-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Waffles Ahead Key CPI Inflation Data

EXECUTIVE SUMMARY

- MNI: Fed's Mester Wants Faster Hikes If Inflation Stays

- MNI BRIEF: Mester Sees No Compelling Case for 50BP Fed Hike

- MNI: Fed Aims For Slow Balance Sheet Runoff To Keep Market Calm

- MNI: Boston Fed Names Susan Collins as Rosengren's Successor

- MORE ECB OFFICIALS ARE SAID TO DISTRUST INFLATION FORECASTS, Bbg

- BOSTIC on CNBC: NEED TO SEE MONTH-OVER-MONTH INFLATION NUMBERS DECLINE .. SEES PCE INFLATION AT 3% BY END OF THIS YEAR .. ACTUAL INFLATION NUMBER NOT AS IMPORTANT AS TRAJECTORY, CNBC/Bbg

US

FED: Federal Reserve officials are coalescing around a gradualist, highly telegraphed approach to reducing its USD8.7 trillion balance sheet, though debate on the extent and pace of runoffs and eventual sales is still incipient, ex-Fed officials and staffers told MNI.

- “They’re not going to take too much of a risk of disrupting markets because they don’t want to cause a liquidity squeeze,” said Randall Kroszner, a former Fed governor, in an interview.

- Policymakers are uncertain about the market effects of quantitative tightening -- and still smarting from turbulent prior attempts to substantially reduce the amount of reserves in the banking system.

- “The last thing they want to do is have to go back in and start buying assets because they started putting them on the market too quickly, ” Kroszner said.

- "Barring an unexpected turn in the economy, I support beginning to remove accommodation by moving the funds rate up in March," she said in remarks prepared for The European Economics and Financial Centre.

- Inflation readings in the U.S. are at their highest levels in four decades and nominal wages are accelerating at a faster pace than seen in decades, she said. Labor markets are "very strong" and the demand for workers is "well outstripping supply."

- "Increases in the fed funds rate in the coming months will be needed, but the ultimate path of rates in terms of the number and pace of increases will depend on how the economy evolves," she said. "For example, if by mid-year, I assess that inflation is not going to moderate as expected, then I would support removing accommodation at a faster pace over the second half of the year." For more see MNI Policy main wire at 1201ET.

- "I don't think there's any compelling case to start with a 50bp hike," she told a European Economics and Financial Centre forum. Whether to start with a 50bp increase or doing consecutive quarter-point hikes is "something to talk about and decide" at each FOMC meeting, she added.

- In particular she is monitoring the supply chain, wage trends and long-term inflation expectations. "If I saw those rising, then, I would say that that's a reason to move at a faster pace of removing accommodation."

- Policymakers must be "as clear as they can" in communicating with markets, and "we will be looking at" market pricing for larger moves in the Fed's benchmark rate, she added, in response to a question regarding rising market pricing for a 50bp hike.

- Collins will be an FOMC voter in 2022 after taking office July 1, following the completion of the academic year at the University of Michigan where she is currently provost and executive vice president for academic affairs. Collins succeeds Eric Rosengren, who left the position in September last year citing a kidney ailment after being at the regional central bank branch for 14 years.

- Collins has a Ph.D. in economics at the Massachusetts Institute of Technology, after graduating from Harvard University. Collins' published research has focused on the determinants of economic growth, exchange rate regimes and economic performance, the implications of global integration for U.S. labor markets, persistent macroeconomic imbalances, and countries’ economic transformations.

US TSYS: Late Risk-On Unwinds, Focus On Thu CPI

Late risk-on unwinds Wednesday as accounts scaled back tactical bets ahead Thursday's key inflation metric Jan CPI (MoM 0.6% rev, 0.4%; YoY 7.0%, 7.2%).

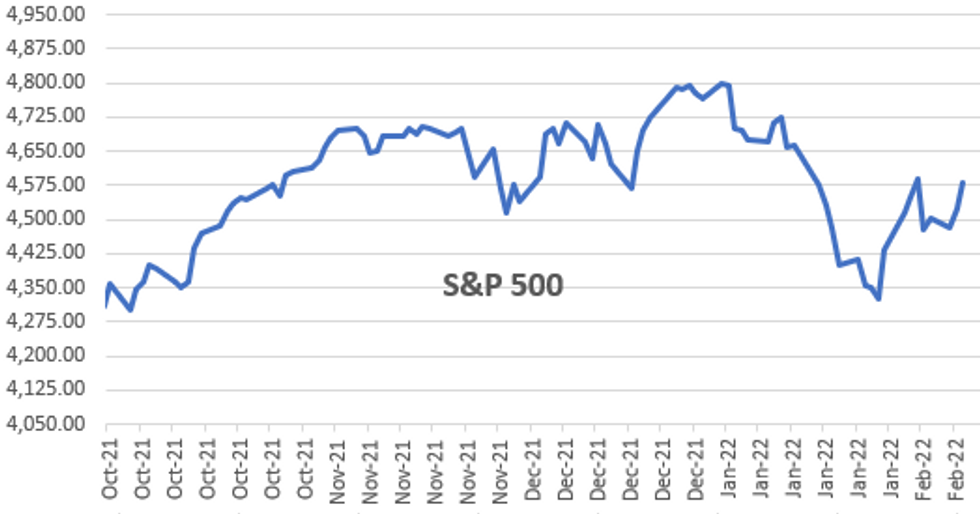

Yields quietly gained after the bell (10YY 1.9433% vs. 1.9071% in post-10Y auction trade) while stocks pared gains after marching to new late session high of 4580.0 after crossing 50-day EMA of 4563.47 earlier.

- Tsy futures extends session highs after strong $37B 10Y note auction (91282CDY4) trades through 2.3bp: 1.904% high yield vs. 1.927% WI; 2.68x bid-to-cover better than last month's 2.43x but still shy a 2.51x 5-month average.

- Indirect take-up surges to 77.56% vs. 65.53% last month (lowest since July '21); direct bidder take-up falls to 15.00% vs. 17.86%, while primary dealer take-up shrinks to record low of 7.44% vs. 16.61% prior.

- Waffles from Cleveland Fed President Loretta Mester, FI markets see-sawed around midday comments that Mester Wants Faster Hikes If Inflation Stays .. but sees No Compelling Case for 50BP Fed Hike.

- Mixed Eurodollar/Tsy option trade: Better upside Eurodollar call skew buying in first half a departure from better downside / rate-hike insurance buying via low delta puts (positions remain on books of course, with some rolling out to mid-late year put buying last few sessions). Meanwhile, Tsy options saw better put skew buying, ATM vol sales.

- After the bell, 2-Yr yield is up 0.5bps at 1.3461%, 5-Yr is down 1.8bps at 1.7985%, 10-Yr is down 3.6bps at 1.927%, and 30-Yr is down 2.6bps at 2.2313%.

OVERNIGHT DATA

US MBA: REFIS -7% SA; PURCH INDEX -10% SA THRU FEB 4 WK

US MBA: UNADJ PURCHASE INDEX -12% VS YEAR-EARLIER LEVEL

US MBA: 30-YR CONFORMING MORTGAGE RATE 3.83% VS 3.78% PREV

US MBA: MARKET COMPOSITE -8.1% SA THRU FEB 04 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 275.99 points (0.78%) at 35739.58

- S&P E-Mini Future up 57 points (1.26%) at 4569

- Nasdaq up 236.8 points (1.7%) at 14435.16

- US 10-Yr yield is down 3.6 bps at 1.927%

- US Mar 10Y are up 6/32 at 126-24.5

- EURUSD up 0.0017 (0.15%) at 1.1433

- USDJPY down 0.07 (-0.06%) at 115.48

- WTI Crude Oil (front-month) up $0.13 (0.15%) at $89.49

- Gold is up $7.49 (0.41%) at $1833.42

- EuroStoxx 50 up 74.84 points (1.81%) at 4204.09

- FTSE 100 up 76.35 points (1.01%) at 7643.42

- German DAX up 239.63 points (1.57%) at 15482.01

- French CAC 40 up 102.47 points (1.46%) at 7130.88

US TSYS FUTURES CLOSE

- 3M10Y -2.746, 164.728 (L: 161.355 / H: 167)

- 2Y10Y -3.704, 58.067 (L: 57.204 / H: 61.286)

- 2Y30Y -2.697, 88.464 (L: 87.356 / H: 91.551)

- 5Y30Y -0.616, 43.26 (L: 42.247 / H: 45.244)

- Current futures levels:

- Mar 2Y down 0.125/32 at 108-0.25 (L: 107-31.375 / H: 108-02.125)

- Mar 5Y up 0.75/32 at 118-8.5 (L: 118-05 / H: 118-13.5)

- Mar 10Y up 5.5/32 at 126-24 (L: 126-13.5 / H: 126-29.5)

- Mar 30Y up 15/32 at 153-8 (L: 152-18 / H: 153-25)

- Mar Ultra 30Y up 18/32 at 184-1 (L: 183-02 / H: 184-27)

US 10Y FUTURES TECHS: (H2) Trend Condition Remains Bearish

- RES 4: 129-14 High Jan 5

- RES 3: 128-26+ 50-day EMA

- RES 2: 127-28/128-22+ 20-day EMA / High Jan 24

- RES 1: 127-01/24 High Feb 7 / High Feb 4

- PRICE: 126-23 @ 15:55 GMT Feb 9

- SUP 1: 126-13+ Low Feb 08

- SUP 2: 126-10+ 61.8% retracement of the 2018 - 2020 bull cycle

- SUP 3: 126-01 1.50 proj of the Jan 13 - 19 - 24 price swing

- SUP 4: 125-26+ 1.618 proj of the Jan 13 - 19 - 24 price swing

Treasuries remain bearish. The contract has traded to a fresh cycle low today but has recovered from the session low. Recent weakness has resulted in a break of 127-02, Jan 19 low and a bear trigger. The move lower also confirmed a resumption of the downtrend and cleared the base of a recent continuation pattern, reinforcing bearish conditions. Attention is on 126-10+, a Fibonacci retracement. Initial firm resistance is at 127-24.

US EURODOLLAR FUTURES CLOSE

- Mar 22 +0.005 at 99.415

- Jun 22 steady at 98.955

- Sep 22 -0.005 at 98.635

- Dec 22 -0.010 at 98.330

- Red Pack (Mar 23-Dec 23) -0.005

- Green Pack (Mar 24-Dec 24) -0.005

- Blue Pack (Mar 25-Dec 25) +0.010 to +0.030

- Gold Pack (Mar 26-Dec 26) +0.030 to +0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00071 at 0.07771% (+0.00071/wk)

- 1 Month -0.00300 to 0.12271% (+0.00742/wk)

- 3 Month +0.01114 to 0.37743% (+0.03843/wk) ** Record Low 0.11413% on 9/12/21

- 6 Month -0.00529 to 0.63457% (+0.07914/wk)

- 1 Year +0.00200 to 1.09371% (+0.09471/wk)

- Daily Effective Fed Funds Rate: 0.08% volume: $70B

- Daily Overnight Bank Funding Rate: 0.07% volume: $263B

- Secured Overnight Financing Rate (SOFR): 0.05%, $896B

- Broad General Collateral Rate (BGCR): 0.05%, $346B

- Tri-Party General Collateral Rate (TGCR): 0.05%, $335B

- (rate, volume levels reflect prior session)

- No buy-op Wednesday, resume Thursday:

- Thu 02/10 1010-1030ET: Tsy 7Y-10Y, appr $3.225B vs. $2.425B prior

- Next updated schedule will be released Friday, Feb 11 at 1500ET

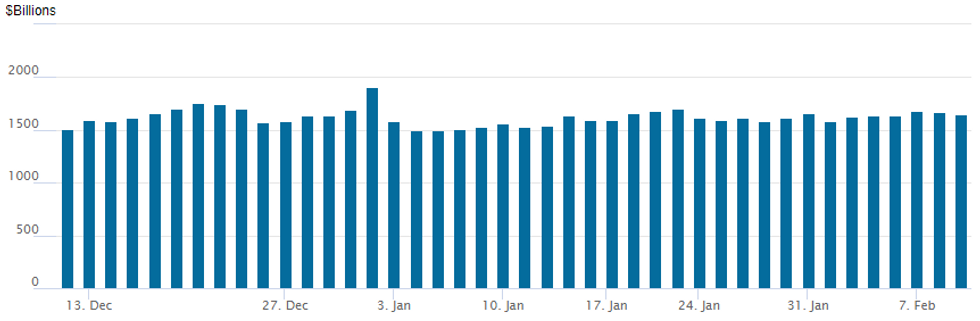

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $1,653.153B w/ 77 counterparties vs. $1,674.610B yesterday -- remains well off all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $3.5B Union Pacific Leads Wed's Deals

At least $11.35B to Price Wednesday, $3.5B Union Pacific leads

- Date $MM Issuer (Priced *, Launch #)

- 02/09 $3.5B #Union Pacific $1.25B 10Y +90, $500M 20Y +107, $1.25B 31Y +125, $500M 50Y +160

- 02/09 $1.5B *Starbucks $500M 2NC1 FRN/SOFR+42, $1B 10Y +110

- 02/09 $1.25B *Japan Bank for Int'l Cooperation (JBIC) 7Y SFOR+45

- 02/09 $1.05B #Nationwide Building Society $750M 6NC5 +117, $300M 6NC5 SOFR+129

- 02/09 $1B #ANZ New Zealand $500M 3Y +57, $500M 3Y FRN/SOFR+60

- 02/09 $800M *EBRD 7Y SOFR+30

- 02/09 $500M *Boardwalk Pipelines WNG 10Y +168

- 02/09 $500M *Harley Davidson 5Y +130

- 02/09 $Benchmark Aptiv 3NC1 +80a, 10Y +135a, 30Y +190a

- 02/09 $700M *Kookmin Bank $400M 3Y +60, $300M 5Y +70

- 02/09 $550M *China Development Bank 5Y +33

- Smaller but notable US$ issuance from Bank of China foreign branches:

- 02/09 $300M *Bank of China Hungarian Branch 2Y +30

- 02/09 $300M *Bank of China Johannesburg Branch 3Y +35

EGBs-GILTS CASH CLOSE: Rally Consolidates

Gilts and Bunds rallied in the morning as ECB/BoE rate hike expectations were pared back slightly, before range range trading dominated for most of the session.

- Long-end EGBs underperformed with supply a key factor (Germany and Spain issuing 30Yrs). BTP spreads narrowed, in sympathy with a broader risk-on tone to the session.

- BOE's Pill didn't explicitly talk down market rate expectations but in laying out reasoning for not voting for a 50bp hike last week made it evident he doesn't see the need for what the market is currently pricing.

- Event focus still lies across the Atlantic, with a 10Y Treasury auction after the European close, and the crucial January CPI figures Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.1bps at -0.349%, 5-Yr is down 6.1bps at 0.02%, 10-Yr is down 5.3bps at 0.212%, and 30-Yr is down 2.8bps at 0.427%.

- UK: The 2-Yr yield is down 4.6bps at 1.283%, 5-Yr is down 5.2bps at 1.322%, 10-Yr is down 5.8bps at 1.431%, and 30-Yr is down 6.2bps at 1.531%.

- Italian BTP spread down 3.9bps at 154.3bps/ Greek up 1.8bps at 225.2bps

FOREX: AUD and NZD Outperform Amid Steady Recovery In Equities

- Firmer major equity benchmarks left Aussie and Kiwi top of the G10 FX leaderboard on Wednesday as broad dollar indices retraced yesterday’s small advance.

- Bolstered risk sentiment filtered through to risk/commodity tied currencies, however, price action/volatility remained subdued as market participants await US January consumer price data, scheduled for release on Thursday.

- For AUDUSD bulls a sustained break of key short-term resistance at 0.7179, the 50-day EMA would alter the bearish technical outlook.

- EURUSD had a brief pop to session highs of 1.1448 on Bloomberg reports that more ECB officials are said to distrust inflation forecasts, which emboldens a shift toward tighter policy this year, according to sources. The move fell just short of yesterday’s 1.1449 peak and any renewed optimism for the single currency was quickly sapped with EURUSD returning to the 1.1430 area.

- Ahead of tomorrow’s data, it is worth noting EURUSD’s recent consolidation appears to be a bull flag, reinforcing bullish conditions following last week's gains and clearance of the 20- and 50-day EMAs. The pair has also breached the top of its bear channel drawn from the Jun 1 high of last year, highlighting a more significant reversal. The focus is on 1.1558, a Fibonacci retracement. Initial support is seen at 1.1336.

- Emerging market currencies were favoured amid the supportive price action for equities, with emerging market currency indices rising around 0.5% and particularly strong performances from ZAR (+1.15%) and EURPLN seen 0.86% lower.

- On Thursday, potential comments from BOE Governor Bailey, speaking at an online event before US inflation data hits the wires 0830ET/1330GMT.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2022 | 0001/0001 | * |  | UK | RICS House Prices |

| 10/02/2022 | 0101/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 10/02/2022 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2022 | 0830/0930 | ** |  | SE | Riksbank Interest Rate |

| 10/02/2022 | 1000/1100 |  | EU | European Commission Winter Economic Forecasts | |

| 10/02/2022 | 1200/1300 |  | EU | ECB de Guindos on Europe post-covid at LSE | |

| 10/02/2022 | 1315/1415 |  | EU | ECB Lane on supply chain disruptions panel discussion | |

| 10/02/2022 | 1330/0830 | ** |  | US | Jobless Claims |

| 10/02/2022 | 1330/0830 | *** |  | US | CPI |

| 10/02/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 10/02/2022 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 10/02/2022 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 10/02/2022 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 10/02/2022 | 1700/1700 |  | UK | BOE Bailey speech at TheCityUK Dinner | |

| 10/02/2022 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 10/02/2022 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2022 | 1900/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.