-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI ASIA OPEN: May Minutes: No Discussion Larger Rate Hikes

EXECUTIVE SUMMARY

- MNI: Restrictive Policy May Become Appropriate--Fed Minutes

- MNI: FED MAY MINUTES SHOW NO DISCUSSION OF LARGER RATE HIKES

- MNI: MOST OFFICIALS SAY 50BP APPROPRIATE NEXT COUPLE MEETINGS

- MNI: Kansas City Fed President George To Retire In Jan

US

FED: Federal Reserve officials think monetary policy may have to become restrictive in order to rein in inflation that has surged far above policymakers' worst fears, as they agreed unanimously to raise interest rates by 50 basis points at their May meeting, minutes released Wednesday showed.

- Many -- but not all -- FOMC participants thought additional rate hikes of the same magnitude would be warranted in the next couple of meetings. There was no discussion of larger increases and widespread agreement on the decision to begin shrinking the USD9 trillion balance sheet.

- "A restrictive policy stance may well become appropriate depending on the evolving economic outlook and the risks to the outlook," the minutes said, highlighting that officials saw upside risk to inflation.

FED: Federal Reserve Bank of Kansas City President Esther George said Wednesday she plans to retire in January coming, the latest in a string of personnel changes on the FOMC this year as officials wage an aggressive fight against inflation.

- George has served at the Kansas City Fed for 40 years and is subject to a mandatory retirement rule. She has a leadership role in developing FedNow, the Fed's instant payments system, and hosts the FOMC's Jackson Hole conference every August.

- The Fed swore in new governors Philip Jefferson and Lisa Cook this month, and the Chicago, Boston and Dallas Fed banks are also seeing turnover at the top.

US TSYS: Relief Rally, Nothing In Minutes That Hasn't Already Been Said

Risk-on gained traction after some initial two-way trade -- Tsys holding narrow range with 2s and 10s outperforming while stocks posted new session highs -- relieved after the minutes showed no discussion of larger rate hikes.

- "A restrictive policy stance may well become appropriate depending on the evolving economic outlook and the risks to the outlook," the minutes said, highlighting that officials saw upside risk to inflation.

- Several participants also noted the potential for "unanticipated effects on financial market conditions" related to the asset-runoff process.

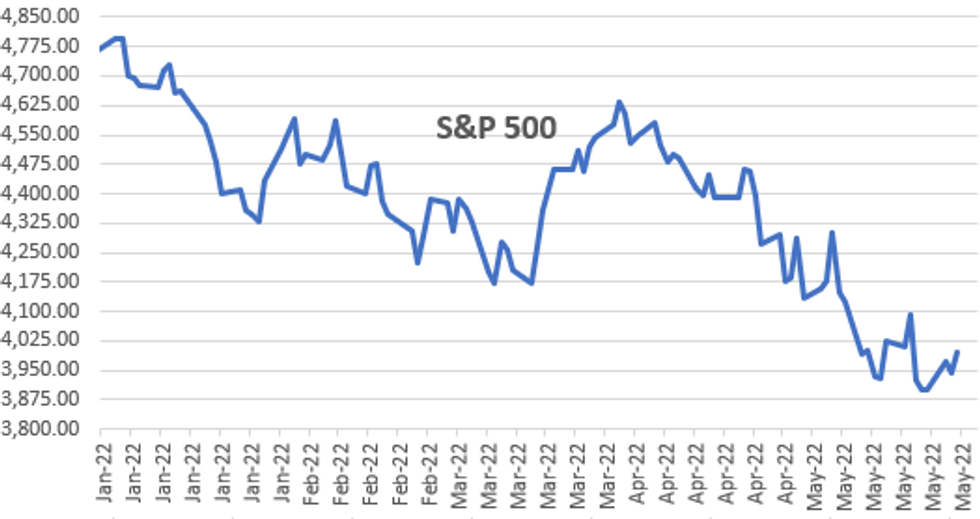

- After some initial two-way trade, SPX eminis extended session highs after the FI close, ESM2 climbed to 3997.25 high.

- Earlier, Tsy futures holding modest gains in 2s-10s, after $48B 5Y note auction (91282CET4) tails slightly: 2.736% high yield vs. 2.732% WI; 2.44x bid-to-cover vs. 2.41x last month.

- Heavy volumes again as Jun/Sep roll neared 75% completion, both FVM and TYM traded over 3M contracts after the bell more than half of which tied to rolling to Sep that takes lead position on May 31.

- Thursday focus: Wkly Claims (215k vs. 218k prior), GDP (8.0%), PCE (2.8%), and $42B 7Y Tsy note sale. Fed speak add: SF Fed Daly interview on CNBC's "The Exchange" at 1300ET.

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE -1.2% SA THRU MAY 20 WK

- US MBA: REFIS -4% SA; PURCH INDEX +0.2% SA THRU MAY 20 WK

- US MBA: UNADJ PURCHASE INDEX -16% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 5.46% VS 5.49% PREV

- Core shipments meanwhile were broadly in line as they firmed to +0.8% M/M from +0.2% M/M.

- Mixed reaction Tsys. The 2Y is holding circa 1bp lower since the release for -2bps on the day, the reaction potentially amplified by coming after yesterday's soft US data. Long-end yields meanwhile fell 2bps before more than reversing that and now sitting almost 2bps higher for -1bps on the day.

- On May 25, the GDPNow model estimate for real GDP growth in the second quarter of 2022 is 1.8 percent, down from 2.4 percent on May 18.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 270.03 points (0.85%) at 32199.35

- S&P E-Mini Future up 49.5 points (1.26%) at 3990.5

- Nasdaq up 222.8 points (2%) at 11487.66

- US 10-Yr yield is down 0.2 bps at 2.7488%

- US Jun 10Y are up 6.5/32 at 120-18.5

- EURUSD down 0.0049 (-0.46%) at 1.0687

- USDJPY up 0.46 (0.36%) at 127.29

- WTI Crude Oil (front-month) up $0.93 (0.85%) at $110.72

- Gold is down $11.61 (-0.62%) at $1854.83

- EuroStoxx 50 up 29.54 points (0.81%) at 3677.1

- FTSE 100 up 38.4 points (0.51%) at 7522.75

- German DAX up 88.18 points (0.63%) at 14007.93

- French CAC 40 up 45.5 points (0.73%) at 6298.64

US TSY FUTURES CLOSE

- 3M10Y +0.331, 167.371 (L: 163.999 / H: 169.314)

- 2Y10Y -2.697, 23.869 (L: 21.365 / H: 27.167)

- 2Y30Y -2.114, 46.061 (L: 42.309 / H: 48.837)

- 5Y30Y +2.447, 24.65 (L: 20.052 / H: 25.854)

- Current futures levels:

- Jun 2Y up 1.125/32 at 106-0.125 (L: 105-30.125 / H: 106-01.875)

- Jun 5Y up 6.25/32 at 113-24.75 (L: 113-17 / H: 113-29)

- Jun 10Y up 6.5/32 at 120-18.5 (L: 120-09.5 / H: 120-26)

- Jun 30Y down 3/32 at 141-26 (L: 141-15 / H: 142-22)

- Jun Ultra 30Y up 1-2/32 at 159-12 (L: 158-00 / H: 160-01)

US TSY FUTURES: Jun Futures Roll Update, Near 75% Complete

Late update -- over 70% complete ahead May 31 First Notice date. Usually spds hold to a 1-2 point intra-day range but note the huge range in 30Y ultra bond from -3.0 to +20.5 -- this tends to occur late in the roll cycle on the less liquid Ultra-bond futures, occurring to a lesser degree over the past six rolls. Current markets:

- TUM/TUU 1,113,100 from 11.12 to 12.50, 12.38 last, 66% complete

- FVM/FVU 2,327,800 from 12.25 to 13.5, 13.25 last, 72% complete

- TYM/TYU 1,958,800 from 11.5 to 13.00, 11.75 last, 70% complete

- UXYM/UXYU 502,300 from 1-03.5 to 1-07, 1-04.5 last, 76% complete

- USM/USU 406,300 from 30.0 to 31.0, 30.75 last, 72% complete

- WNM/WNU 481,400 from -3.0 to 20.5, +13.5 last, 80% complete

Reminder, Jun futures won't expire until next month: 10s, 30s and Ultras on June 21, June 30 for 2s and 5s.

US 10Y FUTURES TECH: (M2) Eyeing The 50-Day EMA

- RES 4: 123-04 High Mar 31

- RES 3: 122-12+ High Apr 4

- RES 2: 121-09 High Apr 14

- RES 1: 120-28+ 50-day EMA

- PRICE: 120-18+ @ 10:20 BST May 25

- SUP 1: 119-15+ Low May 23

- SUP 2: 118-16/117-08+ Low May 18 / Low May 9 and a bear trigger

- SUP 3: 117-07 2.0% 10-dma envelope

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries traded higher Tuesday. The contract has breached resistance at 120-10, May 19 high. This improves the current short-term bullish condition and signals scope for a continuation higher. The focus is on 120-28+, the 50-day EMA and a key near-term resistance. Short-term gains are still considered corrective. Key support and the bear trigger is 117-08+, May 9 low. Initial firm support has been defined at 118-16, May 18 low.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.008 at 98.218

- Sep 22 +0.010 at 97.475

- Dec 22 steady at 96.980

- Mar 23 +0.010 at 96.850

- Red Pack (Jun 23-Mar 24) -0.005 to +0.010

- Green Pack (Jun 24-Mar 25) +0.005 to +0.025

- Blue Pack (Jun 25-Mar 26) +0.025 to +0.025

- Gold Pack (Jun 26-Mar 27) +0.005 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00443 to 0.81943% (-0.00528/wk)

- 1M +0.00643 to 1.02300% (+0.04943/wk)

- 3M +0.02186 to 1.55286% (+0.04643/wk) * / **

- 6M -0.01685 to 2.05429% (-0.02242/wk)

- 12M -0.00486 to 2.68400% (-0.04600/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2Y high: 1.53100% on 5/24/22

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.83% volume: $82B

- Daily Overnight Bank Funding Rate: 0.82% volume: $253B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.78%, $968B

- Broad General Collateral Rate (BGCR): 0.79%, $366B

- Tri-Party General Collateral Rate (TGCR): 0.79%, $350B

- (rate, volume levels reflect prior session)

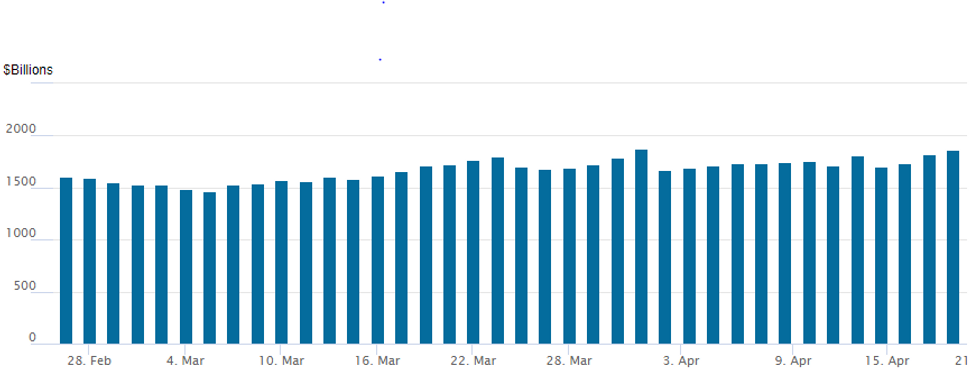

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,995.750B w/ 924counterparties vs. 1,987.865B prior session, compares to Monday's record $2,044.658B.

EGBs-GILTS CASH CLOSE: ECB Hike Pricing Softens Despite 50bp Speculation

Having easily outperformed Tuesday, Gilts underperformed Bunds Wednesday as European curves steepened.

- Long-end yields moved in tandem with equities, falling to session lows mid-afternoon before rebounding late; but short-end yields maintained their drop.

- Monday's Lagarde blog post implying 25bp hikes in Jul and Sep was one of the main points of discussion; Knot said he "fully support[ed] everything that is in the blog" but went on to say that hiking 50bp in July is also compatible with the blog post.

- VP de Guindos didn't appear to totally dismiss a hike bigger than 25bp, stressing data dependence, while Panetta said normalisation should be done "gradually". In the end, ECB hike pricing moderated slightly on the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 4.1bps at 0.34%, 5-Yr is down 3.1bps at 0.655%, 10-Yr is down 1.5bps at 0.952%, and 30-Yr is up 2.9bps at 1.197%.

- UK: The 2-Yr yield is down 2.3bps at 1.43%, 5-Yr is down 0.6bps at 1.56%, 10-Yr is up 2.3bps at 1.91%, and 30-Yr is up 2.9bps at 2.16%.

- Italian BTP spread down 1.2bps at 200.1bps / Spanish down 1.1bps at 110.9bps

FOREX: USD Trades On Surer Footing, DXY Rises 0.35%

- The US Dollar trended weaker in early Wednesday trade, taking its cue from risk sentiment which was tilted to the downside.

- Despite a recovery in major equity benchmarks, the greenback failed to retreat ahead of the FOMC minutes.

- Following the minutes the USD took a very brief initial hit on the release as it was noted that there was no active discussion of rate increases larger than 50bps. However, the pop lower for the greenback was short-lived and the DXY looks set to post a 0.35% intra-day advance.

- CNH (-0.82%) is the weakest performer following comments from Chinese Premier Li Keqiang. The yuan fell as his comments warned the world's second-largest economy is doing worse in some ways than when the pandemic first hit in 2020. Furthermore, Beijing recorded more Covid cases and the nearby port city of Tianjin locked down a city-center district prompting the offshore yuan to break a four-session advance.

- EURUSD snapped its recent strength as the single currency fell back below $1.07. As noted, there is technical scope for further potential strength towards channel top resistance intersecting at 1.0840. Initial support remains at 1.0533, May 20 low.

- Potential further comments from RBNZ Governor Orr overnight, who is due to testify before the Finance and Expenditure Select Committee, in Wellington.

- Some European holidays in observance of Ascension Day on Thursday. Canadian March retail sales data is scheduled as well as the second release of Q1 US GDP. US April Pending home sales rounds off Thursday’s docket.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2022 | 0130/1130 | * |  | AU | Private New Capex and Expected Expenditure |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 26/05/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 26/05/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 26/05/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/05/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 26/05/2022 | 1400/1000 |  | MX | Mexican central Bank policy meet minutes | |

| 26/05/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 26/05/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/05/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/05/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/05/2022 | 1600/1200 |  | US | Fed Vice Chair Lael Brainard | |

| 26/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.