-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Yields Rise As Hawkish Fed Sinks In

EXECUTIVE SUMMARY

- MNI INTERVIEW: Kashkari Says He's Rate-Hike Holdout in Dots; Sees Neutral Policy Being Restored

- MNI BRIEF: Fed's Mester Sees 2022 Hike, Inflation Goals Met

- MNI BRIEF: Fed's George - QE Could Mean Higher Terminal Rate

US

FED: Minneapolis Fed President Neel Kashkari told MNI Friday he's the lone FOMC official who prefers holding interest rates near zero into 2024 because in his view it will take longer to restore maximum employment, while backing Chair Jerome Powell's view on tapering bond purchases.

- "Yes, that is me," Kashkari said in a phone interview when asked if he's the single person to pencil unchanged rates for 2023 into the FOMC's dot plot published Wednesday. "I anticipate the first raise in 2024."

- "The last expansion took 10 years to put essentially everybody back to work and I certainly don't think it's going to take 10 years, but I think it may take longer than perhaps some of my colleagues think," Kashkari said. "I'm not sure we even achieved maximum employment before the pandemic hit. So if we are really going to achieve maximum employment before liftoff, I think it's going to take a little more time." For more see MNI Policy main wire at 1655ET and 1806ET.

FED: Federal Reserve Bank of Cleveland President Loretta Mester has penciled in a 2022 interest rate increase, saying the economy has met the Fed's inflation goals for liftoff and is likely to see maximum employment by the end of next year.

- "The number of payroll jobs and the labor force participation rate are still well below where they were prior to the pandemic, and unemployment rates are still well above their pre-pandemic levels. But as the recovery continues, labor markets will continue to improve, and I expect that the conditions for liftoff of the fed funds rate will be met by the end of next year," she said in remarks prepared for an Ohio bankers meeting.

- She sees the unemployment rate falling to 4.75% by the end of this year and to about 4% by the end of next year. Mester, an FOMC voter in 2022, is among 9 FOMC officials who said this week that a rate hike would be appropriate by December 2022.

- "All else equal, maintaining a larger 'normal' balance sheet should imply a higher 'normal' terminal policy rate, as higher policy rates are needed to offset the stimulative effect of the balance sheet's continued downward pressure on longer-term interest rates," she said in a speech to the American Enterprise Institute, noting that the Fed's balance sheet now totals just under USD8.5 trillion compared to the USD4.2 trillion in March of last year.

- George, an FOMC voter in 2022, said if the zero lower bound is thought to be a costly constraint on policy, there might be an advantage in pushing towards a higher neutral policy rate, arguing for maintaining a relatively large balance sheet weighted towards longer-maturity assets.

OVERNIGHT DATA

- US AUG NEW HOME SALES +1.5% TO 0.740M SAAR

- US JUL NEW HOME SALES REVISED TO 0.729M SAAR

MARKET SNAPSHOT

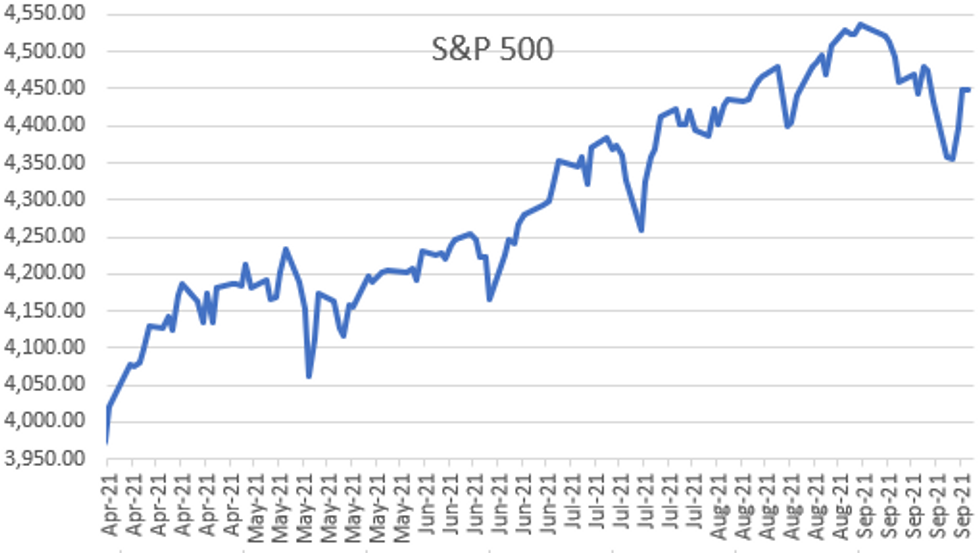

Key late session market levels- DJIA up 8.42 points (0.02%) at 34770.21

- S&P E-Mini Future up 1.5 points (0.03%) at 4439

- Nasdaq down 32.7 points (-0.2%) at 15018.7

- US 10-Yr yield is up 2.8 bps at 1.4578%

- US Dec 10Y are down 11.5/32 at 132-0.5

- EURUSD down 0.0024 (-0.2%) at 1.1715

- USDJPY up 0.45 (0.41%) at 110.78

- Gold is up $4.33 (0.25%) at $1747.07

- EuroStoxx 50 down 36.41 points (-0.87%) at 4158.51

- FTSE 100 down 26.87 points (-0.38%) at 7051.48

- German DAX down 112.22 points (-0.72%) at 15531.75

- French CAC 40 down 63.52 points (-0.95%) at 6638.46

US TSYS: Yields Up, Risk-On, Getting Comfortable With Tapering

Decent overall trade volume by Fri's close with TYZ1>1.6M, as markets continue to price in a taper annc for the November FOMC. Support for bonds since Wed's policy annc evaporated, yield curves rebounding: 5s30s nearly 10bps off late Wed's lows as it tapped 103.145bp high Friday.

- Limited react to Aug new home sales +1.5% to 0.740M SAAR; July new home sale up-revised to 0.729M SAAR. Major focus on Fri October 8 Sep employ data two weeks from now as a prerequisite for Nov FOMC taper annc.

- Session headlines from KC Fed George did not covering new ground, but reiterated tapering asset purchases sooner rather than later as better, Bbg:

- HAVE LONG WAY TO GO, STIMULUS FROM OUR POLICY TO LINGER

- STARTING TAPER PROCESS IS IMPORTANT, NEED FLEXIBILITY

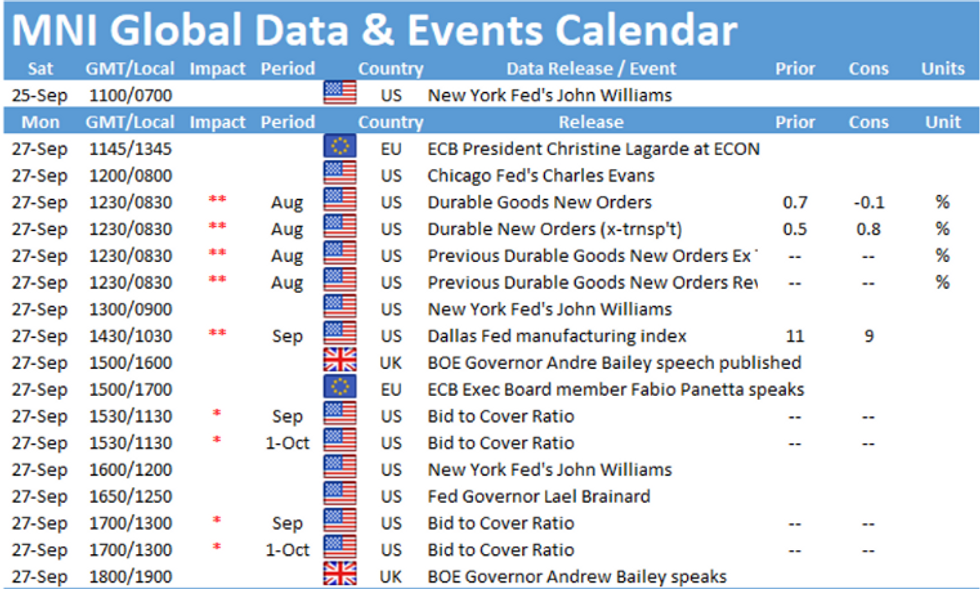

- With month end fast approaching, next week's Tsy auctions jammed into the first half of the week: $82B total 13- and 26W bills Monday in addition to $60B 2Y and $61B 5Y notes on Monday.

- Incoming supply generated some pre-auction short sets, while October Tsy serial options expiry generated two-way hedging as 10s and 30s close to pinning strikes in USV 161 and TYV 132 strikes.

- The 2-Yr yield is up 1.3bps at 0.2736%, 5-Yr is up 0.7bps at 0.955%, 10-Yr is up 2.8bps at 1.4578%, and 30-Yr is up 4.6bps at 1.9854%.

US TSY FUTURES CLOSE

- 3M10Y +3.443, 142.653 (L: 135.974 / H: 142.997)

- 2Y10Y +1.654, 118.386 (L: 114.759 / H: 118.966)

- 2Y30Y +3.409, 171.111 (L: 165.792 / H: 171.528)

- 5Y30Y +3.841, 102.842 (L: 98.879 / H: 103.075)

- Current futures levels:

- Dec 2Y down 1.25/32 at 110-0.5 (L: 110-00.375 / H: 110-02.25)

- Dec 5Y down 4.5/32 at 122-26.25 (L: 122-25.25 / H: 123-00.75)

- Dec 10Y down 11.5/32 at 132-0.5 (L: 131-31 / H: 132-14.5)

- Dec 30Y down 1-7/32 at 160-30 (L: 160-27 / H: 162-07)

- Dec Ultra 30Y down 2-10/32 at 194-26 (L: 194-23 / H: 197-15)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.005 at 99.815

- Mar 22 steady at 99.845

- Jun 22 -0.010 at 99.790

- Sep 22 -0.015 at 99.670

- Red Pack (Dec 22-Sep 23) -0.025 to -0.015

- Green Pack (Dec 23-Sep 24) -0.02 to -0.015

- Blue Pack (Dec 24-Sep 25) -0.045 to -0.025

- Gold Pack (Dec 25-Sep 26) -0.065 to -0.045

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N +0.00062 at 0.07250% (+0.00175/wk)

- 1 Month -0.00087 to 0.08513% (+0.00162/wk)

- 3 Month +0.00000 to 0.13225% (+0.00838/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00038 to 0.15538% (+0.00312/wk)

- 1 Year +0.00063 to 0.22963% (+0.00525/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $264B

- Secured Overnight Financing Rate (SOFR): 0.05%, $878B

- Broad General Collateral Rate (BGCR): 0.05%, $370B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $350B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $20.032B submission

- Next scheduled purchases

- Mon 9/27 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Tue 9/28 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B

- Wed 9/29 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Thu 9/30 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B

- Fri 10/01 1100-1120ET: Tsy 2.25Y-4.5Y, appr $8.425B

FED Reverse Repo Operation

NY Fed reverse repo usage recedes after setting five consecutive record highs: 1,313.657B from 78 counter-parties today vs. Thursday's record $1,352.483B.

PIPELINE: $1.3B NatWest 2Pt Launched

Sole issuer NatWest on the day puts total corporate and supra-sovereign debt issuance over $24B for the week.

- Date $MM Issuer (Priced *, Launch #)

- 09/24 $1.3B #NatWest $1B 5Y +65, $300M 5Y FRN/SOFR+76

FOREX: Risk Appetite Capped, High Beta FX Edges Lower

- The greenback trimmed Thursday's losses to close back toward the upper end of the week's range Friday, keeping the USD Index within range of the bull trigger at the mid-August high of 93.73. Friday saw modest risk-off trade, with equities edging lower on the back of further concerns surrounding China's property development giant Evergrande. USD bondholders were yet to receive a payment due on Thursday, potentially triggering the grace period and default process.

- The risk off tone worked against growth proxies and high beta FX, pressing AUD and NZD to the bottom of the G10 pile. AUD/USD faded back toward the week's lowest, keeping the bearish theme intact and targeting the bear trigger at 0.7220.

- Focus in the coming week turns to thew fallout from the German elections, MNI Chicago Business Barometer data as well as the ISM and UMich releases.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.