-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI ASIA OPEN: WH Support For Powell 2.0, Brainard Vice Chair

EXECUTIVE SUMMARY

- MNI BRIEF: US Oct Existing Home Sales Fastest Since January

- MNI BRIEF: Biden--Bipartisanship Played Role in Powell Pick

- MNI BRIEF: Powell--Committed to Fed's Jobs, Inflation Mandates

- MNI COMMODITIES: Crude Sheds $0.50/bbl On SPR Headlines

- U.S. POISED TO RELEASE OIL FROM RESERVE WITH OTHER NATIONS, Bbg

US

US: U.S. existing home sales grew 0.8% to 6.34 million SAAR in October, beating market expectations and the strongest pace since January, the National Association of Realtors reported Monday.

- "We are easily on pace this year to surpass 6 million on the annual total, which will be the best performance in 15 years," NAR chief economist Lawrence Yun told reporters. "Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment."

- A shortage of housing supply continues to pressure prices, which are up 13.1% yoy to USD353,900, and inventory dipped in October by 0.8% mom to 1.25 million units. Properties on average stayed on the market for 18 days in October, a tick up from September.

- "I believe having Fed leadership with broad bipartisan support is important, especially now in a politically divided nation," Biden said in a speech announcing Powell's renomination along with the appointment of Governor Lael Brainard as the Fed's new vice chair.

- "We know that high inflation takes a toll on families, especially those less able to meet the cost of essentials," Powell said. "We will use our tools both to support the economy and a strong labor market and to prevent inflation from becoming entrenched."

- WTI crude futures shed around $0.50/bbl on that headline - not entirely unexpected (we'd heard similar from Japan, India already today and over the weekend) but still marks a significant moment in Biden's response to inflation.

- Some more details in the story over the numbers: "plans could change but the U.S. is considering a release of more than 35 million barrels over time, according to one of the people."

- Current size of the SPR is approx 605mln bbls.

US TSYS: White House Green-Lights Fed Chair Powell Reappointment

Tsy futures trade broadly weaker across the board, at/near late session lows and testing technical support. Risk-on: Better than expected existing home sales +0.8% MoM to 6.34M SAAR (-1.8% est) was quickly overshadowed by the White House surprise announcement of the reappointment of Jerome Powell as Fed Chairman, Lael Brainard in the vice-chair slot. US$ bid (DXY +.512 at 96.543), gold sharply lower (-40.37 at 1805.36).- Tsy futures draw fast two-way trade near lows, equities climb to new highs (4739.5, banks rally). Further appt's to be announced in the weeks ahead -- before Christmas.

- Tsy futures extending session lows after $58B 2Y note auction (91282CDM0) tailed with 0.623% high yield vs. 0.610% WI; 2.36x bid-to-cover drops vs Oct's 2.69x well over five auction avg: 2.54x.

- Tsy futures remain under pressure -- near late morning lows after another tail: $59B 5Y note auction (91282CDK4) with 1.319% high yield vs. 1.309% WI; 2.34x bid-to-cover recedes vs. last month's 2.55x.

- Heavy roll volume, 10Y over 1M, percentage complete still under 25% ahead Nov 30 first notice. The 2-Yr yield is up 7.4bps at 0.5802%, 5-Yr is up 9.1bps at 1.3119%, 10-Yr is up 8.1bps at 1.627%, and 30-Yr is up 6.8bps at 1.9783%.

US: White House Statement on Powell Re-Appointment

President Biden Nominates Jerome Powell to Serve as Chair of the Federal Reserve, Dr. Lael Brainard to Serve as Vice Chair:- Today, President Biden announced his intent to nominate Jerome Powell for a second term as Chair of the Board of Governors of the Federal Reserve System and to nominate Dr. Lael Brainard to serve as Vice Chair of the Board of Governors of the Federal Reserve System.

- While our country still faces challenges as we emerge from the pandemic, we have made enormous progress in bringing our economy back to life and getting Americans back to work. Since the President took office, the economy has created over 5.6 million jobs, unemployment has fallen to 4.6% – two years faster than projected – and the pace of our economy's growth outstrips the rest of the developed world.

- Link: POWELL

OVERNIGHT DATA

- US OCT EXISTING HOMES SALES +0.8% MOM TO 6.34M SAAR; -5.8% YOY

- NAR: MEDIAN EXISTING-HOME PRICE +13.1% YOY TO $353,900

- NAR: INVENTORY DOWN 0.8% MOM TO 1.25M, -12.0% YOY FROM 1.42M

- CANADA FLASH OCTOBER WHOLESALE SALES +1.4%

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 288.89 points (0.81%) at 35883.54

- S&P E-Mini Future up 28.25 points (0.6%) at 4722

- Nasdaq down 27.2 points (-0.2%) at 16027.26

- US 10-Yr yield is up 7.9 bps at 1.6253%

- US Dec 10Y are down 28.5/32 at 129-31.5

- EURUSD down 0.0057 (-0.5%) at 1.1231

- USDJPY up 0.96 (0.84%) at 114.94

- WTI Crude Oil (front-month) up $0.84 (1.11%) at $76.78

- Gold is down $42.21 (-2.29%) at $1803.82

- EuroStoxx 50 down 17.78 points (-0.41%) at 4338.69

- FTSE 100 up 31.89 points (0.44%) at 7255.46

- German DAX down 44.28 points (-0.27%) at 16115.69

- French CAC 40 down 7.29 points (-0.1%) at 7105

US TSY FUTURES CLOSE

- 3M10Y +8.838, 157.884 (L: 148.626 / H: 158.057)

- 2Y10Y +0.733, 104.277 (L: 101.066 / H: 105.579)

- 2Y30Y -0.305, 139.619 (L: 136.313 / H: 142.113)

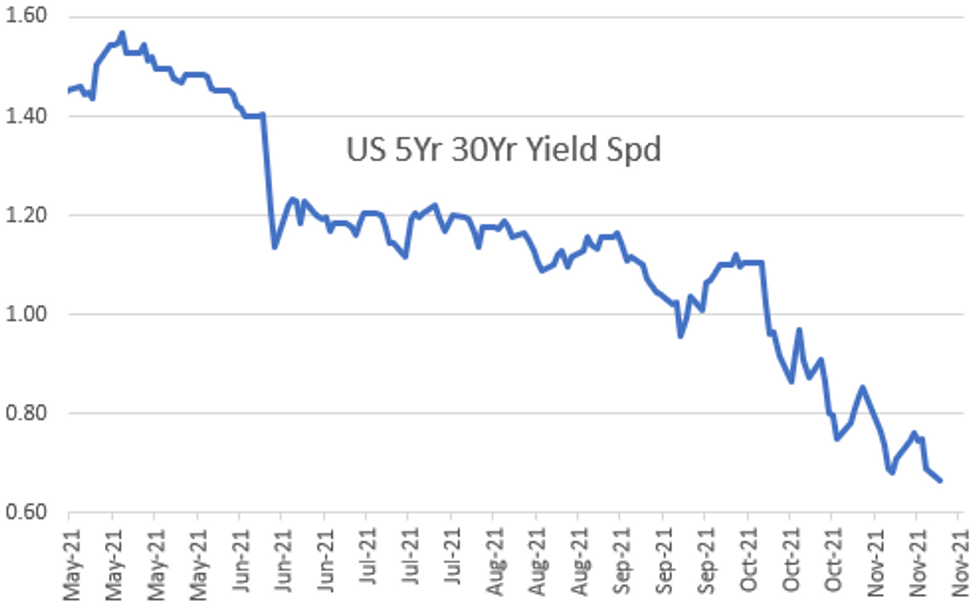

- 5Y30Y -1.843, 66.691 (L: 64.521 / H: 70.019)

- Current futures levels:

- Dec 2Y down 4.625/32 at 109-16.625 (L: 109-16.25 / H: 109-20.75)

- Dec 5Y down 17.75/32 at 121-2.25 (L: 121-02 / H: 121-17)

- Dec 10Y down 28.5/32 at 129-31.5 (L: 129-30.5 / H: 130-24)

- Dec 30Y down 1-18/32 at 160-8 (L: 160-06 / H: 161-27)

- Dec Ultra 30Y down 2-23/32 at 194-13 (L: 194-10 / H: 197-10)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.013 at 99.773

- Mar 22 -0.030 at 99.705

- Jun 22 -0.060 at 99.490

- Sep 22 -0.085 at 99.235

- Red Pack (Dec 22-Sep 23) -0.15 to -0.105

- Green Pack (Dec 23-Sep 24) -0.15 to -0.14

- Blue Pack (Dec 24-Sep 25) -0.13 to -0.12

- Gold Pack (Dec 25-Sep 26) -0.115 to -0.11

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00050 at 0.07550% (+0.00125 total last wk)

- 1 Month -0.00100 to 0.09238% (+0.00425 total last wk)

- 3 Month +0.00563 to 0.16963% (+0.01125 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01450 to 0.24388% (+0.00325 total last wk)

- 1 Year +0.03388 to 0.42563% (-0.00675 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $272B

- Secured Overnight Financing Rate (SOFR): 0.05%, $895B

- Broad General Collateral Rate (BGCR): 0.05%, $350B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $331B

- (rate, volume levels reflect prior session)

- Tsy 10Y-22.5Y, $1.401B accepted vs. $3.704B submission

- Next scheduled purchase

- Tue 11/23 1010-1030ET: TIPS 7.5Y-30Y, appr $1.075B

- Operational purchases paused until Nov 29

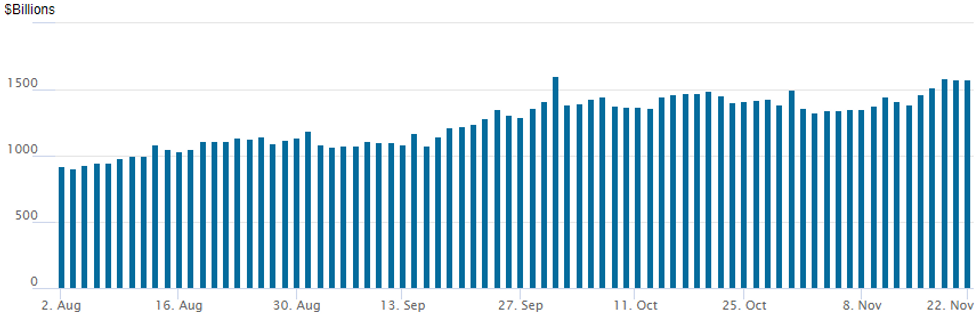

FED Reverse Repo Operation

NY Federal Reserve

NY Fed reverse repo usage recedes to $1,573.769B from 73 counterparties vs. $1,575.384B on Friday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: $1.5B Shell Global 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 11/22 $1.5B #Shell Int Finance 20Y +95, 30Y +105

- 11/22 $500M *RGA Global Funding 5Y +70

- 11/22 $Benchmark Japan Bank for Int Cooperation (JBIC) investor calls

- Anticipated Tuesday issuance:

- 11/23 $Benchmark CADES (Caisse d'Amortissement de la Dette Sociale) 3Y +21a

- 11/23 $500M NRW (North Rhine-Westphalia Rr) 2Y FRN/SOFR+16a

EGBs-GILTS CASH CLOSE: Gains Reverse Despite Lockdown Fears

Bunds and Gilts reversed early gains Monday, with yields rising in the afternoon, making up significant ground on Friday's drop.

- Several bearish factors played into the afternoon weakness, including Fed's Powell being re-nominated as Chair (as opposed to a more dovish replacement), and ECB's Villeroy saying the bank is "serious" about ending PEPP. BTP spreads widened; Gilts underperformed Bunds.

- One undercurrent in the session was the spectre of further COVID lockdowns (Austria started one today, while Germany's Merkel called for tighter restrictions), which kept a lid on equity gains and helped a safe haven bid overnight.

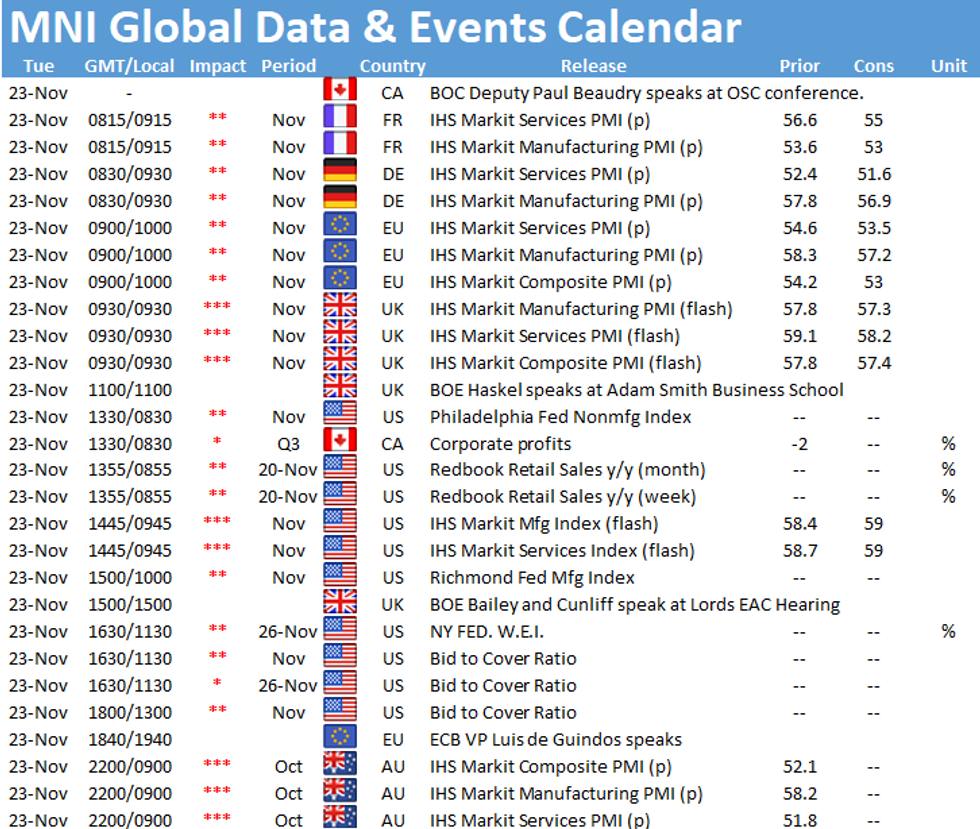

- Light on data today but Tuesday sees flash PMIs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.9bps at -0.739%, 5-Yr is up 4.1bps at -0.596%, 10-Yr is up 4.1bps at -0.301%, and 30-Yr is up 3.8bps at 0.028%.

- UK: The 2-Yr yield is up 4.5bps at 0.534%, 5-Yr is up 3.8bps at 0.681%, 10-Yr is up 5.5bps at 0.934%, and 30-Yr is up 4.7bps at 1.071%.

- Italian BTP spread up 4.2bps at 124.7bps / Spanish down 0.7bps at 71.8bps

FOREX: US Dollar Boosted By Powell Renomination

- The US dollar maintained its upward trajectory to kick off the new week following the announcement that President Biden will stick with Jerome Powell as Fed Chair for another term.

- The dollar index had been trading marginally in the green prior to the announcement and received strong supportive price action in the aftermath amid higher US yields. DXY gains total 0.50% as of writing.

- USDJPY (+0.80%) was the primary beneficiary from the news, jumping from 114.15 to above 114.50 in quick fashion. A slow grind higher throughout the session has seen the pair narrow the gap with the most recent highs at 114.97. Clearance of the Nov 17 high would remove concerns following a bearish engulfing candle last week signalling a potential short-term reversal. Remaining in a technical uptrend overall, the next resistance can be found at 115.51, the Mar 10, 2017 high.

- The New Zealand Dollar was also a notable underperformer against the greenback, extending the month's declines to roughly 3%. For reference, the weakness comes ahead of Wednesday's RBNZ meeting.

- Following a brief re-test of the breakout in EURCHF around 1.0505, the pair remains below the crucial technical pivot. The break (potentially) exposes 1.0397 next, the Jul 15, 2015 low.

- In emerging market FX, the Turkish lira maintained its downward trajectory with USDTRY rising a further 1.4% on Monday and briefly printing fresh highs at 11.4767. At the other end of the spectrum, CLP was the clear and significant outperformer following Sunday's elections.

- Tomorrow's key data will be the release of European flash PMI's, especially in the context of the weaker single currency amid renewed covid restriction fears.

- Wednesday's Core PCE price data and FOMC minutes headline the Thanksgiving week's US calendar.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.