-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hawkish BoC, Global Inflation Cares Spook Mkt

EXECUTIVE SUMMARY

- MNI: BOC Ends New QE Buys, Maintains Stock; Tweaks Guidance

- MNI: Higher Inflation To Drive Fed To Redefine Full Employment

- MNI SOURCES: Hawks Emboldened As ECB Nears Crunch December

- China Warns U.S. Support for Taiwan Poses 'Huge Risks' to Ties, Bbg

- China's Xi Urges Military Advances Amid Growing U.S. Rivalry, Bbg

US

FED: Federal Reserve officials could concede by mid-next year that unemployment and workforce participation rates may not recover to pre-pandemic levels, declaring the maximum employment objective of the Fed's dual mandate met and clearing the way for interest rates to lift off zero if inflation stays uncomfortably high, former senior officials and a regional Fed adviser told MNI.

- Demand for workers has propelled job openings to record levels, leading to higher pay and a speedy recovery in the unemployment rate to below 5%. That's prompted a vocal minority of policymakers to argue that what slack there is in the labor market will soon be absorbed, despite the fact that some 5 million Americans have yet to return to work.

- Continued high inflation next year could convince others to reassess their guideposts for maximum employment and begin normalizing rates as soon as the second half of 2022, the ex-officials said.

CANADA

BOC: The Bank of Canada on Wednesday brought forward its guidance for raising its record low 0.25% interest rate to the "middle quarters of 2022" from the second half, citing persistent inflation pressure and less slack in the economy, while announcing new bond buying has ended but that the Bank was moving to a reinvestment phase, replacing maturing bonds to maintain the stock of QE.

- "We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved. In the Bank's projection, this happens sometime in the middle quarters of 2022," the Governing Council said in a statement accompanying the decision.

- Given the economic recovery, policymakers decided "to end quantitative easing and keep its overall holdings of Government of Canada bonds roughly constant," the statement said. The Bank will release bond purchase details at 10:30 EST, as it moves to exit from the prior pace of CAD2 billion a week. For more see MNI Policy main wire at 1020ET.

EUROPE

ECB: Expectations for the size of monetary stimulus following the conclusion of the European Central Bank's Pandemic Emergency Purchase Programme in March are ratcheting lower, with Governing Council debate seen focussing on adding flexibility to an older bond-buying scheme and the possible creation of a "sleeper" facility only to be used during market stress, eurosystem sources told MNI.

- As fears rise that higher inflation could prove more than transitory, hawkish rate setters, who for the moment seem to have seen off suggestions of an extension of the PEPP, are resisting any indefinite expansion of the size of the Asset Purchase Programme.

- While some hawks would accept an increase in monthly APP activity if capped within a fixed envelope, another proposal aimed at finding consensus would be for APP bond-buying, currently running at EUR20 billion a month, to be fixed in annual terms, permitting the pace of purchases to be increased when necessary so long as the year's total falls within the agreed limit, one source said. For more see MNI Policy main wire at 1110ET.

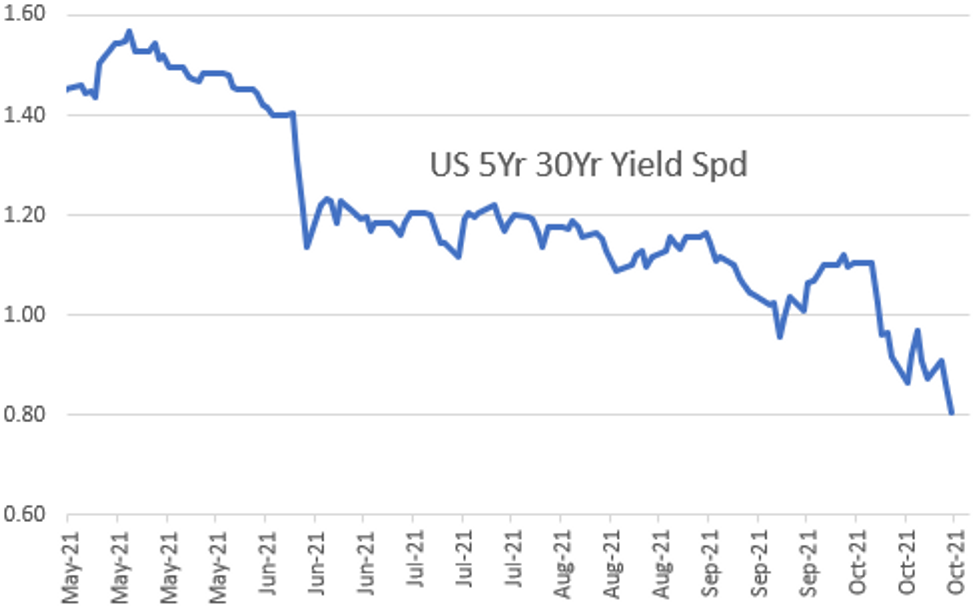

US TSYS: Bull Flattening, Knock-On Effect Of BoC's Hawkish Forward Guidance

Knock-on effect of Bank of Canada's hawkish policy annc Wed (steady rate but ending QE/moves to reinvestment phase pushes forward rate liftoff from 2H22 to midyear) weighed heavily on short end rates, particularly Eurodlr Sep'22 to Red Jun'23, trading 0.085-0.100 lower at one point. A bit of "tail wags dog" scenario desks quipped, while inflation concerns supported the long end.- Heavy volumes (TYZ1>2.2M, USZ>1.4M) as Tsy yield curves bull flattened to new 18 month lows, 30YY tapped 1.9307% low.

- Active second half players include dealer and prop accts selling 2s-3s, fast and Real$ +5s-10s, Real$ and bank portfolio buying 30s, deal-tied unwinds and curve steepener stop-outs as well. After a large 2s5s steepener Block around midday, a 5s/30s ultra bond flattener block crossed.

- Post-Note auction support: Tsy futures gapped higher after 2.3bp stop -- decent $61B 5Y note auction (91282CDG3) with 0.157% high yield vs. 1.180% WI; 2.55x bid-to-cover surge vs Sep's 2.37x (lowest since 2008) well over five auction avg: 2.38x. Indirect take-up: 64.78% new 2021 high after 54.3% 2021 Low last month.

- Equities had been posting modest gains in late trade sold off after Bbg headline noted: SENATE FINANCE CHAIRMAN WYDEN SAYS BILLIONAIRES TAX IS NOT DEAD.

- The 2-Yr yield is up 4.8bps at 0.4872%, 5-Yr is down 3.9bps at 1.1351%, 10-Yr is down 8.2bps at 1.5256%, and 30-Yr is down 10.2bps at 1.9383%.

OVERNIGHT DATA

- US SEP DURABLE NEW ORDERS -0.4%; EX-TRANSPORTATION +0.4%

- US AUG DURABLE GDS NEW ORDERS REV TO +1.3%

- US SEP NONDEF CAP GDS ORDERS EX-AIR +0.8% V AUG +0.5%

- US MBA: REFIS -2% SA; PURCH INDEX +4% SA THRU OCT 22 WK

- US MBA: UNADJ PURCHASE INDEX -9% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 3.30% VS 3.23% PREV

- US MBA: MARKET COMPOSITE +0.3% SA THRU OCT 22 WK

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 105.88 points (-0.3%) at 35651.8

- S&P E-Mini Future up 3 points (0.07%) at 4568.5

- Nasdaq up 104.6 points (0.7%) at 15340.31

- US 10-Yr yield is down 8.2 bps at 1.5256%

- US Dec 10Y are up 18/32 at 131-5.5

- EURUSD up 0.0013 (0.11%) at 1.1609

- USDJPY down 0.37 (-0.32%) at 113.79

- WTI Crude Oil (front-month) down $1.94 (-2.29%) at $82.72

- Gold is up $5.23 (0.29%) at $1798.16

- EuroStoxx 50 down 3.09 points (-0.07%) at 4220.88

- FTSE 100 down 24.35 points (-0.33%) at 7253.27

- German DAX down 51.25 points (-0.33%) at 15705.81

- French CAC 40 down 12.99 points (-0.19%) at 6753.52

US TSY FUTURES CLOSE

- 3M10Y -6.853, 147.855 (L: 146.283 / H: 156.746)

- 2Y10Y -12.288, 103.928 (L: 102.987 / H: 117.16)

- 2Y30Y -14.479, 145.013 (L: 144.359 / H: 160.207)

- 5Y30Y -6.268, 80.017 (L: 77.839 / H: 86.709)

- Current futures levels:

- Dec 2Y down 1.375/32 at 109-20.375 (L: 109-18.125 / H: 109-22.25)

- Dec 5Y up 4.25/32 at 121-28.75 (L: 121-17.25 / H: 121-31)

- Dec 10Y up 16/32 at 131-3.5 (L: 130-14 / H: 131-07)

- Dec 30Y up 1-29/32 at 160-28 (L: 158-24 / H: 161-05)

- Dec Ultra 30Y up 3-26/32 at 196-08 (L: 192-03 / H: 196-24)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.010 at 99.795

- Mar 22 -0.010 at 99.770

- Jun 22 -0.035 at 99.590

- Sep 22 -0.045 at 99.40

- Red Pack (Dec 22-Sep 23) -0.045 to -0.015

- Green Pack (Dec 23-Sep 24) +0.010 to +0.080

- Blue Pack (Dec 24-Sep 25) +0.095 to +0.125

- Gold Pack (Dec 25-Sep 26) +0.130 to +0.140

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00213 at 0.06950% (-0.00400/wk)

- 1 Month +0.00000 to 0.08700% (-0.00088/wk)

- 3 Month -0.00725 to 0.12863% (+0.00375/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00338 to 0.17963% (+0.00763/wk)

- 1 Year +0.00950 to 0.33225% (+0.01538/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $77B

- Daily Overnight Bank Funding Rate: 0.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 0.05%, $877B

- Broad General Collateral Rate (BGCR): 0.05%, $356B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $326B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $4.300B submission

- Next scheduled purchases

- Thu 10/28 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B

- Fri 10/29 1010-1030ET: Tsy 10Y-22.5Y, appr $1.425B

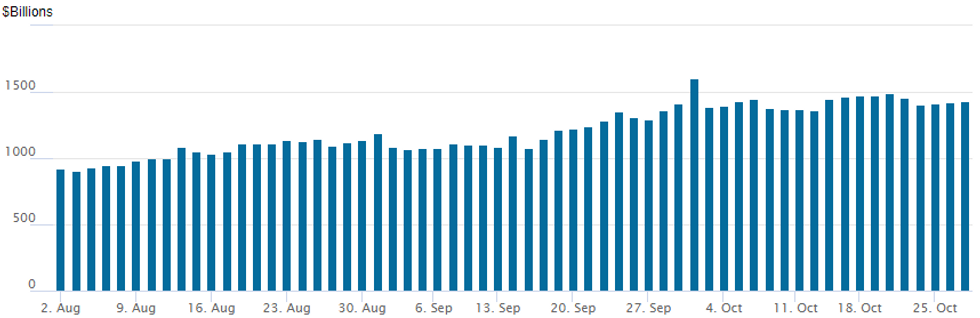

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,433.370B from 75 counterparties from $1,423.198B on Tuesday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: $4B Citigroup 3Pt Launched, IBRD Priced Earlier

- Date $MM Issuer (Priced *, Launch #)

- 10/27 $5B *World Bank 10Y +7

- 10/27 $4B #Citigroup $1B 4NC3+52, $1.75B 11NC10+98, $1.25B 21NC20+98

- 10/27 $1.3B #NextEra 2NC.5 FRN/SOFR+40

- 10/27 $Benchmark US Bancorp 15NC10 +95a

- 10/27 $Benchmark Fifth Third investor calls

- Reverse Yankee

- 10/27 Yen/Benchmark Proctor & Gamble 5Y 0.11%a, 10Y 0.23%a

EGBs-GILTS CASH CLOSE: Gilts Rally Amid Big Issuance Reduction

Long-end Gilt yields fell by the most since March 2020 Wednesday, outperforming Bunds (which still saw one of the biggest rallies of 2021).

- Alongside today's UK budget release, DMO announced a reduction in Gilt issuance of GBP57.8bln in 2021-22 vs the amount projected in April, which was beyond even the biggest sell-side expectations.

- That accelerated a Gilt rally that started in the morning, with yields closing near the lows.

- Periphery EGBs couldn't quite keep pace with Bunds, leaving spreads a little wider. GGBs underperformed; Portugal weaker too amid continued political uncertainty and a short- for long-term bond exchange operation.

- Focus turns to flash October CPI and the ECB decision Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.3bps at -0.645%, 5-Yr is down 2.8bps at -0.469%, 10-Yr is down 6.3bps at -0.18%, and 30-Yr is down 8.9bps at 0.155%.

- UK: The 2-Yr yield is down 6.7bps at 0.559%, 5-Yr is down 9.8bps at 0.702%, 10-Yr is down 12.5bps at 0.985%, and 30-Yr is down 18bps at 1.136%.

- Italian BTP spread up 0.5bps at 111.8bps / Portuguese up 1.9bps at 55.2bps

FOREX: USDCAD Sharply Lower Following Hawkish Bank of Canada

- A more hawkish than expected BOC statement prompted a strong immediate rally in the Canadian dollar. USDCAD had been in positive territory throughout early trade on Wednesday due to declining oil prices, however, appeared offered approaching the decision, trading from 1.2420 down to 1.2400.

- Following the release, the pair traded quickly down to 1.2340 and remained under short-term pressure as it traded down to 1.2301 lows in the aftermath. Cad gains consolidated throughout the US trading session with USDCAD content around 1.2340.

- Technically, the focus turns to the mid-October lows now well in range at 1.2288, with 1.2253 the most significant support of note, the June 23rd low.

- Elsewhere, GBP was under pressure as Chancellor Sunak announced details on the UK budget. Cable traded down to lows of 1.3710 but has since bounced back to 1.3750. EURGBP had a strong relief rally after holding above 0.8400 yesterday, to highs of 0.8465.

- A poorer day for the commodity complex did little to stifle the bid in AUDUSD and NZDUSD, which continue to both consolidate above the September highs.

- USDJPY, however, did suffer and made a new marginal low for October at 113.39 before bouncing into the close.

- EURCHF continues its steady retreat, edging below 1.0650 for the first time since July 2020. While the price action remains very slow, this may be worth monitoring if we start to approach lows at 1.0607 and the 2020 lows close to the 1.05 handle.

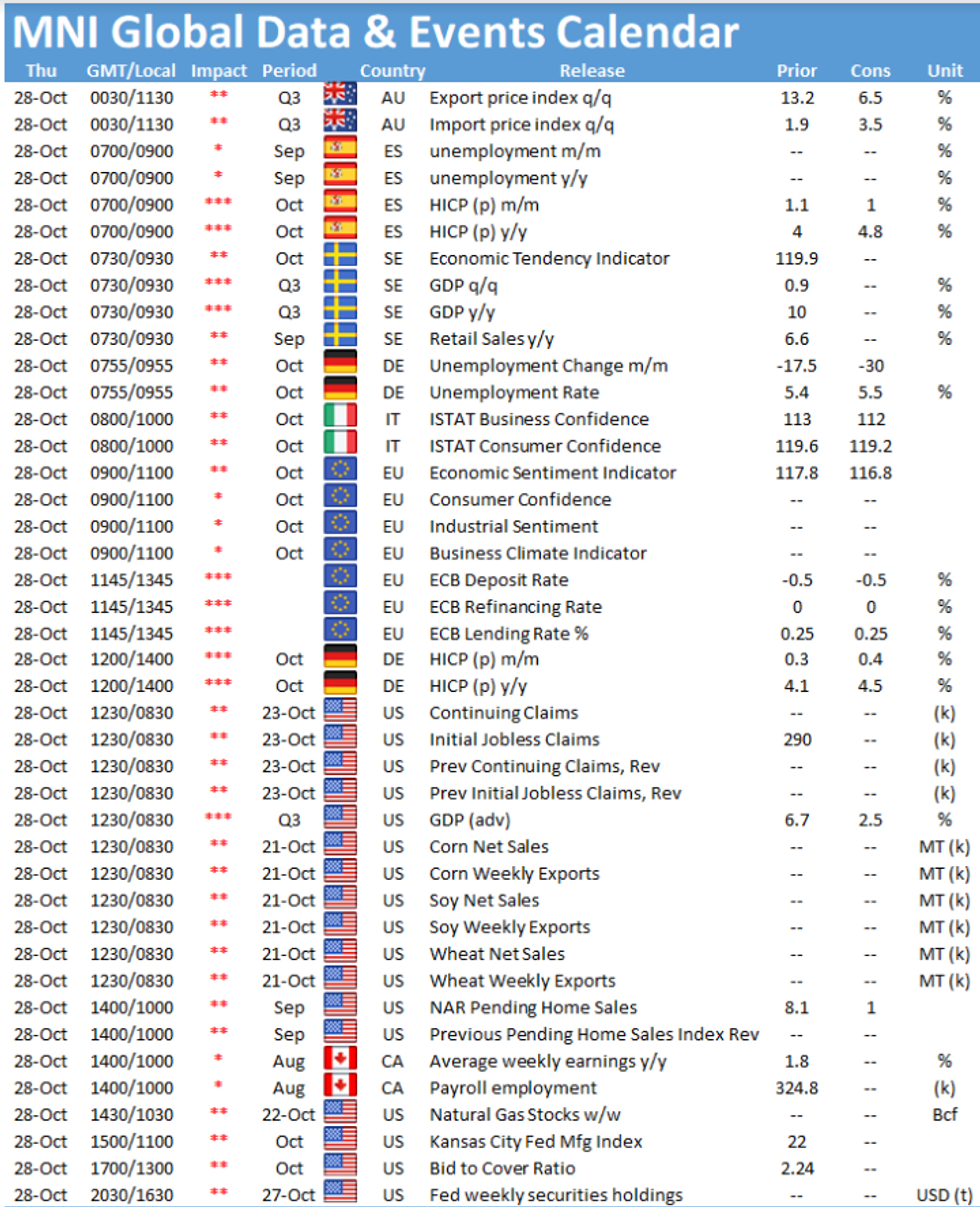

- Overnight, markets will await the Bank of Japan before German CPI data. Later on Thursday, the focus will turn to the ECB statement/press conference and the advance reading of US Q3 GDP.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.