-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Hedging for Live Fed in March

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Factories Face New Backlogs From Omicron-ISM

- MNI BRIEF: MN Fed Kashkari Says Inflation Should Ease With Pandemic

- JOHNSON: HAVE CHANCE TO RIDE OUT OMICRON WAVE WITHOUT LOCKDOWN, Bbg

US

FED: U.S. manufacturers will likely face renewed bottlenecks as the Omicron variant spreads, Institute for Supply Management manufacturing chair Tim Fiore told MNI Tuesday.

- "I'm definitely expecting problems," he said. "I'm expecting problems on the supplier delivery number," Fiore said, "and the employment numbers are going to to sag quite a bit, maybe even contract." For more see MNI Policy main wire at 1340ET.

- While inflation has been surprising in recent months, he pointed to slack, including payrolls that are perhaps six million below where they might be absent the pandemic. "It's been uneven and there are still some big gaps," he said of the economic rebound during an online seminar.

- Earlier he posted an online essay: https://medium.com/@neelkashkari/two-opposing-risks-1276eff73d37 saying his last dot plot submission called for two rate increases this year, rather than September when he told MNI he was the lone person calling for no move until 2024.

FED: Recap Of Likely Biden Picks For Key Roles; Further support for the leading contenders for 2 of the 3 Board positions to be open by end-Jan.

- VC Supervision: Sarah Bloom Raskin is Biden's choice according to Axios late yesterday, pushing her higher from mid-70s to 92c on PredictIt. It could be announced as early as this week.

- Whilst backed by Sen. Warren and in favour of tighter regulation and a greater focus on climate risk, she is seen as having a greater chance of Senate approval than Richard Cordray.

- Board position: Philip Jefferson will likely be nominated according to people familiar with the matter via Bloomberg, adding to WSJ saying he was in contention along with Lisa Cook last week.

- Jefferson is the faculty dean and an economics professor at Davidson College, North Carolina, with a focus on inequality. He had stints at the Fed in the 80s and 90s and would be the fourth Black man to sit on the BoG in its history.

- Not Biden picks but still important: the Boston (2022 voter) and Dallas (2023 voter) Fed presidencies remain vacant, with Dallas holding a town hall on Jan 13 on its search.

- Separately, Powell's Chair renomination and Brainard's VC appointment hearings are also planned for next week.

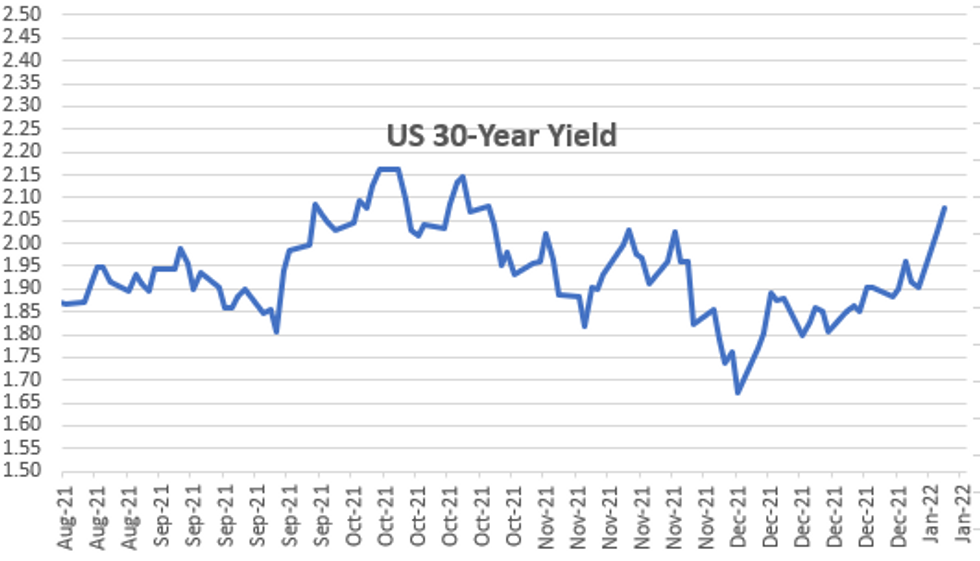

US TSYS: 10Y Real Yields At Post Dec FOMC High

- A decoupling between 10Y Tsy yields and breakevens has seen the breakeven-derived real yield rise 7.5bps to -0.945% (and 12.5bps since the new year).

- This is the highest since the immediate reaction to the Dec FOMC decision and prior to that since pre-Omicron levels.

- Both 10Y nominal yields and breakevens remain elevated, but the 10Y nominal yield is up 3.5bps today at 1.665% whereas the breakeven has dipped 4bps to 2.608%.

- Today’s further rise in the nominal yield takes it to the top end of the post-pandemic range, close to the 1.7% it has struggled to clear in recent months.

- FOMC minutes tomorrow with markets looking for any discussion on how soon they might hike rates after taper is over and any more detail about balance sheet normalisation.

- Yield curves holding steeper but slightly off midday highs (5s30s +4.07 at 70.75 -- steepest since late November.

- Contributing flow in addition to large 5Y Block buy, trading desks report two-way in short end with foreign real$ selling 2s, domestic real$ buying 3s vs. leveraged acct selling.

OVERNIGHT DATA

- US REDBOOK: DEC STORE SALES +17.6% V YR AGO MO

- US REDBOOK: STORE SALES +18.8% WK ENDED JAN 01 V YR AGO WK

- US REDBOOK: WILL RESUME MONTH-TO-MONTH DATA COMPARISON IN FEB 2022

- US ISM PURCHASING MANAGERS INDEX 58.7 DEC VS 61.1 NOV

- US ISM PRICES PAID INDEX 68.2 DEC VS 82.4 NOV (NSA)

- US ISM NEW ORDERS INDEX 60.4 DEC VS 61.5 NOV

- US ISM EMPLOYMENT INDEX 54.2 DEC VS 53.3 NOV

- US ISM PRODUCTION INDEX 59.2 DEC VS 61.5 NOV

- US ISM SUPPLIER DELIVERY INDEX 64.9 DEC VS 72.2 NOV

- US ISM ORDER BACKLOG INDEX 62.8 DEC VS 61.9 NOV (NSA)

- US ISM INVENTORIES INDEX 54.7 DEC VS 56.8 NOV

- US ISM CUSTOMER INV INDEX 31.7 DEC VS 25.1 NOV (NSA)

- US ISM EXPORTS INDEX 53.6 DEC VS 54.0 NOV (NSA)

- US ISM IMPORTS INDEX 53.8 DEC VS 52.6 NOV (NSA)

- US BLS: JOLTS QUITS RATE 3% IN NOV

- CANADA DEC INDUSTRIAL PRICES +0.8% MOM; EX-ENERGY +0.9%

- CANADA DEC RAW MATERIALS PRICES -1.0% MOM; EX-ENERGY +1.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 253.9 points (0.69%) at 36840.37

- S&P E-Mini Future down 3.5 points (-0.07%) at 4782.5

- Nasdaq down 251.3 points (-1.6%) at 15582.47

- US 10-Yr yield is up 3.5 bps at 1.663%

- US Mar 10Y are down 5/32 at 129-9

- EURUSD down 0.0007 (-0.06%) at 1.129

- USDJPY up 0.82 (0.71%) at 116.14

- WTI Crude Oil (front-month) up $0.92 (1.21%) at $77.00

- Gold is up $13.02 (0.72%) at $1814.46

- EuroStoxx 50 up 35.8 points (0.83%) at 4367.62

- FTSE 100 up 120.61 points (1.63%) at 7505.15

- German DAX up 131.88 points (0.82%) at 16152.61

- French CAC 40 up 100.19 points (1.39%) at 7317.41

US TSY FUTURES CLOSE

- 3M10Y +1.979, 157.679 (L: 152.039 / H: 159.781)

- 2Y10Y +4.491, 90.109 (L: 84.026 / H: 91.814)

- 2Y30Y +6.678, 131.898 (L: 123.182 / H: 133.768)

- 5Y30Y +4.377, 71.054 (L: 64.685 / H: 72.636)

- Current futures levels:

- Mar 2Y up 1.625/32 at 109-0.875 (L: 108-30.625 / H: 109-01.375)

- Mar 5Y up 0.25/32 at 120-14.25 (L: 120-10.25 / H: 120-17.5)

- Mar 10Y down 4.5/32 at 129-9.5 (L: 129-04 / H: 129-19)

- Mar 30Y down 1-04/32 at 156-25 (L: 156-13 / H: 158-02)

- Mar Ultra 30Y down 2-13/32 at 189-27 (L: 189-06 / H: 192-16)

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady at 99.645

- Jun 22 +0.015 at 99.405

- Sep 22 +0.030 at 99.195

- Dec 22 +0.040 at 98.950

- Red Pack (Mar 23-Dec 23) +0.025 to +0.035

- Green Pack (Mar 24-Dec 24) -0.02 to +0.005

- Blue Pack (Mar 25-Dec 25) -0.04 to -0.03

- Gold Pack (Mar 26-Dec 26) -0.04 to -0.035

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N +0.00791 at 0.07229% (-0.00537 total last wk)

- 1 Month +0.00246 to 0.10371% (+0.00000 total last wk)

- 3 Month +0.00687 to 0.21600% (-0.00875 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00411 to 0.34286% (-0.00450 total last wk)

- 1 Year +0.01987 to 0.60300% (+0.01600 total last wk)

- Daily Effective Fed Funds Rate: 0.07% volume: $74B

- Daily Overnight Bank Funding Rate: 0.07% volume: $249B

- Secured Overnight Financing Rate (SOFR): 0.04%, $972B

- Broad General Collateral Rate (BGCR): 0.05%, $344B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $321B

- (rate, volume levels reflect prior session)

- TIPS 1Y-7.5Y, $1.501B accepted vs. $5.048B submission

- Next scheduled purchases:

- Wed 01/05 1010-1030ET: Tsy 7Y-10Y, appr $2.425B vs. $2.825B prior

- Wed 01/05 1100-1120ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 01/06 1100-1120ET: TIPS 7.5Y-30Y, appr $0.925B

- Fri 01/07 1010-1030ET: Tsy 0Y-2.25Y, appr $9.325B

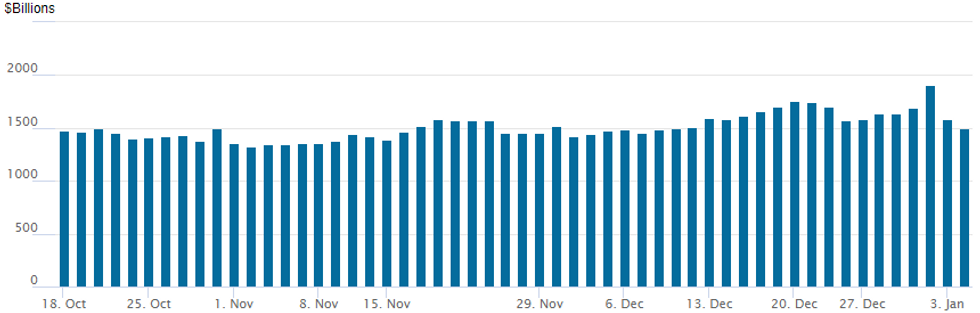

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage continues to recede after from last Friday's all-time high of $1,904.582B -- down to $1,495.692B (72 counterparties) from $1,579.526B on Monday.

EGBs-GILTS CASH CLOSE: Post-Holiday Gilt Sell-Off

German bonds vastly outperformed the UK's Tuesday, though this was distorted by the return to Gilt cash trading from holidays.

- Overall it was a risk-on session in Europe with equities gaining and curves steepening.

- Gilts sold off sharply (vs Dec 31 levels), with short-end/belly yields rising to 2+ year highs. The 10Yr segment underperformed though, with yields up 11+bp (to 'just' 2-month highs).

- GBP strength vs EUR was notable, and largely attributable to a relatively more hawkish policy rate outlook in the UK vs Eurozone.

- Italian curve steepening was exacerbated by a syndication mandate for new 30Yr BTP.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.3bps at -0.613%, 5-Yr is down 0.7bps at -0.418%, 10-Yr is down 0.4bps at -0.122%, and 30-Yr is up 0.5bps at 0.257%.

- UK: The 2-Yr yield is up 8.1bps at 0.768%, 5-Yr is up 9.3bps at 0.913%, 10-Yr is up 11.4bps at 1.085%, and 30-Yr is up 9.5bps at 1.212%.

- Italian BTP spread up 1.3bps at 133.7bps / Spanish down 0.3bps at 71.2bps

FOREX: JPY Stays Weak Despite Equity Backtrack

- JPY headed into US hours at the bottom of the G10 table, and holds that position into the NY close. USD/JPY made light work of resistance ahead of the 116 handle, topping the mark and rallying to touch the best levels since early 2017.

- USD/JPY front-end risk reversals rose in sympathy with spot, prompting 1m RR to almost entirely reverse the omicron-inspired plunge at the end of November, with the contract closing in on the -0.2 points last seen on Nov25.

- Stocks charged higher at the open, helping boost the likes of AUD, NOK and CAD, which held their strength despite a moderation in equity prices after the open.

- The greenback held its ground for much of the European morning, but a miss on expectations for the ISM Manufacturing release worked against the USD Index, with particular attention paid to the subpar prices paid index - another metric that may suggest inflation could be nearing a medium-term peak.

- Final Eurozone PMI data crosses Wednesday as well as the December ADP Employment Change report. Fed minutes are also on the docket.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.