-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

MNI ASIA OPEN: Soft Data Won't Stem 50Bp Fed Hike

EXECUTIVE SUMMARY

- MNI: Weaker Growth To Damp Fed’s Hawkish Resolve-Ex -Officials

- MNI: EU Banking Union Push As Window For Deal Closes-Official

- MNI BRIEF: Dallas Fed's Trimmed Mean PCE Inflation Slows

- RUSSIA'S CB GOV NABIULLINA: WE ARE IN THE ZONE OF COLLOSAL UNCERTAINTY, Rtrts

US

FED: Softening economic growth and higher unemployment later this year could shock the Federal Reserve into slowing or pausing an aggressive string of rate hikes expected in coming meetings, former U.S. central bank officials told MNI.

- Fed officials who were only recently signaling a quarter-point rate hike at every other meeting now appear to be aiming to frontload multiple 50-basis-point increases before reassessing the situation, with ex-officials noting that the rapid hawkish shift has generated a tightening of financial conditions that is already starting to be felt.

- “I just wonder if at the first sign of trouble they won’t panic,” said Thomas Hoenig, former president of the Kansas City Fed. “If the unemployment rate starts to rise I think they’ll get cold feet. Everyone is complaining about inflation right now but believe me when the unemployment rate starts to rise, the pressure on the Fed to back away will be enormous.” For more see MNI Policy main wire at 0845ET.

- Still, the 12-month inflation rate quickened to 3.70% over the 12 months to March, the fastest annual gain since 1991. Officials have cited the Dallas Fed's measure as one of the best indicators of underlying inflation and it had stayed near 2% throughout the pandemic before surging late last year.

EUROPE

EU: Eurogroup Chair Paschal Donohoe will make a fresh push for agreement on the final pillars of European Banking Union at a virtual meeting of finance ministers on May 3, with a senior EU official telling MNI that a deal will not be easy and if this attempt is unsuccessful no further progress may be possible for years.

- Under the two-phase draft compromise proposal, a European fund would backstop national deposit guarantee schemes and measures be taken to increase the transparency of banks’ sovereign holdings by as soon as 2025. Phase one would also include efforts to harmonise bank resolution and state aid frameworks.

- Phase two, starting by 2028 if member states give the go-ahead, would see the gradual introduction of reinsurance-based EU deposit insurance and charges on high concentrations of sovereign holdings. For more see MNI Policy main wire at 1055ET.

US TSYS: Data-Driven Vol, Yields Higher, Stocks Extend Wk Lows

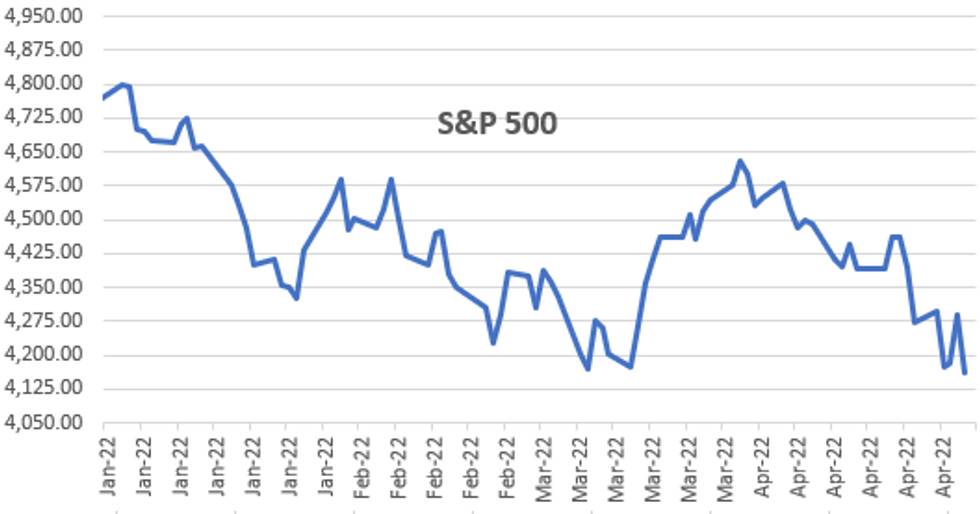

FI markets traded weaker after the bell, off early session lows amid data-driven vol in the first half. Quiet second half trade ensued even as equities fell back to late Tuesday levels (SPX -3.6% to 4128.0)

- Rates trade weaker, curves bear flattening with short end underperforming (Block sale: -10,000 TUM2 105-10.88, sell through 105-11 post-time bid at 0841:030ET) after Personal Income: +0.5%/MoM vs. +0.4% est, Spending +1.1%MoM vs. +0.6% est, PCE Deflator in line at +0.9%, Employment Cost Index is +1.4% vs. 1.1% est.

- FI levels rebounded sharply after April Chicago Business Barometer™ fell to 56.4 vs. 62.0 est. Prices Paid ticked up a modest 0.4 points to 86.1 with over three-quarters of firms citing higher prices this month. The Ukraine war was cited as inflating steel, plastics and lumber costs.

- Data driven volatility evaporated by midday with rates hold to a relative narrow range, yield curves flatter but off lows (2s10s -1.116 at 18.994 vs. 13.399L; 5s30 -1.867 at -3.742 vs. -6.508L).

- Focus turns to next Wednesday's FOMC policy annc, 50bp expected, Tsy refunding early Wednesday as well.

- The 2-Yr yield is up 7.7bps at 2.6943%, 5-Yr is up 7.3bps at 2.9124%, 10-Yr is up 5.9bps at 2.8811%, and 30-Yr is up 4.9bps at 2.9413%.

OVERNIGHT DATA

- US MAR PERSONAL INCOME +0.5%; NOM PCE +1.1%

- US MAR PCE PRICE INDEX +0.9%; +6.6% Y/Y

- US MAR CORE PCE PRICE INDEX +0.3%; +5.2% Y/Y

- US MAR UNROUNDED PCE PRICE INDEX +0.866%; CORE +0.293%

- New Orders saw the largest decline, dropping 10.8 points to 51.1 to a June-2020 low, with almost half of firms seeing no increase. Production slumped 9.1 points to 50.9, over 10 points below the 12-month average. Firms cited key part shortages as particularly acute in April, with supply chain delays dragging on production capabilities.

- MICHIGAN APRIL EXPECTATIONS INDEX AT 62.5 FROM 54.3

- MICHIGAN APRIL CURRENT CONDITIONS AT 69.4 FROM 67.2

- MICHIGAN APRIL 1-YR EXPECTED INFLATION UNCHANGED AT 5.4%

- CANADIAN FLASH Q1 GDP +1.4% QOQ

- CANADA FLASH MARCH GDP +0.5%

- CANADA FEB GDP +1.1% VS +0.8% FORECAST, JAN +0.2%

- CANADA FEB GOODS GDP +1.5%, SERVICES +0.9%

- CANADA FEB GROSS DOMESTIC PRODUCT +1.1% MOM

- CANADA FEB GOODS INDUSTRY GDP +1.5%, SERVICES +0.9%

- CANADA REVISED JAN GROSS DOMESTIC PRODUCT +0.2% MOM

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 733.57 points (-2.16%) at 33185.65

- S&P E-Mini Future down 130.25 points (-3.04%) at 4153.5

- Nasdaq down 442.4 points (-3.4%) at 12430.18

- US 10-Yr yield is up 5.9 bps at 2.8811%

- US Jun 10Y are down 6.5/32 at 119-5

- EURUSD up 0.0066 (0.63%) at 1.0566

- USDJPY down 1.33 (-1.02%) at 129.51

- WTI Crude Oil (front-month) down $0.97 (-0.92%) at $104.35

- Gold is up $8.63 (0.46%) at $1903.25

- EuroStoxx 50 up 25.84 points (0.68%) at 3802.86

- FTSE 100 up 35.36 points (0.47%) at 7544.55

- German DAX up 118.04 points (0.84%) at 14097.88

- French CAC 40 up 25.63 points (0.39%) at 6533.77

US TSY FUTURES CLOSE

- 3M10Y +3.33, 202.263 (L: 198.843 / H: 207.178)

- 2Y10Y -1.643, 18.467 (L: 13.399 / H: 21.32)

- 2Y30Y -2.777, 24.375 (L: 17.877 / H: 28.563)

- 5Y30Y -2.365, 2.802 (L: -2.31 / H: 6.475)

- Current futures levels:

- Jun 2Y down 3.125/32 at 105-13 (L: 105-09.25 / H: 105-18.75)

- Jun 5Y down 5.75/32 at 112-21.25 (L: 112-13.25 / H: 113-03.25)

- Jun 10Y down 6.5/32 at 119-5 (L: 118-24 / H: 119-24)

- Jun 30Y down 16/32 at 140-23 (L: 139-31 / H: 141-29)

- Jun Ultra 30Y down 23/32 at 160-17 (L: 159-12 / H: 162-10)

US 10Y FUTURES TECH: (M2) Bearish Trend Outlook

- RES 4: 122-20+ 50-day EMA

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and a reversal point

- RES 1: 120-18+ High Apr 27 and key resistance

- PRICE: 119-06+ @ 11:17 BST Apr 29

- SUP 1: 118-08 Low Apr 22 and the bear trigger

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries have pulled back from Wednesday’s high of 120-18+. The trend outlook remains bearish. Moving average studies are in a bear mode and fresh cycle lows last week confirmed a resumption of the primary downtrend and an extension of the bearish price sequence of lower lows and lower highs. The focus is on 118-02+ next, a Fibonacci projection. Key short-term resistance has been defined at 120-18+, the Apr 27 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 -0.035 at 98.075

- Sep 22 -0.070 at 97.235

- Dec 22 -0.085 at 96.765

- Mar 23 -0.075 at 96.540

- Red Pack (Jun 23-Mar 24) -0.065 to -0.03

- Green Pack (Jun 24-Mar 25) -0.01 to -0.005

- Blue Pack (Jun 25-Mar 26) -0.01 to -0.005

- Gold Pack (Jun 26-Mar 27) -0.01

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00500 to 0.33000% (+0.00357/wk)

- 1M +0.00329 to 0.80329% (+0.09986/wk)

- 3M +0.04886 to 1.33486% (+0.12125/wk) ** Record Low 0.11413% on 9/12/21

- 6M +0.06257 to 1.91071% (+0.08700/wk)

- 12M +0.07943 to 2.54914% (+0.02186/wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $81B

- Daily Overnight Bank Funding Rate: 0.32% volume: $259B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.28%, $892B

- Broad General Collateral Rate (BGCR): 0.30%, $337B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $327B

- (rate, volume levels reflect prior session)

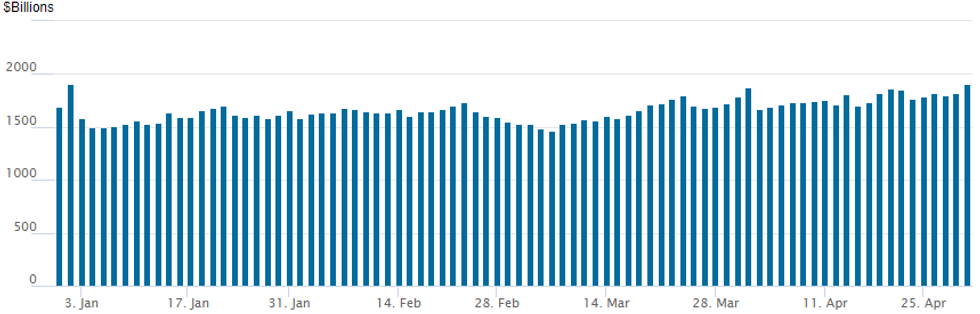

FED Reverse Repo Operation, New All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to new all-time high of 1,906.802B w/ 92 counterparties from prior session 1,818.416B. Compares to prior all-time high of $1,904.582B on Friday, December 31.

PIPELINE

No new issuance Friday, running total for April stands at $175.2B.

FOREX: USD Trims Gains Following Stellar Wkly Performance, Cross/JPY Falters

- The greenback edged lower on Friday, falling against most major currencies as the recent healthy upward momentum stalled approaching the weekend close. The USD Index is 0.7% lower on the day, however, gains for the week remain close to 1.7% and it is important to note the DXY remains over 3% above last week’s low, highlighting the rapidity of the recent broad appreciation.

- Factors contributing to Friday’s USD weakness may have been potential month-end related flows as well as profit-taking dynamics ahead of the weekend.

- Notable strength was seen in both GBP and JPY, both rising over 1% against the greenback as the very sharp weekly declines were partially retraced. In similar vein, EURUSD traded with a much more supportive tone, unable to match yesterday’s lows of 1.0472 and now trading roughly 100 pips higher, approaching the close.

- AUD, NZD and CAD were the anomalies on the day, both residing in marginal negative territory on Friday against the dollar. Even more notable declines against the Japanese Yen is perhaps explained by the renewed weakness in US equity indices that have reversed the entirety of Thursday’s advance, as of writing.

- Final PMI readings on Monday feature on a light economic data calendar. US ISM Manufacturing PMI headlines the US docket. China and the UK are both out for local holidays.

- Heavy central bank week ahead with obvious focus on Wednesday’s Fed meeting. The RBA also meets on Tuesday ahead of the Bank of England on Thursday.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 02/05/2022 | 0600/0800 | ** |  | DE | retail sales |

| 02/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 02/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/05/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 02/05/2022 | 1400/1000 | * |  | US | Construction Spending |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.