-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI: PBOC Net Injects CNY14.2 Bln via OMO Friday

MNI ASIA OPEN: March Focus Ahead Jan FOMC

EXECUTIVE SUMMARY

- MNI INTERVIEW: Some Volatility Healthy During QT -Fed Economist

- MNI: Williams Says Fed Approaching Decision To Normalize Rates

- MNI BRIEF: Fed's Rate Path Is To Normal, Around 2% - Williams

US

FED: The Federal Reserve should consider repricing its administered rates as monetary policy tightens and assets run off to allow room for a healthy amount of rates volatility, Richmond Fed economist Huberto Ennis said in an interview.- "In the process of normalization, we might see a little bit more rate volatility, and I’m not sure that we should be so aggressive about reducing that volatility," Ennis said. "We can welcome volatility, instead of intervening in ways that create unintended consequences. The market has to adapt to it and plan for it."

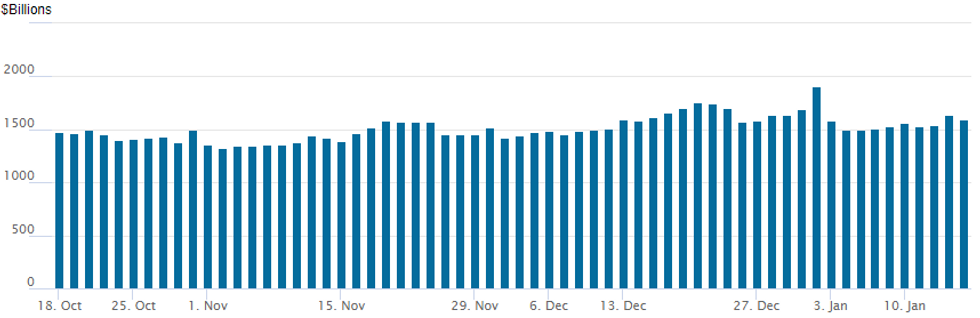

- The Fed's overnight reverse repo facility saw an unprecedented surge in demand after the central bank started paying 5 bps interest to prevent yields from going negative, with usage averaging USD1.6 trillion in December. Record injections of reserves into the banking system to fight the Covid-19 pandemic had driven up demand for short-term securities by money market funds. For more see MNI Policy main wire at 1334ET.

FED: New York Fed President John Williams Friday said the Federal Reserve is approaching a decision to begin ratcheting back its extraordinary accommodative support to the economy during the pandemic back to more normal levels.

- "The next step in reducing monetary accommodation to the economy will be to gradually bring the target range for the federal funds rate from its current very-low level back to more normal levels," he said, noting the central bank's decision in December to quicken the withdrawal of asset purchases. "Given the clear signs of a very strong labor market, we are approaching a decision to get that process underway."

- Williams, vice chair of the FOMC, is the latest Fed official to signal coming interest rate increases, but the New York Fed leader did not hint at how many rate hikes he sees this year. For more see MNI Policy main wire at 1103ET.

- "It's really not so much, is it so many rate increases this year or next year? It's really about just moving interest rates back up to that over the next year or two, moving to that level at least in the base case," Williams told reporters after remarks at a Council on Foreign Relations event.

- The neutral interest rate in real terms was between zero and 0.5% just prior to the onset of the pandemic, he said. Early data about the underlying drivers of the natural rate of interest since then don't appear yet to have changed that, including around demographics globally, he said.

Tsy/Eurodollar Roundup

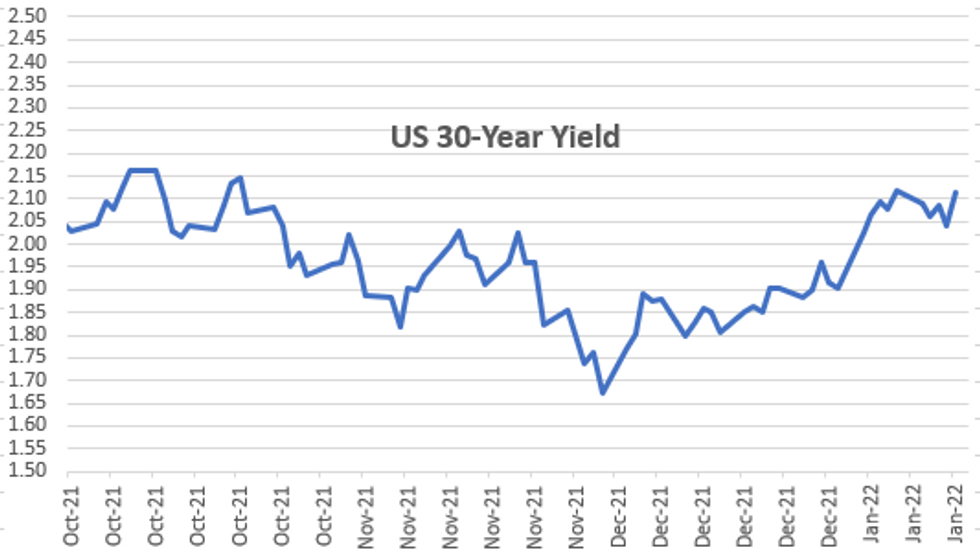

Tsys remain under pressure in late trade, 30Y looking to extend recent session lows even as equities trade weaker/off lows amid sporadic program selling -- squaring up ahead the extended holiday weekend.

- Yield curves only mildly steeper despite the better long end selling, 5s30s just over 56.78 in late trade; 30YY climbs to 2.1212% (shy of Mon's 2.1491% high); 10YY tapped 1.7770% vs. Mon's 1.8064% high.

- Rates took the large Dec Sales miss in stride: headline -1.9% M/M vs -0.1% expected, with ex-auto/gas -2.5% vs -0.2% expected -- trimming losses w/stocks to session highs by midmorning. Ongoing geopol tension between US and allies vs. Russia over Ukraine border troop build.

- Steady refrain from hawkish Fed officials underscoring 3-4 .25bps hikes (more likely the latter) starting in March emboldened sellers and option hedgers. Fed enters media blackout at midnight through Jan 27, day after FOMC annc.

- With March becoming a crowded trade, option accts started shifting focus to mid-year (give or take a month or two) for more aggressive lift-off than currently priced in. For context: Fed Waller suggested during Bbg interview late Thu that if inflation remains high “the case will be made for four, maybe five hikes”.

- Near a perfect storm really for edge/potential profitability in putting on risk abatement hedges or simply for speculation – June was main focus today w/ paper buying June 98.93/99.06/99.18 put fly buyer -- EDM2 is at 99.265 -- looking for underlying to drift near that center strike for max profit. Anecdotal observations: implieds elevated, put skew still favored

- The 2-Yr yield is up 7.2bps at 0.9648%, 5-Yr is up 7bps at 1.5428%, 10-Yr is up 6.2bps at 1.7663%, and 30-Yr is up 6.4bps at 2.1066%.

OVERNIGHT DATA

- US DEC RETAIL SALES -1.9%; EX-MOTOR VEH -2.3%

- US NOV RETAIL SALES REVISED +0.2%; EX-MV +0.1%

- US DEC RET SALES EX GAS & MTR VEH & PARTS DEALERS -2.5% V NOV -0.1%

- US DEC RET SALES EX MTR VEH & PARTS DEALERS -2.3% V US DEC +0.1%

- US DEC RET SALES EX AUTO, BLDG MATL & GAS -2.7% V NOV -0.4%

- US DEC IMPORT PRICES -0.2%

- US DEC EXPORT PRICES -1.8%; NON-AG -2.1%; AGRICULTURE +0.8%

- US DEC INDUSTRIAL PROD -0.1%; CAP UTIL 76.5%

- US NOV IP REV TO +0.7%; CAP UTIL REV 76.6%

- US DEC MFG OUTPUT -0.3%

- US NOV BUSINESS INVENTORIES +1.3%; SALES +0.7%

- US NOV RETAIL INVENTORIES +2.0%

- UMICH JAN. PRELIM CONS SENTIMENT 68.8 (70.0 EXP., 70.6 DEC)

- UMICH JAN. PRELIM 1Y INFL EXPECTATIONS 4.9% (4.8% EXP; 4.8% DEC)

- UMICH JAN. PRELIM 5-10Y INFL EXPECTATIONS 3.1% (2.9% DEC)

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 341.87 points (-0.95%) at 35776.71

- S&P E-Mini Future down 19.75 points (-0.42%) at 4632.5

- Nasdaq down 4.6 points (0%) at 14803.14

- US 10-Yr yield is up 6.2 bps at 1.7663%

- US Mar 10Y are down 16.5/32 at 128-6.5

- EURUSD down 0.0041 (-0.36%) at 1.1414

- USDJPY down 0.07 (-0.06%) at 114.14

- WTI Crude Oil (front-month) up $1.86 (2.27%) at $83.98

- Gold is down $4.87 (-0.27%) at $1817.68

- EuroStoxx 50 down 43.71 points (-1.01%) at 4272.19

- FTSE 100 down 20.9 points (-0.28%) at 7542.95

- German DAX down 148.35 points (-0.93%) at 15883.24

- French CAC 40 down 58.14 points (-0.81%) at 7143

US TSY FUTURES CLOSE

- 3M10Y +6.529, 165.021 (L: 156.597 / H: 165.376)

- 2Y10Y -0.102, 80.61 (L: 78.812 / H: 82.138)

- 2Y30Y +0.236, 114.813 (L: 112.47 / H: 116.416)

- 5Y30Y -0.037, 56.624 (L: 55.526 / H: 58.256)

- Current futures levels:

- Mar 2Y down 4.375/32 at 108-20 (L: 108-19.75 / H: 108-24.5)

- Mar 5Y down 11.75/32 at 119-15.5 (L: 119-15.5 / H: 119-29.25)

- Mar 10Y down 19/32 at 128-4 (L: 128-03.5 / H: 128-25.5)

- Mar 30Y down 1-11/32 at 155-6 (L: 155-03 / H: 156-19)

- Mar Ultra 30Y down 2-16/32 at 188-10 (L: 188-05 / H: 191-03)

US 10Y FUTURE TECHS: (H2) Gains Considered Corrective

- RES 4: 131-19 High Dec 20 and key resistance

- RES 3: 130-18+/28+ High Dec 31 / High Dec 22

- RES 2: 129-31 Low Dec 8 and a recent breakout level

- RES 1: 129-00/13 High Jan 6 / 20-day EMA

- PRICE: 128-12+ @ 16:39 GMT Jan 14

- SUP 1: 127-30 1.764 proj of the Dec 20 - 29 - 31 price swing

- SUP 2: 127-18+ 2.00 proj of the Dec 20 - 29 - 31 price swing

- SUP 3: 127-07 2.236 proj of the Dec 20 - 29 - 31 price swing

- SUP 4: 127-00 Round number support

Treasuries remain in a downtrend and recent short-term gains are considered corrective. A clear bearish price sequence of lower lows and lower highs highlights the current trend direction and signals scope for an extension. The moving average set-up is also in a bear mode, reinforcing current conditions. Initial resistance is seen at 129-00, the Jan 6 high. The focus is on 127-18+ next, a Fibonacci projection.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.015 at 99.575

- Jun 22 -0.040 at 99.260

- Sep 22 -0.050 at 99.010

- Dec 22 -0.065 at 98.730

- Red Pack (Mar 23-Dec 23) -0.11 to -0.085

- Green Pack (Mar 24-Dec 24) -0.11 to -0.10

- Blue Pack (Mar 25-Dec 25) -0.10 to -0.09

- Gold Pack (Mar 26-Dec 26) -0.085 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Settlement resumes:

- O/N -0.00343 at 0.07400% (+0.00129/wk)

- 1 Month -0.00300 to 0.10329% (-0.00200/wk)

- 3 Month +0.00215 to 0.24129% (+0.00515/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00186 to 0.39500% (+0.01857/wk)

- 1 Year +0.01214 to 0.72571% (+0.06400/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $71B

- Daily Overnight Bank Funding Rate: 0.07% volume: $259B

- Secured Overnight Financing Rate (SOFR): 0.05%, $892B

- Broad General Collateral Rate (BGCR): 0.05%, $353B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $341B

- (rate, volume levels reflect prior session)

NY Fed updated purchase schedule: no new buys Friday through Monday's MLK Jr holiday, resume next week Tuesday. NY Fed operations desk "plans to purchase approximately $40 billion over the monthly period from 1/14/22 to 2/11/22" vs. $60B prior as QE winds down.

- Tue 01/18 1010-1030ET: Tsy 4.5Y-7Y, appr $6.025B vs. $4.525B prior

- Thu 01/20 1010-1030ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Fri 01/21 1010-1030ET: Tsy 0Y-2.25Y, appr $12.425B vs. $9.325B prior

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause again around the FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

FED Reverse Repo Operation

NY Federal Reserve/MNI

After surging to $1,636.742B Thursday, NY Fed reverse repo usage recedes to $1,598.887B (80 counterparties) today -- well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: January Total Issuance Over $140B Already, Pause for Earnings

Latest earnings cycle keeping domestic US$ issuers at bay -- No new US$ debt issuance as yet after $10B to priced Thu, $61.25B/wk to a whopping $141.85B in first two weeks of January. In comparison, total Jan'21 issuance was $227.55B.CDX investment grade spds running a touch wider: 53.52 +0.37, Markit indices.

- Date $MM Issuer (Priced *, Launch #)

- 01/13 $2B *China Construction Bank 10NC5 +140

- 01/13 $1.5B *Province of Ontario 10Y +60

- 01/13 $1.2B *CCO Holdings 10NC5 4.75%

- 01/13 $1B *Kommunekredit 12/2023 SOFR+13

- 01/13 $500M *Mitsui & Co 5Y +68

- 01/13 $500M *CIMB Bank 5.5Y +70

- 01/13 $500M *Ares Finance 30Y +172

- 01/13 $500M *Indian Railway Finance 10Y Green +185

- 01/13 $2.5B *EIG Pearl 14.5Y-15Y +185a, 24.5Y-25Y +235a

EGBs-GILTS CASH CLOSE: Prior Gains Reverse With U.S. Driving Price Action

Bund and Gilt yields rebounded from the drop of the three previous sessions Friday, erasing most of Thursday's sharp falls.

- As with most of this week, the US was the source of price action catalysts.

- UK and German yields fell to afternoon lows following very weak US retail sales data, but rebounded and moved higher after strong UMichigan consumer survey inflation expectations.

- The cash session closed on a weak note, with position squaring ahead of the weekend (particularly given the US long weekend).

- Next week sees a pullback in EGB issuance (E24.3bln vs E39.2bln this week).

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at -0.583%, 5-Yr is up 3.5bps at -0.364%, 10-Yr is up 4.4bps at -0.046%, and 30-Yr is up 4.8bps at 0.252%.

- UK: The 2-Yr yield is up 3.5bps at 0.796%, 5-Yr is up 3.4bps at 0.97%, 10-Yr is up 4.5bps at 1.15%, and 30-Yr is up 3.9bps at 1.255%.

- Italian BTP spread up 1.2bps at 131.9bps / Spanish up 0.7bps at 68.4bps

FOREX: DXY Decline Hits Reverse, Steers Clear of 100-DMA Support

- Following several sessions of weakness, the USD Index reversed course of Friday, recovering after a major test of the 100-dma support. The greenback was among the best performers Friday, second only to the JPY, that benefited from a second session of declines for Wall Street equity markets.

- The greenback recovery was most prominent against some of the week's best performers, including the AUD, which retraced back to $0.72 just after the London close. This raises attention on the false break higher earlier in the week that saw prices climb north - but not close above - the 100-dma of 0.7286. Further weakness could see the pair retest the 2022 lows of 0.7130.

- Similarly EUR/JPY posted the largest range of the year so far - putting EUR/JPY through the 100-dma support of 130.02, opening further losses toward the 50-dma at 129.49 - which coincides with the 50% retracement for the Dec-Jan upleg.

- A US holiday on Monday should keep price action muted at the beginning of the week, with focus turning to Chinese GDP data, the BoJ rate decision, UK inflation and the continuation of Q1 earnings season for US corporates.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/01/2022 | 1500/1600 |  | EU | ECB Schnabel Message at FutureLab | |

| 17/01/2022 | 0200/1000 | *** |  | CN | Retail Sales |

| 17/01/2022 | 0200/1000 | *** |  | CN | Industrial Output |

| 17/01/2022 | 0200/1000 | *** |  | CN | Fixed-Asset Investment |

| 17/01/2022 | 0200/1000 | *** |  | CN | GDP |

| 17/01/2022 | 0200/1000 | ** |  | CN | Surveyed Unemployment Rate |

| 17/01/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 17/01/2022 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/01/2022 | 1400/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.