-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Taps Sacks For White House Job

MNI US MARKETS ANALYSIS - NFP Followed by Ample Fedspeak

MNI US OPEN - Soft NFP Report Should Cement December Cut

MNI ASIA OPEN: Rate Weaker as Stocks Near All-Time Highs

EXECUTIVE SUMMARY

- OMICRON HOSPITAL RISK 50-70% LOWER THAN DELTA, U.K. SAYS, Bbg

- MERCK COVID PILL AUTHORIZED FOR EMERGENCY USE IN THE U.S., Bbg

- U.S. PREPARED TO MEET IN EARLY JAN. W/ RUSSIA, NO DATE SET YET, Bbg

- U.S. HAS BEEN CLEAR ON CONSEQUENCES IF RUSSIA FURTHER ESCALATES, Bbg

- RUSSIA MUST DE-ESCALATE TO MAKE PROGRESS IN UKRAINE TALKS: U.S., Bbg

US

DATA REACT: U.Mich Does Little To Change Tsy Steepening

- U.Mich consumer inflation expectations dipped a tenth in the finalized Dec survey after an unchanged preliminary report. The 1y is 4.8% and 5-10y is 2.9%, just off the multi-year highs of 3%.

- General sentiment expectations were revised up a little further and supported by the announced increase in Social Security payments for 2022: "There have only been five times in the past half century that income expectations among low income households have exceeded the December 2021 level."

- However, "too few interviews were conducted to capture the impact of the rapid spread of the Omicron variant in the U.S. Confidence".

- The report has done little to change the bear steepening in USTs since the equity cash open.

- Cash Tsys have seen 2s10s widen 3bps (2.5bps prior to the data) to 81bps as the 10 yield increases 3bps close to week highs of 1.49%.

- Core PCE inflation appeared a tenth stronger than expected in Nov at +0.5% M/M but was helped by rounding at +0.46% M/M.

- This left core PCE inflation running at a very similar pace to Oct's 0.48% M/M (revised up 0.05pps) as it re-accelerated from the 0.3% averaged through Jul-Sep, similar to the CPI release earlier this month.

- There doesn't look to be much particularly new here. Overall PCE inflation was again stronger at +0.61% M/M, boosted by further strong rises in energy (+3.62% M/M) and less so food (+0.67% M/M).

- There has been very little market reaction to the release, with short-dated Tsys selling off less than 0.5bp and Dec'22 Eurodollars now unchanged.

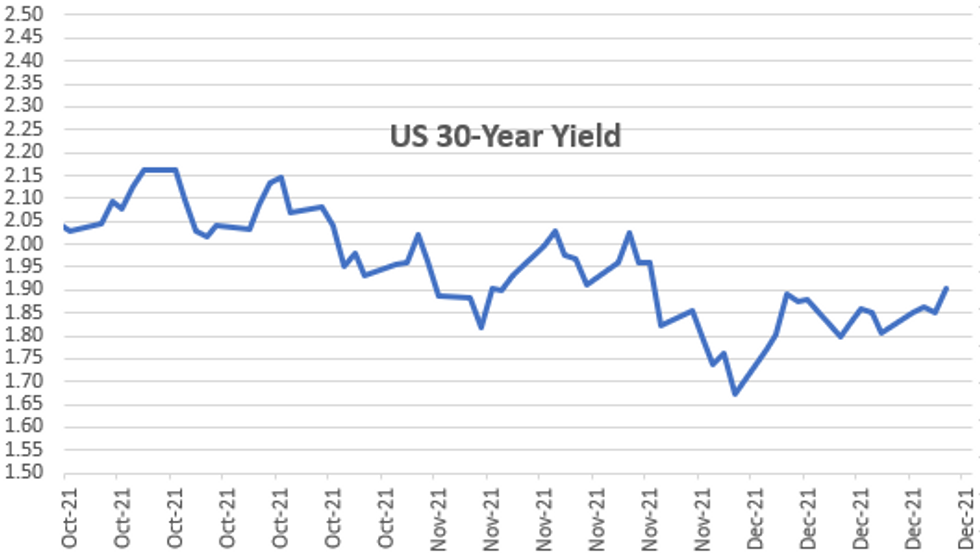

US TSYS: Risk-Rally In Your Stocking

Rates trading weaker after Thursday's early close (Friday markets closed for Christmas Eve) on very light volumes: TYH2 just over 466k.- Tsy futures near bottom of the session range after selling off on another positive showing for equities (ESH2 +33.0 to 4719.0, 4724.25H vs. 4738.5 all-time high on Dec 16).

- Tsy futures pared modest losses briefly post-data (in-line wkly claims, continuing claims beat, durables beat but core cap goods weak). Rates reversed gains after stocks opened and held near lows since midmorning (30YY 1.9122%H; 10YY 1.4995%H).

- U. of Mich. Sentiment in-line with estimate (70.4), existing home sales weaker than estimated: +12.4% TO 0.744M SAAR (.770M est) did spur some light buying in 10s-30s.

- Upbeat Covid headlines similar to Wednesday: OMICRON HOSPITAL RISK 50-70% LOWER THAN DELTA, U.K. SAYS ... MERCK COVID PILL AUTHORIZED FOR EMERGENCY USE IN THE U.S, Bbg

- No new high-grade issuance, Dec running total stands at $62.2B. NY Fed buy-operations pause for holidays, resume Jan 3 with Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior.

- The 2-Yr yield is up 2.6bps at 0.6861%, 5-Yr is up 2.5bps at 1.2401%, 10-Yr is up 4bps at 1.491%, and 30-Yr is up 5.6bps at 1.9052%.

OVERNIGHT DATA

- US JOBLESS CLAIMS +0K TO 205K IN DEC 18 WK

- US PREV JOBLESS CLAIMS REVISED TO 205K IN DEC 11 WK

- US CONTINUING CLAIMS -0.008M to 1.859M IN DEC 11 WK

- US NOV DURABLE NEW ORDERS +2.5%; EX-TRANSPORTATION +0.8%

- US OCT DURABLE GDS NEW ORDERS REV TO +0.1%

- US NOV NONDEF CAP GDS ORDERS EX-AIR -0.1% V OCT +0.9%

- US NOV PERSONAL INCOME +0.4%; NOM PCE +0.6%

- US NOV PCE PRICE INDEX +0.6%; +5.7% Y/Y

- US NOV CORE PCE PRICE INDEX +0.5%; +4.7% Y/Y

- US NOV UNROUNDED PCE PRICE INDEX +0.609%; CORE +0.462%

- US NOV NEW HOME SALES +12.4% TO 0.744M SAAR

- US OCT NEW HOME SALES REVISED TO 0.662M SAAR

- MICHIGAN FINAL DEC. CONSUMER SENTIMENT AT 70.6; EST. 70.4

- CANADA OCT GROSS DOMESTIC PRODUCT +0.8% MOM

- CANADA OCT GOODS INDUSTRY GDP +1.6%, SERVICES +0.6%

- CANADA REVISED SEP GROSS DOMESTIC PRODUCT +0.2% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 202.41 points (0.57%) at 35963.68

- S&P E-Mini Future up 34 points (0.73%) at 4720.5

- Nasdaq up 143.7 points (0.9%) at 15664.76

- US 10-Yr yield is up 4 bps at 1.491%

- US Mar 10Y are down 7/32 at 130-16.5

- EURUSD up 0.001 (0.09%) at 1.1336

- USDJPY up 0.33 (0.29%) at 114.43

- Gold is up $4.28 (0.24%) at $1807.84

- EuroStoxx 50 up 48.8 points (1.16%) at 4265.86

- FTSE 100 up 31.68 points (0.43%) at 7373.34

- German DAX up 162.84 points (1.04%) at 15756.31

- French CAC 40 up 54.48 points (0.77%) at 7106.15

US TSY FUTURES CLOSE

- 3M10Y +3.693, 141.744 (L: 137.037 / H: 143.11)

- 2Y10Y +1.803, 80.282 (L: 77.676 / H: 81.551)

- 2Y30Y +3.133, 121.365 (L: 117.248 / H: 122.879)

- 5Y30Y +2.826, 65.84 (L: 62.551 / H: 66.928)

- Current futures levels:

- Mar 2Y down 1.5/32 at 109-2.5 (L: 109-02.375 / H: 109-04.25)

- Mar 5Y down 3/32 at 120-30.5 (L: 120-29.75 / H: 121-02.75)

- Mar 10Y down 6.5/32 at 130-17 (L: 130-15 / H: 130-26)

- Mar 30Y down 27/32 at 160-17 (L: 160-11 / H: 161-18)

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady at 99.630

- Jun 22 -0.010 at 99.385

- Sep 22 -0.010 at 99.180

- Dec 22 -0.015 at 98.945

- Red Pack (Mar 23-Dec 23) -0.02 to -0.01

- Green Pack (Mar 24-Dec 24) -0.02 to -0.015

- Blue Pack (Mar 25-Dec 25) -0.02 to -0.015

- Gold Pack (Mar 26-Dec 26) -0.025 to -0.02

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00463 at 0.07513% (+0.00088/wk)

- 1 Month -0.00088 to 0.10188% (-0.00062/wk)

- 3 Month +0.00837 to 0.21975% (+0.00713/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01000 to 0.33638% (+0.02363/wk)

- 1 Year +0.00775 to 0.56113% (+0.03150/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $69B

- Daily Overnight Bank Funding Rate: 0.07% volume: $234B

- Secured Overnight Financing Rate (SOFR): 0.04%, $893B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $331B

- (rate, volume levels reflect prior session)

- NY Fed buy-operations pause for holidays, resume Jan 3:

- Mon 01/03 1010-1030ET: Tsy 2.25Y-4.5Y, appr $6.325B vs. $7.375B prior

- Tue 01/04 1100-1120ET: TIPS 1Y-7.5Y, appr $1.525B

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

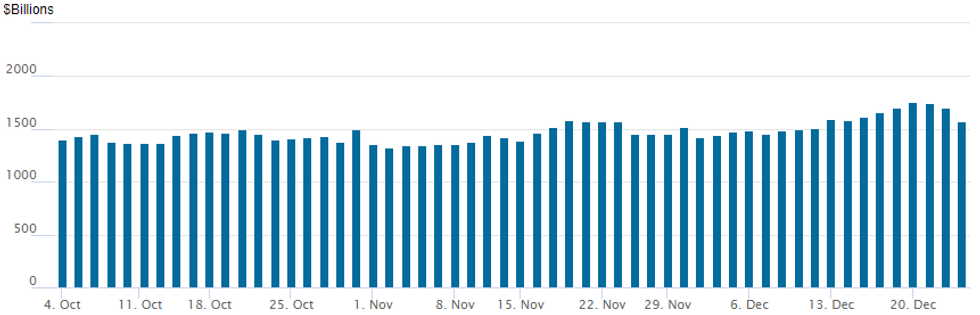

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,577.780B from 76 counterparties vs. $1,699.277B Wednesday. New record high this week of $1,758.041B posted Monday, December 20.

EGBs-GILTS CASH CLOSE: Bunds Underperform Going Into Holiday

The German curve bear steepened Thursday, with Bunds underperforming Gilts.

- Gilts had underperformed in the morning, with the UK gov't reportedly avoiding lockdown restrictions ahead of Christmas.

- But Bunds moved lower (and BTP spreads widened to the most since Q3 2020 though recovered), with RX futures dipping through support. The absence of ECB purchases (the last ones of the year were made Tuesday) was cited by some desks as playing a factor, as was the covering of long positions amid thin liquidity ahead of a prolonged market holiday.

- Most European bond and equity markets are closed Friday (as is the U.S.) in observance of the Christmas holiday. Gilts/FTSE are the main exception, though with a shortened session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.4bps at -0.678%, 5-Yr is up 3.1bps at -0.513%, 10-Yr is up 4.4bps at -0.249%, and 30-Yr is up 5.3bps at 0.117%.

- UK: The 2-Yr yield is up 2bps at 0.66%, 5-Yr is up 2.5bps at 0.772%, 10-Yr is up 3.6bps at 0.922%, and 30-Yr is up 2.6bps at 1.093%.

- Italian BTP spread up 1.9bps at 136.2bps / Spanish up 0.3bps at 75.6bps

FOREX: US Dollar Index Remains At Lows Of Week As Risk Climbs

- Despite some initial strength in broad dollar indices, the greenback weakened back to unchanged and remains close to its worst levels of the week.

- With risk sentiment continuing to climb, evident by supportive price action in both equity and commodity markets, risk tied FX such as AUD, NZD and GBP all extended their rallies.

- In similar price action to the previous two sessions, the Japanese Yen remained weak and USDJPY consolidated gains above the 114 mark grinding up to 114.45, the best levels since November 26.

- Having breached 114.38, the 61.8% Fibonacci retracement of the Nov 24 - 30 downleg, this signals potential for a stronger technical rally.

- AUDJPY and GBPJPY were the strongest performing pairs, gaining close to 0.75%.

- In emerging markets the Turkish lira took another huge boost, firming roughly 17% against the dollar at its peak where USDTRY made lows of 10.25, an astonishing 44% from the week’s high print. The pair bounced back to around 11.25 but remains roughly 7% weaker for Thursday.

- Japanese National Core CPI overnight before an empty Christmas Eve docket with US markets closed for holiday.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/12/2021 | 1600/1100 | ** |  | US | St. Louis Fed Real GDP Nowcast |

| 24/12/2021 | 1600/1100 | ** |  | US | NY Fed GDP Nowcast |

| 27/12/2021 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.