-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI ASIA OPEN: Heavy Data Wednesday Includes Weekly Claims

EXECUTIVE SUMMARY

- MNI: Fed May Reach Job Goal Sooner As Participation Lags

- U.S. WILL MAKE AVAILABLE RELEASES OF 50 MILLION BARRELS OF OIL, Bbg

- US PRES BIDEN: SPR RESERVE RELEASE WILL PROVIDE SUPPLY WE NEED, Bbg

US

FED: Strong labor demand and a slow uptick in worker participation will put the Federal Reserve near full employment in the second half of next year, said economists from the last two presidential administrations and a former Fed visiting scholar, adding to pressure for tighter monetary policy.

- "If you think we're maxed out on supply and there's no real way to increase that, then we have too much demand and we might have a threat of inflation," said Aaron Sojourner, a former member of the White House Council of Economic Advisers and a former visiting scholar at the Minneapolis Fed. Millions of sidelined workers and growth of the potential labor force even through the pandemic "suggests there's still plenty of room to improve supply," he said.

- Labour supply is being held back by more people deciding to retire, staying at home to take care of family, or fearing a return to work and contracting Covid. That means the job market can be tight and arguably meet the Fed's goal of an inclusive recovery even with millions shy of the pre-pandemic trend. Fed officials say inflation criteria for interest-rate liftoff have already been met, so approaching full employment sooner than they predicted just a few months ago could justify tighter monetary policy. For more see MNI Policy main wire at 1045ET.

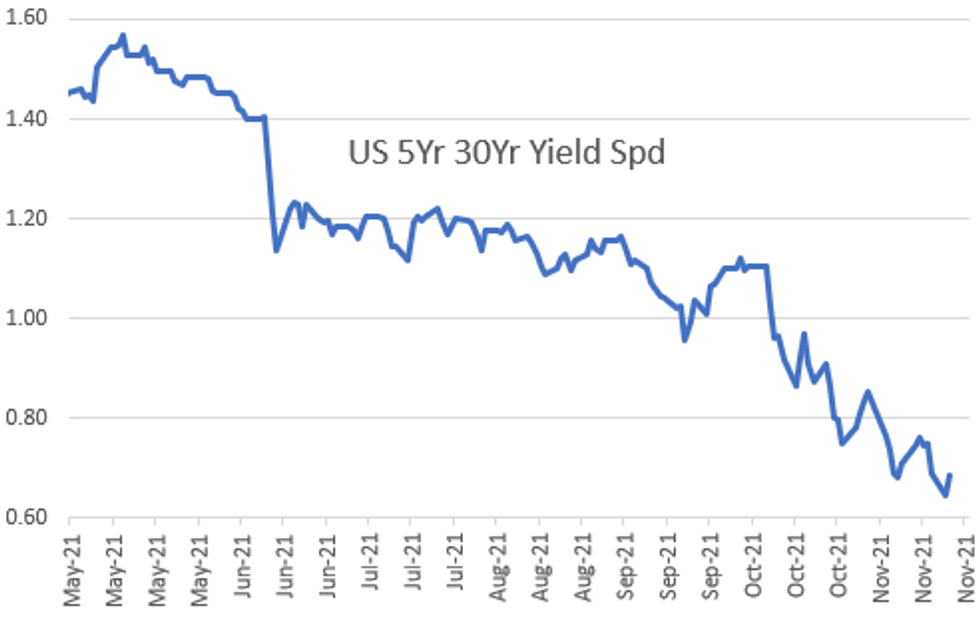

US Tsys: Yield Curves Bounce as 30YY Climbs Over 2.0%

Tsys yields near late session highs after the bell (10YY 1.6686%; 30YY 2.0279%), futures just off late session lows, long end underperforming, yield curves steeper. Heavy volumes tied to ongoing Dec/Mar quarterly roll (Nov 30 first notice), TYZ1 >2.8M.- Coming into the session central banks remained active in short end, better sellers with some sporadic buying, fast- and real$ selling 10s, extension selling in intermediates. Two-way option-tied hedging ahead Dec expiry on Friday.

- Tsy futures bounced briefly off lows after $59B 7Y note auction (91282CDL2) stopped through: 1.588% high yield vs. 1.597% WI; 2.42x bid-to-cover 2021 high (five auction avg: 2.28x). Indirect take-up 59.29% vs. Oct's 63.89% (highest since Jan).

- Due to intermittent technical difficulties this morning, the NY Fed has decided to postpone today's purchase operation of app $1.075B 7.5Y-30Y TIPS at 1010-1030ET to Wednesday at 1100-1120ET.

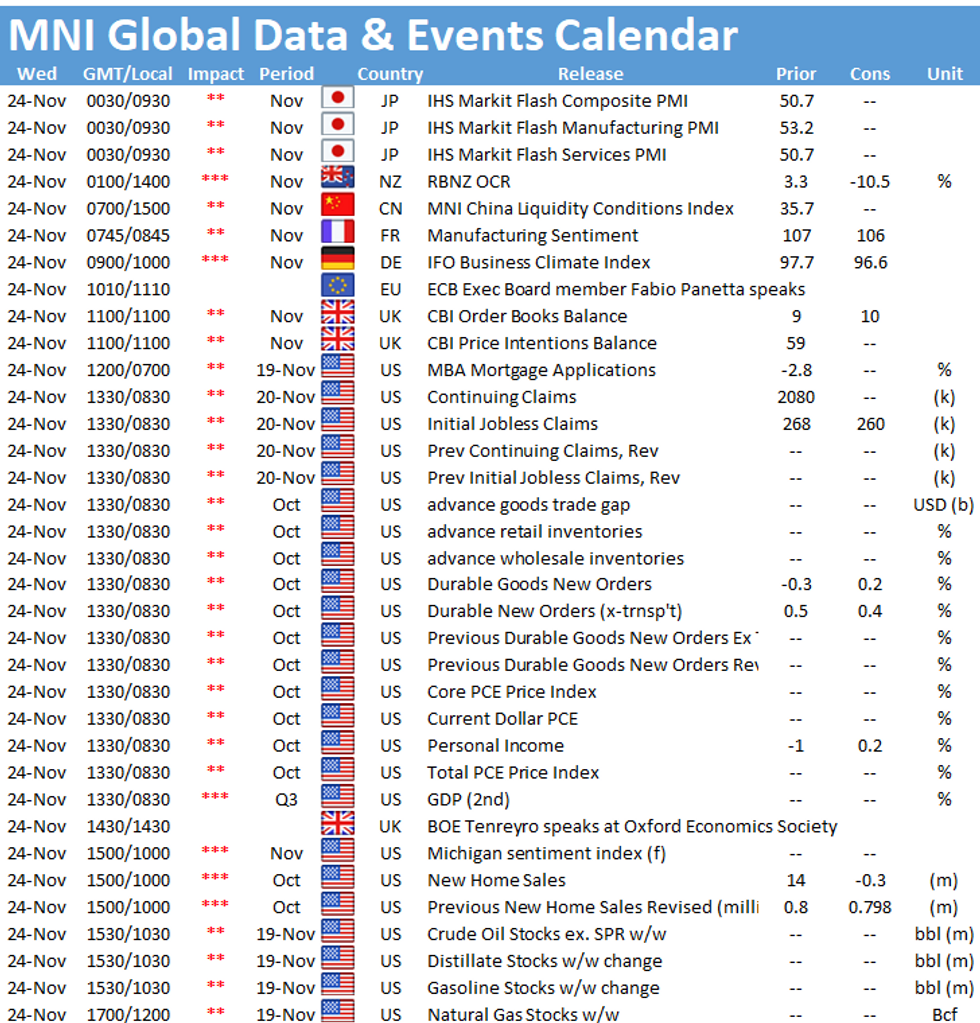

- Heavy slate of data Wednesday includes weekly claims (260k est vs. 268k prior) with Thursday closed for Thanksgiving holiday.

- The 2-Yr yield is up 2bps at 0.6043%, 5-Yr is up 1.1bps at 1.3278%, 10-Yr is up 3.5bps at 1.6582%, and 30-Yr is up 5.5bps at 2.0165%.

OVERNIGHT DATA

- US FLASH NOV MFG PMI 59.1; OCT 58.4; SURVEY 59.1

- US FLASH NOV SVCS PMI 57.0; OCT 58.7; SURVEY 59.0

- US FLASH NOV COMP PMI 56.5; OCT 57.6

- U.S. NOV. RICHMOND FED FACTORY INDEX AT 11 -bbg (11 survey, 12 prior)

- US REDBOOK: NOV STORE SALES +15.3% V YR AGO MO

- US REDBOOK: STORE SALES +15.4% WK ENDED NOV 20 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 157.75 points (0.44%) at 35769.77

- S&P E-Mini Future down 3.25 points (-0.07%) at 4675.5

- Nasdaq down 157.6 points (-1%) at 15695.95

- US 10-Yr yield is up 3.5 bps at 1.6582%

- US Dec 10Y are down 5.5/32 at 129-26.5

- EURUSD up 0.0011 (0.1%) at 1.1248

- USDJPY up 0.15 (0.13%) at 115.04

- WTI Crude Oil (front-month) up $1.89 (2.46%) at $78.66

- Gold is down $14.78 (-0.82%) at $1789.76

- EuroStoxx 50 down 54.87 points (-1.26%) at 4283.82

- FTSE 100 up 11.23 points (0.15%) at 7266.69

- German DAX down 178.69 points (-1.11%) at 15937

- French CAC 40 down 60.38 points (-0.85%) at 7044.62

US TSY FUTURES CLOSE

- 3M10Y +4.154, 161.187 (L: 155.325 / H: 161.867)

- 2Y10Y +2.365, 105.686 (L: 99 / H: 105.86)

- 2Y30Y +4.568, 141.681 (L: 133.151 / H: 141.752)

- 5Y30Y +4.943, 69.079 (L: 63.053 / H: 69.15)

- Current futures levels:

- Dec 2Y up 1.25/32 at 109-17.875 (L: 109-15.5 / H: 109-18.375)

- Dec 5Y steady at at 121-2.5 (L: 120-27.75 / H: 121-04.75)

- Dec 10Y down 7/32 at 129-25 (L: 129-19 / H: 130-02)

- Dec 30Y down 1-01/32 at 159-9 (L: 159-09 / H: 160-17)

- Dec Ultra 30Y down 1-31/32 at 192-18 (L: 192-18 / H: 195-03)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.003 at 99.770

- Mar 22 steady at 99.705

- Jun 22 +0.015 at 99.505

- Sep 22 +0.035 at 99.270

- Red Pack (Dec 22-Sep 23) +0.015 to +0.040

- Green Pack (Dec 23-Sep 24) -0.02 to steady

- Blue Pack (Dec 24-Sep 25) -0.04 to -0.02

- Gold Pack (Dec 25-Sep 26) -0.055 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00300 at 0.07250% (-0.00350/wk)

- 1 Month -0.00038 to 0.09200% (-0.00138/wk)

- 3 Month +0.00837 to 0.17800% (+0.01400/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00800 to 0.25188% (+0.02250/wk)

- 1 Year +0.02337 to 0.44900% (+0.05725/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $278B

- Secured Overnight Financing Rate (SOFR): 0.05%, $930B

- Broad General Collateral Rate (BGCR): 0.05%, $357B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Due to intermittent technical difficulties this morning, the NY Fed has decided to postpone today's purchase operation of app $1.075B 7.5Y-30Y TIPS at 1010-1030ET to Wednesday at 1100-1120ET.

- Operational purchases will resume Monday, Nov 29.

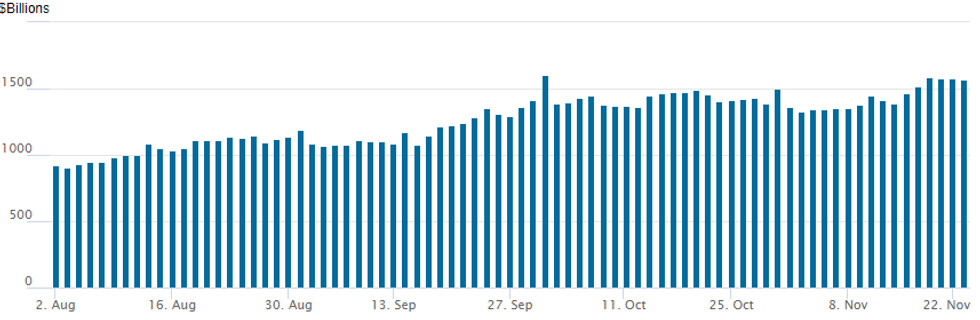

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to inch lower: $1,571.980B from 79 counterparties vs. $1,573.796B on Monday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: $2.5B CADES Priced

- Date $MM Issuer (Priced *, Launch #)

- 11/23 $2.5B *CADES (Caisse d'Amortissement de la Dette Sociale) 3Y SOFR +20

- 11/23 $600M *NRW (North Rhine-Westphalia Rr) 2Y FRN/SOFR +16

- 11/23 $2.5B #CDW $1B 5Y +135, $500M 7Y +170, $1B 10Y +190

EGBs-GILTS CASH CLOSE: PMIs Set Bearish Tone

Another day, another large rise in yields Tuesday, with Italy again the underperformer. Both the UK and German curves saw most weakness in the 10-Yr segment.

- Generally stronger-than-expected European PMIs in the morning set a bearish tone, with the spectre of renewed COVID lockdowns (Germany's Merkel in crisis meetings with party leaders) and weaker equities once again failing to provide much of a safe-haven bid.

- ECB's Schnabel said inflation risks are "skewed to the upside".

- BoE's Bailey said he didn't think the bank would return to a "harder" forward guidance. Earlier, Haskel - a dove - was non-committal on rate hike timing.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.2bps at -0.729%, 5-Yr is up 5.2bps at -0.545%, 10-Yr is up 8.1bps at -0.22%, and 30-Yr is up 7.7bps at 0.105%.

- UK: The 2-Yr yield is up 6.3bps at 0.596%, 5-Yr is up 6.1bps at 0.745%, 10-Yr is up 6.4bps at 0.997%, and 30-Yr is up 1.3bps at 1.083%.

- Italian BTP spread up 2.4bps at 128.1bps / Spanish up 1.4bps at 73.2bps

FOREX: Lira Crisis Takes Focus Away From G10 FX

- Tuesday's G10FX moves were a sideshow for the rapidly accelerating depreciation of the Turkish Lira. USDTRY was up over 18% at its peak where the currency pair printed a high of 13.4539.

- As of writing, USDTRY gains tally 11.5% as President Erdogan met with the central bank to discuss the Lira slide – bringing some momentary consolidation amid extremely thin liquidity conditions.

- Contagion risk amid higher US yields impacted other emerging market currencies with USDMXN rising well over 1% and narrowing the gap to the year's highs above the 21.00 mark.

- The greenback consolidated on Monday's gains and the dollar index remains at its best levels for 15 months. EURUSD lacked direction holding at the midpoint of its 50 pip range around 1.1250.

- Heavy equity indices prompted some initial Yen strength on Tuesday. USDJPY after breaking 115 overnight had a sharp reversal to 1.1449, however, markets remain in dollar dip-buying mode and the pair trades back above 115, approaching the US-APAC session crossover.

- The Swedish Krona was a notable underperformer as EURSEK rose 0.7%. This extends the currency pairs winning streak to four days following the break back above the 10 handle – an important pivot inflection point.

- The main event overnight will be the RBNZ decision/statement where the board may have a close decision between a 25 or 50bp hike.

- German IFO and the second reading of US GDP will precede US Core PCE data on Wednesday. The FOMC minutes will also be published before Thursday Thanksgiving Holiday.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.