-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI ASIA OPEN: Risk-On Ahead Employment Data Risk

EXECUTIVE SUMMARY

- MNI INTERVIEW: Services Prices Seen Up Through Most of '22 -ISM

- XI WON'T GO TO ROME SUMMIT, CHINESE ENVOYS TELL G-20 OFFICIALS, bbg

- CHICAGO FED EVANS: ECONOMY MADE A LOT OF PROGRESS BUT RECOVERY UNEVEN ... EXPECT UNEMPLOYMENT TO DECLINE BELOW 5% BY END 2021, Bbg

US

ISM: The cost of services jumped again in September and isn't likely to slow anytime soon, though consumers aren't pulling back on their spending just yet, ISM services chair Anthony Nieves told MNI Tuesday.

- Labor and materials shortages are driving the price of most services up "considerably," Nieves said, but "people are still paying for the products and services that they want."

- Though most price increases on the production side aren't typically passed down to the consumer, things like fuel and freight surcharges are impacting the cost of the end product this time around, he added.

- "Probably more of the price increase is being passed onto the consumer compared to past recessionary periods because the demand is so strong," he said. "And the consumer is able to afford it" thanks to elevated savings.

OVERNIGHT DATA

- ISM Services Index Edges Higher In Sept

- US SEP ISM SERVICES PMI 61.9 (59.9 est), 61.7 AUG

- US ISM SERVICES PRICES 77.5 SEP VS 75.4 AUG

- US ISM SERVICES EMPLOYMENT INDEX 53.0 SEP VS 53.7 AUG

- US ISM SERVICES BUSINESS INDEX 62.3 SEP VS 60.1 AUG

- US ISM SERVICES NEW ORDERS 63.5 SEP VS 63.2 AUG

- Employment was little changed, down 0.9 pts, while Prices rose modestly after the sharp August decline, up 2.1 pts at 77.5

- US AUG TRADE GAP -$73.3B VS JUL -$70.3B

- CANADIAN AUG TRADE BALANCE +1.9 BILLION CAD

- CANADA AUG EXPORTS 54.4 BLN CAD, IMPORTS 52.5 BLN CAD

- CANADA REVISED JUL MERCHANDISE TRADE BALANCE +0.7 BLN CAD

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 476.02 points (1.4%) at 34467.83

- S&P E-Mini Future up 65.75 points (1.53%) at 4356.75

- Nasdaq up 246.9 points (1.7%) at 14500.48

- US 10-Yr yield is up 4.5 bps at 1.524%

- US Dec 10Y are down 10.5/32 at 131-24

- EURUSD down 0.0023 (-0.2%) at 1.1598

- USDJPY up 0.54 (0.49%) at 111.47

- WTI Crude Oil (front-month) up $1.39 (1.79%) at $79.01

- Gold is down $6.96 (-0.39%) at $1761.53

- EuroStoxx 50 up 69.02 points (1.73%) at 4065.43

- FTSE 100 up 66.09 points (0.94%) at 7077.1

- German DAX up 157.94 points (1.05%) at 15194.49

- French CAC 40 up 98.62 points (1.52%) at 6576.28

US TSYS: Risk-On Ahead Data Risk

Historical correlation between stocks and Treasuries may be short lived, but enjoy the risk-on while it lasts. Throwing caution to the wind ahead Friday's headline Sep employment report (+450k est) and Wed's ADP private jobs data (+430k est), rates sold off sharply Tuesday as equities, still off Sep 9 all-time high of 4538.25 gained 60.0 points to 4351.25.

- Aside from worrying knock-on inflation (nat-gas climbing to appr 12Y highs), why not? If job gains come in 100k either side of the mean estimate, all is good with markets expecting a taper annc from the Fed at the Nov meeting and rate takeoff sometime later in 2022.

- But a significant miss as estimated by StL Fed economist Max Dvorkin would certainly push normalization plans down the road. MNI's interview of Dvorkin from latst Thursday continues to make the rounds. Excerpt:

- U.S. hiring in September "could be weak or even negative" in September, according to a St. Louis Fed analysis of real-time employment data from the scheduling software company Homebase, showing a seasonally-adjusted decline of 818,000 jobs, a St. Louis Fed economist told MNI.

- The model forecasts changes in employment as measured by the BLS's household survey, which tracks closely the headline payrolls figures from the BLS's establishment survey. A smaller drop of 500,000 jobs was forecast by the model without seasonal adjustment, the worst since January.

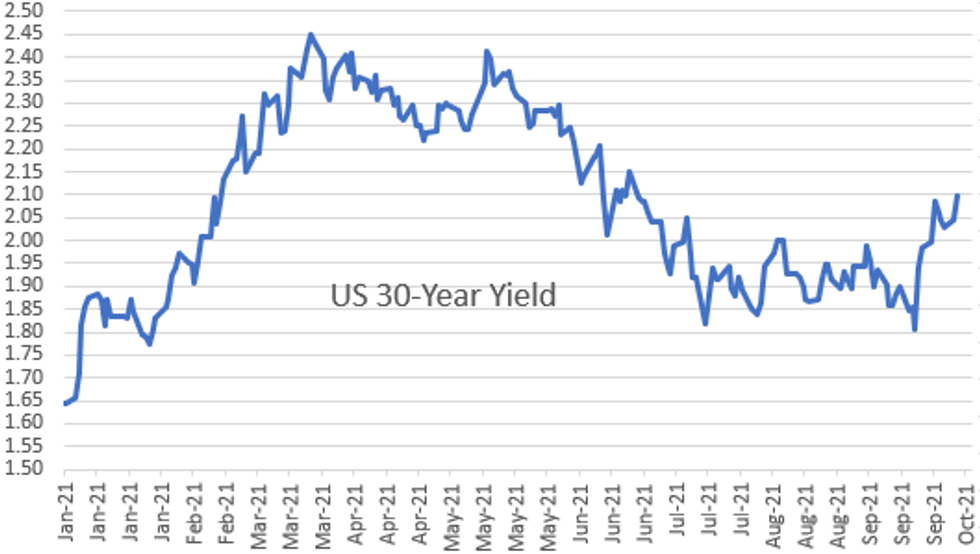

- By the close, 2-Yr yield is up 0.8bps at 0.2856%, 5-Yr is up 3.1bps at 0.9748%, 10-Yr is up 4.5bps at 1.524%, and 30-Yr is up 5bps at 2.0939%.

US TSY FUTURES CLOSE

- 3M10Y +4.953, 149.295 (L: 142.717 / H: 149.896)

- 2Y10Y +4.411, 124.144 (L: 119.067 / H: 124.864)

- 2Y30Y +4.896, 181.155 (L: 175.117 / H: 181.496)

- 5Y30Y +2.512, 112.143 (L: 108.08 / H: 112.161)

- Current futures levels:

- Dec 2Y down 0.75/32 at 110-1.125 (L: 110-01 / H: 110-01.875)

- Dec 5Y down 5/32 at 122-26.5 (L: 122-24.75 / H: 122-31.75)

- Dec 10Y down 11.5/32 at 131-23 (L: 131-20.5 / H: 132-03.5)

- Dec 30Y down 1-02/32 at 159-2 (L: 158-31 / H: 160-12)

- Dec Ultra 30Y down 1-31/32 at 190-24 (L: 190-21 / H: 193-09)

US EURODOLLAR FUTURES CLOSE

- Dec 21 steady at 99.835

- Mar 22 -0.005 at 99.855

- Jun 22 -0.010 at 99.795

- Sep 22 -0.015 at 99.685

- Red Pack (Dec 22-Sep 23) -0.035 to -0.015

- Green Pack (Dec 23-Sep 24) -0.045 to -0.04

- Blue Pack (Dec 24-Sep 25) -0.045

- Gold Pack (Dec 25-Sep 26) -0.055 to -0.05

Short Term Rates

US DOLLAR LIBOR: Latest settlements

- O/N -0.00262 at 0.06988% (-0.00450/wk)

- 1 Month +0.00787 to 0.08575% (+0.01050/wk)

- 3 Month -0.00263 to 0.12400% (-0.00913/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00037 to 0.15513% (-0.00188/wk)

- 1 Year +0.00488 to 0.23688% (+0.00200/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $73B

- Daily Overnight Bank Funding Rate: 0.07% volume: $261B

- Secured Overnight Financing Rate (SOFR): 0.05%, $925B

- Broad General Collateral Rate (BGCR): 0.05%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $343B

- (rate, volume levels reflect prior session)

- Tsy 7Y-10Y, $3.201B accepted vs. $7.622B submission

- Next scheduled purchases

- Wed 10/06 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Thu 10/07 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Fri 10/08 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

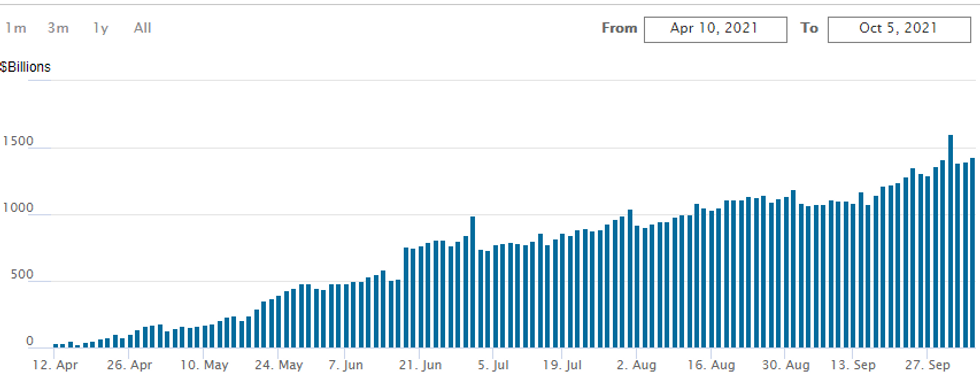

FED Reverse Repo Operation, Second Highest on Record

NY Fed reverse repo usage climbs to $1,431.180B from 80 counterparties vs. Monday's $1.399.173B. Compares to Thursday, September 30 record high of $1,604.881B.

PIPELINE: $3B MUFG Leads

- Date $MM Issuer (Priced *, Launch #)

- 10/05 $3B #MUFG $1B 4NC3 +45, $1.25B 6NC5 +67, $750M 11NC10 +97

- 10/05 $1.25B (upsized from $1B) #Williams Cos 10Y $600M +95, $650M 30Y +142

- 10/05 $1B #Jefferies Group 10Y +120

- 10/05 $1B #Nationwide 5Y +60

- 10/05 $1B #Autodesk 10Y +90

- 10/05 $500M *KFW 2024 tap FRN/SOFR+10

- 10/05 $500M #General Mills 10Y +73

- Expected Wednesday:

- 10/06 $1B Ontario WNG 10Y +31a

EGBs-GILTS CASH CLOSE: Gilt Yields Soar

Gilt yields hit the highest since May 2019, underperforming Bunds once again amid a broader global FI bear steepening move. Periphery spreads were steady.

- The UK move didn't come on an obvious catalyst. Though soaring gas prices continued to make headlines, GBP outperformed EUR, unlike last week. 10Y Breakevens hit the highest level since 1998 though (3.982%), so perhaps inflation fears have something to do with it.

- ECB's Holzmann earlier stated that he was clinging to the hope that the inflation spike is temporary.

- In data, September Spanish and Italian service PMIs disappointed.

- In supply: UK sold GBP5.5bln in Gilts, Germany E0.5bln in linkers, Austria E1.1bln of RAGB.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.8bps at -0.695%, 5-Yr is up 1.9bps at -0.555%, 10-Yr is up 2.6bps at -0.188%, and 30-Yr is up 2.3bps at 0.291%.

- UK: The 2-Yr yield is up 4.5bps at 0.451%, 5-Yr is up 5.2bps at 0.681%, 10-Yr is up 7bps at 1.081%, and 30-Yr is up 6.7bps at 1.446%.

- Italian BTP spread up 0.2bps at 104.6bps / Spanish down 0.4bps at 64.6bps

FOREX: Equities Bounce Boosts Cross/JPY, EURNOK To Fresh Yearly Lows

- A more buoyant session for equity markets/risk kept the Japanese Yen under pressure with USDJPY rising the best part of half a percent and slightly larger moves higher in the likes of AUDJPY and CADJPY.

- USDJPY confirmed the resumption of the bull cycle last week that started Jan 6, opening the potential for 112.23 next, Feb 20, 2020 high.

- Further moves higher in crude futures kept supporting the NOK, with EURNOK breaking to the lowest levels since January 2020. A break of the yearly lows through 9.90 may attract attention with the 2020 lows around 9.81 next on the support list.

- Broad dollar indices maintained very narrow ranges on Tuesday with EURUSD content trading blows either side of the 1.1600 mark. Markets had little reaction to an upside surprise in US ISM services print and may remain treading water as the focus turns to the September NFP report, due on Friday.

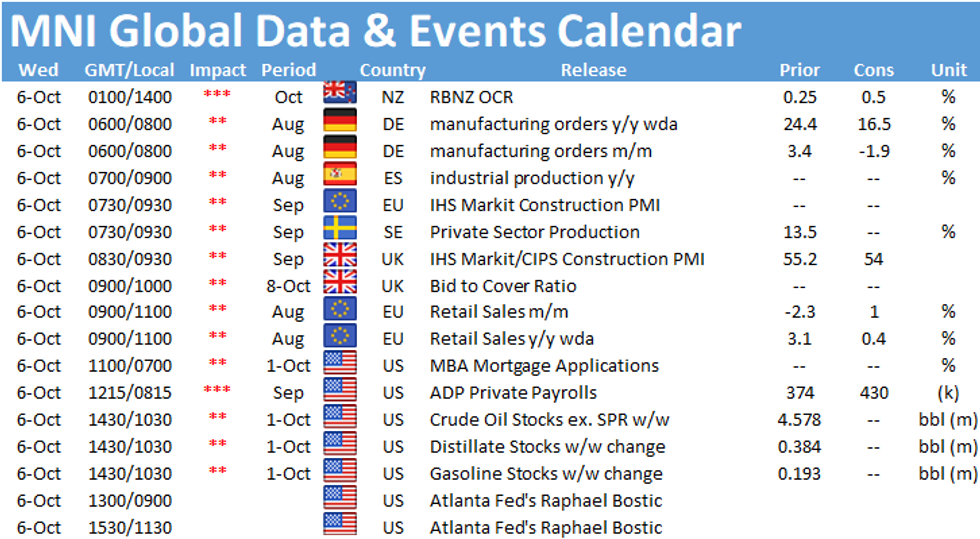

- Overnight we have the RBNZ rate decision and statement where the central bank are widely expected to raise the key rate by 25 bps. Elsewhere, German Factory orders and US ADP will be released on Wednesday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.