-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Acknowledging More Uncertainty About Transitory

EXECUTIVE SUMMARY

- MNI: Fed Framework Creates Room to Wait On 2022 Hikes

- MNI INTERVIEW: Fed To Speed Up Taper, Hike 3 Times in '22-Swonk

- MNI: Fed's George Says Taper Is First Step In Normalization

- US PRES BIDEN SAID TO HAVE MET SEPARATELY WITH POWELL, BRAINARD (late Thursday), Bbg

US

FED: Chairman Powell from Wednesday's post-FOMC press conference: "We are trying to explain what we mean and also acknowledging more uncertainty about transitory. It's become a word that has received a lot of attention which is distracting from our message which we want to be as clear as possible. We understand completely it's particularly people who are living paycheck to paycheck are seeing higher grocery and gas cost and when winter costs higher heating for their homes.

- We understand what they are going through. We will use our tools over time to make sure that doesn't become a permanent feature of life. That is one of our principal jobs, along with achieving maximum employment. That is our commitment.

FED: The Federal Reserve is beginning to tone down its emphasis on its newly-inclusive jobs goal as a surge in prices proves less transitory than expected, but an ambiguous year-old inflation-targeting strategy allows the FOMC an unprecedented degree of flexibility as to when to raise interest rates, former Fed officials told MNI.

- The monetary policy framework inaugurated in August 2020 was designed with the idea of fighting demand shocks and low inflation with rates constrained by the zero bound for years to come. Instead, a pandemic-driven supply shock has pushed inflation uncomfortably high and created a conflict between price stability and full employment objectives.

- "The Fed has never been very specific about how it weighs those two objectives and that creates a lot of uncertainty about the direction of policy," former Dallas Fed principal monetary policy adviser Evan Koenig said. For more see MNI Policy main wire at 0854ET.

- "The fact that they left it open in December means a lot of people were thinking we don't want to keep this at only USD15 billion a month," said Swonk, who regularly advises the Fed's board of governors in Washington as well as the Chicago Fed, in an interview.

- "It was interesting how Jay (Powell) put it, that we decided to keep it after the December meeting because the December meeting is after when we'd have to do the open market operations. Which means it's complete optionality. It opens the door for December or January." For more see MNI Policy main wire at 1154ET.

FED: Kansas City Fed President Esther George said Friday that as prices appear set to remain higher for longer into next year the central bank's dual mandate goals may conflict, but tapering announced this week is a good first step in policy normalization.

- "In most circumstances, the Federal Reserve's dual mandate objectives for maximum employment and stable prices are in alignment, so that the Fed's policy actions support both objectives simultaneously," she said. "There are however times when the objectives can appear to be in conflict. And now might be one of those times with inflation running well ahead of its longer-run average and labor markets appearing to have further room to recover."

- George pointed to record unfilled job openings, wage growth and increased quits as signs of labor market tightness, but said that could prove temporary as workers rejoin the labor market and the childcare industry is restored.

- Still, the Kansas City Fed president saw prices higher for longer and hitting American families.

- "Disruptions that initially appeared to be temporary bottlenecks driving up prices now look as if they may be more long-lasting, with widespread reports suggesting that supply chains will not recover until well into 2022," she said in a speech at an energy conference. About half of an average household's expenditure basket is now experiencing "unusually higher prices," she said.

US TSYS: Solid October Jobs Gains/Up Revisions, Tsys Rally Anyway

Not exactly the result one would expect after solid job gains and up-revisions to prior reads: Treasury futures marched higher all day after initially trading modestly weaker on Oct NFP: +531k job gains vs. +450k est, Sep up-revision to +312k and unemployment rate drop to 4.6% vs. 4.7% est.- Tsys drew some sporadic buying/short covering after initial surge in selling across the curve. Futures marched higher with 30YY tapping 1.8708% low -- last seen Sep 23. Yield curves bull flattened for a period before bull flattening as the session progressed, 5s30s tapped 80.566L before bouncing to 82.671 after the bell.

- Fading the rally, sources report real$ acct selling in 10s, 20s and 30s late morning, rate receivers/payer unwinds in 2s-10s. Trading desks also partially tied rally to re-positioning in aftermath of Thu's FOMC (accelerated taper schedule) and Boe (hawkish hold) while gilts continued to outperform.

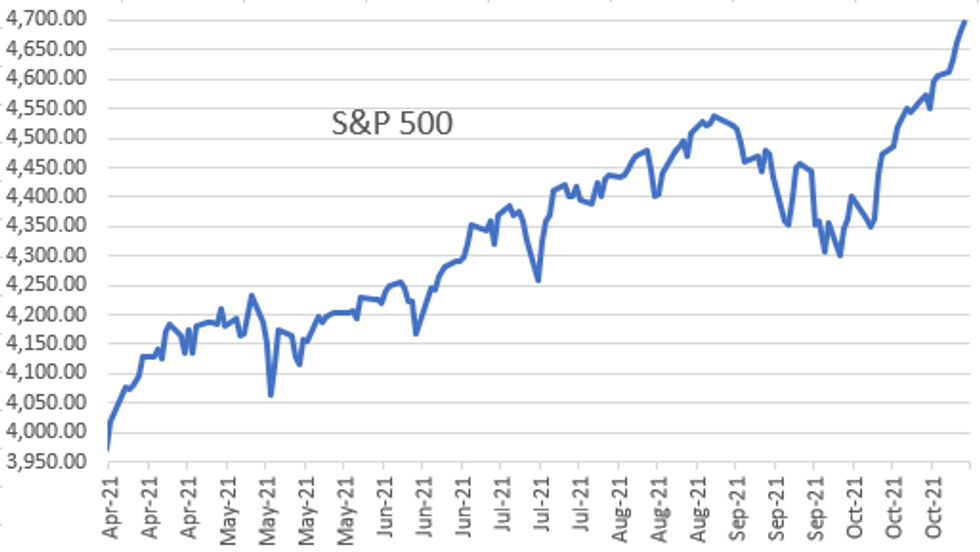

- Equities made new all-time highs (ESZ1 4711.75) while oil surged (WTI +2.75 to 81.56), Bbg story reports: "Saudi Aramco Raises Oil Prices Sharply After OPEC+ Defies Biden" call to increase output.

- Data look ahead: PPI and CPI on next week's shortened Veterans Day holiday (Nov 11), Treasury coupon supply (3s, 10s and 30s on reduced size) and Fed speakers coming off the sidelines.

- After the bell, 2-Yr yield is down 2.6bps at 0.3988%, 5-Yr is down 6bps at 1.0507%, 10-Yr is down 7.7bps at 1.4496%, and 30-Yr is down 7.9bps at 1.8837%.

OVERNIGHT DATA

US DATA: Strong Employment Report All Around...A few highlights from what looks like a strong October jobs report release all around, apart from participation:

- BLS: "Job growth was widespread in October, with notable job gains occurring in leisure and hospitality, in professional and business services, in manufacturing, and in transportation and warehousing. Employment in public education declined over the month."

- On the participation side, labor force participation rate was unchanged at 61.6%, while the closely-watched prime age (25-54 year old) participation rate ticked up to 81.7% from 81.6%, still below Aug though.

- The employment-population ratio of 58.8% was little changed over the month.

- The unemp rate fell a to 4.6% from 4.8%, a little below 4.7% consensus. Avg hourly earnings were in line with expectations.

US DATA: But Unlikely To Impact Fed Policy … From a Fed policy perspective, though, the October payrolls report is unlikely to a game changer.

- While the headline number and revisions beat handily, participation is not doing much (it might take some time for that to move up convincingly, and that's a big criteria for hiking as Powell reminded Weds), and wage growth was in line with expectations so this report is not fanning the inflation flames.

- Perhaps some further encouragement came in the broad swathe of industries enjoying job gains as we emerge from the Delta wave (leisure/hospitality +164k, prof biz services +100k, manufacturing +60k, transport/warehousing +54k, construction +44k, healthcare +37k, retail trade +35k, and the only significant minus was in gov't education (-65k)). the prime-age employment to population ratio ticked up 0.3pp vs stalling in October.

- Little here for the Fed to reconsider the taper pace at the Dec meeting though, and there's another jobs report in the interim anyway.

MARKET SNAPSHOT

Key late session market levels

- DJIA up 195.54 points (0.54%) at 36328.02

- S&P E-Mini Future up 17.75 points (0.38%) at 4691.75

- Nasdaq up 28.5 points (0.2%) at 15970.8

- US 10-Yr yield is down 7.7 bps at 1.4496%

- US Dec 10Y are up 16.5/32 at 131-26.5

- EURUSD down 0.0002 (-0.02%) at 1.1553

- USDJPY down 0.38 (-0.33%) at 113.38

- WTI Crude Oil (front-month) up $2.57 (3.26%) at $81.32

- Gold is up $22.29 (1.24%) at $1814.32

- EuroStoxx 50 up 29.7 points (0.69%) at 4363.04

- FTSE 100 up 24.05 points (0.33%) at 7303.96

- German DAX up 24.71 points (0.15%) at 16054.36

- French CAC 40 up 53 points (0.76%) at 7040.79

US TSY FUTURES CLOSE

- 3M10Y -7.403, 140.143 (L: 138.499 / H: 149.574)

- 2Y10Y -4.898, 104.879 (L: 103.912 / H: 111.44)

- 2Y30Y -5.117, 148.354 (L: 146.947 / H: 154.83)

- 5Y30Y -1.807, 83.202 (L: 80.566 / H: 85.544)

- Current futures levels:

- Dec 2Y up 1.125/32 at 109-26.75 (L: 109-23.125 / H: 109-27.625)

- Dec 5Y up 7.25/32 at 122-14.5 (L: 121-31.75 / H: 122-16.5)

- Dec 10Y up 16.5/32 at 131-26.5 (L: 131-01.5 / H: 131-30.5)

- Dec 30Y up 1-22/32 at 162-27 (L: 160-22 / H: 163-04)

- Dec Ultra 30Y up 2-30/32 at 198-11 (L: 194-21 / H: 198-25)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.005 at 99.805

- Mar 22 +0.010 at 99.790

- Jun 22 +0.020 at 99.645

- Sep 22 +0.030 at 99.470

- Red Pack (Dec 22-Sep 23) +0.045 to +0.065

- Green Pack (Dec 23-Sep 24) +0.065 to +0.080

- Blue Pack (Dec 24-Sep 25) +0.085 to +0.095

- Gold Pack (Dec 25-Sep 26) +0.095 to +0.105

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00363 at 0.07263% (+0.00050/wk)

- 1 Month -0.00100 to 0.08863% (+0.00213/wk)

- 3 Month -0.00163 to 0.14275% (+0.01050/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00763 to 0.22088% (+0.01988/wk)

- 1 Year -0.00500 to 0.35750% (-0.00363/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 0.05%, $925B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $338B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $8.401B accepted vs. $22.622B submission

- Next scheduled purchases

- Mon 11/08 1010-1030ET: Tsy 22.5Y-30Y, appr $2.025B

- Tue 11/09 1010-1030ET: TIPS 7.5Y-30Y, appr $1.225B

- Wed 11/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B

- Fri 11/12 1500ET: Update NY Fed Operational Purchase Schedule

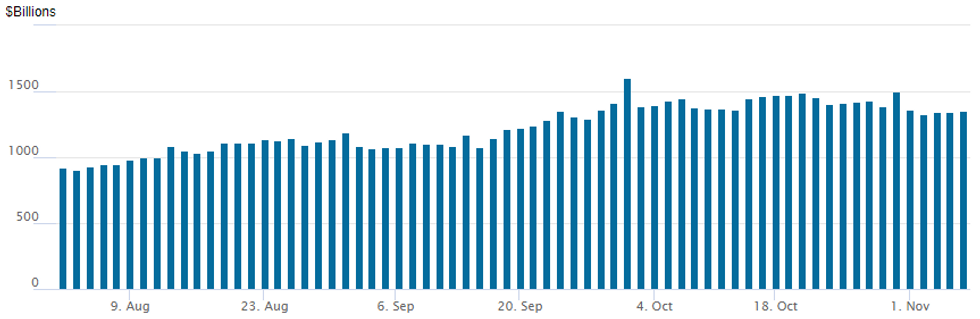

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,354.059B from 75 counterparties vs. $1,348.539B on Thursday. Record high remains at $1,604.881B from Thursday, September 30.

PIPELINE: Southern Co Upsized, Priced

- Date $MM Issuer (Priced *, Launch #)

- 11/05 $600M *Southern Co 1.5NC.5 FRN/SOFR+37

- $3.95B Priced Thursday; $16.15B/wk

- 11/04 $1.75B *Public Storage $650M 5Y +43, $550M 7Y +58, %550M 10Y +73

- 11/04 $1.5B *Public Service Enterprise Grp $750M 2NC0.5 +43, $750M 10Y +95

- 11/04 $700M *Lear Corp 10Y $350M +110, $350M 30Y +160

- 11/04 $Benchmark Ford investor calls

EGBs-GILTS CASH CLOSE: BoE Fallout Continues

UK yields continued to drop sharply Friday following Thursday's unexpected BoE rate hold, once again dragging down yields across the European FI space.

- Yields continued their drop in the afternoon despite a better-than-expected US jobs report.

- Among other highlights, 30Y yields outperformed and have now erased all the late Sep/Oct rise, while 2-/5Y yields completed their biggest weekly fall since 2009 (2Y -30.2bp, 5Y -27.1bp).

- Though Bund 10Y yields fell sharply (w biggest weekly drop since the pandemic), periphery EGBs kept pace, with spreads flat/only slightly wider.

- Note, Moody's reviews Italy after the close, though stable outlook.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.9bps at -0.729%, 5-Yr is down 2bps at -0.579%, 10-Yr is down 5.6bps at -0.28%, and 30-Yr is down 9.2bps at 0.067%.

- UK: The 2-Yr yield is down 9bps at 0.408%, 5-Yr is down 9.5bps at 0.565%, 10-Yr is down 9.9bps at 0.845%, and 30-Yr is down 12.8bps at 1.016%.

- Italian BTP spread unchanged at 115.7bps / Greek up 2.9bps at 136.9bps

FOREX: Narrow Ranges for G10FX, EURUSD Fresh Year Lows As 1.1500 Support Holds

- A solid NFP print with complimentary stellar revisions initially boosted the US dollar on Friday. However, major currencies lacked the appetite for any sustained reactions, prompting the greenback to gradually unwind throughout the remainder of the session.

- This price action was mirrored by EURUSD, making fresh 2021 lows post the data at 1.1514. Strong support at the 1.15 handle capped the dollar strength and the pair reversed back to 1.1550. The focus will remain on 1.1493, the 50.0% retracement of the Mar '20 - Jan '21 bull phase. A break of this level will be needed to confirm the resumption of the underlying downtrend.

- The gradual unwinding of dollar strength supported the Japanese Yen, which was the clear outperformer on Friday, rising 0.35%. If USDJPY were to close here around 1.1340, it would be the lowest daily close since October 13. Clearance of the 1.1300 support zone would signal scope for a deeper pullback and open 112.08, Sep 30 high and a recent breakout level.

- The bolstered risk profile was most evident in the emerging market currency space, with the JPMorgan EM Currency Fund up 0.62% approaching the close. Notable +1% rallies in MXN and ZAR underpinned the improved sentiment.

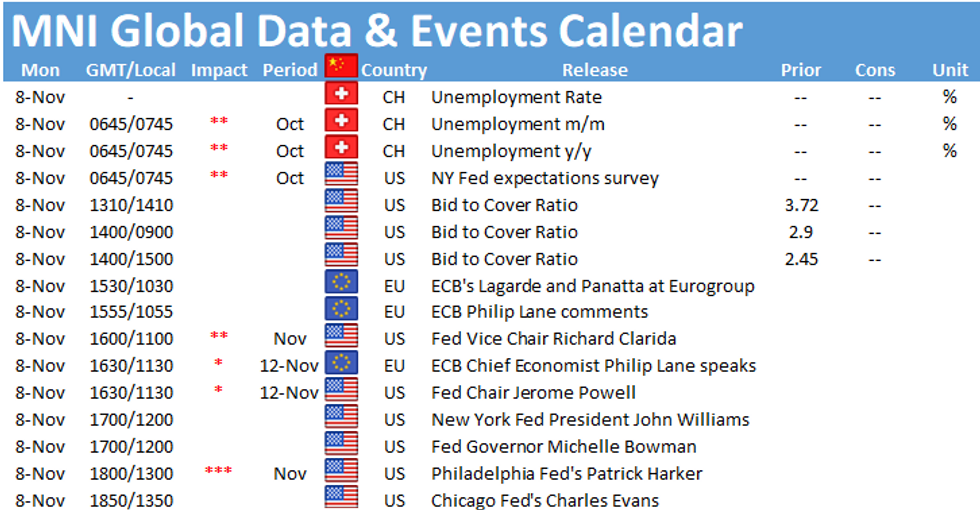

- Lots of Fed speakers, including Chair Powell, kick off a data light Monday next week. Wednesday's US CPI data will headline the calendar before the North American holiday on Thursday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.