-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on Fed over Jobs Data

EXECUTIVE SUMMARY

- MNI INTERVIEW: Fed's Barkin Says Hikes Not On Set 50BP Course

- MNI: BARKIN TELLS MNI WANTS RATE HIKES 'FAST AS FEASIBLE'

- MNI: BARKIN: WATCHING INFLATION EXPECTATIONS FOR BIGGER MOVES

- MNI BRIEF: BOE Pill Makes Case For Gradualism In Hiking Rates

US

FED: Federal Reserve Bank of Richmond President Tom Barkin told an MNI podcast Friday interest rate increases are not on a preset course and he would like to see interest rates on a path to normal that is as fast as feasible, backing this week's historic FOMC decision to raise the fed funds rate 50bps, while not ruling out the potential for a supersized 75bp increase if needed.

- Given that inflation remains uncomfortably high, broad-based, and persistent and with demand extremely strong, raising rates by 50bps was "pretty straightforward," Barkin said in his first public comments after the FOMC meeting, backing the Committee's move.

- Asked whether he'd back two more consecutive 50bp moves, he said: "In my mind, were conditions to stay the same which of course is a pretty big if, I think let's normalize as fast as we can feasibly get there."

- The Richmond Fed president did not completely rule out a larger 75bp move. "I think anything would be on the table," he said. "I think you've been around me long enough to know I never rule anything out."

UK

BOE: Bank of England Chief Economist Huw Pill on Friday warned against large rate hikes, advocating instead for tightening through a string of smaller increases. The Bank's Monetary Policy Committee made its fourth successive 25 basis point hike Thursday.

- Pill, speaking at a BOE agents event, said that if the policy rate was hiked more than 50 basis points in one go the risk would be that "that monetary policy itself becomes a source of some volatility." He said that the MPC was agreed that it should "not make overly aggressive .. moves but rather have a smoother and more sustained and resolute and purposeful approach to policy".

- "That .. has been one of the reasons why I have favoured a set of moves in the same direction rather than one big move," he said. Three MPC members backed a 50 bps hike in May but Pill was in the majority, voting for 25 bps.

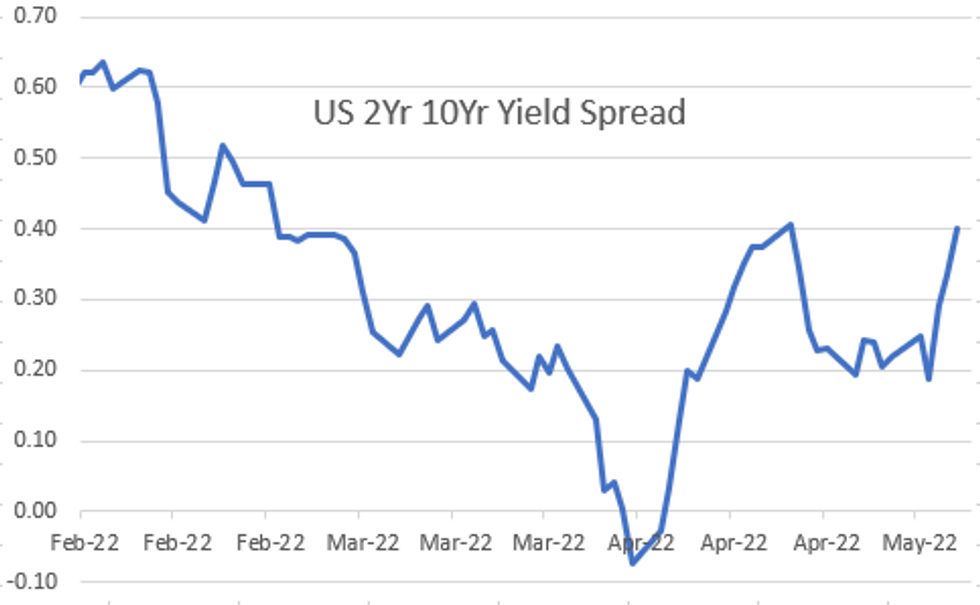

US TSYS: Yield Curves Bear Steepen, Focus on Fed over Jobs Data

Yield curves continued to bear steepen Friday, 2s10s session high of 43.067 back to early March levels as bond yields climbed to 3.2338% high -- last seen early December 2018. Relative calm end to the week for a NFP session.

- Tsy futures bounced higher briefly, scaled back amid steady selling after Apr NFP jobs gained more than estimated +428k vs. +380k est, avg hourly earning little weaker than exp at 0.3% vs. 0.4% est. Total down-revisions to Feb-Mar -39k.

- Fed out of blackout: limited react to essay published by Minneapolis Fed Pres Kashkari: Long-Term Real Rates Are Already Back To Neutral. ""If the economy is in fact in a higher-pressure equilibrium, that might indicate the neutral long-term real rate has increased, which would then require even higher rates to reach a contractionary stance that would bring the economy into balance."

- MNI interview w/ Richmond Fed Barkin: interest rate increases are not on a preset course and he would like to see interest rates on a path to normal that is as fast as feasible, backing this week's historic FOMC decision to raise the fed funds rate 50bps, while not ruling out the potential for a supersized 75bp increase if needed.

OVERNIGHT DATA

- US APR NONFARM PAYROLLS +428K; PRIVATE +406K, GOVT +22K

- US PRIOR MONTHS PAYROLLS REVISED: MAR +428K; FEB +714K

- US APR UNEMPLOYMENT RATE 3.6%

- US APR AVERAGE HOURLY EARNINGS +0.3% Vs MAR +0.5%; +5.5% YOY

- US APR AVERAGE WEEKLY HOURS 34.6 HRS

- US MAR CONSUMER CREDIT +$52.4B

- US MAR REVOLVING CREDIT +$31.4B

- US MAR NONREVOLVING CREDIT +$21.1BB

- CANADA HOURLY WAGES +3.3% YOY; PERMANENT WORKERS +3.4%

- CANADA APRIL EMPLOYMENT +15.3K VS FORECAST +40K, MARCH +72.5K

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 97.15 points (-0.29%) at 32901.08

- S&P E-Mini Future down 30.25 points (-0.73%) at 4113.75

- Nasdaq down 173 points (-1.4%) at 12144.66

- US 10-Yr yield is up 9 bps at 3.1265%

- US Jun 10Y are down 11/32 at 117-23

- EURUSD up 0.0004 (0.04%) at 1.0546

- USDJPY up 0.35 (0.27%) at 130.55

- WTI Crude Oil (front-month) up $2.32 (2.14%) at $110.59

- Gold is up $4.85 (0.26%) at $1881.73

- EuroStoxx 50 down 67.46 points (-1.82%) at 3629.17

- FTSE 100 down 115.33 points (-1.54%) at 7387.94

- German DAX down 228.23 points (-1.64%) at 13674.29

- French CAC 40 down 110.04 points (-1.73%) at 6258.36

US TSY FUTURES CLOSE

- 3M10Y +6.654, 227.309 (L: 218.11 / H: 229.878)

- 2Y10Y +7.276, 39.565 (L: 31.057 / H: 43.067)

- 2Y30Y +8.532, 49.084 (L: 38.668 / H: 53.143)

- 5Y30Y +4.549, 15.293 (L: 9.262 / H: 18.34)

- Current futures levels:

- Jun 2Y up 0.375/32 at 105-12.25 (L: 105-10 / H: 105-17.75)

- Jun 5Y down 5.5/32 at 112-3 (L: 112-00.75 / H: 112-16.25)

- Jun 10Y down 11.5/32 at 117-22.5 (L: 117-19.5 / H: 118-09.5)

- Jun 30Y down 1-01/32 at 136-8 (L: 136-04 / H: 137-29)

- Jun Ultra 30Y down 2-0/32 at 151-19 (L: 151-12 / H: 154-25)

US 10Y FUTURES TECH: (M2) Heading South

- RES 4: 122-02 50-day EMA

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14 and a reversal point

- RES 1: 119-22+/120-18+ 20-day EMA / High Apr 27

- PRICE: 117-22 @ 1615ET May 6

- SUP 1: 117-19+ Low May 6

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-20 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

Treasuries remain bearish and traded to a fresh cycle low on Friday. Support at 118-08, Apr 22 low, has been cleared, confirming a resumption of the primary downtrend and an extension of lower lows and lower highs. Moving average studies remain in a bear mode, reinforcing current conditions. Sights are on 116-28 next, the 0.764 proj of the Mar 7 - 28 - 31 price swing. Key short-term resistance is unchanged at 120-18+, Apr 27 high.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.015 at 98.160

- Sep 22 +0.035 at 97.335

- Dec 22 +0.015 at 96.790

- Mar 23 +0.005 at 96.515

- Red Pack (Jun 23-Mar 24) -0.005 to +0.010

- Green Pack (Jun 24-Mar 25) -0.04 to -0.015

- Blue Pack (Jun 25-Mar 26) -0.07 to -0.05

- Gold Pack (Jun 26-Mar 27) -0.085 to -0.07

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00343 to 0.81857% (+0.48857/wk)

- 1M -0.00272 to 0.84214% (+0.03885/wk)

- 3M +0.03115 to 1.40186% (+0.06700/wk) * / **

- 6M -0.00757 to 1.96457% (+0.05386/wk)

- 12M +0.02257 to 2.69471% (+0.06614/wk)

- * Record Low 0.11413% on 9/12/21; ** 2Y high 1.40614% on 5/4/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $74B

- Daily Overnight Bank Funding Rate: 0.82% volume: $284B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.79%, $992B

- Broad General Collateral Rate (BGCR): 0.80%, $354B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $336B

- (rate, volume levels reflect prior session)

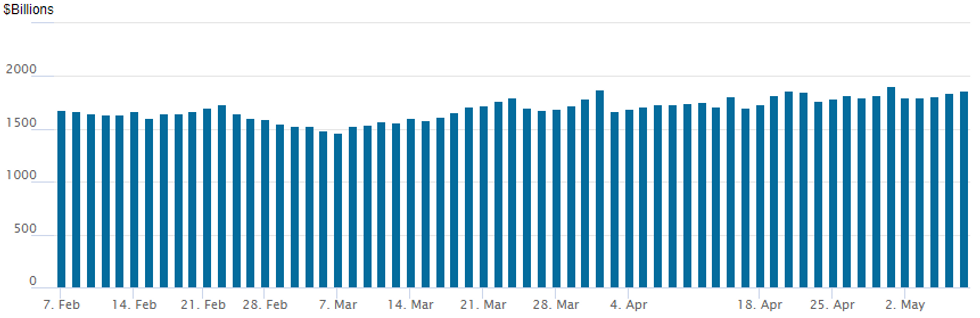

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage at 1,861.866B w/ 84 counterparties vs. prior session's 1,844.762B (all-time high of $1,906.802B on Friday, March 29, 2022).

EGBs-GILTS CASH CLOSE: Yields Rise Again As ECB Looks More Hawkish

An apparent hawkish turn from influential ECB members applied fresh pressure on European FI Friday, with rate hike expectations rising and German yields hitting multi-year highs.

- The key comment was from Banque de France's Villeroy who said he sees rates in positive territory by year-end.

- Gilts outperformed, with the short-end continuing to rally post-dovish BoE.

- 10Y Bund yields rose to the highest since Aug 2014.

- 10Y BTP spreads rose only slightly but closed above the 200bp mark for the first time since April 2020.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.5bps at 0.32%, 5-Yr is up 8.5bps at 0.851%, 10-Yr is up 8.8bps at 1.132%, and 30-Yr is up 7bps at 1.241%.

- UK: The 2-Yr yield is down 4.1bps at 1.506%, 5-Yr is down 1bps at 1.66%, 10-Yr is up 3.1bps at 1.995%, and 30-Yr is up 4.8bps at 2.173%.

- Italian BTP spread up 0.9bps at 200.4bps / Greek up 3.6bps at 244.4bps

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/05/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 09/05/2022 | 0645/0845 | * |  | FR | Current Account |

| 09/05/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 09/05/2022 | 1230/0830 | * |  | CA | Building Permits |

| 09/05/2022 | 1300/1400 |  | UK | BOE Saunders Speaks at Resolution Foundation Event | |

| 09/05/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 09/05/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 09/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.