-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Hedging Hot CPI

EXECUTIVE SUMMARY

MNI US: Blinken Australia Trip Puts Asia Back In Focus

SCHUMER: CONFIDENT DEAL CAN BE REACHED ON LONG-TERM SPENDING, Bbg

US

US: Secretary of State Antony Blinken is in Australia today meeting with QUAD representatives from Australia, Japan, and India. Meetings are expected to focus on curtailing the influence of China in the region.

- The trip will reposition US foreign policy back to Asia. The US is particularly concerned about the 'no limits strategic partnership' between China and Russia which was ratified last week.

- Blinken will be hoping to convince Delhi to support Washington's foreign policy toward China and Russia. The US might suspect that the ongoing deterioration of bilateral relations between Delhi and Beijing can stimulate greater material support for the US 'pivot to the east'.

- There has also been a recent cooling of relations between traditionally close India and Russia which the US may be hoping to exploit. There have been calls within India to reduce dependency on Russian trade in light of the Ukraine crisis, so an escalation of tensions in Ukraine may have Delhi looking to firm up alternative bilateral relationships.

- Blinken is also expected to get assurances from Australia to assist in supplying Europe will LNG.

- The trip comes as US has just approved the sale of a USD$100 million package of equipment and services to Taiwan to 'sustain, maintain, and improve' Taiwan's Patriot missile defence system.

US TSYS: Eurodlr/Tsy Roundup, Hedging for Hot CPI, 50bp March Liftoff

Despite softer Tsys and late Tue stock bounce, risk appetite felt skittish ahead of Thu's CPI inflation data, (0.6% revised, vs. 0.5% prior).

- CPI seasonal revisions from BLS this morning, JP Morgan economists said the "underlying data (before seasonal adjustment) did not change, and the %oya price increases through December were unaffected and continue to look strong (headline: 7.0%, core: 5.5%)." JPM forecast for Thu's January CPI "is not meaningfully impacted by the revised seasonal factors, and we still look for 0.4% monthly increases in both the headline and core CPI measures, with the core change at 0.44% to two decimals."

- Treasury futures held weaker but holding inside range after $50B 3Y note auction (91282CDZ1) comes in on the screws: 1.592% high yield vs. 1.592% WI; 2.45x bid-to-cover vs. 2.47x last month.

- Indirect take-up surges to new year high of 68.55% vs. last month's high of 61.65%, while direct bidder take-up falls to 11.14% (15.511% Jan). Primary dealer take-up recedes to 20.31% vs. 22.84% in Jan, well under the 5M average of 28.06%.

- Eurodollar/Tsy option trade focus on buying rate hike insurance in March-Sep expiries in short end 5s and 10s, trading accts hedging for a hot CPI read to signal increased chances of a 50bps hike in March and June.

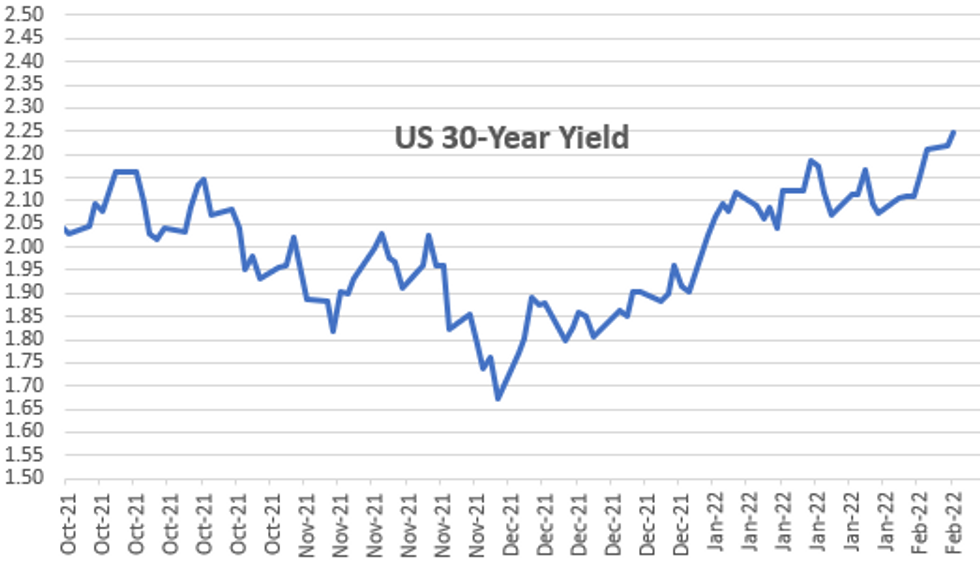

- The 2-Yr yield is up 4.9bps at 1.3394%, 5-Yr is up 4.2bps at 1.8067%, 10-Yr is up 3.8bps at 1.9541%, and 30-Yr is up 3.3bps at 2.2495%.

OVERNIGHT DATA

- US DEC TRADE GAP -$80.7B VS NOV -$79.3B

- US December CPI Revised Up to 0.6% Gain from 0.5% Previous, Core Unrevised at 0.6% Increase

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 246.72 points (0.7%) at 35337.64

- S&P E-Mini Future up 18.5 points (0.41%) at 4494.5

- Nasdaq up 104.2 points (0.7%) at 14120.43

- US 10-Yr yield is up 3.8 bps at 1.9541%

- US Mar 10Y are down 10.5/32 at 126-18.5

- EURUSD down 0.0027 (-0.24%) at 1.1416

- USDJPY up 0.44 (0.38%) at 115.54

- WTI Crude Oil (front-month) down $2.23 (-2.44%) at $89.07

- Gold is up $6.8 (0.37%) at $1827.28

- EuroStoxx 50 up 8.69 points (0.21%) at 4129.25

- FTSE 100 down 6.4 points (-0.08%) at 7567.07

- German DAX up 35.74 points (0.24%) at 15242.38

- French CAC 40 up 19.16 points (0.27%) at 7028.41

US TSYS FUTURES CLOSE

- 3M10Y -1.578, 167.69 (L: 164.205 / H: 170.754)

- 2Y10Y -1.105, 61.043 (L: 60.44 / H: 64.055)

- 2Y30Y -1.621, 90.628 (L: 89.437 / H: 93.799)

- 5Y30Y -1.176, 43.842 (L: 42.112 / H: 45.764)

- Current futures levels:

- Mar 2Y down 2.75/32 at 108-0.125 (L: 107-31.875 / H: 108-03.375)

- Mar 5Y down 7.25/32 at 118-7.25 (L: 118-05.5 / H: 118-15.5)

- Mar 10Y down 11/32 at 126-18 (L: 126-15 / H: 126-29.5)

- Mar 30Y down 23/32 at 152-25 (L: 152-14 / H: 153-18)

- Mar Ultra 30Y down 1-7/32 at 183-14 (L: 182-26 / H: 184-28)

US 10Y FUTURES TECHS: (H2) Fresh Trend Low

- RES 4: 129.14 High Jan 5

- RES 3: 128-29+ 50-day EMA

- RES 2: 128-00+/22+ 20-day EMA / High Jan 24

- RES 1: 127-24 High Feb 4

- PRICE: 126-18+ @ 16:32 GMT Feb 8

- SUP 1: 126-15+ Low Feb 8

- SUP 2: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

- SUP 3: 126-01 1.50 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 125-26+ 1.618 proj of the Jan 13 - 19 - 24 price swing

Treasuries remain bearish and traded lower Tuesday. Recent weakness has resulted in a break of 127-02, Jan 19 low and a bear trigger. The move lower has also confirmed a resumption of the downtrend and cleared the base of a recent triangle or pennant formation, reinforcing current bearish conditions. Attention is on 126-10+, a Fibonacci retracement level. Initial resistance is at 127-24.

US EURODOLLAR FUTURES CLOSE

- Mar 22 steady00 at 99.415

- Jun 22 -0.025 at 98.950

- Sep 22 -0.040 at 98.635

- Dec 22 -0.055 at 98.330

- Red Pack (Mar 23-Dec 23) -0.065 to -0.055

- Green Pack (Mar 24-Dec 24) -0.06 to -0.055

- Blue Pack (Mar 25-Dec 25) -0.055 to -0.045

- Gold Pack (Mar 26-Dec 26) -0.045 to -0.04

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00014 at 0.07700% (+0.00000/wk)

- 1 Month +0.00100 to 0.12571% (+0.01042/wk)

- 3 Month +0.00386 to 0.36629% (+0.02729/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.01729 to 0.63986% (+0.08443/wk)

- 1 Year +0.00000 to 1.09171% (+0.09271/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $72B

- Daily Overnight Bank Funding Rate: 0.07% volume: $260B

- Secured Overnight Financing Rate (SOFR): 0.05%, $905B

- Broad General Collateral Rate (BGCR): 0.05%, $347B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

- Tsy 22.5Y-30Y, appr $1.801B accepted vs. $3.665B submitted

- Next scheduled purchase

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

- Next updated schedule will be released Friday, Feb 11 at 1500ET

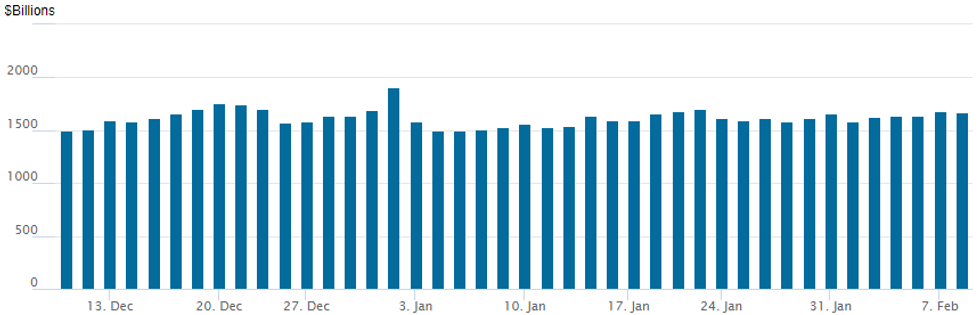

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,674.610B w/ 81 counterparties vs. second highest for year of $1,679.932B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $1.75B CEF 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 02/08 $1.75B #Comision Federal de Electricidad (CFE) $1.25B +7Y +275, $500M 30Y +400

- 02/08 $1B *Inter-American Development Bank (IADB) 7Y SOFR+30

- 02/08 $750M #Bell Canada 30Y +145

- 02/08 $700M *Kia $400M 3Y +90, $300M 5Y +105

- 02/08 $700M *Development Bank of Japan 3Y +30

- 02/08 $500M News Corp 10NC5 5.25%a

- 02/08 $Benchmark Kookmin Bank 3Y/5Y investor calls

- Expected Wednesday:

- 02/09 $Benchmark Japan Bank for Int'l Cooperation (JBIC) 2029 SFOR+46a

- 02/09 $500M EBRD 7Y SOFR+30a

EGBs-GILTS CASH CLOSE: Heavy Supply Weighs On Long End

European curves bear steepened Tuesday, with yield rises accelerating in the afternoon.

- Supply was a key factor in bear steepening, with long-ends pressured by a Spain 30Y mandate announcement, UK 50Y and NGEU issuance, and ahead of Germany auctioning a 30Y Wednesday.

- Gilts underperformed Bunds, with 10Y yields hitting 1.5% for the first time since 2018.

- BTP spreads underperformed; while GGBs performed, this appeared to be more of a retracement (5bp) of Monday's 20+bp widening.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1.1bps at -0.298%, 5-Yr is up 2.6bps at 0.08%, 10-Yr is up 3.6bps at 0.264%, and 30-Yr is up 6bps at 0.453%.

- UK: The 2-Yr yield is up 5.3bps at 1.328%, 5-Yr is up 6.4bps at 1.373%, 10-Yr is up 8bps at 1.488%, and 30-Yr is up 8.9bps at 1.592%.

- Italian BTP spread up 2.9bps at 158.2bps / Greek down 5.1bps at 223.4bps

FOREX: Greenback Continues To Consolidate Ahead Of Inflation Data

- G10 currencies held narrow ranges on Tuesday amid a very light data calendar and markets remaining calm ahead of US inflation data on Thursday.

- The US dollar index is 0.2% higher for the day, however, the index remains broadly unchanged from the start of European trade. Continuing to edge off the recent lows, the DXY looks to be consolidating after last week’s consistent selling pressure.

- Underperformers of note are CAD (-0.39%), JPY (-0.36%) and NOK -0.7%), whereas the Australian dollar managed to post a win as EURAUD continued to erode recent gains.

- Of note in tomorrow’s session, we have Bank of Canada Governor Macklem due to speak at the Canadian Chamber of Commerce on the role of productivity in fostering non-inflationary growth. Having explicitly tied the rate path to productivity growth, his comments will be eagerly anticipated before the March meeting.

- The USDCAD outlook remains bullish despite yesterday’s bearish session. A positive theme follows the recovery from 1.2451, Jan 19 low. Price trading above the 50-day EMA reinforces a bullish theme and has opened 1.2843, a 76.4% retracement. Initial firm support lies at 1.2560, Jan 26 low with immediate support residing at 1.2650, Jan 27 and Feb 2 low.

- Overnight, quarterly inflation expectations for New Zealand will be in focus.

DATA CALENDAR for WEDNESDAY

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/02/2022 | 0700/0800 | ** |  | DE | trade balance |

| 09/02/2022 | 0900/1000 | * |  | IT | industrial production |

| 09/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 09/02/2022 | 1310/1310 |  | UK | BOE Pill at UK Monetary Policy outlook conference | |

| 09/02/2022 | 1500/1000 | ** |  | US | wholesale trade |

| 09/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 09/02/2022 | 1530/1030 |  | US | Fed Governor Michelle Bowman | |

| 09/02/2022 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 09/02/2022 | 1700/1200 |  | CA | BOC Governor Macklem speaks to Chamber of Commerce | |

| 09/02/2022 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 09/02/2022 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 09/02/2022 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.