-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Evans, Bostic Temper Bullard

EXECUTIVE SUMMARY

- MNI Fed's Evans Says Too Soon To Think Much Past Neutral Rate

- MNI INTERVIEW: Rates May Have To Exceed Neutral-Fed's Giannoni

- MNI: IMF Chops Global Growth Forecast 0.8pp To 3.6% On War

- BIDEN SAYS U.S. WILL BE SENDING MORE ARTILLERY TO UKRAINE

- ATL FED BOSTIC: ASKED ABOUT 75 BPS HIKE, BOSTIC SAYS THAT NOT ON HIS RADAR, Bbg

- SWISS NATIONAL BANK CHAIRMAN SAYS THERE COULD BE SOME RISK TO PRICE STABILITY; SNB CHAIRMAN SAYS BIGGEST IMPACT ON SWISS PRICE STABILITY COMES FROM ENERGY PRICES AND SUPPLY CHAIN PROBLEMS, Rtrs

US

FED: The Federal Reserve is on track to lift interest rates towards a neutral range of 2.25%-2.5% by the end of this year, and how much policymakers go beyond that will be clearer in December with more inflation evidence in hand, Chicago President Charles Evans said Tuesday.

- "We're moving to adjust that to at least toward neutral and then we'll see," he told the Economic Club of New York. If inflation isn't coming down by then "we're going beyond neutral, absolutely." Evans also said economic momentum should continue even as borrowing costs rise.

FED: U.S. inflation pressures show some early signs of retreat as Fed tightening begins to slow demand, but elevated energy prices and continued supply chain disruptions raise the likelihood of having to take interest rates above neutral to tame inflation, Dallas Fed research director Marc Giannoni told MNI.

- Although CPI hit another four-decade high in March as gas prices surged after Russia's invasion of Ukraine, core inflation cooled on a month-on-month basis, but Giannoni said it was too early to say price rises had peaked. More expensive oil and supply chain snags are likely to persist for some time, contributing to the risk that higher inflation becomes built into the expectations of consumers and firms’ price-setting behavior, which would require a monetary policy response.

- Financial conditions have already tightened substantially on expectations of more aggressive monetary tightening, he noted in an interview.

IMF

The International Monetary Fund chopped its global economic growth forecast by 0.8pp to 3.6% this year as Ukraine's GDP may plunge 35% amid Russia's invasion, and warned central banks face tougher choices in responding to the resulting new round of supply disruptions.

- Russia's output may shrink 8.5%, and the euro area's growth is seen 1.1pp lower than previously at 2.8% according to the fund's World Economic Outlook . U.S. growth was lowered 0.3pp to 3.7% amid rising interest rates and China's by 0.4pp to 4.4% amid tough Covid lockdowns and a fragile real estate sector.

- The IMF reduced the 2023 global growth estimate 0.2pp to 3.6% from its prior World Economic Outlook projection from January, and said medium-term growth beyond that has been lowered to 3.3%. Global output grew 6.1% last year.

US TSYS: Tsy Yld Surge: 30YY at 3.016%, 3Y Highs

Rates trading near session lows after the bell -- yield curves bear flattening after tapping 2-week highs in early trade.

- Fresh cycle lows after slightly stronger than forecasted Housing Starts (1.793M) and Building Permits (1.873M) for March.

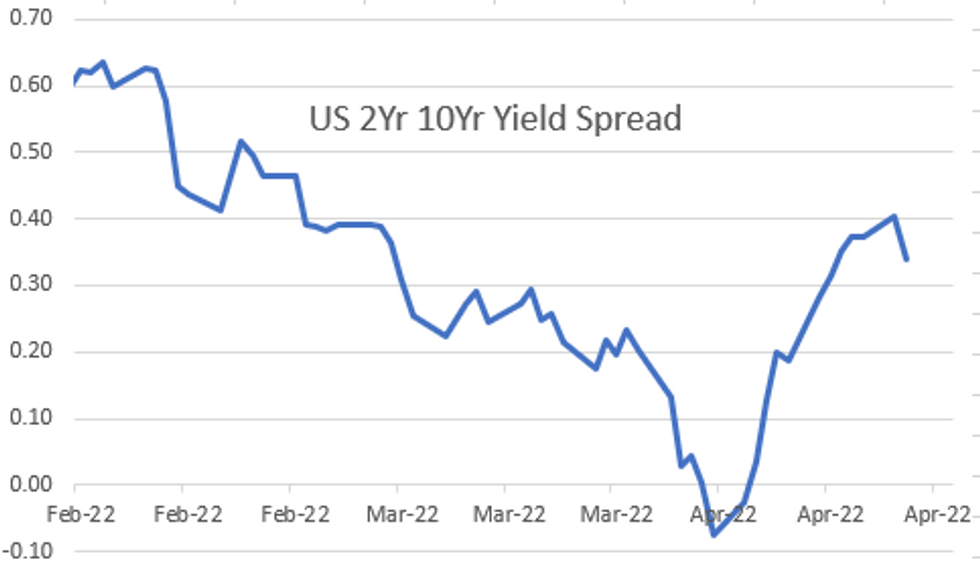

- Yield curves reversed late overnight steepening, extending flatter amid heavy selling in short end since the open: 2YY surging to 2.6102% high from 2.4273% low. 2s10s curve hit inverted low of -9.561 two weeks ago topped out at 42.897 this morning is trading 33.590 at the moment. 30YY tops 3.0161% - appr 3-year highs.

- Early blocks contributing (-2s/ultra bond, outright sale 2s) as recession concerns, ability of Fed to engineer a soft landing being sapped after leading hawk StL Fed Bullard opened dialog on chance of 75bp hike at May 4 FOMC late Monday.

- Late rebuttal from Chicago Fed Evans and Atl Fed Bostic -- neither see more than a 50bp hike in the near term as necessary.

- Meanwhile, IMF joined World bank opinion from late Monday: knock-on effect of Russia invasion reducing global growth/increase inflation forecasts.

- Cross asset levels: Gold selling off after nearly topping $2,000 Mon, -31.3 at 1947.5; support for Crude cools: WTI -5.53 at 102.68.

- On tap for Wednesday: Existing Home Sales (6.02M, 5.78M); MoM (-7.2%, -4.0%) at 1000ET, more Fed speak ahead late Friday blackout.

OVERNIGHT DATA

- US MAR HOUSING STARTS 1.793M; PERMITS 1.873M

- US FEB STARTS REVISED TO 1.788M; PERMITS 1.865M

- US MAR HOUSING COMPLETIONS 1.303M; FEB 1.365M (REV)

- US REDBOOK: APR STORE SALES +14.3% V YR AGO MO

- US REDBOOK: STORE SALES +15.2% WK ENDED APR 16 V YR AGO WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 513.78 points (1.49%) at 34924.77

- S&P E-Mini Future up 73.5 points (1.68%) at 4460

- Nasdaq up 293 points (2.2%) at 13623.78

- US 10-Yr yield is up 7.8 bps at 2.9303%

- US Jun 10Y are down 21/32 at 118-31.5

- EURUSD up 0.0003 (0.03%) at 1.0785

- USDJPY up 1.94 (1.53%) at 128.94

- WTI Crude Oil (front-month) down $5.84 (-5.4%) at $102.37

- Gold is down $33.12 (-1.67%) at $1945.43

- EuroStoxx 50 down 17.92 points (-0.47%) at 3830.76

- FTSE 100 down 15.1 points (-0.2%) at 7601.28

- German DAX down 10.39 points (-0.07%) at 14153.46

- French CAC 40 down 54.56 points (-0.83%) at 6534.79

US TSY FUTURES CLOSE

- 3M10Y +0.37, 208.191 (L: 196.444 / H: 208.869)

- 2Y10Y -6.181, 33.673 (L: 32.551 / H: 42.897)

- 2Y30Y -7.817, 40.836 (L: 40.14 / H: 52.282)

- 5Y30Y -5.418, 9.404 (L: 9.123 / H: 17.122)

- Current futures levels:

- Jun 2Y down 7.5/32 at 105-15.625 (L: 105-15.5 / H: 105-25.25)

- Jun 5Y down 17.25/32 at 112-20.75 (L: 112-20.25 / H: 113-10.75)

- Jun 10Y down 21/32 at 118-31.5 (L: 118-30.5 / H: 119-26.5)

- Jun 30Y down 30/32 at 139-8 (L: 138-31 / H: 140-18)

- Jun Ultra 30Y down 1-14/32 at 159-16 (L: 159-07 / H: 161-18)

US 10Y FUTURES TECH: (M2) Bearish Extension

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09/20 High Apr 14 / 20-day EMA

- RES 1: 120-00+ High Apr 18

- PRICE: 119-07 @ 14:30 BST Apr 19

- SUP 1: 119-02+ Intraday low

- SUP 2: 118-24+ Low Nov 16 2018 (cont)

- SUP 3: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 4: 117-22+ Low Nov 8 2018 (cont)

Treasuries remain soft and have once again traded lower today, reaching a fresh cycle low of 119-02+. This has confirmed a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. Moving average studies also point south and scope is for a move towards 119-04+ next, the Dec 3 2018 low (cont). Initial firm resistance has been defined at 121-09, the Apr 14 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.040 at 98.290

- Sep 22 -0.085 at 97.565

- Dec 22 -0.110 at 97.030

- Mar 23 -0.135 at 96.715

- Red Pack (Jun 23-Mar 24) -0.165 to -0.155

- Green Pack (Jun 24-Mar 25) -0.155 to -0.14

- Blue Pack (Jun 25-Mar 26) -0.13 to -0.105

- Gold Pack (Jun 26-Mar 27) -0.095 to -0.075

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements resume with London back from holiday

- O/N +0.00871 at 0.33100% (-0.00529 total last wk)

- 1 Month +0.03028 to 0.62471% (+0.08043 total last wk)

- 3 Month +0.03558 to 1.09829% (+0.05200 total last wk) ** Record Low 0.11413% on 9/12/21

- 6 Month +0.05043 to 1.60714% (+0.01628 total last wk)

- 1 Year +0.08100 to 2.30257% (-0.05000 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $76B

- Daily Overnight Bank Funding Rate: 0.32% volume: $263B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.29%, $896B

- Broad General Collateral Rate (BGCR): 0.30%, $349B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $338B

- (rate, volume levels reflect prior session)

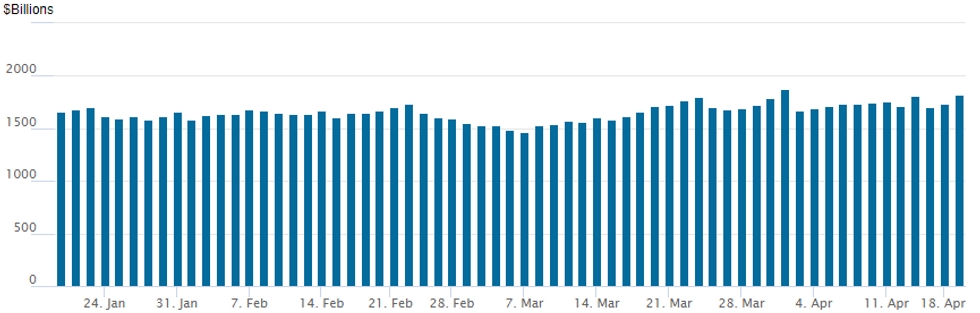

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,817.292B w/ 80 counterparties from prior session 1,738.379B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE: $8.5B JP Morgan 4Pt Launched

JP Morgan lion's share of $18.85B to price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 04/19 $8.5B #JP Morgan $3B 4NC3 +125, $500M 4NC3 SOFR+132, $3B 6NC5 +140, $2B 11NC10 +165

- 04/19 $3.5B #Taiwan Semiconductor Mfg (TSMC) 5Y +100, 7Y +120, 10Y +135, 30Y +150

- 04/19 $2.15B #Cargill $500M 3NC1 +80, $500M 5Y +85, $650M 10Y +117, $500M 30Y +140

- 04/19 $2B *Bank of America Perp NC5 6.125%

- 04/19 $1.7B #BNY Mellon 3Y +55, 3Y FRN, 7Y +90

- 04/19 $1B *Berkshire Hathaway 31Y +162.5

- On tap for Wednesday:

- 04/20 $Benchmark Canada 3Y +10a

- 04/20 $Benchmark ADB 3Y SOFR+24, 10Y SOFR+47a

FOREX: JPY Continues Downward Trajectory, CNH Weakens To Six-Month Low

- USDJPY continues to defy gravity and maintains this week’s extension of its current uptrend, trading to a fresh cycle high, just below the 129.00 mark. The break higher has reinforced underlying bullish technical conditions and signals potential for a continuation of the bull cycle towards 129.44, a Fibonacci projection, and the psychological 130.00 handle.

- However, the trend condition is overbought and it should be noted that warnings from Japanese officials over the sharp depreciation have intensified.

- Fed rhetoric has kept upward pressure on US Treasury yields and dollar indices look set to extend their winning streak to four, gradually improving on last Thursday’s impressive advance.

- The Chinese yuan slipped to its weakest level in six months, pressured by additional concern surrounding China’s growth outlook. China’s central bank unveiled nearly two dozen measures and promises intended to boost lending and support industries that have been beaten down by recent Covid lockdowns, including a pledge to guide banks to expand loan extensions.

- Furthermore, amid this surge in U.S. yields, there was considerable pressure on emerging market currencies, with notable downswings in both ZAR (-2.15%) and MXN (-1.12%).

- Elsewhere in the G10 space, the Swiss Franc also came under pressure on Tuesday, with USDCHF breaking a significant horizontal resistance area, dating back to July 2020, around 0.9470. A clean break has seen the pair rise to highs of 0.9520 and consolidate these gains above the 0.95 handle. AUD was the clear outperformer with the late boost in equity indices underpinning the relative strength.

- A relatively quiet overnight data docket on Wednesday should place the focus on Canadian CPI, with US existing home sales and the Fed’s Beige Book headlining the US calendar.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2022 | 0000/2000 |  | US | Minneapolis Fed's Neel Kashkari | |

| 20/04/2022 | 2350/0850 | ** |  | JP | Trade |

| 20/04/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/04/2022 | 0845/0945 |  | UK | BOE Mutton Panelist on Central Bank Digital Currencies | |

| 20/04/2022 | 0900/1100 | ** |  | EU | industrial production |

| 20/04/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 20/04/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 20/04/2022 | - |  | EU | ECB Lagarde & Panetta at G7 &G20 Finance Ministers' Meetings | |

| 20/04/2022 | 1230/0830 | *** |  | CA | CPI |

| 20/04/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/04/2022 | 1430/1030 |  | US | Chicago Fed's Charles Evans | |

| 20/04/2022 | 1430/1030 |  | US | San Francisco Fed's Mary Daly | |

| 20/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 20/04/2022 | 1700/1300 |  | US | Atlanta Fed's Raphael Bostic | |

| 20/04/2022 | 1800/1400 |  | US | FOMC Beige Book | |

| 21/04/2022 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.