-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Equities Recover Heavy Losses Late

ESECUTIVE SUMMARY

- MNI: Fed Could Hike Rate More Than Four Times in 2022- Ex-Staff

- US Troops on Deployment Standby Alert

- NATO LAUNCHING MILITARY EXERCISE CALLED NEPTUNE STRIKE22

US

FED: The Federal Reserve’s December estimate for three interest rate increases this year already looks outdated, and even market expectations for four hikes this year may be too conservative, former Fed economists tell MNI.

- “Anyone who says the Fed is done pivoting is totally wrong -- they’ve barely started,” said Andrew Levin, a former economist at the Federal Reserve Board of Governors for two decades and now at Dartmouth College, in an interview.

- Fed Chair Jerome Powell should use this week’s press conference to warn markets that the Fed “may need to move at every meeting this year. That means the federal funds rate could be closer to 2% by the end of the year,” he said. For more see MNI Policy main wire at 1506ET.

US: Tsy futures actually scaled-back gains somewhat, yld curves steepening as long end underperforms: Pentagon issues US troop standby alert on Russia/Ukraine tensions.

- Pentagon Places Hundreds of Troops on Standby for Deployment to Eastern Europe, Sources Say --WSJ

- 'Prepare to Deploy' Orders Issued to Troops at Several Bases in U.S., Sources Say --WSJ

- Order Will Signal to Moscow That U.S. Prepared to Bolster NATO Defenses in Case of Russian Invasion of Ukraine, Sources Say --WSJ

- Troops Will Be on Standby to Support Evacuation of U.S. Citizens From Ukraine, if U.S. Decides, Sources Say --WSJ

US TSYS

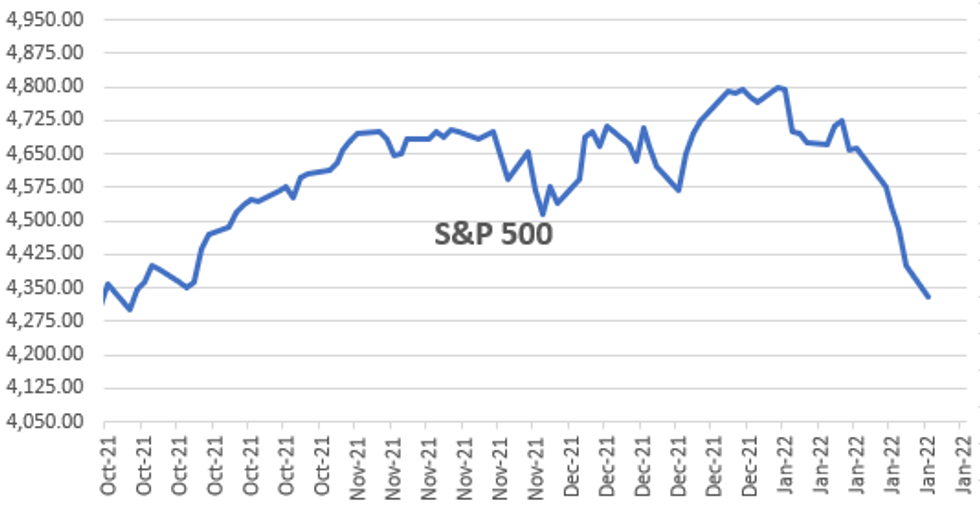

Strong, carry-over risk-off tone kicked off new week Mon, normally all about Wed's FOMC policy annc was overshadowed by growing Russia/Ukraine tension and what NATO, US and allies would do if Russia invades it's southern border. Risk off completely evaporated an hour after the FI close with Tsy curves bear steepening, equities trading higher (ESH2 +10.0 at 4400.0).

- NATO forces on standby "and sending additional ships and fighter jets to NATO deployments in eastern Europe”. Pentagon issued US troop standby alert ahead possible Russia/Ukraine action. Pentagon official, spokesman John Kirby added U.S. IS TAKING STEPS TO HEIGHTEN READINESS OF FORCES, 8,500 U.S. PERSONNEL READY TO BE ACTIVATED TO AID NATO.

- Risk-off actually scaled back late, bonds weaker but off lows, while equities rebounded but still traded in the lower after the FI close (ESH2 -4353.0 vs. 4212.75 low (mid-July '21 lows).

- Limited react to data: CHICAGO FED NATIONAL ACTIVITY INDEX AT -0.15 VS 0.44 PRIOR; US FLASH JAN SERVICES PMI 50.9; DEC 57.6.

- Decent 2Y sale, Tsy futures remain bid after $54B 2Y note auction (91282CDV0) stops through: 0.990% high yield vs. 1.002% WI; 2.81x bid-to-cover outpaces last moth's 2.55x, well over five auction avg: 2.51x.

- Short expiriy options continued to favor hedging for quarterly 25bp rate hikes starting in March, additional 2-3 hikes in 2023, policy path uncertainty around late 2024.

- Tues' data roundup: FHFA House Price Index, Consumer Confidence, Richmond Fed Mfg, $55B 5Y note sale (91282CDT5).

- The 2-Yr yield is down 4.5bps at 0.9566%, 5-Yr is down 3.5bps at 1.5223%, 10-Yr is down 1.6bps at 1.7422%, and 30-Yr is up 1.9bps at 2.0899%.

OVERNIGHT DATA

- CHICAGO FED NATIONAL ACTIVITY INDEX AT -0.15 VS 0.44 PRIOR

- US FLASH JAN SERVICES PMI 50.9; DEC 57.6

- US FLASH JAN SERVICES PMI 50.9; DEC 57.6

- US FLASH JAN MFG PMI 55.0; DEC 57.7

MARKETS SNAPSHOT

Key levels on equity cash close:

- DJIA up 99.13 points (0.29%) at 33774.33

- S&P E-Mini Future up 4.25 points (0.1%) at 4317.5

- Nasdaq up 86.2 points (0.6%) at 13575.24

- US 10-Yr yield is up 0.9 bps at 1.7671%

- US Mar 10Y are down 2/32 at 128-8

- EURUSD down 0.002 (-0.18%) at 1.1319

- USDJPY up 0.28 (0.25%) at 113.82

- WTI Crude Oil (front-month) down $1.34 (-1.57%) at $83.35

- Gold is up $7.58 (0.41%) at $1839.09

Fore comparison, Key late session market levels:

- DJIA down 483.14 points (-1.41%) at 33774.33

- S&P E-Mini Future down 71 points (-1.62%) at 4317.5

- Nasdaq down 192.2 points (-1.4%) at 13575.24

- US 10-Yr yield is down 1.6 bps at 1.7422%

- US Mar 10Y are up 4/32 at 128-14

- EURUSD down 0.0025 (-0.22%) at 1.1319

- USDJPY up 0.15 (0.13%) at 113.82

- WTI Crude Oil (front-month) down $1.77 (-2.08%) at $83.35

- Gold is up $3.82 (0.21%) at $1839.09

European bourses closing levels:

- EuroStoxx 50 down 175.2 points (-4.14%) at 4054.36

- FTSE 100 down 196.98 points (-2.63%) at 7297.15

- German DAX down 592.75 points (-3.8%) at 15011.13

- French CAC 40 down 280.8 points (-3.97%) at 6787.79

US TSY FUTURES CLOSE

- 3M10Y -1.333, 156.977 (L: 153.129 / H: 160.037)

- 2Y10Y +3.508, 78.555 (L: 70.328 / H: 78.91)

- 2Y30Y +6.926, 113.264 (L: 102.061 / H: 113.893)

- 5Y30Y +5.774, 56.832 (L: 49.142 / H: 57.269)

- Current futures levels:

- Mar 2Y up 2.625/32 at 108-22 (L: 108-16.5 / H: 108-23.37)

- Mar 5Y up 4.25/32 at 119-22.25 (L: 119-09.75 / H: 119-26.75)

- Mar 10Y up 3.5/32 at 128-13.5 (L: 127-31.5 / H: 128-22.5)

- Mar 30Y down 6/32 at 155-24 (L: 155-12 / H: 156-19)

- Mar Ultra 30Y down 31/32 at 189-9 (L: 189-03 / H: 191-09)

US 10YR FUTURE TECHS: (H2) Gains Considered Corrective

- RES 4: 129-19 50-day EMA

- RES 3: 129.14 High Jan 5

- RES 2: 128-25+/27 20-day EMA / High Jan 13

- RES 1: 128-21+ High Jan 24

- PRICE: 128-17+ @ 16:06 GMT Jan 24

- SUP 1: 127-28/02 Low Jan 21 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

The downtrend in Treasuries remains intact. For now though, the contract has entered a corrective cycle. Key short-term resistance has been defined at 128-27, the Jan 13 high and is just above the 20-day EMA at 128-25+. A break of these two resistance points is required to suggest potential for a stronger recovery that would open 129-00 and above. A resumption of weakness would refocus attention on the bear trigger at 127-02, Jan 19 low.

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady at 99.565

- Jun 22 +0.025 at 99.260

- Sep 22 +0.040 at 99.015

- Dec 22 +0.055 at 98.765

- Red Pack (Mar 23-Dec 23) +0.070 to +0.085

- Green Pack (Mar 24-Dec 24) +0.045 to +0.070

- Blue Pack (Mar 25-Dec 25) +0.020 to +0.035

- Gold Pack (Mar 26-Dec 26) +0.005 to +0.015

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00200 at 0.07671% (+0.00071 total last wk)

- 1 Month +0.00072 to 0.10843% (+0.00442 total last wk)

- 3 Month +0.00943 to 0.26714% (+0.01642 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00414 to 0.44857% (+0.04943 total last wk)

- 1 Year -0.00500 to 0.79357% (+0.07286 total last wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $76B

- Daily Overnight Bank Funding Rate: 0.07% volume: $276B

- Secured Overnight Financing Rate (SOFR): 0.05%, $875B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $328B

- (rate, volume levels reflect prior session)

- No buy-op Monday, next scheduled purchases:

- Tue 01/25 1010-1030ET: TIPS 1Y-7.5Y, appr $2.025B vs. $1.525B prior

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

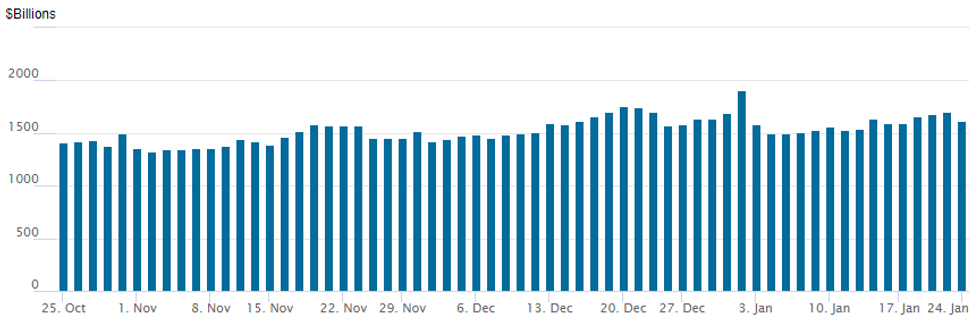

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,614.002B w/81 counterparties today vs. last Friday's third consecutive high of 2022 of $1,706.127B -- still well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Corporate Credit Update

Fairly slow start to week, domestic issuers near the sidelines ahead Wed's FOMC and as latest earning cycle resumes. Foreign acct US$ issuance filling the void: China Cinda commercial bank, Hanwha Life Korean insurance and supra-sovereign Pakistan on the docket Monday. CDP Fncl rolled to Tuesday.- Date $MM Issuer (Priced *, Launch #)

- 01/24 $Benchmark China Cinda 5Y +175a

- 01/24 $Benchmark Hanwha Life 10NC5 +200a

- 01/24 $Benchmark Pakistan Sukuk 7Y 8.25%a

- Rolled to Tuesday

- 01/25 $Benchmark CDP Financial 5Y SOFR+40a

FOREX: Extension Of Weakness In Equities Weighs On AUD, Boosts USD

- Global equity indices continued their plunge on Monday as tensions surrounding Ukraine exacerbated the dampening risk sentiment. While volatility in global markets has remained high, intra-day ranges for G10 FX remains fairly contained in comparison.

- With that said, the greenback is higher with the dollar index rising 0.3% as investors sought a flight to quality and risk tied currencies did come under pressure.

- The Australian dollar is the standout, weakening 0.71% and briefly dipping back below the 0.71 handle for the first time in a month. The recent sell-off represents a concern for bulls and today’s move lower prompted a breach of 0.7130, Jan 7 low. The 0.7082 Low on Dec 20 is a key short-term support before the significant support residing just below the 0.70 mark.

- GBP, NZD, CAD and CHF all similarly came under pressure, falling by between 0.3-0.5% on Monday.

- Greater pressure was seen in emerging markets with the Russian Ruble extending its decline. USDRUB will likely end the day up 1.75% having risen above the 2021 highs around the 78.00 level. With risk on the backfoot, the South African rand also slumped to a 1.4% loss with the broad basket of emerging market currencies losing 0.66% to start the week.

- Australian CPI data will be published overnight before German IFO during the European session. All focus will be firmly on Wednesday’s central bank decisions from both the Fed and the BoC.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/01/2022 | 0030/1130 | *** |  | AU | CPI inflation |

| 25/01/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 25/01/2022 | 0800/0900 | ** |  | ES | PPI |

| 25/01/2022 | 0900/1000 | *** |  | DE | IFO Business Climate Index |

| 25/01/2022 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 25/01/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/01/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/01/2022 | 1400/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/01/2022 | 1400/0900 | ** |  | US | FHFA Home Price Index |

| 25/01/2022 | 1400/1500 | ** |  | BE | BNB Business Sentiment |

| 25/01/2022 | 1500/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/01/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 25/01/2022 | 1630/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 25/01/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 25/01/2022 | 1800/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.