-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Gov Quarles Inflation Significant Upside Risk

EXECUTIVE SUMMARY

- MNI: Quarles Warns 'Significant Upside Risk' for US Inflation

- MNI BRIEF: Fed Policy Shift To Have Limited Yuan Impact: Pan

- MNI BRIEF: Supply Shortages Pinch Outlook, Fed Beige Book Says

- MNI INSIGHT: Rates Pricing Races Ahead As BOE Sticks To Script

- SINGAPORE TO EXTEND COVID CURBS TO NOV. 21 ON HOSPITAL PRESSURE, Bbg

- EXXON DEBATES ABANDONING SOME OF BIGGEST OIL, GAS PROJECTS: DJ

US

FED: Federal Reserve Governor Randy Quarles said Wednesday he sees "significant upside risks" to inflation that could force tighter monetary policy even if the labor market falls short of a complete recovery.

- "My focus is beginning to turn more fully from the rapidly improving labor market to whether inflation begins its descent toward levels that are more consistent with our price-stability mandate," he said in remarks prepared for a Milken Institution conference in Los Angeles. "If inflation does remain more than moderately above 2%, be assured that the FOMC has the framework and the tools to address it."

- The FOMC has pledged to keep rates near zero "until labor market conditions have reached levels consistent with the Committee's assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2 percent for some time." For more see MNI Policy main wire at 1301ET.

FED: Any policy shift by the Federal Reserve is expected to have a limited impact on the yuan forex market, which will remain stable at a reasonable and balanced level, Pan Gongshen, deputy governor of the People's Bank of China, told the Annual Conference of Financial Street Forum Wednesday.

- The differential between US economic growth and its counterparts and their policies are both smaller than last time when the Fed tightened, which will restrain the US dollar's rally, said Pan, who is also head of State Administration of Foreign Exchange. Factors including the steady economic fundamentals, the increased flexibility of the yuan and the improved structure of capital inflow will help offset any external shock, he pointed out.

- Employment increased at a "modest to moderate" rate in recent weeks as demand for workers was high, but labor growth was dampened by a low supply of workers, the report said. "Many firms offered increased training to expand the candidate pool. In some cases, firms increased automation to help offset labor shortages. The majority of Districts reported robust wage growth," the report said. For more see MNI Policy main wire at 1416ET.

ENGLAND

BOE: Sterling money market pricing has undergone a dramatic shift to imply more aggressive tightening by the Bank of England, but investors may have read too much into recent comments by policy makers which contained nothing new about the timing or size of future rate hikes.

- Market-moving declarations by Governor Andrew Bailey in a video conference on Sunday merely reinforced the message that monetary stimulus has to be unwound, initially via an increase in Bank Rate. "We at the Bank of England have signalled, and this is another such signal, that we will have to act," he said at the G30 Annual International Banking Seminar.

US TSYS: Carry-Over Weakness for Bonds

Carry-over weakness in Bonds continued Wednesday, yield curves bear steepening off Monday's early 2020 lows (5s30s +5.3 Wed to 57.4 after the bell). Bund and Gilt rates traded similarly with short end outperforming as rate hike speculation ebbed.- Inside range day on little substantive data and little to no reaction from Fed speakers. Fed Gov Quarles stating the Fed has not "met more stringent test for rate liftoff" about 24 hours after Fed Gov Waller posited more than just tapering MAY be needed in 2022.

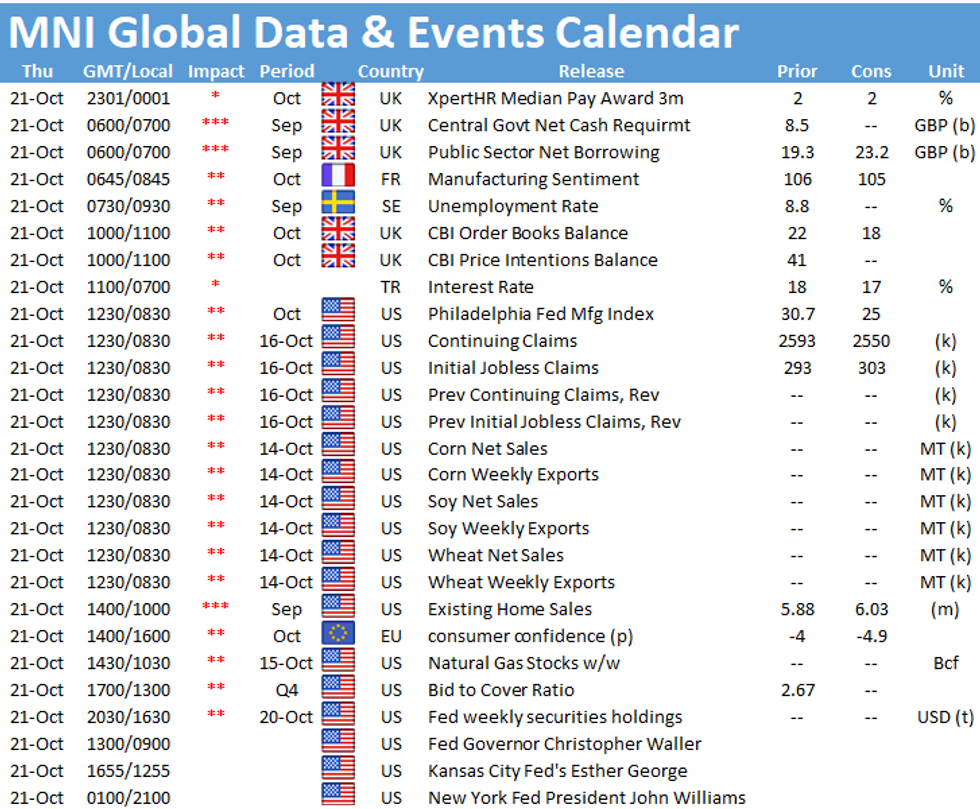

- Weekly claims (+297k est) and existing home sales (6.09M est) on tap Thursday while Fed Gov Waller speaks again on US economy.

- Tsys that had surged back to early session highs ahead the 20Y auction, sold off after the $24B 20Y Bond auction re-open (912810TA6) tailed: drawing a high yield of 2.100% (1.795% last month) vs. 2.070% WI. Bid-to-cover 2.25 vs. 2.36 in September.

- Beige Book: "MOST DISTRICTS REPORTED `SIGNIFICANTLY ELEVATED' PRICES", while "LABOR SHORTAGE WEIGHED ON GROWTH, WORKER TURNOVER HIGH".

- After the bell, 2-Yr yield is down 2.2bps at 0.3732%, 5-Yr is down 1.6bps at 1.1456%, 10-Yr is down 0.3bps at 1.6338%, and 30-Yr is up 2.4bps at 2.1091%.

OVERNIGHT DATA

- US MBA: REFIS -7% SA; PURCH INDEX -5% SA THRU OCT 15 WK

- US MBA: UNADJ PURCHASE INDEX -12% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.23% VS 3.18% PREV

- CANADIAN SEP CONSUMER PRICE INDEX INFLATION +4.4% YOY

- CANADA MOM CPI INFLATION WAS +0.2% IN SEP

- CANADA'S INFLATION RATE IS HIGHEST SINCE 2003

MARKETS SNAPSHOT

Key late session market levels:

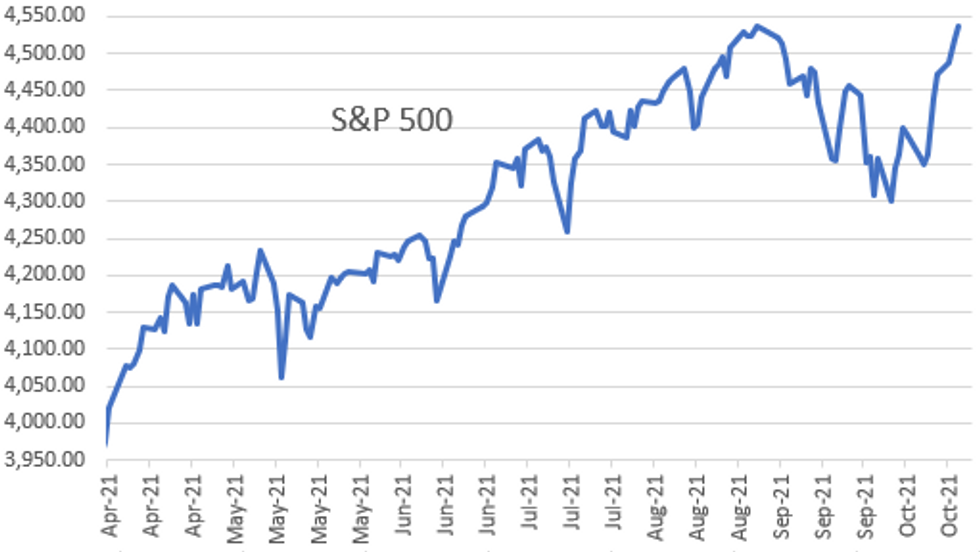

- DJIA up 162.97 points (0.46%) at 35618.39

- S&P E-Mini Future up 16.25 points (0.36%) at 4527

- Nasdaq down 9.2 points (-0.1%) at 15117.63

- US 10-Yr yield is down 0.3 bps at 1.6338%

- US Dec 10Y are up 2/32 at 130-20

- EURUSD up 0.0024 (0.21%) at 1.1657

- USDJPY down 0.17 (-0.15%) at 114.21

- WTI Crude Oil (front-month) up $0.91 (1.1%) at $83.87

- Gold is up $17.04 (0.96%) at $1786.43

- EuroStoxx 50 up 5.34 points (0.13%) at 4172.17

- FTSE 100 up 5.57 points (0.08%) at 7223.1

- German DAX up 7.09 points (0.05%) at 15522.92

- French CAC 40 up 35.76 points (0.54%) at 6705.61

US TSY FUTURES CLOSE

- 3M10Y -0.166, 158.23 (L: 156.215 / H: 160.991)

- 2Y10Y +2.241, 126.028 (L: 123.607 / H: 127.211)

- 2Y30Y +5.277, 173.885 (L: 169.015 / H: 175.575)

- 5Y30Y +4.405, 96.52 (L: 91.924 / H: 98.219)

- Current futures levels:

- Dec 2Y up 0.625/32 at 109-24.875 (L: 109-22.5 / H: 109-25.5)

- Dec 5Y up 1.5/32 at 121-30.75 (L: 121-22.75 / H: 122-01.5)

- Dec 10Y up 2/32 at 130-20 (L: 130-08 / H: 130-24)

- Dec 30Y down 6/32 at 158-3 (L: 157-18 / H: 158-15)

- Dec Ultra 30Y down 29/32 at 190-4 (L: 189-11 / H: 191-14)

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.005 at 99.810

- Mar 22 +0.005 at 99.80

- Jun 22 steady at 99.690

- Sep 22 +0.005 at 99.535

- Red Pack (Dec 22-Sep 23) +0.010 to +0.025

- Green Pack (Dec 23-Sep 24) +0.010 to +0.025

- Blue Pack (Dec 24-Sep 25) steady to +0.010

- Gold Pack (Dec 25-Sep 26) -0.015 to steady

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00150 at 0.07325% (+0.00012/wk)

- 1 Month +0.00012 to 0.08575% (+0.00538/wk)

- 3 Month -0.00125 to 0.12825% (+0.00462/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00300 to 0.17050% (+0.01000/wk)

- 1 Year +0.00462 to 0.29675% (+0.01712/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $269B

- Secured Overnight Financing Rate (SOFR): 0.03%, $875B

- Broad General Collateral Rate (BGCR): 0.05%, $368B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $359B

- (rate, volume levels reflect prior session)

FED: NY Fed Operational Purchase

- Tsys 7Y-10Y, $3.201B accepted vs. $8.333B submission

- Next scheduled purchases

- Thu 10/21 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 10/22 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B

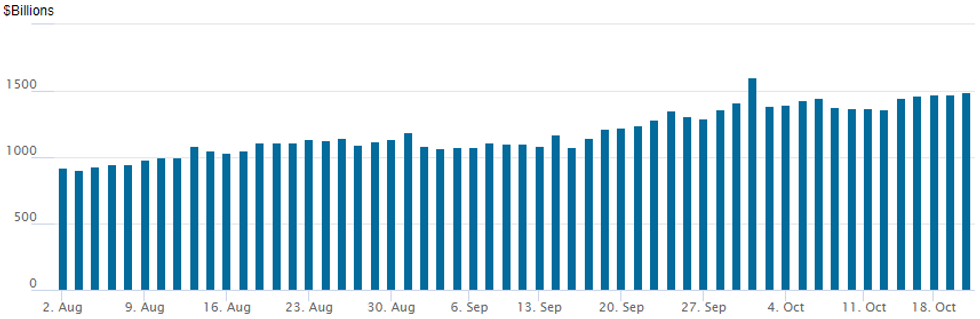

FED Reverse Repo Operation Second Highest on Record

NY Federal Reserve

NY Fed reverse repo usage recedes slightly -- to $1,493.961B from 78 counterparties vs. $1,470.739B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $4.5B Taiwan Semiconductor Mfg 4Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/20 $4.5B #TSMC (Taiwan Semiconductor Mfg) $1.25B 5Y +60, $1.25B 10Y +90, $1B 20Y +110, $1B 30Y +120

- 10/20 $1.5B #Bank of NY Mellon $700M 3Y+17, $400M 3Y FRN/SOFR+20, $400M 7.25Y +45

- 10/20 $1B *Citigroup PerpNC5 preferred 4.15%

- 10/20 $1B *Finnvera WNG 5Y +23

- Expected Thursday:

- 10/21 $Benchmark CADES (Caisse d'Amortissement de la Dette Sociale) 5Y +6

EGBs-GILTS CASH CLOSE: Short-End Sell-Off Relents

Bund and Gilt yields closed lower for the first time since last Thursday, with the short end outperforming as rate hike speculation took a step back.

- A miss on UK inflation at the beginning of the session set a slightly more dovish tone than seen previously in the week, with curves bull steepening.

- Periphery spreads fell with the exception of Greece.

- The biggest headline of the session was the unexpected resignation of Bundesbank President Weidmann, effective at the end of this year (successor to be decided by the next government).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 3.3bps at -0.658%, 5-Yr is down 3.3bps at -0.473%, 10-Yr is down 2bps at -0.126%, and 30-Yr is down 0.5bps at 0.291%.

- UK: The 2-Yr yield is down 4.9bps at 0.684%, 5-Yr is down 4.2bps at 0.818%, 10-Yr is down 2.1bps at 1.148%, and 30-Yr is up 1.5bps at 1.387%.

- Italian BTP spread down 1.4bps at 104bps / Spanish down 0.4bps at 63bps

FOREX: AUD and NZD Extend Positive Trend

- Antipodean FX continued its appreciating trend on Wednesday amid a slightly weaker dollar index. Positive risk sentiment continued to filter through to risk-tied FX with both AUDUSD and NZDUSD rising over 0.5%.

- NZDUSD completes a six-day winning streak which has seen the pair extend through the September peak to print fresh four-month highs above 0.7200. Further strength will bring the May highs at 0.7316 into focus.

- GBP had a fairly volatile session and saw a strong bounce off the lows throughout the latter half of Wednesday. Initially, a lower-than-expected CPI print prompted steady selling during European hours down to a low of 1.3742. However, dip buying proved powerful enough to reverse all the way to session highs above 1.3830 and keep the bullish theme intact. The recent break higher opens 1.3913, Sep 14 high.

- In emerging markets, USDTRY fell close to 1% after failing above 9.35 for the second consecutive session. Potential profit taking in play ahead of tomorrow's CBRT decision where the consensus expectation is for the central bank to cut rates by 100bps for the second consecutive meeting amid considerable background political pressure.

- US data on Thursday includes Philly fed Manufacturing Index alongside Initial Jobless Claims which should precede comments by Fed's Waller. Capping off Thursday schedule will be RBA Governor Lowe due to participate in a panel discussion.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.