-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: A Lot Riding On Fri's Jan Employment Data

EXECUTIVE SUMMARY

- MNI INTERVIEW: US Services Prices To Stay Higher Longer - ISM

- MNI: Covid Revives Phillips Curve-Former Fed, BOE Officials

- MNI BRIEF: Fed Nominee Raskin Grilled on Energy Comments

- MNI BRIEF: Fed Nominee Jefferson Says Must Tackle Inflation

- MNI STATE OF PLAY: BOE Moves Fast, Hopes For Lower Rate Peak

- MNI STATE OF PLAY: ECB's Lagarde Doesn't Rule Out '22 Rate Rise

US FI: Eurodollar/Treasury Roundup, Hikes Already Priced In, Waiting on NFP

Rates finished session broadly lower, early sell-off triggered after after Bank of England raised bank rate by 25bp to .50% (4 out of nine Bank members called for 50bp hike).- Mkt initially shrugged on ECB leaving key deposit rate at -0.5%; subtle statement change omits "and in either direction" in shift to next step in addressing inflation.

- Early buying from prop accts playing the range evaporated after ECB Lagarde presser failed to calm hawks, chances of rate hike sooner than later on the rise.

- Little react to US weekly claims data this morning (238k vs. 245k est), Unit Labor Costs +.3% vs. 1.0% est.

- More focus on Fri's employment data for Jan (+150k est vs. +199k in Dec) -- little change to estimate after Wed's ADP private employ miss (-301k vs. +180k est).

- Tsy yields higher but off high: 30YY climbed to 2.1822% high (vs. 2.0886 opening low) finished 2.1473%; 10YY 1.8450% high finished 1.8217%.

- Eurodollar and Treasury option flow faded the sell-off, active trade in buying calls and call plays while unwinding or taking profits in put positions. Dec put condor Block sale appears to be bet on futures not adding any more than current 125bp in hikes by year end: +12,610 Dec 98.37/98.62/98.87/99.12 put condors, 6.0 vs. 98.445 at 1015:00ET.

- Note on equities: extending lows, tech shares heavy after Meta earnings/outlook miss. Eyes on Amazon annc after shares close (3.57 eps est).

- The 2-Yr yield is up 3.2bps at 1.1859%, 5-Yr is up 4.6bps at 1.654%, 10-Yr is up 4.3bps at 1.8181%, and 30-Yr is up 2.9bps at 2.137%.

US

US: U.S. service costs appear set to stay near record highs longer into 2022 than previously expected and may not see much quick relief from Fed interest rate increases in the spring, ISM services survey chair Anthony Nieves told MNI Thursday.

- "It's definitely going to be more toward the latter part of the year in the third or fourth quarter at best," Nieves said about when to expect cooling prices. "Most of the prices will be buoyed in the first half of the year versus the second half, but it could take longer in the latter half of the year if we see any relief."

- Prices in the monthly services survey eased by 1.6 percentage points to 82.3 in January but all 18 services industries reported an increase in prices paid in the month. The survey showed 63% of firms reporting higher prices, while only 1.7% registered lower prices. For more see MNI Policy main wire at 1304ET.

- In the years prior to the pandemic, the failure of inflation to rise as unemployment hit low levels in developed economies led some central bankers to ponder whether the Phillips Curve was dead. But former Bank of England Monetary Policy Committee and MIT professor Kristin Forbes and Joseph Gagnon, a former senior Fed official now at the Peterson Institute for International Economics, have argued in research co-authored with Christopher Collins that it was merely in abeyance.

- Inflation tends not respond to changes in slack when this is substantial but can rise steeply in a low-slack environment, such as that now observed in rich countries, Gagnon and Forbes told MNI. For more see MNI Policy main wire at 1209ET.

- "I have great concern about your nomination," said Senator Kevin Cramer of North Dakota, echoing the comments of several of his colleagues.

- Raskin replied that "it is not a regulator or supervisory function for a regulator to take over a basic business decision that a bank is making."

FED:The Fed's primary focus right now must be to bring down inflation from levels well above the central bank's 2% target, Federal Reserve board nominee Philip Jefferson told the Senate Banking Committee Thursday.

- "In this moment, the inflation rate is high relative to the Fed's target so the directive is clear: The Fed must take steps to bring inflation back in line with its targets," Jefferson said in response to questions from senators.

UK

BOE: The Bank of England has got off to a flying start with tightening policy, following December's 25-basis-point hike with another in February, with four of the nine members voting for a 50-bps increase, and triggering quantitative tightening.

- But the forecasts in its quarterly Monetary Policy Report and comments by Governor Andrew Bailey sent a strong signal that the Bank believes market rate expectations have been overblown. The strategy is to tighten rapidly now in the hope of ensuring that the rate peak is lower, with MPC members only divided over how fast they should go.

EUROPE

ECB: European Central Bank president Christine Lagarde refused to rule out raising interest rates in 2022 on Thursday and said risks to inflation were tilted to the upside, particularly in the near term, but she stressed that the Governing Council is committed to the triple lock of conditions that must be met before any hike.

- March's meeting will be the appropriate time to analyse economic data and inflation, Lagarde said, adding that there was unanimous concern among governors that rising prices, particularly energy costs, are eating into household income.

- Thursday's move not to adjust policy was a consensus decision, but the ECB will not be complacent if it needs to act, she said.

CANADA

CANADA: GoC Short End Retraces BOE Sell-Off

GoCs cheapened 2-3bps after opening on hawkish dissent at the BoE but have since retraced roughly half the move, and more so in the case of the 2Y.

This leaves the 2YY down -1.2bps from yesterday's close at 1.270%, the lowest since Powell's conference sparked what was ultimately an 8bp sell-off.

OIS pricing has softened, currently sitting at 26.5bps for March and between 5.5-5.75 hikes for 2022.

OVERNIGHT DATA

- US JOBLESS CLAIMS -23K TO 238K IN JAN 29 WK

- US CONTINUING CLAIMS -0.044M to 1.628M IN JAN 22 WK

- US Q4 PREL UNIT LABOR COSTS +0.3% VS Q3 +9.3%; Y/Y +3.1%

- US Q4 PREL NONFARM PRODUCTIVITY +6.6% VS Q3 -5.0%; Y/Y +2.0%

- US FINAL JAN SVCS PMI 51.2r; DEC 50.9

- US JAN SVCS PMI REVISED UP FROM 50.9

- US FINAL JAN COMP PMI 51.1r; DEC 50.8

- US JAN COMP PMI REVISED UP FROM 50.8\

- US DEC FACTORY ORDERS -0.4%; EX-TRANSPORT NEW ORDERS +0.1%

- US DEC DURABLE ORDERS -0.7%

- US DEC NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.3%

- US JAN ISM SERVICES PMI 59.9 VS 62.0 DEC

MARKETS SNAPSHOT

Key late session market levels:

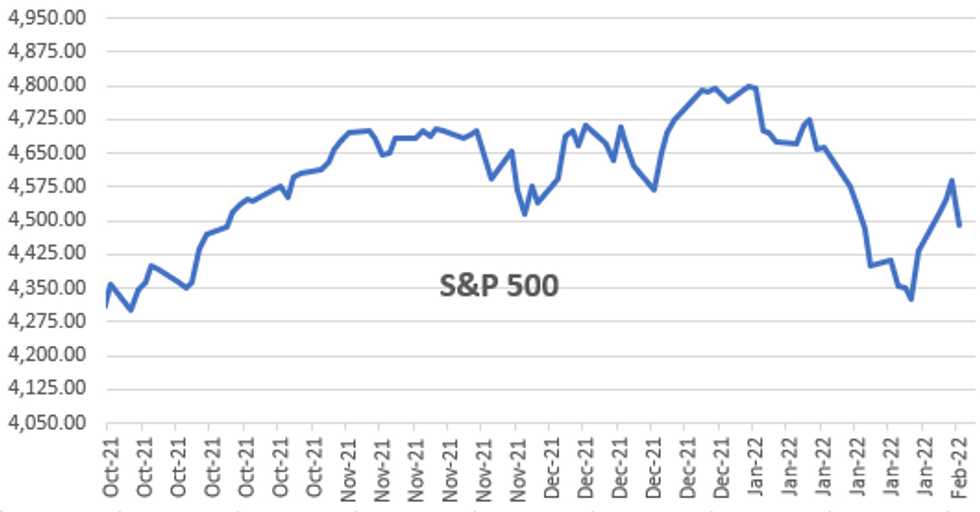

- DJIA down 439.06 points (-1.23%) at 35196.25

- S&P E-Mini Future down 94.75 points (-2.07%) at 4483.75

- Nasdaq down 455 points (-3.2%) at 13966.37

- US 10-Yr yield is up 4.1 bps at 1.8163%

- US Mar 10Y are down 14/32 at 127-22

- EURUSD up 0.0128 (1.13%) at 1.1433

- USDJPY up 0.44 (0.38%) at 114.9

- WTI Crude Oil (front-month) up $1.99 (2.25%) at $90.25

- Gold is down $0.48 (-0.03%) at $1806.32

- EuroStoxx 50 down 81.03 points (-1.92%) at 4141.02

- FTSE 100 down 54.16 points (-0.71%) at 7528.84

- German DAX down 245.3 points (-1.57%) at 15368.47

- French CAC 40 down 109.64 points (-1.54%) at 7005.63

US TSYS FUTURES CLOSE

- 3M10Y +3.971, 161.194 (L: 154.071 / H: 163.959)

- 2Y10Y +1.04, 62.999 (L: 61.575 / H: 65.213)

- 2Y30Y -0.053, 95.222 (L: 93.979 / H: 99.36)

- 5Y30Y -1.384, 48.489 (L: 47.535 / H: 52.757)

- Current futures levels:

- Mar 2Y down 2/32 at 108-9.25 (L: 108-07.625 / H: 108-12.87)

- Mar 5Y down 9/32 at 119-0.25 (L: 118-29.25 / H: 119-11.75)

- Mar 10Y down 14.5/32 at 127-21.5 (L: 127-17 / H: 128-07.5)

- Mar 30Y down 1-0/32 at 155-0 (L: 154-09 / H: 156-05)

- Mar Ultra 30Y down 1-25/32 at 187-11 (L: 185-28 / H: 189-10)

US 10Y FUTURES TECHS: (H2) Triangle Pattern Reinforces Bear Theme

- RES 4: 129-31 Low Dec 8

- RES 3: 129.14 High Jan 5

- RES 2: 129-05 50-day EMA

- RES 1: 128-10+/22+ 20-day EMA / High Jan 24

- PRICE: 127-20 @ 16:13 GMT Feb 3

- SUP 1: 127-06+/02 Low Jan 26 / Low Jan 19 and the bear trigger

- SUP 2: 127-00+ Low Jul 31, 2019 (cont)

- SUP 3: 126-23 Low Jul 17, 2019 (cont)

- SUP 4: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

Treasuries trade lower on the day. A potential triangle formation since Jan 19, has appeared on the daily chart. Triangles are continuation patterns and this reinforces the underlying bearish theme. Attention is on the key support at 127-02, Jan 19 low where a break would confirm a resumption of the downtrend. Key resistance is unchanged at 128-27, Jan 13 high. A breach of this hurdle would signal a short-term reversal.

US EURODOLLAR FUTURES CLOSE

- Mar 22 -0.020 at 99.480

- Jun 22 -0.030 at 99.095

- Sep 22 -0.025 at 98.80

- Dec 22 -0.030 at 98.520

- Red Pack (Mar 23-Dec 23) -0.045 to -0.04

- Green Pack (Mar 24-Dec 24) -0.06 to -0.05

- Blue Pack (Mar 25-Dec 25) -0.065 to -0.06

- Gold Pack (Mar 26-Dec 26) -0.065 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00029 at 0.07843% (-0.00257/wk)

- 1 Month +0.00315 to 0.11129% (+0.00500/wk)

- 3 Month +0.00443 to 0.31500% (-0.00157/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.00557 to 0.52871% (-0.00572/wk)

- 1 Year +0.01415 to 0.94386% (-0.00400/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $274B

- Secured Overnight Financing Rate (SOFR): 0.05%, $927B

- Broad General Collateral Rate (BGCR): 0.05%, $340B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $328B

- (rate, volume levels reflect prior session)

- Tsys 10Y-22.5Y, $1.601B accepted vs. $4.193B submitted

- Next scheduled purchases:

- Tue 02/08 1010-1030ET: Tsy 22.5Y-30Y, appr $1.825B

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

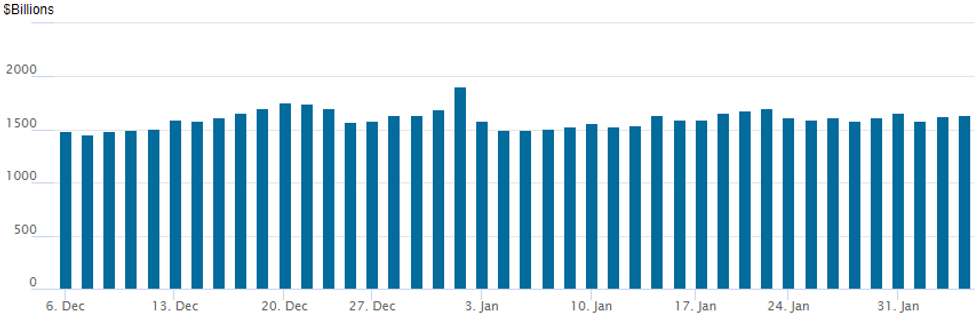

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $1,640.397B w/80 counterparties vs. $1,626.895B prior session -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: Corporate Debt Issuers Hit Sidelines Ahead Fri's Jan Employ Report

Higher yielding issuers McAfee and Scientific Games Holdings lone issuers today after Wednesday slipped to $6.55B from $11.25B on Monday.

- Date $MM Issuer (Priced *, Launch #)

- 02/03 $2.02B McAfee 8NC3 7.375$a

- 02/03 $800M #Scientific Games Holdings 8NC3 6.625%

- $6.55B Priced Wednesday, $17.8B/wk

- 02/02 $1.8B *IBM $650M 5Y +60, $500M 10Y +95, $650M 30Y +132

- 02/02 $1.8B *Alexandria Real Estate $800M 12Y +120, $1B 30Y +145

- 02/02 $1.5B *State St $300M 4NC3 +38, $650M 6NC5 +60, $550M 11NC10 +85

- 02/02 $800M *Brookfield Finance $400M 01/25/28 tap +95, $400M 30Y +152

- 02/02 $650M *Valero Energy 30Y +200

- 02/02 $Benchmark Development Bank of Japan 3Y investor calls

EGBs-GILTS CASH CLOSE: Hawkish Turns

The BoE and ECB each surprised to the hawkish side with their decisions on "Super Thursday", leading to one of the biggest routs in European fixed income in recent years.

- The BoE hiked 25bp as expected, but that was almost an unexpected 50bp hike (favoured by 4 of 9 voters). Then Lagarde repeatedly refused to declare a 2022 ECB rate hike as "unlikely" and emphasised upside inflation concerns.

- Markets repriced accordingly. 40bp of ECB hikes are now seen (incl 10bp by Jul, 40bp by end-year); German 2Y yields rose by the most since Sept 2019, 10Y BTP since April 2020.

- UK FI "outperformed" but yields were also up double-digits.

- Little let-up Friday, with the US employment report set for release.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 12.9bps at -0.329%, 5-Yr is up 14bps at -0.04%, 10-Yr is up 10.5bps at 0.145%, and 30-Yr is up 4.4bps at 0.333%.

- UK: The 2-Yr yield is up 11.7bps at 1.146%, 5-Yr is up 11.4bps at 1.222%, 10-Yr is up 11.2bps at 1.369%, and 30-Yr is up 9.6bps at 1.457%.

- Italian BTP spread up 11bps at 150bps / Spanish up 5.3bps at 79.7bps

FOREX: Euro Surges As Markets Digest More Hawkish ECB

- The single currency sprung to life on Thursday as markets interpreted the ECB’s press conference as a hawkish pivot, bringing forward bets that the ECB could tighten policy much sooner than previously anticipated.

- With risks to the inflation outlook, particularly in the near term, tilted to the upside compared to December’s meeting, ECB President Lagarde failed to rule out a rate hike this year which saw EURUSD spike to three-week highs, back above 1.14.

- Entering the press conference, EURUSD was a little softer around 1.1285. However, the weakness was short-lived and EURUSD rose quickly above the day’s high of 1.1308 and yesterday’s peak of 1.1330.

- The momentum continued with the pair blowing through noted resistance levels including the 50-day exponential moving average and the bear channel top drawn from the June 1, 2021 high. The rally narrows the gap with cluster resistance just ahead of the 1.1500 mark that may prove a short-term obstacle for short-term Euro bulls.

- EUR strength was broad based with EUR crosses all benefitting and especially EURJPY marching 1.56% higher, despite overall weakness in global equity indices.

- The other major central bank decision was a 25bp hike from the Bank of England. With 4 dissenting voters calling for a bolder 50bp hike, GBP immediately strengthened which prompted EURGBP to test multi-year support below 0.8300. With the strategy to tighten rapidly now in the hope of ensuring that the rate peak is lower, sterling gains were fairly short lived, retracing the moves ahead of the ECB.

- Amid the renewed optimism for the Euro, EURGBP had a very noteworthy 1.5% turnaround, likely to close the day back above 0.84.

- Dragged down by the impressive Euro rally, the dollar index extends on its recent downswing, with total losses for the index exceeding 2% on the week, retreating in every session. This comes ahead of January US non-farm payrolls data which headlines the Friday data schedule.

Data Calendar for Friday

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/02/2022 | 0700/0800 | ** |  | DE | manufacturing orders |

| 04/02/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/02/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/02/2022 | 0900/1000 |  | EU | ECB Survey of Professional Forecasters | |

| 04/02/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/02/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/02/2022 | 1215/1215 |  | UK | BOE Broadbent & Pill Monetary Policy Briefing | |

| 04/02/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/02/2022 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 04/02/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.