-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Omicron On Your Mind?

EXECUTIVE SUMMARY

- US Pres Biden "will direct FDA, CDC to use 'fastest process available' to clear Covid vaccines targeting omicron" CNBC

- BIDEN NOT TAKING ANY OPTIONS OFF TABLE ON COVID: PSAKI, Bbg

- FAUCI SAYS NEW U.S RESTRICTIONS AMID OMICRON UNLIKELY, Reuters

- PFIZER CEO: OMICRON UNLIKELY TO COMPLETELY ESCAPE EXISTING SHOT, Bbg

US TSYS: Pres Biden Rules Out Omicron-Tied Lockdown This Winter

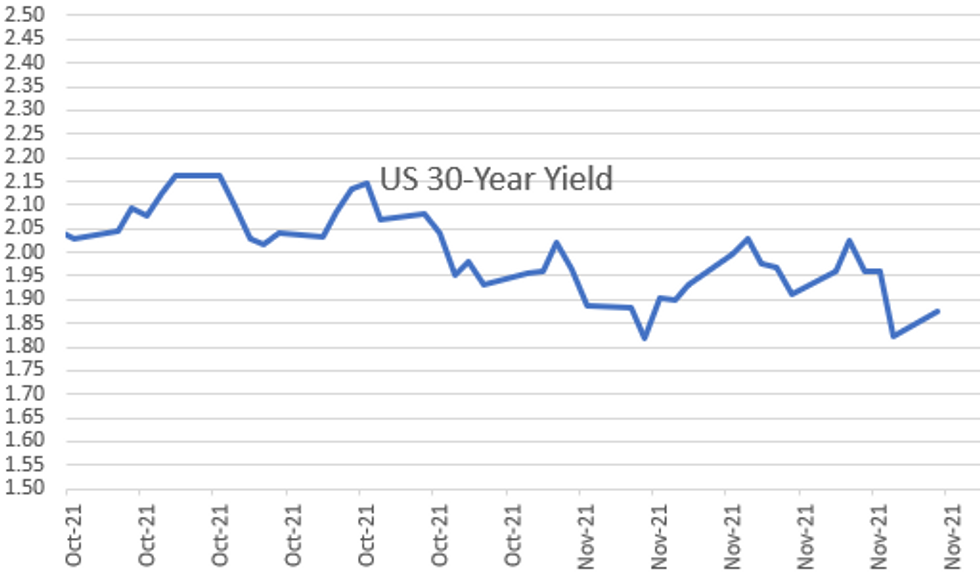

Mkts still skittish to Omicron/Covid variant related headlines that sent bond soaring last Friday. Rates rebounded on the Asia session open, pared gains and held narrow range into early London trade.- Otherwise the Tsy week opener was rather muted on light volume (TYZ1 <875k) w/ some desks still lightly staffed after Thanksgiving holiday. Tsys extended lows (30YY 1.9087%H) back to around the middle of Fri's range -- rebounded after mixed data: Pending Home Sales +7.5% vs. 1.0% exp; Dallas Fed Mfg 11.8 vs. 15.0 exp.

- Sources report domestic Real$ acct buying in 10s pick up after central bank buying in 5s and 10s earlier, not to mention over 21,000 Block buys in FVF from 121-02 to 121-07.

- Buying waned: Yield curves held steeper as support for 5s-10s evaporated, equities making new session highs (ESZ1 +74.0 to 4469.75) after Pres Biden ruled out lockdowns this winter to combat spd of Omicron-Covid variant.

- Fed Chairman Powell spoke briefly today/gives testimony on CARES Act with Tsy Sec Yellen on Tue-Wed, unlikely much will be conveyed to upset markets prior to Fed media/policy blackout that starts Midnight Friday, final 2021 FOMC annc on Dec 14-15.

- The 2-Yr yield is up 1.8bps at 0.5157%, 5-Yr is up 2.7bps at 1.1871%, 10-Yr is up 5.5bps at 1.5277%, and 30-Yr is up 5.5bps at 1.8764%.

OVERNIGHT DATA

- US NAR OCT PENDING HOME SALES INDEX 125.2 V 116.5 IN SEP

- US NAR OCT PENDING HOME SALES +7.5% MOM; -1.4% YOY

- U.S. NOV. DALLAS FED MANUFACTURING INDEX AT 11.8 (15.0 exp)

- CANADA OCT INDUSTRIAL PRICES +1.3% MOM; EX-ENERGY +0.6%

- CANADA OCT RAW MATERIALS PRICES +4.8% MOM; EX-ENERGY +0.1%

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 303.7 points (0.87%) at 35202.45

- S&P E-Mini Future up 67.5 points (1.47%) at 4663

- Nasdaq up 317 points (2%) at 15808.88

- US 10-Yr yield is up 5.5 bps at 1.5277%

- US Dec 10Y are down 4/32 at 131-1.5

- EURUSD down 0.0044 (-0.39%) at 1.1273

- USDJPY up 0.4 (0.35%) at 113.78

- WTI Crude Oil (front-month) up $1.49 (2.19%) at $69.63

- Gold is down $19.82 (-1.1%) at $1782.65

- EuroStoxx 50 up 19.93 points (0.49%) at 4109.51

- FTSE 100 up 65.92 points (0.94%) at 7109.95

- German DAX up 23.82 points (0.16%) at 15280.86

- French CAC 40 up 36.52 points (0.54%) at 6776.25

US TSY FUTURES CLOSE

3M10Y +6.215, 147.527 (L: 145.576 / H: 151.556)

2Y10Y +4.554, 101.304 (L: 97.396 / H: 102.243)

2Y30Y +4.834, 136.576 (L: 130.702 / H: 136.926)

5Y30Y +3.457, 69.301 (L: 62.605 / H: 69.526)

Current futures levels:

Dec 2Y up 1/32 at 109-23.375 (L: 109-20 / H: 109-23.375)

Dec 5Y up 1.25/32 at 121-26.75 (L: 121-16.25 / H: 121-27.75)

Dec 10Y down 2.5/32 at 131-3 (L: 130-20.5 / H: 131-06)

Dec 30Y down 25/32 at 162-3 (L: 161-14 / H: 162-22)

Dec Ultra 30Y down 1-24/32 at 197-25 (L: 196-19 / H: 198-27)

US TSY FUTURES: December Quarterly Futures Roll Nearly Complete

Lead quarterly position rolls from Dec'21 to Mar'22 nearly complete ahead Tuesday first notice (March futures take lead quarterly position). Current roll markets:

- TUZ/TUH 23,200 from 9.5 to 11.0, 10.25 last, 91% complete

- FVZ/FVH 62,200 from 17.5 to 18.75, 18.0 last, 90% complete

- TYZ/TYH 110,300 from 23.75 to 25.25, 25.0 last, 90% complete

- UXYZ/UXYH 20,100 from 2.0 to 4.0, 3.5 last, 92% complete

- USZ/USH 19,900 from 1-17.5 to 1-18.25, 1-18 last, 92% complete

- WNZ/WNH 9,000 from 13.75 to 15.75, 15.25 last, 93% complete

US EURODOLLAR FUTURES CLOSE

- Dec 21 +0.005 at 99.793

- Mar 22 +0.010 at 99.740

- Jun 22 +0.010 at 99.580

- Sep 22 +0.010 at 99.380

- Red Pack (Dec 22-Sep 23) -0.005 to steady

- Green Pack (Dec 23-Sep 24) -0.005 to +0.005

- Blue Pack (Dec 24-Sep 25) -0.025 to -0.01

- Gold Pack (Dec 25-Sep 26) -0.045 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00225 at 0.07638% (-0.00187 total last wk)

- 1 Month +0.00887 to 0.09925% (-0.00300 total last wk)

- 3 Month -0.00450 to 0.17088% (+0.01138 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00000 to 0.24600% (+0.01662 total last wk)

- 1 Year +0.00950 to 0.41988% (+0.01863 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $85B

- Daily Overnight Bank Funding Rate: 0.07% volume: $268B

- Secured Overnight Financing Rate (SOFR): 0.05%, $895B

- Broad General Collateral Rate (BGCR): 0.05%, $334B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $327B

- (rate, volume levels reflect prior session)

- Tsy 2.25Y-4.5Y, $7.351B accepted vs. $22.425B submission

- Next scheduled purchases

- Tue 11/30 1010-1030ET: Tsy 7Y-10Y, appr $2.825B

- Tue 11/30 1100-1120ET: Tsy 22.5Y-30Y, appr $1.600B

- Wed 12/01 1100-1120ET: Tsy 4.5Y-7Y, appr $5.275B

- Thu 12/02 1010-1030ET: TIPS 7.5Y-30Y, appr $1.075B

- Fri 12/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

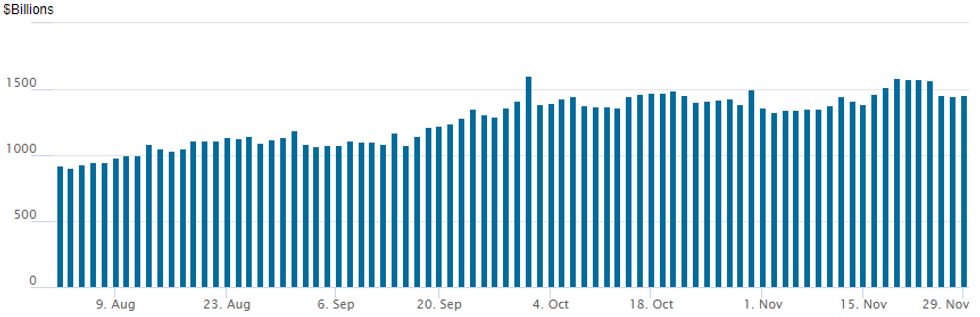

FED Reverse Repo Operation Bounce

NY Federal Reserve/MNI

NY Fed reverse repo usage bounces slightly: $1,459.339B from 79 counterparties vs. $1,451.108B on Friday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: Consolidated Edison Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 11/29 $1.35B #Consolidated Edison $750M 2.4% '31 tap +87, $600M 30Y +132

- 11/29 $625M *Burlington Northern WNG 30Y +102

- 11/29 $600M #American Transmission WNG 10Y +115

- 11/29 $Benchmark Duke Energy FL10Y +95a, 30Y +120a

- 11/29 $Benchmark Dollar Tree 10Y +130a, 30Y +165a

- 11/29 $Benchmark Swedish Export Credit 2023 tap FRN/SOFR+16

- 11/29 $Benchmark Olympus 5Y investor calls

- 11/22-11/26 only $7.6B priced during Thanksgiving week, but running total for November at $120.875B after third week issuance crested the total for first two weeks.

EGBs-GILTS CASH CLOSE: Partial Reversal

European FI partially reversed Friday's huge rally on Monday, though the emphasis is on "partially", with continued concerns over potential European lockdowns putting a lid on yield rises.

- German Nov CPI came in at the highest since 1992 and well above expected, after which Bunds weakened to session-worst levels. But they regained ground later amid a fade in the oil price rally, and reports that the gov't sought an "emergency brake" to deal with Covid.

- Gilt yields underperformed; as expected, UK authorities are set to expand vaccination efforts to head off the Omicron variant threat.

- Spain also saw strong price gains (as expected); Eurozone flash CPI out tomorrow.

- Periphery spreads tightened, with Spain outperforming.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.5bps at -0.751%, 5-Yr is up 1.5bps at -0.625%, 10-Yr is up 1.8bps at -0.317%, and 30-Yr is down 0.1bps at 0.019%.

- UK: The 2-Yr yield is up 3.3bps at 0.505%, 5-Yr is up 3.5bps at 0.652%, 10-Yr is up 3.6bps at 0.861%, and 30-Yr is up 1.9bps at 0.946%.

- Italian BTP spread down 1.5bps at 129.4bps / Spanish down 2.5bps at 73.9bps

FOREX: Greenback Regains Poise As Risk Sentiment Recovers

- Global equity indices are firmly in the green on Monday having retraced a significant portion of Friday’s losses as Omicron-variant fuelled panic subsided.

- The dollar index is up roughly 0.3% and has recovered over a half of a percent from Friday’s worst levels.

- EURUSD remained under pressure throughout the trading day and finds itself comfortably back below the 1.13 handle with multiple prints at 1.1258 providing some intra-day support.

- A more volatile session for USDJPY. Despite some initial strength following the open, a fresh wave of selling as Europe sat down prompted a marginal new low from Friday at 112.99. Since the early dip lower, price action has remained supportive, in line with broadly improved sentiment which saw USDJPY grind all the way back to session highs just below the 114 mark.

- NZDUSD has now fallen for a seventh consecutive trading session, notably breaching the August and yearly lows through 0.6805.

- In emerging markets, the improved risk backdrop did little to support the Turkish Lira with TRY weakness firmly back in the spotlight. USDTRY is currently up over 4% as the pair re-approaches 13.00 amid President Erdogan saying he will never advocate for a rate hike. As a reminder, last week’s highs reside at 13.45.

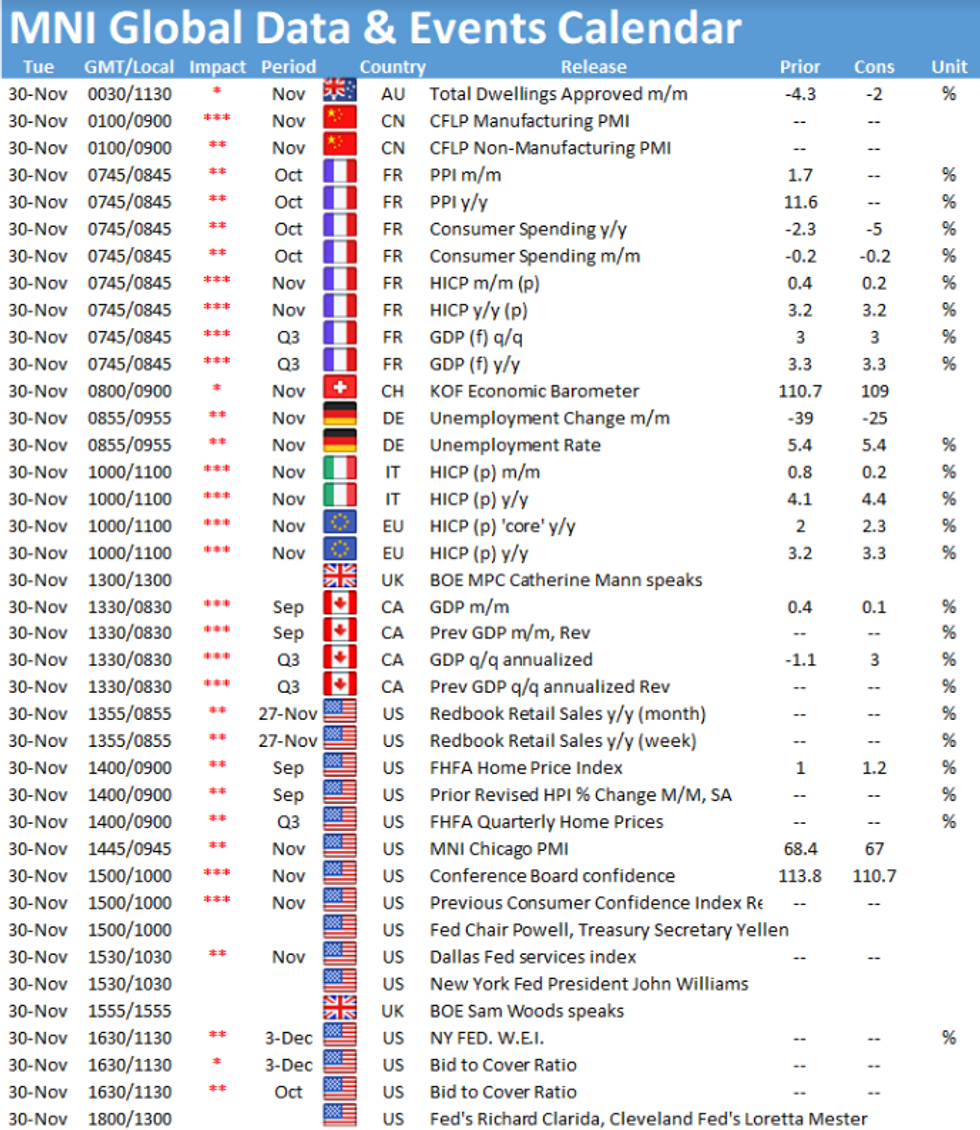

- Chinese Manufacturing PMI due overnight before the Eurozone publish their Flash estimates for November CPI. Canadian CPI and the MNI Chicago business barometer headline the North American docket. It is also worth noting the potential for increased volumes and volatility related to month-end rebalancing.

- Markets will also keenly await Friday’s November US employment report.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.