11%) at $72.65

- Gold is down $11.35 (-0.63%) at $1793.33

- EuroStoxx 50 down 45.73 points (-1.09%) at 4145.94

- FTSE 100 down 17.57 points (-0.25%) at 7016.49

- German DAX down 106.99 points (-0.68%) at 15616

- French CAC 40 down 69.35 points (-1.04%) at 6583.62

US TSYS

Early session highs around the opening bell were short lived Wednesday -- support for Tsy futures in lead-up to import/export prices evaporated despite the weaker than forecasted August import price data:

- Prices for U.S. imports decreased 0.3 percent in August following a 0.4-percent advance in July, while Export prices rose 0.4 percent in August, after increasing 1.1 percent the previous month.

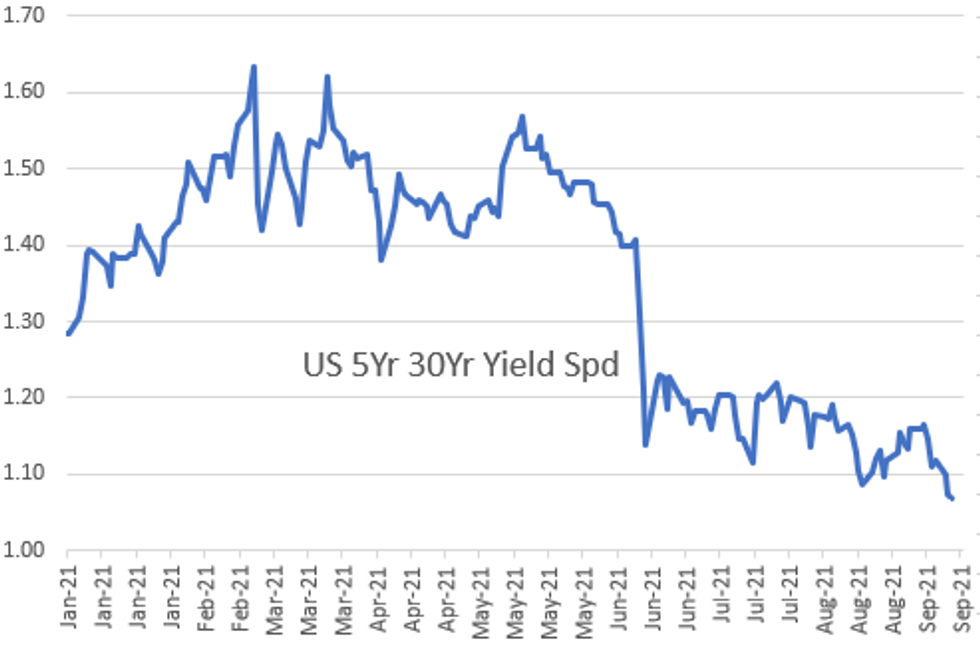

Current session trade included some flatteners:

- -9,767 FVZ1 123-20.25, post-time bid at 0930:00ET vs. +4,001 UXYZ1 148-13 post-time offer

- overnight/late Tuesday Block: 5s/ultra-bond flattener: -9,409 FVZ 123-21.25, sell through 123-21.5 post-time bid at 2339:11ET vs. +1,362 WNZ 200-00, nuy through 199-26 post time offer

Background color on large 10Y Block sale (-10,327 TYZ1 at 133-12 (-7.5 and below session low of 133-13). Sources say was dv01 neutral spd vs. 4,720 RXZ1 at 171.60, and a likely unwind as well. Trigger for executing the spd is another matter.

The 2-Yr yield is up 0.4bps at 0.2111%, 5-Yr is up 1.3bps at 0.7983%, 10-Yr is up 1.9bps at 1.3022%, and 30-Yr is up 0.7bps at 1.8659%.

US TSY FUTURES CLOSE

- 3M10Y +2.534, 126.334 (L: 121.782 / H: 127.856)

- 2Y10Y +1.414, 108.879 (L: 104.928 / H: 110.601)

- 2Y30Y +0.258, 165.214 (L: 161.208 / H: 167.098)

- 5Y30Y -0.421, 106.571 (L: 103.872 / H: 107.784)

- Current futures levels:

- Dec 2Y down 0.5/32 at 110-5 (L: 110-04.75 / H: 110-05.5)

- Dec 5Y down 3.75/32 at 123-19 (L: 123-18 / H: 123-23.25)

- Dec 10Y down 7.5/32 at 133-12 (L: 133-09 / H: 133-22.5)

- Dec 30Y down 16/32 at 163-26 (L: 163-16 / H: 164-24)

- Dec Ultra 30Y down 23/32 at 199-18 (L: 198-30 / H: 201-12)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.825

- Mar 22 -0.005 at 99.850"

- Jun 22 steady at 99.815

- Sep 22 -0.005 at 99.725

- Red Pack (Dec 22-Sep 23) -0.015 to -0.005

- Green Pack (Dec 23-Sep 24) -0.025 to -0.02

- Blue Pack (Dec 24-Sep 25) -0.03 to -0.025

- Gold Pack (Dec 25-Sep 26) -0.04 to -0.035

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00025 at 0.07213% (+0.00050/wk)

- 1 Month -0.00050 to 0.08413% (+0.00025/wk)

- 3 Month +0.00200 to 0.12000% (+0.00425/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00050 to 0.14838% (-0.00100/wk)

- 1 Year -0.00087 to 0.22163% (-0.00087/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $258B

- Secured Overnight Financing Rate (SOFR): 0.05%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $380B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $357B

- (rate, volume levels reflect prior session)

- Tsy 0Y-12.25, $12.401B accepted vs. $38.125B submission

- Next scheduled purchases

- Thu 9/16 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Fri 9/17 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

FED: REVERSE REPO OPERATION

NY Fed reverse repo usage recedes to 1,081.342B from 75 counter-parties vs. $1,169.280B Tuesday. Record high holds at $1,189.616B set Tuesday, Aug 31.

PIPELINE: $13.85B To Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 09/15 $3.5B *IADB 3Y SOFR+14

- 09/15 $3.25B #JP Morgan Chase $2.75B 6NC5 +67, $500M 6NV5 FRN/SOFR

- 09/15 $1.25B #Glencore $750M 10Y +135, $500M 30Y +160

- 09/15 $1.15B #F&G Global funding $750M 3Y +47, $400M 7Y +95

- 09/15 $1B *Council of Europe (COE) WNG 5Y -1

- 09/15 $1B *Bangkok Bank 15NC10 tier 2 +215

- 09/15 $850M #Boston Properties 12Y Green +115

- 09/15 $750M #Aviation Capital Grp 5Y +120

- 09/15 $600M #Florida Gas Trans WNG 10Y +100

- 09/15 $500M #Sealed Air 5Y +77

EGBs-GILTS CASH CLOSE: Weak Afternoon

After some modest weakness in morning trade, Bunds and Gilts fell sharply Wednesday afternoon alongside US Treasuries.

- The bearish tone was set early with a pre-open beat on UK CPI, with some of Tuesday's post-US CPI global rally appearing to be reconsidered as the underlying inflation dynamics weren't particularly favourable for future Fed tightening prospects.

- The German curve steepened sharply; UK had more of a parallel shift. That said, no particular trigger for the moves.

- Italian spreads widened after 10Y/Bunds appeared to be establishing a hold below 100bp (low was 98.9, a little higher vs Tues low). Greece modestly outperformed.

- Upcoming supply potentially eyed by bears: Austria set to sell new 15Y RAGB via syndication Thursday, while Spain/France sells E14+B of Bonds.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.1bps at -0.701%, 5-Yr is up 2bps at -0.624%, 10-Yr is up 3.4bps at -0.306%, and 30-Yr is up 4bps at 0.192%.

- UK: The 2-Yr yield is up 3.4bps at 0.265%, 5-Yr is up 3.4bps at 0.453%, 10-Yr is up 3.9bps at 0.777%, and 30-Yr is up 3.4bps at 1.077%.

- Italian BTP spread up 2.1bps at 100.8bps / Spanish up 0.4bps at 65bps

FOREX: CAD and NOK Boosted, USDJPY Holds Mid-August Lows

- A near three percent rally in crude futures lent support to both the Canadian dollar and the Norwegian Krone on Wednesday.

- NOK remained buoyant throughout the entirety of Wednesday's trade with USDNOK (-0.85%) marking its lowest point since early July around 8.57.

- USDCAD retreated just shy of 0.5%, reversing Tuesday's gains, however the selloff fell a way short of yesterday's low print at the 1.26 mark.

- USDJPY (-0.25%) continued a downward trajectory during European hours, however found support at the mid-August lows, bouncing from 109.11 back to the 109.40 area. Technically, a bearish risk is still present and key support lies at 108.72, Aug 4 low where a break would strengthen a bearish case and open 108.47, a Fibonacci retracement.

- Elsewhere, G10FX held narrow ranges with the dollar index just marginally softer on the day, down just 0.07%.

- New Zealand Q2 GDP data will be followed by Australian August Employment figures overnight.

- ECB President Lagarde is due to speak about the euro and the European economy at an online event where a Q+A is expected.

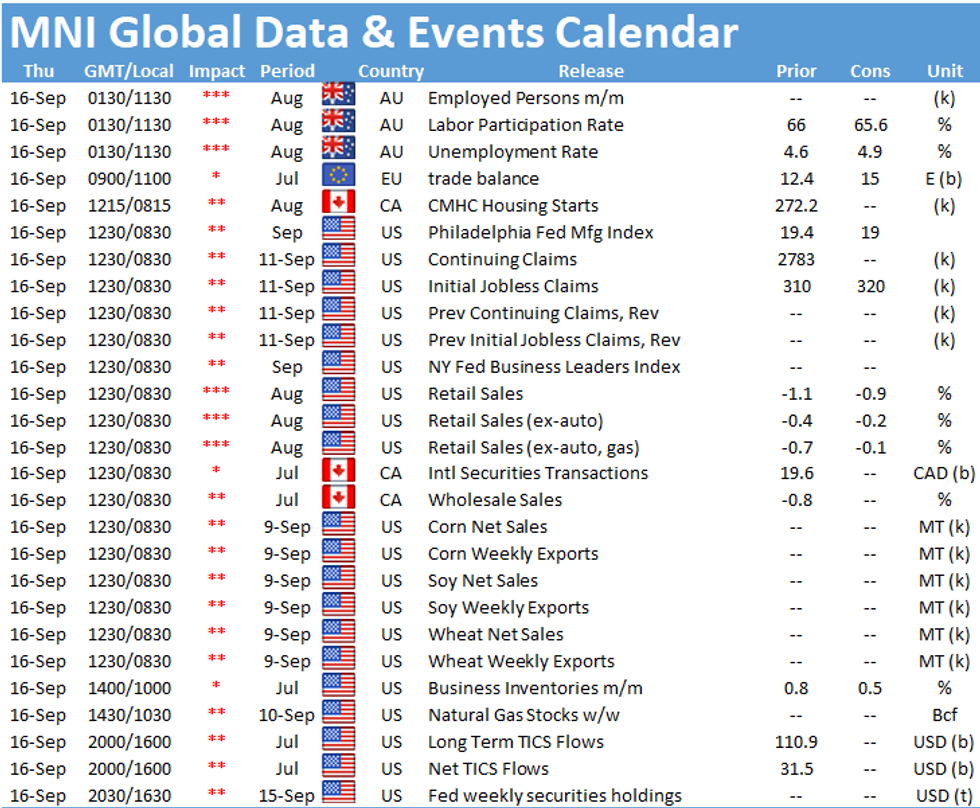

- Thursday's US data docket will be headlined by August retail sales and September Philly Fed.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.