-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Hike Fast Without Breaking Anything

EXECUTIVE SUMMARY

- MNI: Barkin Warns Recession Possible As Fed Hikes Quiet Demand

- MNI BRIEF: US Existing Home Sales Fall 3.4% To 5.41M In May

- MNI: Just One-Third of High US Inflation Is Demand: SF Fed

- MNI INTERVIEW-Canada Job Mkt May Get Even Hotter: Indeed Econ

- BARKIN: ANY DECISION ON WHETHER TO SELL MBS IS DOWN THE ROAD, Bbg

US

FED: U.S. economic strength could limit the length and depth of any recession as the Fed raises interest rates to dampen demand, Federal Reserve Bank of Richmond President Thomas Barkin said Tuesday.

- "I understand why some are forecasting a recession," he said in remarks prepared for a meeting of the Risk Management Association in Richmond, Va. "But the challenge in predicting a recession for tomorrow is the strength of the aggregate data today."

- "We’ve been scarred by our memories of the Great Recession and the Volcker recession, but it’s worth remembering that most other recessions aren’t that long or that deep," he added. For more see MNI Policy main wire at 1534ET.

US: U.S. existing home sales fell to a seasonally adjusted annual rate of 5.41 million in May, sinking 3.4% from a month earlier and down 8.6% from a year earlier, the National Association of Realtors said Tuesday.

- Rising mortgage rates and sustained high inflation have prevented many consumers from purchasing a home, NAR chief economist Lawrence Yun told reporters. The median existing home price surpassed $400,000 for the first time, up 14.8% from a year ago.

- The inventory of unsold existing homes rose to 1.16 million by the end of May, or the equivalent of 2.6 months at the current monthly sales pace.

- Supply-side issues account for about half of elevated prices, with demand driving another third and the remainder coming from products not clearly tied to either, according to research by economist Adam Hale Shapiro.

- "The large impact of supply factors implies that inflationary pressures will not completely subside until labor shortages, production constraints, and shipping delays are resolved. Although supply disruptions are widely expected to ease this year, this outcome is highly uncertain," he wrote in a paper for the SF Fed's "Economic Letter."

CANADA

CANADA: Canada's record-low unemployment rate could inch down further to provide an even bigger cushion against any hard landing in other parts of the economy, Indeed economist and former finance department researcher Brendon Bernard told MNI.

- Low layoff rates, a 70% jump in postings on the job service's Canadian site this year and faster wage gains indicate momentum as the economy faces a potential drag from higher central bank borrowing costs, he said.

- “We’re in a bit of an uncertain patch at this point in terms of the recovery, in terms of recession worries and some declines in stock markets,” Bernard said. “Momentum definitely has cooled a bit over the last few weeks, but nothing that really reverses the huge surge in job postings.” For more see MNI Policy main wire at 0840ET.

US TSYS: Tsy Yields Climb Ahead Fed Chair Powell Testimony Wed

US Tsy yields see-saw higher upon return from Juneteenth holiday Tuesday, but scaled back moves well after the close: 30YY off morning high of 3.3922% at 3.3496% (+.0701) w/ futures off late session lows (Block 5Y buy +7,603 FVU2 at 110-12.25 helped get the ball rolling).

- Wide range for steeper yield curves, still well off pre-FOMC levels: 2s10s +4.775 at 8.641 vs. 11.154 high, 5s10s still inverted at -8.448 (3.525) but well off early low (-12.223).

- Limited impact from data: Existing Home Sales for May in-line: -3.4% TO 5.41M SAAR; Chicago Fed National Activity Index 0.01 vs. 0.47 expected, 0.4 prior. Attention turns to Richmond Fed Barkin as he takes part in virtual moderated Q&A session w/ NABE at the top of the hour: "need to raise rates fast .. without breaking anything".

- "I understand why some are forecasting a recession," he said in remarks prepared for a meeting of the Risk Management Association in Richmond, Va. "But the challenge in predicting a recession for tomorrow is the strength of the aggregate data today."

- Focus on Fed Chair Powell semi-annual Senate panel testimony early Wednesday (0930ET) followed by Barkin again, Chicago Fed Evans and Philly Fed Harker.

OVERNIGHT DATA

- US JUN PHILADELPHIA FED NONMFG INDEX 4.6

- CHICAGO FED NATIONAL ACTIVITY INDEX AT 0.01 VS 0.4 PRIOR (0.47 expected)

- US MAY EXISTING HOME SALES -3.4% TO 5.41M SAAR

- US MAY MEDIAN EXISTING HOME PRICE RECORD $407,600, +14.8% YOY

- NAR: TOTAL INVENTORY +12.6% MOM TO 1.16M UNITS, 2.6-MONTH SUPPLY

- CANADIAN APR RETAIL SALES +0.9%; SALES EX-AUTOS/PARTS +1.3%

- CANADA APR RETAIL SALES EX-AUTOS/PARTS-GASOLINE +1.0%

MARKETS SNAPSHOT

Key late session market levels:

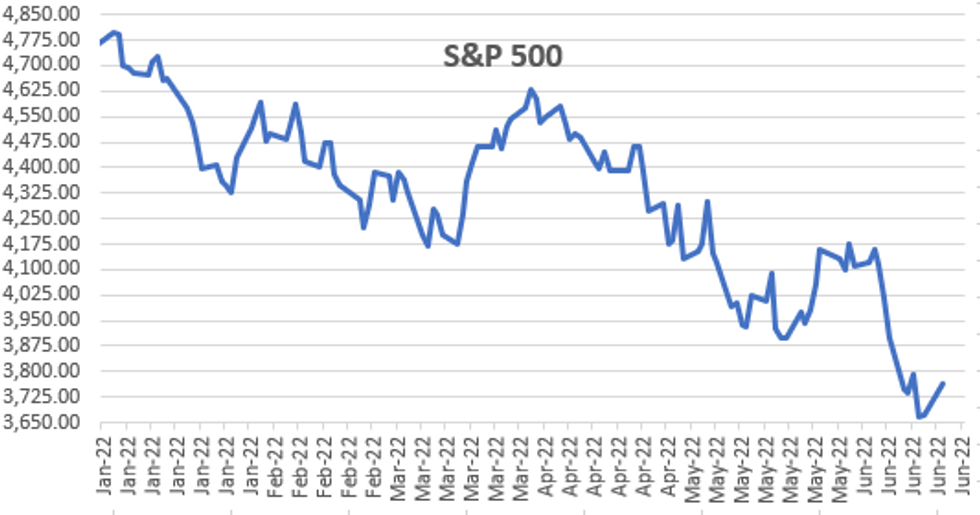

- DJIA up 643.39 points (2.15%) at 30532.17

- S&P E-Mini Future up 90.25 points (2.46%) at 3765

- Nasdaq up 271 points (2.5%) at 11069.3

- US 10-Yr yield is up 7.6 bps at 3.3015%

- US Sep 10Y are down 11.5/32 at 115-26.5

- EURUSD up 0.0019 (0.18%) at 1.053

- USDJPY up 1.59 (1.18%) at 136.65

- WTI Crude Oil (front-month) up $1.09 (0.99%) at $110.65

- Gold is down $7.92 (-0.43%) at $1830.63

- EuroStoxx 50 up 24.17 points (0.7%) at 3494

- FTSE 100 up 30.24 points (0.42%) at 7152.05

- German DAX up 26.8 points (0.2%) at 13292.4

- French CAC 40 up 44.57 points (0.75%) at 5964.66

US TSY FUTURES CLOSE

- 3M10Y +14.749, 173.446 (L: 162.76 / H: 175.099)

- 2Y10Y +6.234, 10.1 (L: 2.485 / H: 11.154)

- 2Y30Y +8.58, 17.83 (L: 8.071 / H: 19.33)

- 5Y30Y +6.286, -0.304 (L: -6.904 / H: 1.289)

- Current futures levels:

- Sep 2Y down 0.25/32 at 104-10.25 (L: 104-04.75 / H: 104-10.875)

- Sep 5Y down 4/32 at 110-11.25 (L: 110-04.25 / H: 110-16.75)

- Sep 10Y down 11.5/32 at 115-26.5 (L: 115-22.5 / H: 116-10.5)

- Sep 30Y down 1-04/32 at 133-17 (L: 133-09 / H: 135-00)

- Sep Ultra 30Y down 2-09/32 at 147-12 (L: 146-29 / H: 150-03)

US 10Y FUTURES TECH: (U2) Trend Signals Still Point South

- RES 4: 119-00 50-day EMA

- RES 3: 118-06 High Jun 10

- RES 2: 117-12 20-day EMA

- RES 1: 116-21+ 38.2% of the May 26 - Jun 14 range

- PRICE: 115-31 @ 15:34 BST Jun 21

- SUP 1: 114-07+ Low Jun 14 and the bear trigger

- SUP 2: 114-00 Round number support

- SUP 3: 113-19 Low Jun 19, 2009 (cont)

- SUP 4: 112-27+ 1.236 proj of the Mar 31 - May 9 - 26 price swing

Despite the recovery from last week’s low of 114-07+, the trend needle in Treasuries still points south. Last week’s break of key support at 116-21, May 9 low, confirmed a resumption of the primary downtrend and maintains the bearish price sequence of lower lows and lower highs. The move lower opens 114-00 next. Firm resistance is seen at 117-12, the 20-day EMA. A stronger bounce would be considered corrective.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.025 at 96.620

- Dec 22 -0.020 at 96.030

- Mar 23 -0.015 at 95.995

- Jun 23 +0.025 at 96.095

- Red Pack (Sep 23-Jun 24) +0.015 to +0.030

- Green Pack (Sep 24-Jun 25) -0.015 to +0.010

- Blue Pack (Sep 25-Jun 26) -0.07 to -0.03

- Gold Pack (Sep 26-Jun 27) -0.095 to -0.08

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00757 to 1.57500% (+0.00757/wk)

- 1M +0.01528 to 1.64157% (+0.02928/wk)

- 3M +0.03100 to 2.15443% (+0.05857/wk) * / **

- 6M +0.02900 to 2.84186% (+0.06143/wk)

- 12M +0.00486 to 3.62543% (+0.03957/wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.15443% on 6/22/22

- Daily Effective Fed Funds Rate: 1.58% volume: $84B

- Daily Overnight Bank Funding Rate: 1.57% volume: $243B

- Secured Overnight Financing Rate (SOFR): 1.45%, $923B

- Broad General Collateral Rate (BGCR): 1.46%, $365B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $352B

- (rate, volume levels reflect prior session)

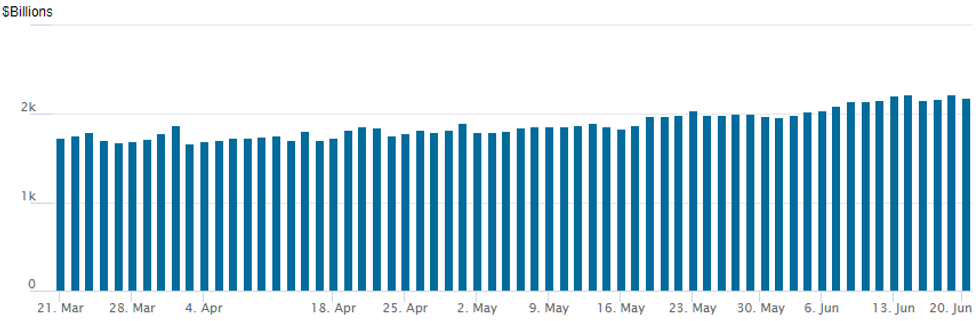

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes from last Friday's record high of $2,229.279B to $2,188.627 w/ 97 counterparties currently.

PIPELINE: $4B NextEra Energy, $3B KLA Corp Launched

- Date $MM Issuer (Priced *, Launch #)

- 06/21 $4B #NextEra Energy $750M 2Y +100, $1B 3Y +110, $1.25B 5Y +125, $1B 10Y +170

- 06/21 $3B #KLA Corp $1B 10Y +135, $1.2B 30Y +160, $800M 40Y +185

- 06/21 $Benchmark Hanwha Energy 3Y Green +87.5

- Rolled to Wednesday:

- 06/22 $Benchmark PSP Capital 5Y SOFR+58a

- 06/22 $1B Kommuninvest WNG 1.5Y SOFR

- 06/22 $Benchmark AIIB 3Y SOFR+38a

- 06/22 $Benchmark IADB 2Y SOFR+8a

EGBs-GILTS CASH CLOSE: Supply Pushes Long-End Yields Higher

European curves bear steepened Tuesday, with periphery EGBs outperforming as speculation continued over an ECB anti-fragmentation tool.

- 50Y Gilt supply via syndication helped Gilts underperform with curve steepening. 30Y yields rose to post-2014 highs just shy of 2.9% at one point.

- Likewise long-end green NGEU (and German 2038 Bund sale Weds) underpinned a rise in core/semicore EGB yields.

- Early comments by ECB's Rehn that the central bank was "firmly committed" to contain "unwarranted fragmentation" helped periphery spreads continue compressing.

- GGBs outperformed with spreads over 10Y bunds down nearly 10bp; BTP spreads closed at the tightest since May 26th.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 0.2bps at 1.155%, 5-Yr is up 0.2bps at 1.552%, 10-Yr is up 2.2bps at 1.771%, and 30-Yr is up 3.4bps at 1.975%.

- UK: The 2-Yr yield is up 1.6bps at 2.316%, 5-Yr is up 3.1bps at 2.34%, 10-Yr is up 5bps at 2.654%, and 30-Yr is up 7.5bps at 2.871%.

- Italian BTP spread down 2.8bps at 192.7bps / Greek down 9.8bps at 217.4bps

FOREX: Greenback Recovers Early Declines, USDJPY Trend Remains North

- A more positive tilt to risk sentiment and bolstered global equity indices prompted further significant pressure on the Japanese Yen on Tuesday. USDJPY’s firm bounce following the BOJ meeting last Friday has extended and the pair’s trend needle continues to point North.

- Cycle highs at Y135.59 have been broken momentum buying through the break level has seen USDJPY print as high as 136.45, now residing at its highest level since 1998. The pair remains in close proximity of the day’s best levels as we approach the APAC crossover. With a number of resistance points being breached, the next focus technically will be on 137.30, the 1.50 Fibonacci projection of the Feb 24 - Mar 28 - 31 price swing.

- Naturally cross/JPY has seen some significant gains, with the likes of AUDJPY and CADJPY up close to 1.5%, capitalising on the improved risk environment.

- Early risk on also placed the US dollar on the backfoot, with the DXY trading down roughly half a percent approaching the US open. However, a slow grinding recovery sees the Index now trading at close to unchanged levels for the session.

- The better bid greenback weighed on a previously perky Euro, which saw EURUSD fall from a 1.0582 intra-day peak back down to around 1.0530/40 as of writing.

- NZD shows relative underperformance on the back of a quarterly Westpac Survey showing that consumer confidence in New Zealand tumbled to a record low. CAD (+0.43%) outperforms following a decent set of April retail sales data that came in above estimates, underpinning the loonie.

- Coming up during Wednesday’s APAC session will be NZ trade data as well as the BOJ minutes from the June meeting. Focus will then turn to CPI data from both the UK and Canada before Fed Chair Jerome Powell is due to testify on the Semi-Annual Monetary Policy Report before the Senate Banking Committee.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 22/06/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 22/06/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 22/06/2022 | 0700/0900 |  | EU | ECB de Guindos Q&A at Universidad Internacional Menendez Pelayo | |

| 22/06/2022 | 0735/0935 |  | EU | ECB Elderson Speech on Climate & Q&A at Frankfurt School of Finance | |

| 22/06/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 22/06/2022 | 0840/0940 |  | UK | BOE Cunliffe Panels Point Zero Forum | |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.