-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Appetite For Risk Remains Strong

EXECUTIVE SUMMARY

- MNI: Fed To Replace Transitory With Conditional Price Outlook

- DEBT LIMIT CAN BE RAISED AS SOON AS THIS WEEK: SENATE AID, Bbg

- U.S. WEIGHS OPTIONS FOR POTENTIAL EVACUATION FROM UKRAINE: CNN

- MCCONNELL SAYS DEAL REACHED WITH SCHUMER ON RAISING DEBT LIMIT, Bbg

US

FED: The Federal Reserve next week will likely remove the word "transitory" from its post-meeting statement in describing the current bout of historically high inflation in favor of more conditional language, but will largely retain the underlying message that prices are expected to fall over time, former Fed staffers told MNI.

- The evolution in the Fed's communications will also be accompanied by updated economic forecasts showing higher prices that will only gradually fall back to target in 2023 rather than in 2022, the ex-officials said.

- "They could simply substitute 'expected to eventually recede' for 'transitory,'" former Fed Board research director David Wilcox suggested. "The 'eventually' stretches out the time period and leaves some ambiguity with regard to whether those inflation factors will disappear altogether."

US TSYS: Risk-On Carries On

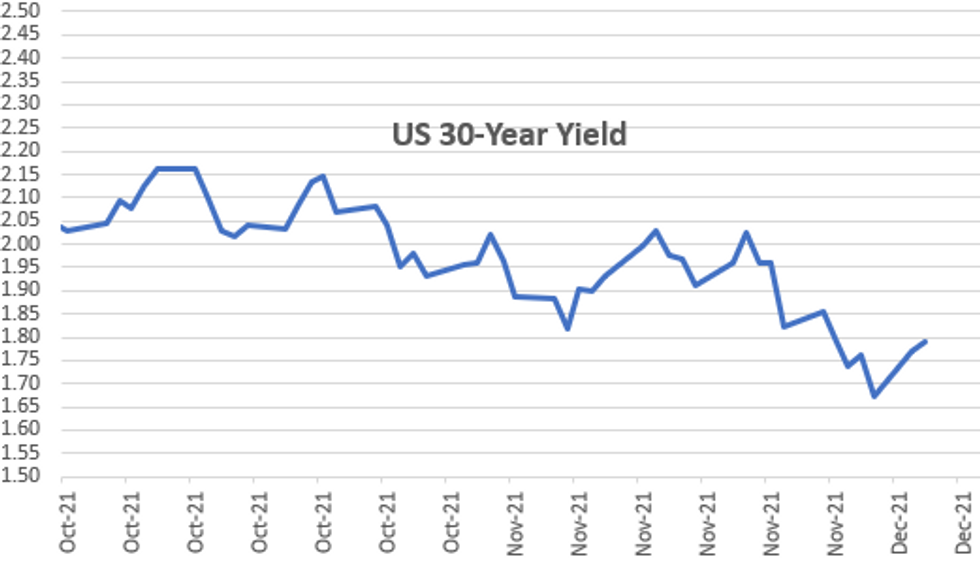

Second consecutive session for risk-on trade, Tsys near lows after the bell (30YY tapped 1.8078% high), equities pushing higher late (ESZ1 +85.0 to 4675.00 -- around Nov 25 levels).- Not a heavy economic data day (US OCT TRADE GAP -$67.1B VS SEP -$81.4B; Q3 UNIT LABOR COSTS +9.6%; Y/Y +6.3%; US REDBOOK: DEC STORE SALES +15.3% V YR AGO MO), markets more reacting to headlines re: Omicron variant less severe than feared -- though it spds more readily. Light data ahead for Wed: JOLTS Job Openings, Tsy 10Y note auction re-open.

- Late US fiscal headlines positive: MCCONNELL SAYS DEAL REACHED WITH SCHUMER ON RAISING DEBT LIMIT.

- Treasury futures held near lows after $54B 3Y note auction (91282CDN8) stopped through: 1.000% high yield vs. 1.002% WI; 2.43x bid-to-cover in-line with 5-auction average and better than Nov's 2.33x.

- Indirect take-up dipped to 52.17% vs. last month's year high of 57.62%, while direct bidder take-up holds near 1+ year high at 18.01% (18.04% Nov). Primary dealer take-up bounces to 29.81% vs. 24.34% in Nov, over the 5M average of 28.06%.

- The 2-Yr yield is up 5.4bps at 0.6852%, 5-Yr is up 4.7bps at 1.2532%, 10-Yr is up 4.1bps at 1.4751%, and 30-Yr is up 1.9bps at 1.7891%.

OVERNIGHT DATA

- US Q3 REV NONFARM PRODUCTIVITY -5.2%; Y/Y -0.6%

- US Q3 UNIT LABOR COSTS +9.6%; Y/Y +6.3%

- US OCT TRADE GAP -$67.1B VS SEP -$81.4B

- US REDBOOK: DEC STORE SALES +15.3% V YR AGO MO

- US REDBOOK: STORE SALES +15.3% WK ENDED DEC 04 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- CANADIAN OCT TRADE BALANCE +2.1 BILLION CAD

- CANADA OCT EXPORTS 56.2 BLN CAD, IMPORTS 54.1 BLN CAD

- CANADA REVISED SEP MERCHANDISE TRADE BALANCE +1.4 BLN CAD

MARKET SNAPSHOT

Key late session market levels:

- DJIA up 506.57 points (1.44%) at 35734.14

- S&P E-Mini Future up 95.25 points (2.08%) at 4685

- Nasdaq up 462.3 points (3%) at 15687.19

- US 10-Yr yield is up 4.3 bps at 1.4768%

- US Mar 10Y are down 10.5/32 at 130-10.5

- EURUSD down 0.0028 (-0.25%) at 1.1257

- USDJPY up 0.13 (0.11%) at 113.61

- WTI Crude Oil (front-month) up $2.51 (3.61%) at $72.01

- Gold is up $5.74 (0.32%) at $1784.45

- EuroStoxx 50 up 139.09 points (3.36%) at 4276.2

- FTSE 100 up 107.62 points (1.49%) at 7339.9

- German DAX up 433.15 points (2.82%) at 15813.94

- French CAC 40 up 199.61 points (2.91%) at 7065.39

US TSY FUTURES CLOSE

- 3M10Y +3.075, 141.172 (L: 136.234 / H: 142.186)

- 2Y10Y -0.808, 79.097 (L: 76.349 / H: 81.13)

- 2Y30Y -2.468, 111.058 (L: 107.725 / H: 114.391)

- 5Y30Y -2.021, 54.236 (L: 51.467 / H: 56.847)

- Current futures levels:

- Mar 2Y down 3.5/32 at 109-1.375 (L: 109-01.125 / H: 109-05.625)

- Mar 5Y down 8/32 at 120-25.75 (L: 120-25.5 / H: 121-04.5)

- Mar 10Y down 10.5/32 at 130-10.5 (L: 130-09 / H: 130-25.5)

- Mar 30Y down 21/32 at 161-28 (L: 161-24 / H: 162-24)

US EURODOLLAR FUTURES CLOSE

- Dec 21 -0.0075 at 99.783

- Mar 22 -0.025 at 99.665

- Jun 22 -0.040 at 99.460

- Sep 22 -0.050 at 99.220

- Red Pack (Dec 22-Sep 23) -0.06 to -0.05

- Green Pack (Dec 23-Sep 24) -0.055

- Blue Pack (Dec 24-Sep 25) -0.055

- Gold Pack (Dec 25-Sep 26) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00462 at 0.07575% (-0.00075/wk)

- 1 Month -0.00113 to 0.10200% (-0.00213/wk)

- 3 Month +0.00825 to 0.19825% (+0.01062/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00713 to 0.28338% (+0.01225/wk)

- 1 Year +0.01700 to 0.48250% (+0.02100/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $994B

- Broad General Collateral Rate (BGCR): 0.05%, $355B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $334B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, $1.574B accepted vs. $2.655B submission

- Next scheduled purchases

- Wed 12/08 1010-1030ET: Tsy 2.25Y-4.5Y, appr $7.375B

- Thu 12/09 1010-1030ET: Tsy 0Y-2.25Y, appr $10.875B

- Thu 12/09 1100-1120ET: Tsy 10Y-22.5Y, appr $1.425B

- Fri 12/10 1010-1030ET: Tsy 7Y-10Y, appr $2.825B

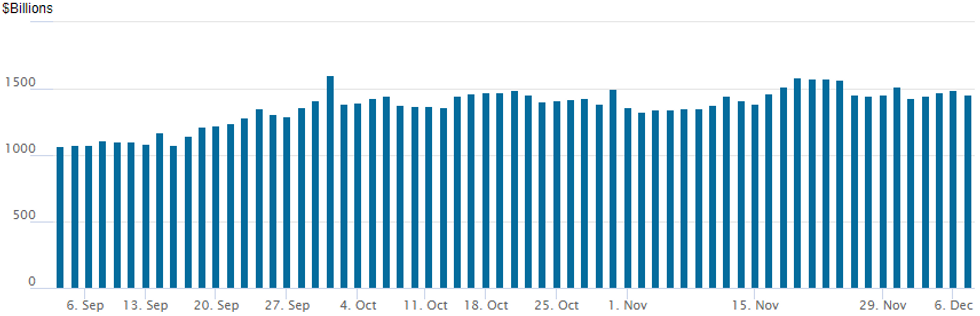

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,455.038B from 73 counterparties vs. $1,487.996B on Friday. Record high remains at 1,604.881B from Thursday, September 30.

PIPELINE: $2.75B JP Morgan 2Pt Launched Late

- Date $MM Issuer (Priced *, Launch #)

- 12/07 $8B #Merck 5pt, $1.5B 5Y +45, $1B 7Y +50, $2B 10Y +70, $2B 30Y +95 and $1.5B 40Y +110

- 12/07 $3B #Emerson Electric $1B 7Y +80, $1B 10Y +95, $1B 30Y +120

- 12/07 $2.75B #JP Morgan $2.35B 4NC3 fix/FRN +60, $400M 4NC3 FRN/SOFR +60

- 12/07 $1B #Western Digital $500M 7Y +145, $00M 10Y +165

- 12/07 $800M #GLP Capital 10Y +185

- 12/07 $600M #GA Global Funding 2Y +60

EGBs-GILTS CASH CLOSE: Gilts Outperform As BoE Hike Calls Retreat

German and UK yields were mixed Tuesday with Bunds underperforming in a risk-on session.

- Though equities soared, including the FTSE recovering all its late November losses, UK 10Yr yields touched a fresh post-September low; 30s since the first week of 2021.

- In the past day, multiple sell-side analysts have pushed back their BoE first hike calls, from December to February.

- BTPs underperformed in the periphery after rallying Monday.

- Mixed ECB news this morning, with Austria's Holzmann seeing potential for rate hikes alongside asset purchases; conversely an FT piece corroborating an earlier Reuters report that some GC members want to postpone post-PEPP decisions past next week's meeting.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at -0.701%, 5-Yr is up 2.5bps at -0.601%, 10-Yr is up 1.3bps at -0.375%, and 30-Yr is down 0.3bps at -0.093%.

- UK: The 2-Yr yield is down 0.6bps at 0.462%, 5-Yr is down 0.4bps at 0.572%, 10-Yr is down 0.8bps at 0.73%, and 30-Yr is down 2.2bps at 0.803%.

- Italian BTP spread up 2.9bps at 129.6bps / Spanish down 1.5bps at 70.9bps

FOREX: AUD and CAD Extend Recovery Amid Bolstered Risk Sentiment

- A second wave of positive sentiment across global markets lent further support to commodity-tied currencies such as the Australian dollar and the Canadian dollar.

- AUD led G10 gains with AUDUSD distancing itself further from the November 2020 lows around 0.6990. As well as bolstered sentiment and yesterday’s PBOC easing, some analysts have interpreted the latest RBA statement through a hawkish lens which may have extended the Aussie’s bounce.

- AUDUSD is up 0.92%, trading at 0.7115 as of writing. Clearance of last Friday’s high at 0.7099 suggests there may be scope for a stronger correction, opening 0.7194, the 20-day EMA.

- Similarly, USDCAD (-0.85%) has breached short-term support at 1.2714, suggesting a deeper sell-off towards the 50-day EMA at 1.2597 could be on the cards.

- The Norwegian krone has also extended on Monday’s gains amid the sharp bounce back in crude futures despite the announcement that the government will re-introduce additional measures to limit the spread of COVID-19.

- Despite AUD and CAD gains against the greenback, the dollar index still traded in marginally positive territory. Largely down to a soft Euro, euro crosses made some impressive moves to the downside that saw EURAUD and EURCAD fall over 1%.

- EURUSD itself made a push towards recent lows following a break of 1.1267. The broader trend remains bearish and key short-term resistance has been defined at 1.1383, Nov 30 high. Moving average studies remain in bear mode and the bear trigger resides at 1.1186/85.

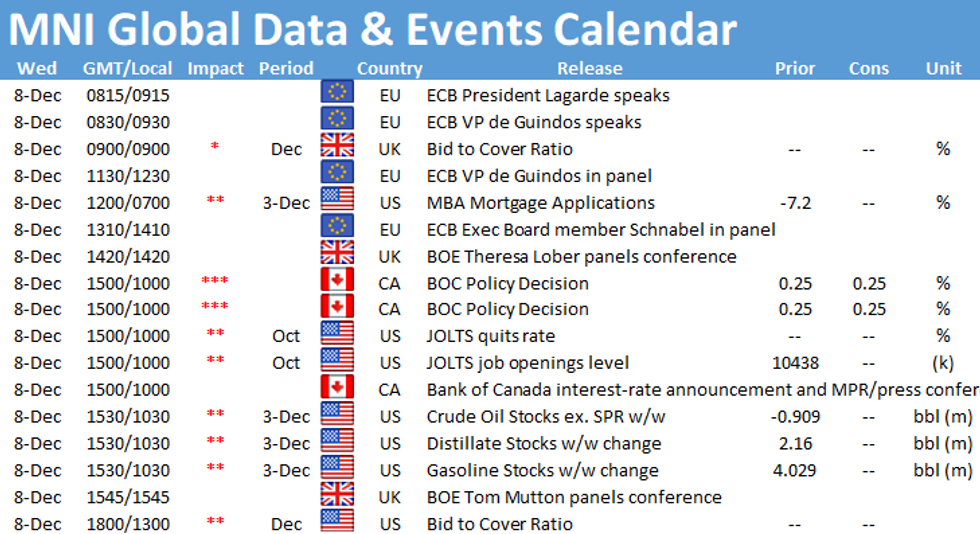

- Tomorrow’s main event risk will be the Bank of Canada decision/statement. Elsewhere there may be comments from RBA’s Lowe as well as JOLTS data from the U.S.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.