-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN - 30Y TSY Auction Tails

MNI ASIA OPEN - 30Y TSY Auction Tails

HIGHLIGHTS:

- US Inflation Surges, USTs Offered

- 30Y UST Yield Spikes Following Tailed Auction

US

US (MNI): Cleveland Fed Median CPI Highest Since 1982

The Cleveland Fed confirms that median CPI in October was +0.57% M/M, which wasthe highest since 1982. Per the Cleveland Fed, the metric - which excludes all price changes apart from the one in the center of the distribution of price changes" - "is even better at forecasting PCE inflation in the near and longer term than the core PCE price index." Yet another sign that US inflation pressures are not merely confined to the outlying categories.

WHITE HOUSE: Biden To Host Canada's Trudeau, Mexico's AMLO Nov 18

The White House has released a statement confirming a North American leader's summit to take place 18 November at the White House. Statement says that the summit, "will reaffirm their strong ties and integration while also charting a new path for collaboration on ending the COVID-19 pandemic and advancing health security; competitiveness and equitable growth, to include climate change; and a regionalvision for migration." The visit will be one of the very few that Mexican President Andres Manuel Lopez Obrador has taken outside his home country since he took over the presidency in 2018. Migration remains a major political hot-button issue in the US. VP Kamala Harris has been tasked with seeking a solution to the major flows of migrants from central America through Mexico to the US' southern border. However, these efforts have proved fruitless and have contributed to her plummeting approval ratings.

EUROPE

EUROPE (MNI): Positive Start To EU Debt Reform Talks, Long Haul Ahead

Eurogroup Chairman Paschal Donohoe hopes to build on a constructive initial meeting by eurozone finance ministers on reforming European Union rules on public borrowing by drawing together common themes from statements next month ahead of draft national budgets, officials told MNI.

EUROPE (MNI): Draghi To Drive Through Projects For NextGenEU Cash

Italian Prime Minister Mario Draghi plans to simplify rules for awarding infrastructure projects and allow the government to directly appoint key officials as it accelerates preparations for spending tens of billions of euros of European Covid aid after delays which risked a public warning from Brussels, a source close to the matter told MNI.

EUROPE: EU Ambassadors Not To Close The Door On EC-UK Talks

EU ambassadors agreed Wednesday to stay calm and united and to give the ongoing talks between the EU Commission and the UK government a full chance of securing agreement based on the package of measures recently published by the EU, MNI understands.

EUROPE: Fiscal, MonPol Should Normalise, GCEE Report Says

Germany's average inflation rate will be 3.1% in 2021 and 2.6% in 2022, according to the German Council of Economic Experts' Annual Report published Wednesday, with GDP likely to reach the level seen in Q4 2019 during the first quarter of next year. Germany's economic output will increase by 2.7 % in 2021 and by 4.6 % in 2022.

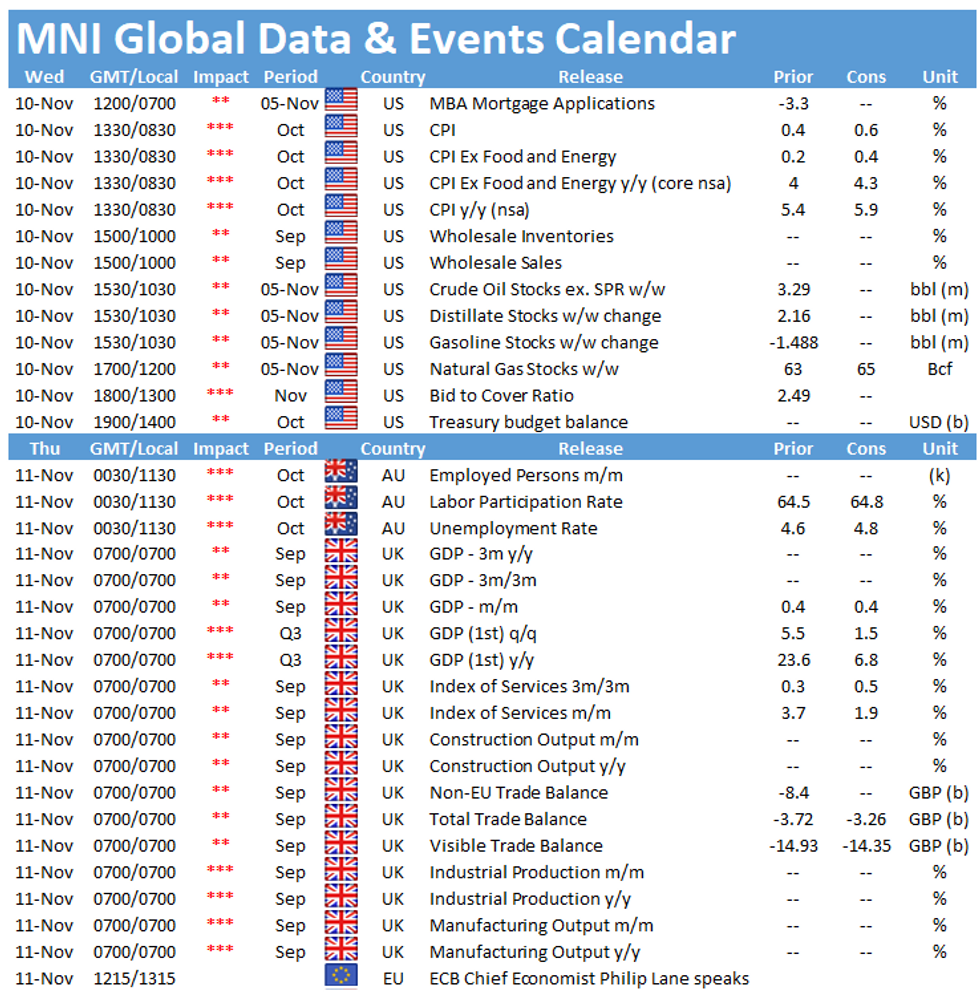

DATA

MNI BRIEF: US Oct CPI Above-Expected 6.2%, Highest Since 1990

U.S. CPI jumped 0.9% mom and 6.2% yoy in October, the largest 12-month rise since 1990, the BLS reported Wednesday, further evidence of broad inflation that may pressure more Fed officials to look at raising near-zero interest rates.

Core CPI rose 0.6% mom and 4.6% yoy, the most since 1991 and above the highest market forecast. Shelter was up 0.5% mom, with Owners' Equivalent Rent rising 0.4%. Used cars and trucks rose 2.5% after declining in August and September and the index for new vehicles added 1.4%, a seventh consecutive increase. Apparel was unchanged and airfares fell 0.7%.

"The monthly all items seasonally adjusted increase was broad-based," the report said. Energy prices rose 4.8% mom in October and 30.0% in the largest 12-month increase since 2005, BLS said.

MNI: US JOBLESS CLAIMS -4K TO 267K IN NOV 06 WK

US PREV JOBLESS CLAIMS REVISED TO 271K IN OCT 30 WK

US CONTINUING CLAIMS +0.059M to 2.160M IN OCT 30 WK

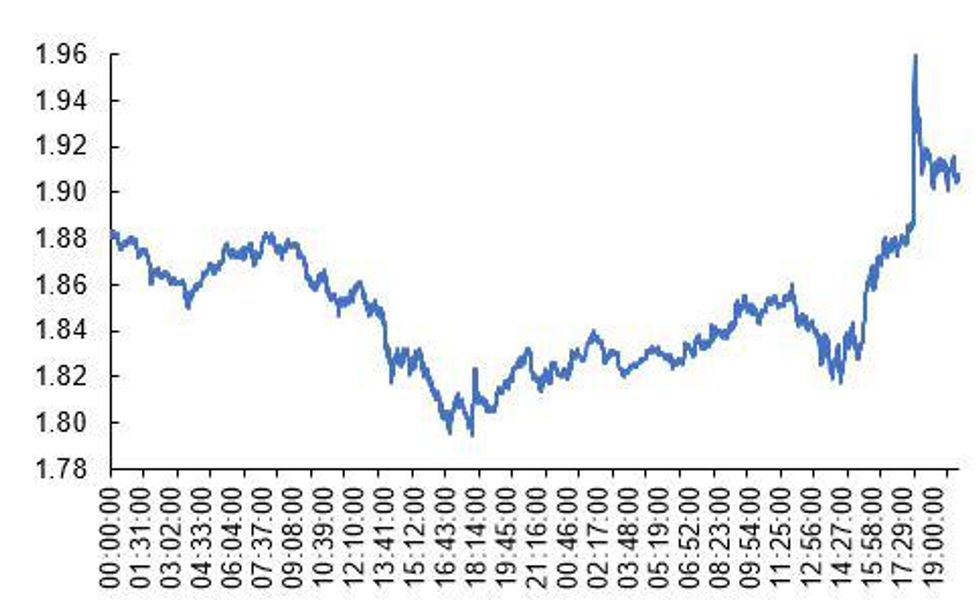

US TSYS: Belly Underperforms In A Day of Substantial Downside

USTs have been offered through the day, spurred on by the bumper CPI print for October (6.2% Y/Y vs 5.9% expected).

- Cash yields are 9-14bp higher on the day, with the belly of the curve underperforming.

- The 30Y bond auction provided a further catalyst for selling pressure, with the sale incurring a large tail and triggering an immediate leg lower. Although yields subsequently pulled back from the intraday high, the current trading yield for the 30y is still above pre-auction trade.

- TYZ1 has pushed lower through the day and has made a second attempt at the intraday low. The contract currently trades at 130-22 in a relatively wide intraday range (L: 130-19+ / H: 131-25).

- Looking ahead, tomorrow's data slate will be light, with focus instead turning to the Michigan consumer confidence survey update on Friday.

EGBs-GILTS CASH CLOSE: Global Inflation-Led Rout

European yields rose sharply Wednesday, with unexpectedly high inflation driving a global bond selloff.

- Higher-than-anticipated Chinese price data overnight set a bearish tone, with a big beat on US CPI data accelerating losses in Bunds and Gilts in the afternoon.

- Gilts underperformed both Bunds and Tsys, with most weakness at both ends of the curve (2s and 30s), and yields up by double-digits.

- Peripheries weakened, Italy 10Y spread ~4bp wider ahead of supply Thursday.

- Early focus Thursday is UK GDP; may prove a quieter session with US cash Tsy trading on holiday.

Closing yields/10-Yr Spreads to Bunds:

- Germany: The 2-Yr yield is up 3.9bps at -0.703%, 5-Yr is up 4.6bps at -0.54%, 10-Yr is up 4.8bps at -0.25%, and 30-Yr is up 5.1bps at 0.058%.

- UK: The 2-Yr yield is up 12bps at 0.572%, 5-Yr is up 11.4bps at 0.711%, 10-Yr is up 10bps at 0.924%, and 30-Yr is up 12.2bps at 1.049%.

- Italian BTP spread up 3.9bps at 117.8bps / Spanish up 2.8bps at 70.6bps

FOREX: Greenback Soars After Large CPI Beat, EURUSD Below 1.15 Level

- The dollar index rose to its best levels since July 2020 following the higher-than-expected CPI data from the US. Currently up just shy of 1%, the DXY may look to target the June 2020 lows, residing at 95.71.

- Higher US yields and renewed dollar strength prompted a strong reaction in USDJPY after the release. After closing at its lowest levels for 4 weeks yesterday, the pair came roaring back above the 113 handle to briefly trade above 114 before the rally ran out of steam. The trigger for a resumption of the underlying uptrend remains at 114.70, Oct 20 high.

- In other G10 FX the price action was a little more volatile in the immediate aftermath of the data. EURUSD traded roughly 20 pips lower on the release before reversing 40 points higher to trade at 1.1574. As the dust settled, the dollar garnered broad based support, taking the single currency to fresh yearly lows and beneath the 1.15 level which has previously been technically significant.

- Elsewhere, AUD and NZD both retreated over half a percent with cable a significant underperformer, dropping around 1% within close proximity to 1.3412, the Sep 29 low and bear trigger.

- Notable weakness in both SEK and NOK, falling 1.45% and 1.58% respectively against the greenback, with emerging market currencies also taking a plunge. USDZAR sticks out, rising 2.6% with USDMXN also bouncing 1.4% amid the pickup in US yields.

- Overnight, Australian employment data is scheduled before the UK publishes the first estimate for Q3 GDP. Widely expected to be a subdued afternoon amid market closures with North America out for the Veterans Day holiday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.