-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Short End Hit, Pricing in Steeper Liftoff

EXECUTIVE SUMMARY

- MNI: FED KEEPS KEY INTEREST RATE AT 0%-0.25%

- FOMC EXPECTS RATE HIKE 'WILL SOON BE APPROPRIATE'

- MNI BRIEF: Powell–Inflation Slightly Worse Than December

- MNI FED: Surprise "Principles" On Runoff, Details Thin

- MNI: BOC Holds 0.25% Rate, Drops Guidance to Say Hike Coming

- U.S. URGES AMERICANS IN UKRAINE TO CONSIDER DEPARTING NOW, Bbg

- Russia threatens retaliation if Ukraine demands not met- AP

- Supreme Court Justice Stephen Breyer to retire

US

FED: Federal Reserve Chair Jerome Powell told reporters Wednesday he thinks inflation has risen somewhat since the Fed's last forecasts in December.

- "Since the December meeting I would say that the inflation situation is about the same but slightly worse," he said. "I'd be inclined to raise my own estimate of core inflation by a few tenths."

- Affirms that the Fed funds rate is the primary means of adjusting monetary policy

- Confirms timing/pace of runoff will be determined; FOMC expects that balance sheet reduction will commence after raising rates

- FOMC intends to reduce holdings over "time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account"

- Intends to "maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime."

- Intends to "intends to hold primarily Treasury securities in the SOMA"

- And "The Committee is prepared to adjust any of the details of its approach to reducing the size of the balance sheet in light of economic and financial developments."

Eurodlr/Tsy Futures/Options Roundup: Short End Hammered Post FOMC

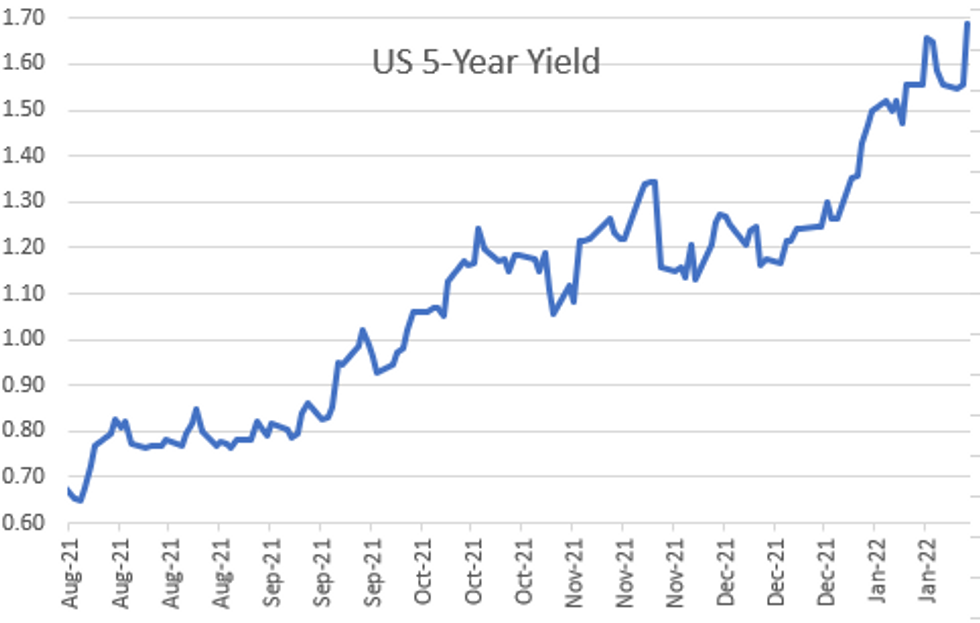

Markets reacted bearishly to the FOMC holding rates steady:- Short end yields surged on heavy volumes (2YY 1.1424%; 5YY 1.6713%) while equities gave up strong gains to trade weaker as Chairman Powell conceded liftoff will "soon be appropriate" as economic activity continues to expand at a robust pace and ""inflation remains well above our longer run goal of 2%."

- Stocks initially held gains until balance sheet run-off was discussed, lacking details over "sooner, faster" asset reductions appeared to trigger a sell-off.

- Short to intermediate rates sold off sharply as prospect for more than just 25bp rate hikes past March gained traction: lead quarterly Mar'22 Eurodollar futures slipped to 99.515 (-0.040) while June fell to 99.14 low (-0.090). Red pack (EDH3-EDZ3) traded -0.140-0.160 by the close -- Red March 2023 pricing in 125-150bp in hikes.

- Option trade saw some profit taking: over 20,000 TYH 127 puts sold from 30-26 (total session volume over 110k) after heavy buying over the last week; paper sold 10,000 Apr/Jun 98.93/99.06 put spd strip, 3.25, unwinding tactical play after paying 1.75 total to buy the double spd last wk.

- Otherwise, active accts continued to add to downside/rate hike positioning: for example paper +10,000 May 98.87/99.06/99.18 put flys, 2.75 adds to +50k Tue from 2.25-2.75.

OVERNIGHT DATA

U.S. ADVANCE RETAIL INVENTORIES ROSE 4.4 % IN DEC.

U.S. ADVANCE WHOLESALE INVENTORIES ROSE 2.1 % IN DEC.

US DEC NEW HOME SALES +11.9% TO 0.811M SAAR

US NOV NEW HOME SALES REVISED TO 0.725M SAAR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 129.64 points (-0.38%) at 34598.39

- S&P E-Mini Future down 18.5 points (-0.43%) at 4416.5

- Nasdaq up 2.8 points (0%) at 13881.2

- US 10-Yr yield is up 10.2 bps at 1.8709%

- US Mar 10Y are down 27.5/32 at 127-8.5

- EURUSD down 0.0064 (-0.57%) at 1.1287

- USDJPY up 0.75 (0.66%) at 114.35

- WTI Crude Oil (front-month) up $1.35 (1.58%) at $87.40

- Gold is down $30.64 (-1.66%) at $1831.32

- EuroStoxx 50 up 86.34 points (2.12%) at 4164.6

- FTSE 100 up 98.32 points (1.33%) at 7469.78

- German DAX up 335.52 points (2.22%) at 15459.39

- French CAC 40 up 144 points (2.11%) at 6981.96

US TSY FUTURES CLOSE

- 3M10Y +9.259, 166.118 (L: 155.854 / H: 166.657)

- 2Y10Y -3.677, 71.078 (L: 69.759 / H: 77.438)

- 2Y30Y -7.042, 102 (L: 101.012 / H: 110.977)

- 5Y30Y -6.709, 48.898 (L: 48.202 / H: 55.897)

- Current futures levels:

- Mar 2Y down 8.75/32 at 108-10.875 (L: 108-10.375 / H: 108-20.625)

- Mar 5Y down 19.75/32 at 118-28 (L: 118-27.5 / H: 119-19)

- Mar 10Y down 27.5/32 at 127-8.5 (L: 127-07.5 / H: 128-08.5)

- Mar 30Y down 40/32 at 154-0 (L: 153-29 / H: 155-18)

- Mar Ultra 30Y down 58/32 at 186-9 (L: 186-01 / H: 188-26)

US TREASURY TECHNICALS: (H2) Nearing Support

- RES 4: 129-31 Low Dec 8

- RES 3: 129-16 50-day EMA

- RES 2: 129.14 High Jan 5

- RES 1: 128-22+/27 20-day EMA / High Jan 13

- PRICE: 127-16 @ 20:28 GMT Jan 26

- SUP 1: 127-13+/02 Low Jan 26 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

Treasuries dipped on Wednesday in response to the Fed rate decision, showing through both the Tuesday and Monday lows. This keeps the broader downtrend intact as the current corrective cycle plays out. This follows the recovery from 127-02, Jan 19 low. Key S/T resistance is at 128-27, Jan 13 high and just above the 20-day EMA at 128-22+. A break of this zone would suggest potential for a stronger recovery and open 129-00 and above. A resumption of weakness would refocus attention on 127-02, Jan 19 low.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.045 at 99.510

- Jun 22 -0.085 at 99.145

- Sep 22 -0.140 at 98.845

- Dec 22 -0.165 at 98.570

- Red Pack (Mar 23-Dec 23) -0.185 to -0.16

- Green Pack (Mar 24-Dec 24) -0.14 to -0.105

- Blue Pack (Mar 25-Dec 25) -0.10 to -0.085

- Gold Pack (Mar 26-Dec 26) -0.085 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00072 at 0.07814% (+0.00343/wk)

- 1 Month +0.00128 to 0.10914% (+0.00143/wk)

- 3 Month +0.01000 to 0.27757% (+0.01986/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01371 to 0.46400% (+0.01957/wk)

- 1 Year +0.01885 to 0.80871% (+0.01014/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $78B

- Daily Overnight Bank Funding Rate: 0.07% volume: $278B

- Secured Overnight Financing Rate (SOFR): 0.05%, $943B

- Broad General Collateral Rate (BGCR): 0.05%, $349B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $336B

- (rate, volume levels reflect prior session)

- Pause for FOMC policy annc on Jan 26

- Thu 01/27 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Mon 01/31 1010-1030ET: Tsy 2.25Y-4.5Y, appr $8.425B vs. $6.325B prior

- Tue 02/01 1100-1120ET: TIPS 7.5Y-30Y, appr $1.225B vs. $0.925B prior

- Thu 02/03 1100-1120ET: Tsy 10Y-22.5Y, appr $1.625B steady

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B steady

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

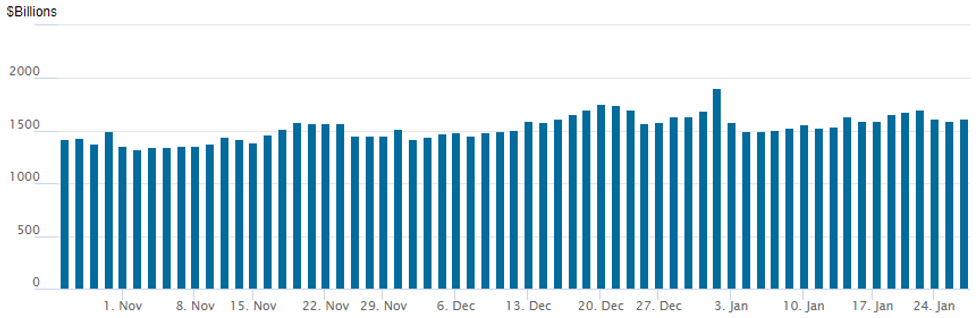

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $1,613.046B w/79 counterparties vs. $1,599.502B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Corporate Debt Issuers Sideline Ahead FOMC

- Date $MM Issuer (Priced *, Launch #)

- 01/26 No new corporate debt issuance Wednesday ahead FOMC, $Benchmark Kia Corp 3Y, 5Y investor calls scheduled for Thursday

- $1.5B Priced Tuesday, $4.25B/wk

- 01/25 $1.5B *CDP Financial 5Y SOFR+39

EGBs-GILTS CASH CLOSE: BTPs Weaker As Political Uncertainty Persists

BTP weakness was the standout in Wednesday's European trade, with the Italian curve bear steepening and spreads widening.

- The German and UK curves likewise bear steepened, with safe havens on retreat ahead of the Federal Reserve decision and as equities bounced.

- The 10Y BTP/Bund spread closed above 140bp for the first time since Sept 2020 as the Italian presidential voting impasse continued (MNI published a sourced exclusive on the election, including on Draghi's future)

- Finland's 20Y syndication saw lukewarm demand (books >E16bln on E3bln size).

- Attention after hours firmly on the Fed.

Closing levels:

- Germany: The 2-Yr yield is up 0.4bps at -0.645%, 5-Yr is up 0.6bps at -0.353%, 10-Yr is up 0.6bps at -0.074%, and 30-Yr is up 1.1bps at 0.246%.

- UK: The 2-Yr yield is up 2bps at 0.916%, 5-Yr is up 2.6bps at 1.022%, 10-Yr is up 3.4bps at 1.198%, and 30-Yr is up 4.8bps at 1.332%.

- Italy / German 10-Yr spread 3.3bps wider at 140.2bps

FOREX: Greenback Spikes As Chair Powell Fails To Rule Out Larger Hikes

- After some initial two-way price action following the release of the January FOMC decision/statement, broad dollar indices spiked as Chair Powell failed to rule out the potential for larger rate hikes going forward.

- The dollar index (DXY) has risen to the best levels in over a month, printing above 96.50 and hugging close to the highs approaching the close.

- The greenback strength was broad based with EUR, AUD, NZD, CAD, CHF and JPY all falling between 0.4-0.65%, reflecting the sharp adjustment higher in front-end US yields.

- Further weakness in global benchmarks may weigh on risk related currencies such as the Aussie. AUDUSD’s recent failure to remain above the 50-day EMA and the subsequent sharp sell-off strengthens the case for bears and signals potential for a deeper pullback.

- EURUSD makes fresh year-to-date lows, retreating below 1.1250 and narrowing the gap to the next technical point of note at 1.1222, the Dec 15 low. More significant support comes in at 1186/85 - Low Nov 24 / Low Jul 1, 2020 and the bear trigger.

- New Zealand CPI kicks off the APAC session overnight before markets await the Advance reading of US Q4 GDP. Durable goods orders, pending home sales and jobless claims also on the docket.

Data Calendar for Thursday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/01/2022 | 0030/1130 | ** |  | AU | Trade price indexes |

| 27/01/2022 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 27/01/2022 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 27/01/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 27/01/2022 | 1330/0830 | ** |  | US | durable goods new orders |

| 27/01/2022 | 1330/0830 | *** |  | US | GDP (adv) |

| 27/01/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 27/01/2022 | 1330/0830 | * |  | CA | Payroll employment |

| 27/01/2022 | 1500/1000 | ** |  | US | NAR pending home sales |

| 27/01/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 27/01/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 27/01/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 27/01/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.