-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS Treasury Auction Calendar Through April 2025

MNI ASIA OPEN: Abbreviated Week Opener

EXECUTIVE SUMMARY

- MNI: Bullard Says Fed's Credibility Is Stretched By Inflation

- MNI INTERVIEW: UK Labour Supply Hit Likely To Persist

- VILLEROY: NEW ECB TOOL’S INTERVENTIONS SHOULD BE STERILIZED (BBG)

- VILLEROY: STILL ‘OPEN ISSUES’ ON ECB’S ANTI-FRAGMENTATION TOOL (BBG)

US

FED: The Federal Reserve's credibility is being tested by inflation and policy makers have taken "important first steps" to settle things down, though a risk of expectations becoming unstable remains, St. Louis President James Bullard said Monday.

- "Inflation in the U.S. is far above target and is at levels last seen in the 1970s and early 1980s. This situation is risking the Fed’s credibility with respect to its inflation target," Bullard's slide presentation to the AXA-Barcelona School of Economics said. The remarks titled "The First Steps toward Disinflation" didn't weigh in on if another 75bp rate increase is needed at the next decision.

- "U.S. inflation expectations could become unmoored without credible Fed action," he said, and "the Fed has reacted by taking important first steps to return inflation to the 2% target." For more see MNI Policy man wire at 1245ET.

UK

BOE: An exodus of older workers from the UK labour force is likely to persist, tightening supply side constraints for an economy already facing high inflation and complicating Bank of England monetary policy, associate director at the Institute for Fiscal Studies Jonathan Cribb told MNI.

- The UK workforce has shrunk by 450,000 since 2019, the last year before the start of the Covid pandemic, a fall described by BOE Governor Andrew Bailey as very large by historical standards, and an study IFS of survey data found that much of this shift was driven by early retirement. Past evidence shows that those who retire are unlikely to return to work, a troubling finding for the Treasury which faces a permanent loss of tax revenue and for the Bank of England as it considers how to respond to a tight labour market and surging inflation. For more see MNI Policy man wire at 1151ET.

US TSYS: Market Roundup: StL Fed Bullard in Barcelona

US Tsy futures finished lower on exceptionally light volumes Monday: TYU2 only 45k since after the open to 210k at the moment, GLOBEX electronic trade suspended, will re-open at 1800ET.- No economic data or significant headline risk as cash rates and stock exchanges closed in observance of Juneteenth holiday.

- StL Fed Pres Bullard is discussing interest rates and inflation to the AXA-Barcelona School of Economics at the moment, Q&A forthcoming. "Inflation in the U.S. is far above target and is at levels last seen in the 1970s and early 1980s. This situation is risking the Fed’s credibility with respect to its inflation target," Bullard said, adding "U.S. inflation expectations could become unmoored without credible Fed action."

- US 30Y Bond futures have inched off midday lows, USU2 -18 at 134-03.

- Otherwise, no obvious headline driver weighing on rates, hard to call the move risk-on though SPX emini equity futures holding near session highs, ESU2 +40.0 3715.75.

MARKETS SNAPSHOT

Key market levels after Globex close:

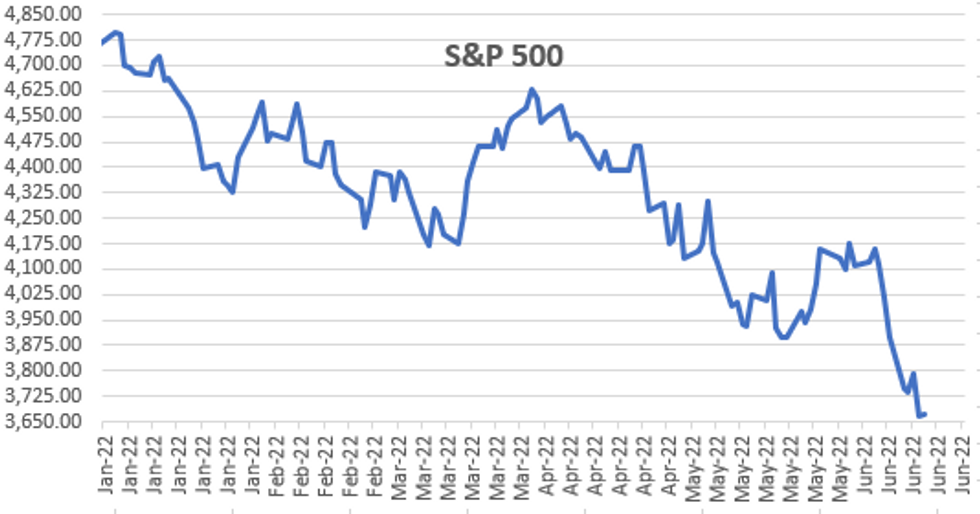

- S&P E-Mini Future up 40.25 points (1.1%) at 3716

- US Sep 10Y are down 8.5/32 at 115-29.5

- EURUSD up 0.0014 (0.13%) at 1.0511

- USDJPY up 0.06 (0.04%) at 135.09

- WTI Crude Oil (front-month) up $0.61 (0.56%) at $110.17

- Gold is down $2.94 (-0.16%) at $1836.24

- EuroStoxx 50 up 31.37 points (0.91%) at 3469.83

- FTSE 100 up 105.56 points (1.5%) at 7121.81

- German DAX up 139.34 points (1.06%) at 13265.6

- French CAC 40 up 37.44 points (0.64%) at 5920.09

US TSY FUTURES CLOSE

- Sep 2Y down 4.625/32 at 104-5.875 (L: 104-05.75 / H: 104-09.75)

- Sep 5Y down 6.5/32 at 110-8.75 (L: 110-05.25 / H: 110-16.75)

- Sep 10Y down 8.5/32 at 115-29.5 (L: 115-24.5 / H: 116-10.5)

- Sep 30Y down 18/32 at 134-3 (L: 133-29 / H: 135-00)

- Sep Ultra 30Y down 1-12/32 at 148-7 (L: 147-27 / H: 150-03)

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.020 at 96.625

- Dec 22 -0.070 at 95.980

- Mar 23 -0.090 at 95.920

- Jun 23 -0.085 at 95.985

- Red Pack (Sep 23-Jun 24) -0.075 to -0.05

- Green Pack (Sep 24-Jun 25) -0.045 to -0.03

- Blue Pack (Sep 25-Jun 26) -0.035 to -0.025

- Gold Pack (Sep 26-Jun 27) -0.03 to -0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N no settle, finished 1.56743% last Friday (+0.74814 total last wk)

- 1M +0.01400 to 1.62629% (+0.33015 total last wk)

- 3M +0.02757 to 2.12343% (+0.35115 total last wk) * / **

- 6M +0.03243 to 2.81286% (+0.46886 total last wk)

- 12M +0.03471 to 3.62057% (+0.58043 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.09586% on 6/17/22

EGBs-GILTS CASH CLOSE: 2Y Gilt Yields At Post-2008 Highs

Gilts underperformed Bunds Monday in a relatively light trading session (US markets observing a holiday) punctuated by central bank speakers.

- BoE's Mann told an MNI Connect event that she voted for a 50bp hike at the last meeting in part to avert further currency weakness further boosting imported inflation.

- 2Y Gilt yields hit post-2008 highs.

- ECB's Lagarde highlighted that wages were beginning to rise.

- OAT spreads widened following President Macron's failure to secure a parliamentary majority in Sunday's elections, though remain off June's highs.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.9bps at 1.153%, 5-Yr is up 9.3bps at 1.55%, 10-Yr is up 8.8bps at 1.749%, and 30-Yr is up 9bps at 1.941%.

- UK: The 2-Yr yield is up 9.6bps at 2.3%, 5-Yr is up 10.2bps at 2.309%, 10-Yr is up 10.6bps at 2.604%, and 30-Yr is up 12.9bps at 2.796%.

- Italian BTP spread up 1.8bps at 195.5bps / Greek down 9.8bps at 227.2bps

FOREX: US Holiday Prompts Narrow FX Ranges, DXY Marginally Lower

- The greenback tracked marginally lower during the APAC session on Monday and has maintained the slightly softer price action to start the week. The USD index remains around -0.25% below NY closing levels from last Friday, residing around 104.40.

- Firmer equity futures are appearing the main catalyst for this dip, boosting the likes of AUD, NZD and CAD which look set to post +0.3% gains for the session.

- Strong leads from China stocks regionally bolstered the Chinese Yuan, which also outperforms to start the week.

- As expected, global markets have remained very quiet amid the US market closures and FX ranges throughout NY trade have echoed this narrative. EURUSD and USDJPY remain very close to unchanged with the latter’s trend conditions remaining bullish.

- The rebound from Thursday’s low suggests a recent USDJPY correction is over. The recent print above 135.00 maintains the positive price sequence of higher highs and higher lows. The focus is on a climb towards 136.04, a Fibonacci projection. Initial firm support is seen at Thursday’s low of 131.50, just below the 20-day EMA.

- Looking ahead, RBA Governor Lowe is due to speak about the economic outlook and monetary policy at an event co-hosted by the American Chamber of Commerce and Australia and New Zealand Banking Group, in Sydney. Q&A expected.

- Following this event, the RBA minutes from the June meeting are due for release.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 21/06/2022 | 0130/1130 |  | AU | RBA Minutes June Meeting | |

| 21/06/2022 | 0715/0815 |  | UK | BOE Pill at Institute of Accountants Economic Summit | |

| 21/06/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 21/06/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 21/06/2022 | 1215/1315 |  | UK | BOE Tenreyro Seminar at Goethe University | |

| 21/06/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 21/06/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 21/06/2022 | 1500/1100 |  | US | Richmond Fed's Tom Barkin | |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 21/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/06/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 21/06/2022 | 1930/1530 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.