-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Sentiment Recovers Despite Simmering Geopolitical Tensions

EXECUTIVE SUMMARY

- BIDEN SEES RUSSIA MOVING ON UKRAINE, SOWS DOUBT ON WESTERN RESPONSE (RTRS)

- TORY MPS STEPPING BACK FROM CHALLENGE AGAINST BORIS JOHNSON (BBC)

- PBOC CUT LOAN PRIME RATES, SET USD/CNY MID-POINT AT LOWEST POINT SINCE 2018

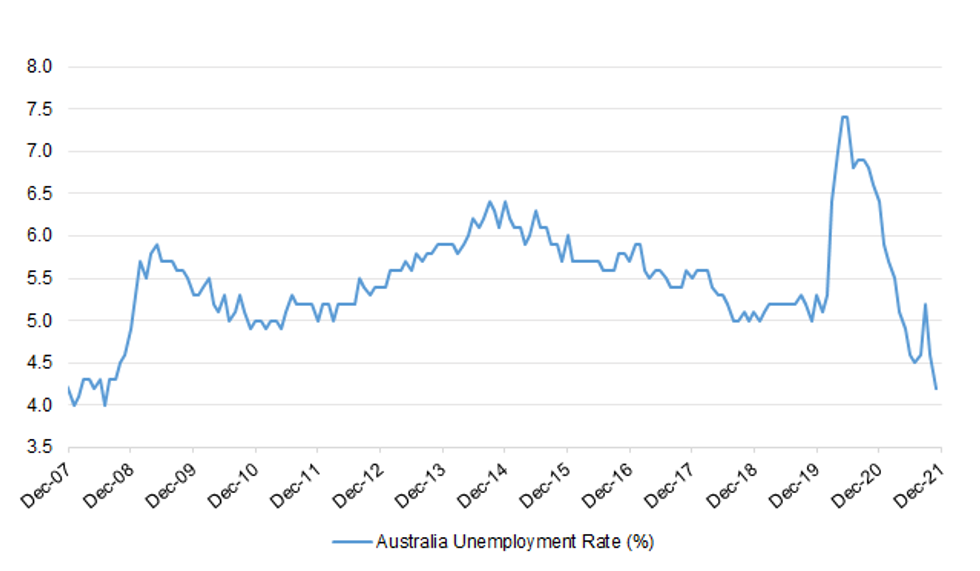

- AUSTRALIAN JOBS DATA BEAT EXPECTATIONS, UNEMPLOYMENT DROPS TO 13-YEAR LOW

- NORTH KOREA HINTS IT WILL RESTART ICBM, NUCLEAR TESTS

Fig. 1: Australia Unemployment Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Conservative MPs are starting to "step back" and think twice about a leadership challenge against Boris Johnson, a minister has said. Conor Burns - the government's minister for Northern Ireland - said colleagues were now choosing to wait for the report into the No 10 lockdown parties. It follows a dramatic day in Westminster with calls for the PM to quit and a Tory MP defecting to Labour. No 10 has insisted the prime minister will fight any leadership challenge. (BBC)

POLITICS: Boris Johnson is engaged in a desperate fightback to save his political life, after a ferocious attack from one of the Conservatives’ most senior former ministers and the defection of one of its newest MPs failed to fell him. But the dramatic interventions did not trigger the flood of letters from MPs needed to force a confidence vote in Mr Johnson. While up to 20 discontented Tories were understood to have submitted letters to the chair of the backbench 1922 Committee, Sir Graham Brady, none broke cover to declare their positions publicly. Senior Tories told The Independent that the developments may have helped shore up Mr Johnson’s position at least until the publication of Whitehall mandarin Sue Gray’s report into “partygate” – now expected next week – as wavering MPs think twice about appearing disloyal. There was speculation that even if Sir Graham receives the necessary 54 letters in the coming days, he may delay a vote until the report is published in order to ensure MPs have the information they need. But a member of the group of younger MPs who arrived in parliament in 2019 urged colleagues not to wait to submit their letters. One former cabinet member said Mr Davis’s assault on the PM was “courageous, principled and right”. And a backbench Tory made clear he had no faith in Johnson’s claim not to have realised that a drinks event in the No 10 garden was a party. But friends of the former Brexit secretary said that his strike against the PM was not co-ordinated with like-minded MPs, including some who had spoken to Mr Davis within the last few days and had no inkling of what he was planning. (Independent)

POLITICS: Sir Roger Gale, who has already submitted a letter of no confidence in Boris Johnson, says he thinks their number could reach 54 after this weekend. This is the quantity needed to make a leadership challenge possible. Asked if this would happen this week, he tells Sky News: "I think more likely, if it's going to happen now, probably after this weekend." (Sky)

POLITICS: The 1922 committee of Conservative backbench MPs is considering changing the rules on no confidence votes, Sky's political editor Beth Rigby has learned. Under the current rules, if a prime minister wins a vote of confidence then they cannot be challenged again for a year. But a proposal was floated for a "super trigger" that means a second ballot could be called within a year. The aim is to give the party "more flexibility" and make the leader "more accountable", Rigby says. However, to prevent there being too easy a trigger, the threshold for the number of no confidence letters needed could shift from 15% to a third. MPs could "move quickly" on this as they don't want to change the rules after a ballot. (Sky)

POLITICS: More Tory MPs are considering switching to Labour following the dramatic defection of Bury North MP Christian Wakeford, party sources have said. According to senior Labour figures, the party is in discussions with “several others” from the Conservative benches who follow the Red Wall MP in crossing the Chamber. MPs are unhappy with the direction of the Conservative Party under a beleaguered Boris Johnson, Labour sources said – but they would not specify the number of possible defectors. (i)

ECONOMY: More jobseekers in Britain are looking to work remotely, a survey showed, indicating that the shift away from office work may outlast the pandemic. Indeed, a job search website, said 10% of its advertisements now offer remote work as an option and about 2.4% of all searches by potential candidates, up 10-fold from 2019. Britain had one of the biggest increases in remote working during the pandemic and in the share of vacancies offering it as an option, Indeed said, citing its own research and work by the OECD. Those posts were disproportionately concentrated in higher-paying, non-client facing roles. (BBG)

UK/U.S.: The UK and US announced on Wednesday they would begin talks to try to reach a deal over Trump-era tariffs on UK steel and aluminium. UK trade secretary Anne-Marie Trevelyan, US trade representative Katherine Tai and US commerce secretary Gina Raimondo said in a joint statement that talks would “address global steel and aluminium excess capacity” and address US tariffs on British metals and London’s retaliatory tariffs on US goods. (FT)

EUROPE

EU: EU officials sought to reassure the US that Brussels remains committed to Washington-led negotiations with Russia over averting further conflict in Ukraine, after French president Emmanuel Macron broke ranks to call for a competing EU dialogue with Moscow. Macron on Wednesday used a speech to the European Parliament to call on EU states to “conduct their own dialogue” with Russia rather than engage with diplomatic efforts involving the US and Nato, in remarks that blindsided exasperated EU officials. “We were given zero notice of this crazy idea,” one told the FT. “I hope [the Americans] realise this will go nowhere.” (FT)

GERMANY: German prosecutors have opened an investigation into the two leaders of the co-governing Greens, Robert Habeck and Annalena Baerbock, over alleged special coronavirus payments, the party said on Wednesday. Spiegel Online reported the start of the investigation for a possible breach of trust to the detriment of the party over illegal payments of 1,500 euros to Greens board members in 2020. The allegations concern the approval of a "coronavirus bonus" given by board members to themselves in 2020, a spokesperson for Berlin prosecutors was quoted by Spiegel Online as saying. (RTRS)

ITALY: Democratic Party (PD) leader Enrico Letta said Wednesday that he was satisfied after talks with 5-Star Movement (M5S) chief Giuseppe Conte and Health Minister Roberto Speranza of the left-wing LeU group in view of the start of voting for Italy's new president next week. He added, however, that the meeting had not produced a joint candidate from the three groups for the successor to President Sergio Mattarella, whose seven-year term is coming to an end. "There is no agreement on the names because we'll talk about that with the centre right in the coming days," Letta said. (Ansa)

GREECE: Greece has begun imposing recurring fines on those over the age of 60 who are unvaccinated against COVID-19 to try to boost inoculation in the most vulnerable age group even as infection rates from the fast-spreading Omicron variant are slowing. (RTRS)

FINLAND/NATO: Finland does not plan to join NATO in the near future but is ready to stand with its European allies and United States by imposing tough sanctions on Russia if it attacks Ukraine, Finland's Prime Minister Sanna Marin said on Wednesday. "It would have a very substantial impact and the sanctions would be extremely tough," Marin told Reuters in an interview on Wednesday. Marin said it is "very unlikely" that Finland would apply for a NATO membership during her term of office. (RTRS)

U.S.

FED: Joe Biden backed the Federal Reserve’s shift towards tighter monetary policy to fight inflation as the US president opened his first formal press conference in several months with a vow to rein in higher prices afflicting the economic recovery.”Given the strength of our economy and the pace of recent price increases, it is appropriate, as Fed chairman [Jay] Powell has indicated, to recalibrate the support that is now necessary,” Biden said, adding that he supported the central bank’s independence. (FT)

POLITICS: Senate Democrats failed to change the legislative filibuster for a voting bill on Wednesday night, after Sens. Joe Manchin (D-W.Va.) and Kyrsten Sinema (D-Ariz.) voted with Republicans to oppose the rules reform, handing President Biden and the party a stinging defeat. Senators voted 52-48 to defeat the rules change, which would have nixed the 60-vote hurdle for the election bill. To have been successful, Democrats would need total unity from all 50 of their members, plus Vice President Harris to break a tie. The outcome of the vote was telegraphed, but it marks a defeat of Democrats’ months-long push to pass voting rights legislation, even if it meant changing the rules so they could do it alone. (Hill)

POLITICS: The U.S. Supreme Court on Wednesday rejected former President Donald Trump's request to block the release of White House records sought by the Democratic-led congressional panel investigating last year's deadly attack on the Capitol by a mob of his supporters. The decision means the documents, held by a federal agency that stores government and historical records, can be disclosed even as litigation over the matter continues in lower courts. Trump's request to the justices came after the U.S. Court of Appeals for the District of Columbia Circuit on Dec. 9 ruled that the businessman-turned-politician had no basis to challenge President Joe Biden's decision to allow the records to be handed over to the House of Representatives select committee. (RTRS)

POLITICS: The congressional committee probing the Jan. 6, 2021, attack on the U.S. Capitol issued subpoenas on Wednesday to two far-right leaders who had joined former President Donald Trump's unsuccessful attempt to overturn his election defeat. The House of Representatives committee said it believed Nicholas J. Fuentes and Patrick Casey have information about the planning, coordination and funding of events that preceded the attack. (RTRS)

CORONAVIRUS: The U.S. government will make 400 million non-surgical "N95" masks from its strategic national stockpile available for free to the public starting next week, a White House official said, as the Biden administration tries to curb the COVID-19 pandemic. (RTRS)

INFRASTRUCTURE: President Joe Biden said his $2 trillion economic agenda will have to be broken up so that a scaled back version can pass Congress in the face of resistance in his own party that’s stalled the expansive package. “It is clear to me that we are probably going to have to break it up,” Biden said Wednesday at a White House press conference. Democrats will have to “get as much as we can now and come back and fight for the rest later.” Still, the president disputed the idea that his agenda has to be scaled down in its ambition and said he will be making the case to pass it all through road trips around the country this year. “We just have to make the case what we are for,” he said. (BBG)

INFRASTRUCTURE: Several House Democrats promise to sink President Joe Biden’s economic agenda if a scaled-back version now being considered eliminates an expansion of the federal deduction for state and local taxes. Their demands, critical in a chamber where Democrats can afford only four defections, add to the long list of hurdles the party must clear as lawmakers rewrite Biden’s centerpiece legislation to push it through the evenly divided Senate. (BBG)

INFRASTRUCTURE: Disruption to U.S.-bound air travel caused by the rollout of 5G services in the United States eased on Wednesday as authorities approved more flights, but a top airline warned "irresponsible" regulatory confusion would be felt internationally for days. (RTRS)

OIL: President Joe Biden pledged to continue trying to lower oil prices that are running at a seven-year high despite his faltering effort to persuade producing countries to increase output. “We’re going to work on trying to increase oil supplies that are available,” Biden told reporters at the White House on Wednesday. “But it’s going to be hard.” The global benchmark Brent crude has jumped 25% since the end of November to about $88 a barrel. Some in the market now think it’s now a question of when -- not if -- oil hits triple digits, somewhere it hasn’t been since 2014. (BBG)

OTHER

GLOBAL TRADE: President Joe Biden on Wednesday said it was too soon to make commitments on lifting U.S. tariffs on Chinese goods, but his chief trade negotiator Katherine Tai was working on the issue. "I'd like to be able to be in a position where I could say they're meeting their commitments, or more of their commitments, and be able to lift some of them, but we're not there yet," Biden told a news conference at the White House. He was referring to China's commitments under a Phase 1 trade deal signed by his predecessor Donald Trump. China has fallen far short of its pledge under the two-year Phase 1 trade agreement to buy $200 billion in additional U.S. goods and services during 2020 and 2021, and it remains unclear how the shortfall will be addressed. (RTRS)

U.S./CHINA: A technology-focused antitrust bill set to be considered by a U.S. Senate committee Thursday will be expanded to include China’s two largest social media companies -- a change that seeks to address criticism that the legislation would give an advantage to foreign digital firms. The bill’s criteria for a covered platform will be expanded to include companies that have 1 billion worldwide monthly users or $550 billion in net annual sales, in addition to the existing $550 billion market capitalization-threshold. These new criteria would capture ByteDance Ltd.’s TikTok and Tencent Holdings Ltd.’s WeChat. (BBG)

U.S./CHINA: Chinese forces followed and warned away a U.S. warship which entered waters near the Paracel Islands in the South China Sea, the country's military said on Thursday, in the latest uptick in tensions in the disputed waterway. The Southern Theatre Command of the People's Liberation Army said the USS Benfold "illegally" sailed into Chinese territorial waters without permission, violating the country's sovereignty, and that Chinese naval and air forces tracked the ship. (RTRS)

GEOPOLITICS: U.S. President Joe Biden predicted on Wednesday that Russia will make a move on Ukraine, saying Russia would pay dearly for a full-scale invasion but suggesting there could be a lower cost for a "minor incursion." Biden's comments at a White House news conference injected uncertainty into how the West would respond should Russian President Vladimir Putin order an invasion of Ukraine, prompting the White House later to seek to clarify what Biden meant. "My guess is he will move in," Biden said of Putin at a news conference. "He has to do something." U.S. President Joe Biden predicted on Wednesday that Russia will make a move on Ukraine, saying Russia would pay dearly for a full-scale invasion but suggesting there could be a lower cost for a "minor incursion." (RTRS)

GEOPOLITICS: Moscow expects a written response from the US and NATO countries as soon as possible to Russian proposals on security guarantees, Head of the Russian delegation to the Vienna talks Konstantin Gavrilov said on Wednesday. Gavrilov drew attention to the participants of the OSCE Forum for Security Co-operation. "We expect a detailed written response to our proposals as quickly as possible. After its thorough study in Moscow, among other things, there will be an understanding of whether the Forum for Security Co-operation can be integrated into the work on security guarantees," the head of the Russian delegation noted. (TASS)

GEOPOLITICS: President Joe Biden said “it’s not time to give up” on reviving the accord restraining Iran’s nuclear program as talks between world powers drag on in Vienna. “There is some progress being made,” but “it remains to be seen” if Tehran will make a deal, Biden said in a news conference Wednesday marking his first year in office. Biden’s negotiators say they’ve largely agreed on the sanctions that would be lifted in exchange for Iran coming back into compliance with the Joint Comprehensive Plan of Action. But they’re unable to satisfy Iranian President Ebrahim Raisi’s demand for guarantees that a future U.S. administration won’t quit the deal as former President Donald Trump did in 2018. (BBG)

GEOPOLITICS: Canada fears armed conflict could break out in Ukraine and is working with allies to make clear to Russia that any more aggression towards Kiev is unacceptable, Prime Minister Justin Trudeau said on Wednesday. Canada, with a sizeable and politically influential population of Ukrainian descent, has taken a strong line with Russia since its annexation of Crimea from Ukraine in 2014. Canadian troops are in Latvia as part of a NATO mission and Trudeau said they would "continue the important work that NATO is doing to protect its eastern front". Canada has had a 200-strong training mission in western Ukraine since 2015. (RTRS)

NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern said on Thursday that restrictions will be tightened across the country if there is a community transmission of the Omicron variant of the coronavirus but she ruled out lockdowns. New Zealand's tight controls and geographic advantage has helped it remain free of the Omicron variant in the community, although many cases have now been reported at quarantine facilities at the border. A "red" traffic light setting would be imposed within 24 to 48 hours of Omicron arriving in the community, Ardern told a news conference, which would mean masks would be mandated and there would be limits on public gatherings. (RTRS)

NORTH KOREA: North Korea would bolster its defences against the United States and consider restarting "all temporally-suspended activities," state media KCNA reported Thursday, an apparent reference to a self-imposed moratorium on testing its nuclear bombs and long-range missiles. Tension has been rising over a recent series of North Korea missile tests. A U.S. push for fresh sanctions was followed by heated reaction from Pyongyang, raising the spectre of a return to the period of so-called "fire and fury" threats of 2017. North Korean leader Kim Jong Un convened a meeting of the powerful politburo of the ruling Workers' Party on Wednesday to discuss "important policy issues," including countermeasures over "hostile" U.S. policy, the official KCNA news agency said. (RTRS)

NORTH KOREA: South Korea's military has detected signs of North Korea preparing for a military parade ahead of the reclusive regime's key political events, a Seoul official said Thursday. (Yonhap)

HONG KONG: Hong Kong will suspend face-to-face teaching in secondary schools from Monday until after the approaching Lunar New Year, authorities said, because of a rising number of coronavirus infections in several schools in the Chinese-ruled territory. (RTRS)

THAILAND: Thailand will resume a quarantine-free visa program for vaccinated visitors after its suspension last month helped the tourism-reliant nation curb a new wave of Covid infections. International travelers can start applying for visas under Thailand’s Test & Go entry program from Feb. 1, Rachada Dhnadirek, a government spokeswoman, said on Twitter after a meeting of the nation’s main Covid task force on Thursday. The quarantine-free entry will be extended to applicants of all nationalities, and they will need to undergo two Covid tests, one upon arrival and another on the fifth day, Rachada said. (BBG)

BRAZIL: The Brazilian real gained after leftist ex-President Luiz Inacio Lula da Silva, the front-runner in this year’s presidential race, said he would like to have former Sao Paulo Governor Geraldo Alckmin as his running mate. “We have divergences, and different visions of the world, but I will not have any problem in making a ticket with Alckmin to win the elections and govern this country,” Lula, 76, told local websites on Wednesday, saying for the first time he will seek the support of centrist and even center-right parties before the October vote. “It reduces the likelihood that Lula’s program will be radical,” said Juan Prada, a currency strategist at Barclays Capital. “If he is looking for alliances with centrists, not-market-unfriendly people, that is positive.” (BBG)

RUSSIA: Russia’s powerful security services have convinced central bank Governor Elvira Nabiullina to back a complete ban of cryptocurrencies domestically to prevent them from funding the country’s opposition, according to two people familiar with the issue. The Federal Security Service, or FSB, lobbied for a blanket ban as the hard-to-trace payments are increasingly used by Russians to donate to undesirable organizations, including media resources that have been labeled “foreign agents,” said the people, who asked not to be identified because the information is not public. (BBG)

ISRAEL: Contacts on a plea deal between former prime minister Benjamin Netanyahu and the state prosecution have restarted, a day after they were said to have stalled, according to Hebrew media reports on Wednesday. A Channel 13 report said that the latest offer for a deal sent to Netanyahu’s attorneys in the restarted discussions includes a “moral turpitude” clause, which would bar the former premier from political life for seven years. The deal drawn up by Attorney General Avichai Mandelblit and prosecutors would also require the opposition leader to perform seven to nine months of community service. (Times of Israel)

MIDDLE EAST: Yemen’s Houthis used cruise and ballistic missiles and drones to attack Abu Dhabi this week, the United Arab Emirates ambassador to the U.S. said, in the first official details to emerge on how the strikes were conducted. “Several were intercepted,” Yousef Al Otaiba told an online event organized by the Jewish Institute for National Security of America on Wednesday. But a few weren’t “and three innocent civilians unfortunately lost their lives.” (BBG)

OIL: The oil market is getting tighter and there may be even less slack in the system than forecasts suggest. The latest outlooks from the International Energy Agency and the U.S. Energy Information Administration show the world needing more oil this year from the members of the Organization of Petroleum Exporting Countries than they did a month ago. The bigger worry is the growing mismatch between the level of oil stockpiles they can measure and the volumes their models predict. Stockpiles are one of the oil market's safety valves, alongside spare production capacity, for dealing with unexpected outages or soaring demand. With spare capacity among OPEC+ producers heading toward multi-year lows, any suggestion that oil stockpiles are lower than previously thought could put an even bigger fire under oil prices that have already climbed to a seven-year high. (BBG)

CHINA

PBOC: The People’s Bank of China is likely to further cut banks’ reserve requirement ratios in Q1 after the authorities hinted that there is room for RRR cut, China Securities Journal reported citing analysts. At least one RRR cut is required as banks’ reserve accounts will need to increase by CNY1.5 trillion in 2022 along with growing deposits, and conducting MLFs alone will not be enough, the newspaper said citing analyst Xie Yunliang with Cinda Securities. Following recent rate cuts, RRR cuts can help fill the liquidity gap amid the Spring Festival starting at the end of January, tax season and local government special bond issuance, the newspaper said citing Huang Wentao, chief economist of CSC Financial. (MNI)

ECONOMY: Chinese authorities should guide Internet platforms toward orderly open ecosystems and closer cooperation, and make the industry more innovative and empowering beyond online purchases and bicycle sharing, the Economic Daily said in an editorial referring to new rules on the country’s largest E-merchants, such as Alibaba and Tencent. Rather than limiting and attacking platform-based economy, the government has focused on strengthening anti-monopoly rules, closer supervision of finance, data and algorithms, the editorial said. Platforms should increase investments in innovation and help modernize manufacturing and agriculture while boosting internal demand, it said. (MNI)

CORONAVIRUS: China is ramping up its coronavirus testing regime after linking at least two omicron cases at opposite ends of the country to international parcels. Residents in the Southern city of Guangzhou who received overseas mail between Jan. 16 and 19 were told Wednesday to take a coronavirus test within three days. Additionally, local authorities are rolling out a free program from Thursday that will see anyone who has accepted an international package tested within three to seven days. (BBG)

OLYMPICS: Comcast's Corp's NBCUniversal, under pressure from human rights groups, on Wednesday said that its broadcast coverage of the 2022 Beijing Olympics will include the "geopolitical context" of China as the host nation. The coverage plans, detailed in a video presentation to reporters, followed the urgings of human rights groups and a U.S. congressional committee to cover China's rights violations during the Olympics, which begin on Feb. 4. (RTRS)

INFRASTRUCTURE: China will extend its high-speed rail network nearly 32 per cent by 2025, roughly equal to the combined length of the next five largest countries by network size, amid an emerging consensus that Beijing is again leaning on infrastructure investment to curb an economic slowdown. The country also plans to widen use of its Beidou satellite navigation system at home and abroad, while tightening control of transport data, as technological self-reliance and national security have become government work priorities. China, which has the world’s largest high-speed railway network, will expand its length to 50,000km by 2025, 12,000km longer than the end of 2020, according to the new five-year transport plan issued on Tuesday by the State Council, the country’s cabinet. (SCMP)

PROPERTY: Listed real estate companies in China have increased financing activities significantly with lower costs and large amount, mainly to add liquidity, restructure or repay debts and invest in new projects, China Securities Journal reported. Most financing interest rates are kept within 5%, the newspaper said. The real estate market has gradually stabilized at the bottom as developers’ financing condition improved amid eased regulations, and developers increased bids for land in recent auctions, the newspaper said citing Zhang Dawei, chief analyst of Centaline Property. (MNI)

PROPERTY: The government of Guangdong province, where Evergrande is based in, will steadily push ahead with mitigation of debt risks of property developers including Evergrande Group in a market-oriented and law-based way, according to the annual work report by acting provincial Governor Wang Weizhong. (BBG)

OVERNIGHT DATA

CHINA DEC SWIFT GLOBAL PAYMENTS CNY 2.70%; NOV 2.14%

JAPAN DEC TRADE BALANCE -Y582.4BN; MEDIAN -Y787.6BN; NOV -Y955.6BN

JAPAN DEC TRADE BALANCE ADJ -Y435.3BN; MEDIAN -Y744.1BN; NOV -Y473.9BN

JAPAN DEC EXPORTS +17.5% Y/Y; MEDIAN +15.9%; NOV +20.5%

JAPAN DEC IMPORTS +41.1% Y/Y; MEDIAN +43.0%; NOV +43.8%

AUSTRALIA DEC UNEMPLOYMENT RATE 4.2% Y/Y; MEDIAN 4.5%; NOV 4.6%

AUSTRALIA DEC EMPLOYMENT CHANGE +64.8K; MEDIAN +60.0K; NOV +366.1K

AUSTRALIA DEC FULL-TIME EMPLOYMENT CHANGE +41.5K; +128.3K

AUSTRALIA DEC PART-TIME EMPLOYMENT CHANGE +23.3K; NOV +237.8K

AUSTRALIA DEC PARTICIPATION RATE 66.1%; MEDIAN 66.2%; NOV 66.1%

AUSTRALIA JAN CONSUMER INFLATION EXPECTATIONS +4.4% Y/Y; NOV +4.8%

AUSTRALIA DEC RBA FX TRANSACTIONS GOV’T -A$1.983BN; NOV -A$896MN

AUSTRALIA DEC RBA FX TRANSACTIONS MARKET -A$1.940BN; NOV +A$866MN

AUSTRALIA DEC RBA FX TRANSACTIONS OTHER +A$768MN; NOV +A$1.174BN

NEW ZEALAND DEC FOOD PRICES +0.6% M/M; NOV -0.6%

NEW ZEALAND DEC ANZ TRUCKOMETER HEAVY -0.6% M/M; NOV +4.9%

December brought more volatility in traffic flows. The lifting of the Auckland boundary saw car traffic bounce. The Light Traffic Index jumped 15.7% on top of a 10.9% increase in November, while the Heavy Traffic Index eased 0.6% but that was on the back of a strong lift in November. Heavy traffic is not far off pre-Delta levels but light traffic still has a way to go. (ANZ)

NEW ZEALAND DEC NON-RESIDENT BOND HOLDINGS 57.9%; NOV 57.1%

SOUTH KOREA DEC PPI +9.0% Y/Y; NOV +9.8%

UK DEC RICS HOUSE PRICE BALANCE 69%; MEDIAN 69%; NOV 71%

CHINA MARKETS

PBOC INJECTS NET CNY90BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY100 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. The operation has led to a net injection of CNY90 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:30 am local time from the close of 2.1135% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 51 on Wednesday vs 49 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3485 THURS VS 6.3624

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3485 on Thursday, compared with 6.3624 set on Wednesday.

MARKETS

Sentiment Recovers Despite Simmering Geopolitical Tensions

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 339.37 points at 27806.6

- ASX 200 up 9.902 points at 7342.4

- Shanghai Comp. up 8.536 points at 3566.716

- JGB 10-Yr future down 8 ticks at 150.84, yield down 0bp at 0.144%

- Aussie 10-Yr future up 0.5 ticks at 97.98, yield down 0.4bp at 1.992%

- U.S. 10-Yr future -0-08 at 127-13+, yield down 0.71bp at 1.8575%

- WTI crude up $0.31 at $87.27, Gold down $1.09 at $1839.4

- USD/JPY up 14 pips at Y114.47

- BIDEN SEES RUSSIA MOVING ON UKRAINE, SOWS DOUBT ON WESTERN RESPONSE (RTRS)

- TORY MPS STEPPING BACK FROM CHALLENGE AGAINST BORIS JOHNSON (BBC)

- PBOC CUT LOAN PRIME RATES, SET USD/CNY MID-POINT AT LOWEST POINT SINCE 2018

- AUSTRALIAN JOBS DATA BEAT EXPECTATIONS, UNEMPLOYMENT DROPS TO 13-YEAR LOW

- NORTH KOREA HINTS IT WILL RESTART ICBM, NUCLEAR TESTS

BOND SUMMARY: Broader Risk Recovery Outweighs Geopol Worry, Short-End ACGBs Go Offered On RBA Repricing

Core bond markets briefly showed some strength, which may have been linked to further complications on the geopolitical front. With tensions surrounding Russia's military activity near the Ukrainian border simmering in the background, North Korea hinted that it might resume testing intercontinental ballistic missiles (ICBM) and nuclear weapons. Core FI space gradually lost shine later into the session, as Asia Pac equity markets and U.S. e-mini futures crept higher.

- T-Notes rose to a session high of 127-20 before trimming gains and stabilising. TYH2 last trades -0-06+ at 127-15. Eurodollar futures trade 0.5-5.0 ticks lower through the reds. Bull flattening remains evident in U.S. Tsy curve, while yields have trimmed losses and last sit just 0.2-1.2bp lower. Weekly jobless claims, existing home sales & Philadelphia Fed Business Outlook take focus on the data front, with a 10-year Tsy auction also up today.

- Selling pressure hit short-end ACGBs after the release of strong Australian jobs data, which fanned expectations of an earlier withdrawal of stimulus by the RBA. The unemployment rate fell to a 13-year low of 4.2% in December from 4.6% prior, undershooting the median estimate of 4.5%. While the ABS highlighted that the survey was taken before a sharp spike in Covid-19 cases, the report fell on a fertile ground, as Westpac had earlier front-loaded their RBA rate-hike call. Although a subsequent spell of demand for core FI brought some reprieve to ACGBs, they resumed losses amid further hawkish RBA repricing. YM trades -3.0 as we type, with XM unch. at typing. Bills run +1 to -4 ticks through the reds. The weakness in short-end ACGBs drives flattening in cash curve, with yields last seen unch. to +3.2bp & 3-Year ACGBs taking the biggest hit. A note from Goldman Sachs may have added fuel to short-end ACGB sales, as they now expect the RBA to scrap new QE purchases this coming Feb (previously this May) and start raising the cash rate in May 2023 (previously Nov 2023).

- JGB futures posted a leg lower upon the re-opening of Tokyo markets. They staged a recovery attempt on the back of the aforementioned bid in core FI, but lost ground into the lunch break and after. JBH2 last trades at 150.88, 4 ticks below previous settlement. Cash JGB curve runs slightly steeper, as the super long end underperforms.

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.355tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y30bn worth of floating-rate JGBs

FOREX: AUD Surges On Strong Jobs Data, Leaves Antipodean Cousin Behind

A combination of strong labour market data released out of Australia and a hawkish change to the rate-hike call of an influential RBA watcher bolstered the Australian dollar, which still comfortably outperforms all G10 peers. Buying was triggered by the December jobs report, which showed that the unemployment rate undershot the expected level (4.5%) and fell to a 13-year low of 4.2%. Employment growth was slightly faster than forecast, while the participation rate stayed at 66.1%. The data came with a caveat, as the ABS noted that the survey was taken "was prior to the high number of COVID cases associated with the Omicron variant," but was enough to fuel hawkish RBA bets.

- Before the release of Australian jobs report, Westpac's Bill Evans said that he now expects Australia's central bank to deliver the first cash rate hike this coming August, which will be followed by another hike in October. Evans had earlier forecast the cash rate not being raised until February 2023.

- Trans-Tasman flows pushed AUD/NZD to within touching distance from the NZ$1.0700 mark. BBG trader sources suggested that buy-stops were triggered above resistance from Jan 5 high of NZ$1.0651. The swing in AUD/NZD sapped strength from the broader kiwi dolar and the flightless bird landed at the bottom of the G10 pile.

- Spot USD/CNH ground lower with all eyes on the PBOC. China's central bank cut their 1-Year & 5-Year Loan Prime Rates, which came after reductions to 1-Year MLF & 7-Day Reverse Repo rates delivered earlier this week. Meanwhile, the USD/CNY reference level was set at the lowest point since May 2018, which some interpreted as a sign of the PBOC's sense of comfort with redback appreciation.

- The DXY moved in tandem with U.S. Tsy yields, as both retreated in early trade only to gradually recoup the bulk of their losses. The initial weakness in U.S. Tsy yields dragged USD/JPY lower, but the yen went offered later in the session amid firming risk appetite. Worth noting that it is a Gotobi day in Japan, which may have contributed to eventual JPY weakness.

- U.S. weekly jobless claims, final EZ CPI, ECB Dec MonPol meeting minutes & Norges Bank MonPol decision take focus from here.

FOREX OPTIONS: Expiries for Jan20 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250-65(E997mln), $1.1280-90(E1.1bln), $1.1300-15(E3.8bln), $1.1345-58(E2.2bln), $1.1400-10(E635mln), $1.1450(E1.1bln)

- USD/JPY: Y114.00-20($1.4bln), Y114.65-75($674mln)

- GBP/USD: $1.3750-70Gbp632mln)

- AUD/USD: $0.7260-70(A$526mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/01/2022 | 0700/0800 | ** |  | DE | PPI |

| 20/01/2022 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/01/2022 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 20/01/2022 | 1000/1100 | *** |  | EU | HICP (f) |

| 20/01/2022 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 20/01/2022 | 1230/1330 |  | EU | ECB publishes Dec meet accounts | |

| 20/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 20/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/01/2022 | 1500/1000 | *** |  | US | NAR existing home sales |

| 20/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 20/01/2022 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 20/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 21/01/2022 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.