-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Pending Home Sales Better Than Expected

EXECUTIVE SUMMARY

- NATO: Stoltenberg Convenes Special Session To Address Turkish Security Concerns

- MNI BRIEF: KC Fed To Update On Search For Successor To George

- US: 5 Republicans Who Voted For Jan 6 Commission Face Primaries Tomorrow

- SECURITY: US To Indirectly Participate In Iran Nuclear Talks

US

US: The next tranche of midterm primaries take place in Colorado, Illinois, New York, Oklahoma, and Utah tomorrow.

- The key theme of the day will be the role of the January 6 committee in shaping the future of the GOP. There will be five of the 35 House Republicans who voted for the establishment of the January 6 Commission on the ballot.

- Rep. Blake D. Moore (R-UT), Rep. Stephanie Bice (OK), Rep. John Curtis (R-UT), Rep. Rodney Davis (R-IL), and Rep Michael Guest (R-MI) will have a runoff with Michael Cassidy.

- Cassidy said in a campaign ad: "Tuesday's Republican primary isn't just a choice between Congressman Guest and myself, it's your chance to say 'no' to the Jan. 6 commission that Guest voted for."

- The event will be held on Wednesday, July 13, at 6:15 pm ET and panelists will include Mara Griego-Raby, who chairs the presidential search committee and Kansas City Fed board chair Edmond Johnson. The town hall will be livestreamed: http://youtube.com/kansascityfed.

- Wires reporting less optimism of a successful resolution of talks than before talks collapsed earlier this year.

- Joseph Haboush of Al Arabiya: "[US] State Department official confirms indirect talks w/Iran to begin "in the Gulf this week." Official says US ready to immediately conclude and implement deal negotiated in Vienna. "But for that, Iran needs to decide to drop their additional demands that go beyond the JCPOA.""

- Wall Street Journal's Laurence Norman: "Now have my own confirmation of US-Iran indirect talks via EU in Doha starting tomorrow. Western sources very much downplaying expectations."

EUROPE

NATO: Secretary General Jens Stoltenberg is holding a joint press conference with Swedish Prime Minister Magdalena Andersson to announce new measures to appease Turkey ahead of the NATO summit in Madrid this week.

- Livestream here: https://www.youtube.com/watch?v=fAomwUHWSUU

- The NATO accession plans of Sweden and Finland are currently being blocked by Turkey over concerns that the two Nordic states are harbouring Kurdish terrorist elements.

- Stoltenberg says that he has convened a "special session" at the NATO summit to discuss counter-terrorism with a view to addressing Ankara's "legitimate security demands."

US TSYS: Weak 5Y Auction Spurs late Tsy Selling

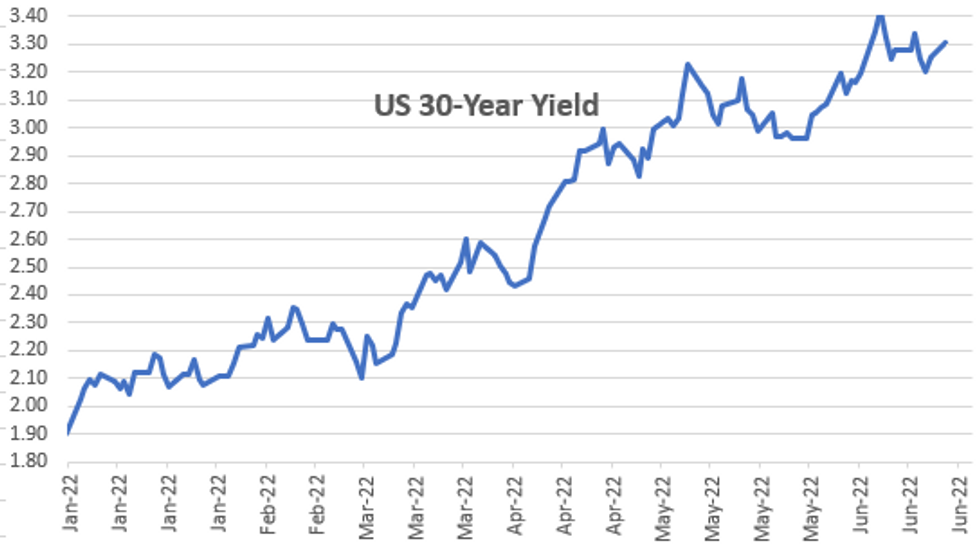

Rates trade weaker after the bell, near middle of session range, late block buying 5Y futures (+12,635 FVM2 111-03.25) helped yld curves finish steeper, but well off early highs: 2s10s +1.202 at 7.072%, 5s10s still inverted at -6.039. Average overall volumes expected to thin out ahead extended 4Th of July holiday weekend.

- Limited react to stronger than expected pending home sales +0.7% vs. -3.9%, YoY comes in weaker than the prior month at -12.0%, vs. -11.5% prior. Slight dip in rate futures after Durable New orders +0.7%, ex-trans: +0.7%.

- Stocks reversed early gains -- coincided with dip in crude at the time, WTI trades -1.56 at 106.06 a few minutes after extending high of 108.69 in early trade. WTI regained footing in second half tapping 110.44 high before slipping back to 109.50 (+1.88) after the FI close.

- Weak Tsy auctions, particularly 5s weighed on rates:

- Mildly weak 2Y sale, Tsy futures holding near middle of lower session range (curves steeper) after $46B 2Y note auction (91282CEX5) tails: 3.084% high yield vs. 3.077% WI; 2.51x bid-to-cover vs. last moth's 2.61x.

- Tsy futures sell-off after weak $47B 5Y note auction's (91282CEW7) tail: 3.271% high yield vs. 3.237% WI; 2.28x bid-to-cover vs. 2.44x last month.

OVERNIGHT DATA

- US MAY DURABLE NEW ORDERS +0.7%; EX-TRANSPORTATION +0.7%

- US APR DURABLE GDS NEW ORDERS REV TO +0.4%

- US MAY NONDEF CAP GDS ORDERS EX-AIR +0.5% V APR +0.3%

- US MAY PENDING HOME SALES RISE 0.7% M/M; EST. DOWN 4%

- US MAY PENDING HOME SALES FALL 12.0% FROM PREVIOUS YEAR

- DALLAS FED MFG INDEX OF GENERAL BUSINESS ACTIVITY -17.7 IN JUNE VS -7.3 IN MAY

- DALLAS FED MFG OUTPUT INDEX 2.3 IN JUNE VS 18.8 IN MAY

- Atlanta Fed GDPNow model estimate for real GDP growth in the second quarter of 2022 is 0.3 percent, up from 0.0 percent on June 16.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 81.6 points (-0.26%) at 31417.07

- S&P E-Mini Future down 13.5 points (-0.34%) at 3902.25

- Nasdaq down 83.2 points (-0.7%) at 11523.97

- US 10-Yr yield is up 6.6 bps at 3.196%

- US Sep 10Y are down 17.5/32 at 116-25.5

- EURUSD up 0.0032 (0.3%) at 1.0585

- USDJPY up 0.19 (0.14%) at 135.42

- WTI Crude Oil (front-month) up $1.75 (1.63%) at $109.35

- Gold is down $3.45 (-0.19%) at $1823.45

- EuroStoxx 50 up 5.71 points (0.16%) at 3538.88

- FTSE 100 up 49.51 points (0.69%) at 7258.32

- German DAX up 67.94 points (0.52%) at 13186.07

- French CAC 40 down 26.04 points (-0.43%) at 6047.31

US TSY FUTURES CLOSE

- 3M10Y +6.593, 150.365 (L: 142.717 / H: 152.697)

- 2Y10Y +1.39, 7.26 (L: 4.499 / H: 10.069)

- 2Y30Y -0.252, 18.502 (L: 15.815 / H: 23.521)

- 5Y30Y -1.57, 5.215 (L: 2.75 / H: 10.835)

- Current futures levels:

- Sep 2Y down 3/32 at 104-20.125 (L: 104-17.875 / H: 104-24)

- Sep 5Y down 11.5/32 at 111-2 (L: 110-29 / H: 111-14.75)

- Sep 10Y down 17.5/32 at 116-25.5 (L: 116-18.5 / H: 117-13)

- Sep 30Y down 25/32 at 135-08 (L: 134-25 / H: 136-06)

- Sep Ultra 30Y down 1-10/32 at 149-10 (L: 148-16 / H: 150-26)

US 10Y FUTURES TECH: (U2) Corrective Cycle Still In Play

- RES 4: 120-00 Round number resistance

- RES 3: 119-16+ High Jun 1

- RES 2: 119-03+ 76.4% retracement of the May 26 - Jun 14 bear leg

- RES 1: 118-08/22 High Jun 24 / 50-day EMA

- PRICE: 117-00 @ 1500ET Jun 27

- SUP 1: 116-25+ Low Jun 23

- SUP 2: 115-20/114-07+ Low Jun 17 / Low Jun 14 and bear trigger

- SUP 3: 114-00 Round number support

- SUP 4: 113-19 Low Jun 19, 2009 (cont)

Treasuries maintain a firmer short-term tone despite a minor retracement from last week’s high. Last Thursday’s gains resulted in a break of the 20-day EMA, suggesting potential for a continuation higher. The focus is on 118-22, the 50-day EMA. The primary trend remains down and recent gains are considered corrective. Initial firm support to watch is 115-20, the Jun 17 low. A break would signal the end of the correction and open 114-07+.

US EURODOLLAR FUTURES CLOSE

Sep 22 -0.025 at 96.725

Dec 22 -0.035 at 96.230

Mar 23 -0.055 at 96.215

Jun 23 -0.050 at 96.315

Red Pack (Sep 23-Jun 24) -0.08 to -0.055

Green Pack (Sep 24-Jun 25) -0.09 to -0.08

Blue Pack (Sep 25-Jun 26) -0.075 to -0.07

Gold Pack (Sep 26-Jun 27) -0.07 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00514 to 1.57100% (+0.00881 total last wk)

- 1M +0.01958 to 1.65229% (+0.02042 total last wk)

- 3M -0.00286 to 2.23157% (+0.13857 total last wk) * / **

- 6M -0.00443 to 2.86214% (+0.08714 total last wk)

- 12M +0.02729 to 3.57200% (-0.04115 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 2+Y high: 2.19729% on 6/23/22

- Daily Effective Fed Funds Rate: 1.58% volume: $91B

- Daily Overnight Bank Funding Rate: 1.57% volume: $256B

- Secured Overnight Financing Rate (SOFR): 1.46%, $926B

- Broad General Collateral Rate (BGCR): 1.46%, $367B

- Tri-Party General Collateral Rate (TGCR): 1.46%, $352B

- (rate, volume levels reflect prior session)

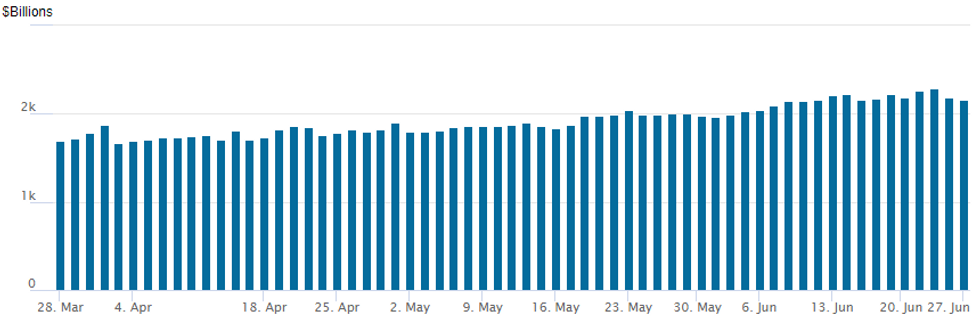

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,155.942B w/ 96 counterparties vs. $2,180.984B prior session. Compares to record high of $2,285.428B from Thursday June 23.

PIPELINE: $2.75B Toyota Motor Cr Leads Mon's Issuance

- Date $MM Issuer (Priced *, Launch #)

- 06/27 $2.75B #Toyota Motor Cr $650M 1.5Y SOFR+65, $1.3B 3Y +80, $800M 7Y +125

- 06/27 $1B #NatWest 6.25NC5.25 +227

- 06/27 $600M *NongHyup Bank $300M 3.5Y +90, $300M 5Y +110

- 06/27 $500M #MetLife 5Y +115

- Expected Tuesday:

- 06/28 $Benchmark AfDB (African Dev Bank) 3Y SOFR+25a

- 06/28 $Benchmark CDP Financial 3Y SOFR+42a

EGBs-GILTS CASH CLOSE: Yields Maintain Rise Despite Equity Fade

Core EGB and Gilt yields rose sharply to start the week.

- While initial bond weakness came alongside a morning rebound in equities, yields gave nothing back in the afternoon as stocks retraced and risk appetite faded.

- Short end / belly underperformed in Germany (Bobl yields in particular underperformed), while the UK curve more clearly bear steepened.

- Fairly minimal newsflow and fairly light volumes, with ECB speakers (incl Lagarde, Lane) due to speak in the next 24 hours.

- Periphery EGB spreads tightened for the most part, with 10Y BTPs coming back down through the 200bp mark vs Germany.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 9.2bps at 0.905%, 5-Yr is up 12.6bps at 1.289%, 10-Yr is up 10.5bps at 1.547%, and 30-Yr is up 6.1bps at 1.752%.

- UK: The 2-Yr yield is up 8.1bps at 2.013%, 5-Yr is up 8.6bps at 2.04%, 10-Yr is up 9.1bps at 2.393%, and 30-Yr is up 9.7bps at 2.644%.

- Italian BTP spread down 5bps at 197.1bps / Greek down 2.9bps at 230.9bps

FOREX: Euro Crosses Outperform, USD Index On Backfoot

- Early strength in equities underpinned a calmer outlook to currency markets on Monday and as a result, the greenback traded marginally softer to start the week. Despite global equity benchmarks paring these gains the USD Index remains -0.25% weaker and resides through last week's lows.

- Across G10, performance was mixed with the Euro shining above other majors. EURUSD briefly made a two-week high above 1.0605 but has since fallen back around 25 pips. The single currency strength is more notable in the crosses with EURAUD and EURNZD advancing around 0.7% and maintaining their upward trajectory throughout June.

- USDJPY printed just shy of 134.50 during the APAC session as within a summary of opinions from the BoJ's most recent monetary policy meeting, one member said the Bank should pay "due attention" to FX market developments. However, the early yen strength was gradually but firmly reversed throughout Europe and US trading hours, peaking at 135.55.

- USDJPY remains in an uptrend. The pair broke to new cycle highs last week, which confirmed a resumption of the primary uptrend. The move higher also maintains the bullish price sequence of higher highs and higher lows and has opened 136.88 next, the Oct 1998 high

- Turning to Tuesday, commentary is expected from ECB board members at the ECB Forum on Central Banking in Sintra. President Lagarde is due to give an introductory speech before multiple sessions are chaired by ECB Board Member Philip Lane.

- A very light day for data with US consumer confidence and Richmond manufacturing index headlining the calendar.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/06/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2022 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 28/06/2022 | 0830/1030 |  | EU | ECB Lane on Globalisation & Labour Markets at ECB Forum | |

| 28/06/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 28/06/2022 | 0930/1130 |  | EU | ECB Elderson on Energy Prices & Sources at ECB Forum | |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.