-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

MNI ASIA OPEN: Ylds Drop As Stocks Crater

EXECUTIVE SUMMARY

- MNI: Fed's Harker Favors 'Measured Pace' for Hikes After July

- MNI BRIEF: Fed Nominee Barr Commits To Bring Inflation Down

- MNI FED: Barr "Strongly Committed To Bringing Down Inflation" Ahead Of Thurs Hearing

- CHINA PHONE MAKERS TELL SUPPLIERS TO SCALE BACK ORDERS: NIKKEI, Bbg

- WELLS FARGO INVESTMENT INSTITUTE CUTS YEAR-END 2022 GDP GROWTH TARGET TO 1.5% FROM 2.2%, KEEPS CPI INFLATION TARGET AT 7.7%, Rtrs

US

FED: Federal Reserve Bank of Philadelphia President Patrick Harker on Wednesday backed Chair Jerome Powell's plan to raise the fed funds rate target by more aggressive half-point increments in June and July before dialing back to a "measured pace" of rate increases.

- "Going forward, if there are no significant changes in the data in the coming weeks, I expect two additional 50 basis point rate hikes in June and July. After that, I anticipate a sequence of increases in the funds rate at a measured pace until we are confident that inflation is moving toward the Committee’s inflation target," he said in remarks prepared for a virtual meeting of the Mid-Size Bank Coalition of America.

- A "measured pace" was a phrase last used by former Fed Chair Alan Greenspan decades ago to signal a quarter-point rate hike at each meeting. The current fed funds target range is 0.75% to 1%. For more see MNI Policy main wire at 1601ET.

FED: Federal Reserve vice chair for supervision nominee Michael Barr said inflation is too high and if confirmed would be committed to bringing it down to the central bank's 2% target.

- "Inflation is running far too high, affecting communities all across our country," he wrote in testimony released early for a hearing before the Senate Thursday.

- "I would be strongly committed to bringing down inflation to the Federal Reserve's target, consistent with the Federal Reserve's dual mandate of maximum employment and price stability."

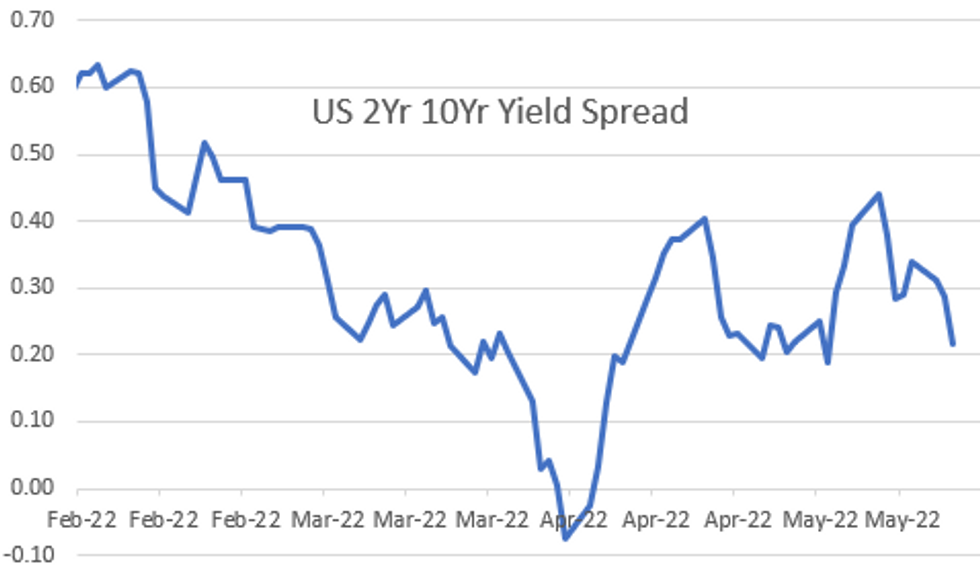

US Tsys: Bull Flatteners, 5s10s Inverted Again

US TSYS: US FI markets climbed steadily through the session, bonds leading the rally finishing near session highs (30YY -.1115 at 3.0663%).

- Yield curves bull flattening (2s10s -6.230 at 21.721, 5s10s -2.771 at -.846) amid renewed concerns over stagflation as equities tumbled on the back of mostly poor earnings/cutting guidance for large retailers this week tied to supply chain constraints, higher operating costs, etc.

- On flattening curves, BMO portends the FOMC "will hike the economy into a recession, whether the ‘blame’ for the slowdown lies with monetary policymakers, subprime mortgages, or a global pandemic is a debate that can only be conducted with the benefit of hindsight. As such, while we are very much on board with 2s/10s revisiting negative territory, this does not necessarily ensure that an economic contraction is in the offing."

- Tsy futures extending session highs (30YY 3.0968% at the moment) after $17B 20Y note auction (912810TH1) comes in on the screws: 3.290% high yield vs. 3.290% WI; 2.50x bid-to-cover vs. last month's 2.80x.

- Thursday focus:

- May-19 0830 Initial Jobless Claims (203k, 200k)

- May-19 0830 Continuing Claims (1.343M, 1.320M)

- May-19 0830 Philadelphia Fed Business Outlook (17.6, 15.0)

- May-19 1000 Existing Home Sales (5.77M, 5.65M); MoM (-2.7%, -2.1%)

- May-19 1000 Leading Index (0.3%, 0.0%)

- US retail giant Target's miss on EPS and weaker guidance is dragging stock futures lower. Target is now down 17% premarket; it had been an outperformer this year, down 7% this year as of Tuesday vs -26% for the S&P consumer discretionary index.

- Along with Walmart's huge miss Tuesday, retail giants have not been coping well with the high inflation environment. One never wants to make too many macro conclusions from something like this but the share price reaction suggests, as did Walmart's yesterday, that equities haven't yet fully priced in stagflationary risks. Quotes from the Bloomberg writeup of Target's results:

- On rising costs: "Target said fuel and freight were $1 billion more than expected during the first quarter, while additional hits came from higher pay for warehouse employees and markdowns driven by bloated inventories."

- On consumer activity: Despite higher-than-expected revenue, "strong demand for food and beverages, beauty products and household essentials went along with 'lower-than-expected sales in discretionary categories,' Target said. That's a sign that shoppers are pulling back as they struggle to buy basic goods."

- On passing along prices to consumers: The CFO "said the company has been raising some prices, although it's also trying to avoid turning off customers with big increases."

OVERNIGHT DATA

- US APR HOUSING STARTS 1.724M; PERMITS 1.819M

- US MAR STARTS REVISED TO 1.728M; PERMITS 1.879M

- US APR HOUSING COMPLETIONS 1.295M; MAR 1.365M (REV)

- US MBA: MARKET COMPOSITE -11.0% SA THRU MAY 13 WK

- US MBA: REFIS -10% SA; PURCH INDEX -12% SA THRU MAY 13 WK

- US MBA: UNADJ PURCHASE INDEX -15% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.49% VS 5.53% PREV

- CANADIAN APR CONSUMER PRICE INDEX INFLATION +6.8% YOY

- CANADIAN APR CONSUMER PRICE INDEX INFLATION +6.8% YOY

- CANADA MOM CPI INFLATION WAS +0.6% IN APR

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 1187.03 points (-3.64%) at 31464.44

- S&P E-Mini Future down 166.25 points (-4.07%) at 3917.5

- Nasdaq down 570.4 points (-4.8%) at 11412.25

- US 10-Yr yield is down 9.3 bps at 2.8931%

- US Jun 10Y are up 16/32 at 119-11.5

- EURUSD down 0.0083 (-0.79%) at 1.0468

- USDJPY down 1.15 (-0.89%) at 128.23

- WTI Crude Oil (front-month) down $3.04 (-2.7%) at $109.29

- Gold is up $1.83 (0.1%) at $1816.95

- EuroStoxx 50 down 50.77 points (-1.36%) at 3690.74

- FTSE 100 down 80.26 points (-1.07%) at 7438.09

- German DAX down 178.18 points (-1.26%) at 14007.76

- French CAC 40 down 77.25 points (-1.2%) at 6352.94

US TSY FUTURES CLOSE

- 3M10Y -4.446, 184.607 (L: 181.701 / H: 193.225)

- 2Y10Y -6.619, 21.332 (L: 21.125 / H: 29.988)

- 2Y30Y -7.746, 39.557 (L: 38.899 / H: 51.039)

- 5Y30Y -3.908, 17.369 (L: 16.272 / H: 23.999)

- Current futures levels:

- Jun 2Y up 1.25/32 at 105-17.875 (L: 105-14.625 / H: 105-19.875)

- Jun 5Y up 5.75/32 at 112-27.25 (L: 112-14.25 / H: 113-00)

- Jun 10Y up 16/32 at 119-11.5 (L: 118-16 / H: 119-17)

- Jun 30Y up 46/32 at 140-3 (L: 137-30 / H: 140-12)

- Jun Ultra 30Y up 78/32 at 155-29 (L: 152-10 / H: 156-12)

US 10Y FUTURES TECH: (M2) Trading Below Its Recent Highs

- RES 4: 122-12+ High Apr 4

- RES 3: 121-09 High Apr 14

- RES 2: 121-03+ 50-day EMA

- RES 1: 120-00+/120-18+ High May 12 / High Apr 27

- PRICE: 119-11+ @ 1445ET May 18

- SUP 1: 118-03+/117-08+ Low May 11 / Low May 9 and a bear trigger

- SUP 2: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 116-16+ 2.0% 10-dma envelope

- SUP 4: 116.00 Round number support

Treasuries remain below the recent high of 120-00+ on May 12. The trend direction remains down and recent short-term gains are considered corrective - a pause in the downtrend. Any resumption of gains would open 120-18+, the Apr 27 high. This level represents an important short-term resistance where a break would signal scope for a stronger retracement. Key support and the bear trigger is unchanged at 117-08+.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.005 at 98.178

- Sep 22 +0.010 at 97.325

- Dec 22 +0.020 at 96.810

- Mar 23 +0.025 at 96.645

- Red Pack (Jun 23-Mar 24) +0.025 to +0.030

- Green Pack (Jun 24-Mar 25) +0.030 to +0.045

- Blue Pack (Jun 25-Mar 26) +0.050 to +0.070

- Gold Pack (Jun 26-Mar 27) +0.080 to +0.100

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00015 to 0.82029% (-0.00542/wk)

- 1M -0.00114 to 0.92729% (+0.04058/wk)

- 3M +0.03043 to 1.47800% (+0.03429/wk) * / **

- 6M +0.02800 to 2.03314% (+0.03814/wk)

- 12M +0.06329 to 2.74100% (+0.08886wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.47800% on 5/18/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $80B

- Daily Overnight Bank Funding Rate: 0.82% volume: $267B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.80%, $977B

- Broad General Collateral Rate (BGCR): 0.80%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.80%, $352B

- (rate, volume levels reflect prior session)

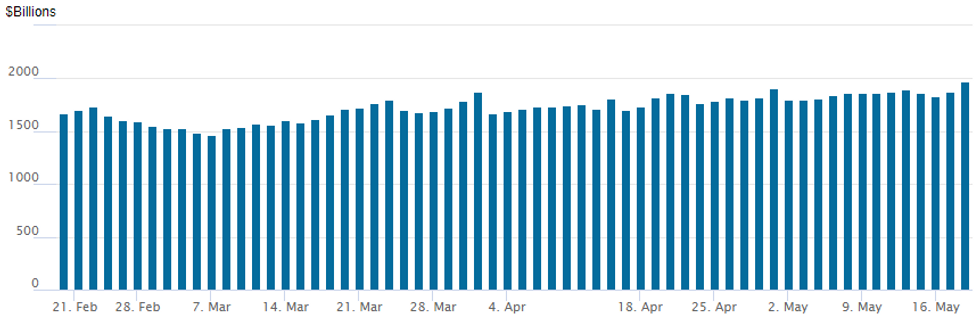

FED Reverse Repo Operation: New All-Time High

NY Federal Reserve/MNI

NY Fed reverse repo usage surges to new all-time high of 1,973.373B w/ 91 counterparties vs. prior record of $1,906.802B on Friday, March 29, 2022.

PIPELINE: Total $12.2B to Price Wednesday

- Date $MM Issuer (Priced *, Launch #)

- 05/18 $2.25B #Westpac $700M 3.25Y +90, $550M 3.25Y SOFR, $1B 5.25Y +115

- 05/18 $1.75B #Romania $1B 5.5Y +240, $750M 12Y +310

- 05/18 $1.25B #Munich 20NC10 Green 5.875%

- 05/18 $1.25B #Southern California Edison 3Y +140, 5Y +185, 30Y +240

- 05/18 $1.05B #Citizens Bank $650M 3NC2 +145, 00M $15NC10 +275

- 05/18 $1B #Nucor $500M 3Y +115, $00M 5Y +145

- 05/18 $1B *OKB 3Y SOFR+25

- 05/18 $900M *Japan Int Cooperation Agcy (JICA) 5Y SOFR+63

- 05/18 $750M #American Express 11NC10 fix/FRN +210

- 05/18 $500M *Church and Dwight WNG 30Y +190

- 05/18 $500M #Essential Utilities 30Y +225

EGBs-GILTS CASH CLOSE: ECB Hike Expectations Fade Late

European curves flattened Wednesday despite a late rally at the short end as ECB rate hike price expectations cooled and equities retreated to session lows.

- After implied rates rose earlier in the session on comments by ECB's Rehn calling for an end to negative rates "relatively quickly", they fell to session lows in late afternoon trade after MNI published a Policy piece which in part cited ECB sources downplaying ECB Knot's call for a possible 50bp hike.

- The German curve pared earlier flattening as short-end yields dipped. The repricing erased most of Gilts' earlier outperformance, following a high but in-line CPI print this morning.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 1.5bps at 0.392%, 5-Yr is up 0.1bps at 0.735%, 10-Yr is down 1.7bps at 1.029%, and 30-Yr is down 2.9bps at 1.147%.

- UK: The 2-Yr yield is up 1.6bps at 1.461%, 5-Yr is up 1.5bps at 1.58%, 10-Yr is down 2bps at 1.861%, and 30-Yr is down 0.3bps at 2.089%.

- Italian BTP spread up 1.3bps at 192.9bps / Spanish unch at 107.2bps

FOREX: Japanese Yen Boosted As Equities Plunge, EURCHF Sharply Lower

- Weakness across major equity benchmarks placed the Japanese Yen as the best performing major currency on Wednesday. With risk-off flows also prompting a small recovery for the US dollar, it was cross/JPY that felt the brunt of the moves.

- GBPJPY sticks out after dropping around 2.1% which has a small miss in UK April inflation contributing to the weakness. The pair is closely followed by the likes of AUDJPY and NZDJPY, also dropping around 1.75% amid the 3.5% declines in e-mini S&P 500 futures.

- There was a very strong move lower in EURCHF throughout the US session. Natural risk off moves contributed, however, relative diverging central bank headlines prompted an acceleration to the downside.

- The Swiss franc has been bolstered by Swiss National Bank President, Thomas Jordan, saying it is ready to act if inflation pressures continue.

- “Uncertainty requires vigilance” and “the SNB will take care to maintain price stability,” he said at an event in Baden, northwest of Zurich. “We see the risk of second-round effects.”

- On the contrary, ECB rate hike pricing has pulled back sharply on the back of MNI's Policy piece which in part cites ECB sources downplaying Dutch central bank chief Knot's call for a possible 50bp hike, weighing on the single currency.

- EUR/CHF fell from levels just shy of 1.0500 all the way to 1.0332, the lowest level in two weeks. Firm support does not come into play until 1.0190.

- Aussie employment data highlights the APAC session on Thursday ahead of the Annual Budget release from New Zealand. The latest ECB Monetary Policy Meeting Accounts are then due before US Philly Fed and Existing Home Sales figures.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/05/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 19/05/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/05/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 19/05/2022 | 1130/1330 |  | EU | ECB April meeting Accounts | |

| 19/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 19/05/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 19/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 19/05/2022 | 1230/1430 |  | EU | ECB de Guindos Keynote Address at Harvard | |

| 19/05/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 19/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 19/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/05/2022 | 2000/1600 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.