-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN:Hot CPI, Curve Inversions and 100Bp Hike Pricing

EXECUTIVE SUMMARY

- MNI INTERVIEW: Risk Inflation Stays High Longer -Fed's Garriga

- FED: Fed's Bostic Says Everything In Play For Future Policy Decisions

- MNI BRIEF: Sign Of Economy Slowing In Fed's Beige Book

- MNI BRIEF: US Budget Deficit Narrows to USD515B Through June

- Nomura Calls for 100bp Jul Hike

- MNI INTERVIEW: Another 100BP Canada Hike Possible- Ex Adviser

US

FED: The risk that U.S. inflation continues to stay elevated is rising amid a worsening global energy crisis and fears that Shanghai will be forced into another Covid lockdown, Federal Reserve Bank of St. Louis research director Carlos Garriga told MNI.

- "The FOMC has been clear: we need to have solid signals of inflation not only moderating but getting back to our target and remaining near target," he said in an interview. "All the news we're getting from the global economy points in the opposite direction. Risks are elevated to the upside. The blockage of the gas pipeline to Germany, discussions on additional lockdowns in China which will put additional pressure on supply chains. A lot of businesses will have to factor this into their operation strategy." For more see MNI Policy main wire at 1253ET.

FED: The U.S. economy is slowing and there is a growing risk of recession as consumers experience ongoing and large price rises, according to business contacts in the Federal Reserve's latest Beige Book report released Wednesday.

- "Several districts reported growing signs of a slowdown in demand, and contacts in five districts noted concerns over an increased risk of a recession," the report said. "Substantial price increases were reported across all Districts, at all stages of consumption. Most contacts expect pricing pressures to persist at least through the end of the year."

US TSY: The U.S. Treasury Department rang up a USD515 billion budget deficit through June, a record decline of over USD1.7 trillion relative to the same point in the previous fiscal year, the agency reported Wednesday.

- The Treasury said the federal deficit hit USD89 billion in June, an improvement of USD85 billion compared to the year-ago month. Compared to fiscal year 2021, year-to-date revenue is up 26%, hitting a record, while spending is down 18%. The U.S. ended fiscal year 2021 with a USD2.8 trillion deficit and ended 2020 with a USD3.1 trillion deficit, the largest in U.S. history.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said "everything is in play" for policy action after data showed that US inflation accelerated again to a fresh four-decade high last month. (Bbg).

- "The top-line number is a source of concern," Bostic told reporters Wednesday during a visit to St. Petersburg, Florida.

- "Everything is in play." Asked if that included by raising rates by a full percentage point, he replied, "it would mean everything."

US: Helping push Fed swaps to pricing a 50% chance of a 100bp hike in July, Nomura economists call for a 100bp hike following the June CPI upside surprise, especially considering one of the major drivers was rent inflation, whilst also noting the BoC’s surprise 100bp hike.

- They see the choice between 75bp and 100bp in July may still be close for participants but believe 100bp is the right call.

- When asked about 100bp at the June press conference, Chair Powell noted that “we’re going to react to the incoming data and appropriately.”

- They see this being followed by 50bp in Sep, 25bp hikes in Nov, Dec and Feb to a peak range of 3.75-4%, 25bp higher than their previous forecast. They then envisage a pause switching to cutting 25bp per meeting from Sep’23 through 2024 to 1-1.25% come end-2024.

- Risks to their call: 1) Fed continues to hike by larger than 50bp increments for longer. 2) Start of rate cuts will be delayed but will be larger once easing begins.

CANADA

BOC: The Bank of Canada could raise interest rates by another percentage point at the next meeting in September to help catch up with inflation according to David Laidler, a former adviser to the central bank and retired Western University professor.

- The Bank's move Wednesday to 2.5% leaves borrowing costs well below inflation that's likely now between 8% and 9%, he said. While price gains are likely to slow, the overnight rate needs to exceed CPI at some point to check inflation, he said.

- “I wouldn’t be surprised if the next interest rate hike was another 100 basis points," said the author of several books on Canadian monetary policy.

- Governor Tiff Macklem's description of the rate hike as 'front loading' rings hollow after forward guidance earlier in the pandemic suggesting rate increases wouldn't be needed until well into this year, Laidler said. The biggest rate hike since 1998 is still a welcome change of course that puts the Bank on a better path, he said. For more see MNI Policy main wire at 1503ET.

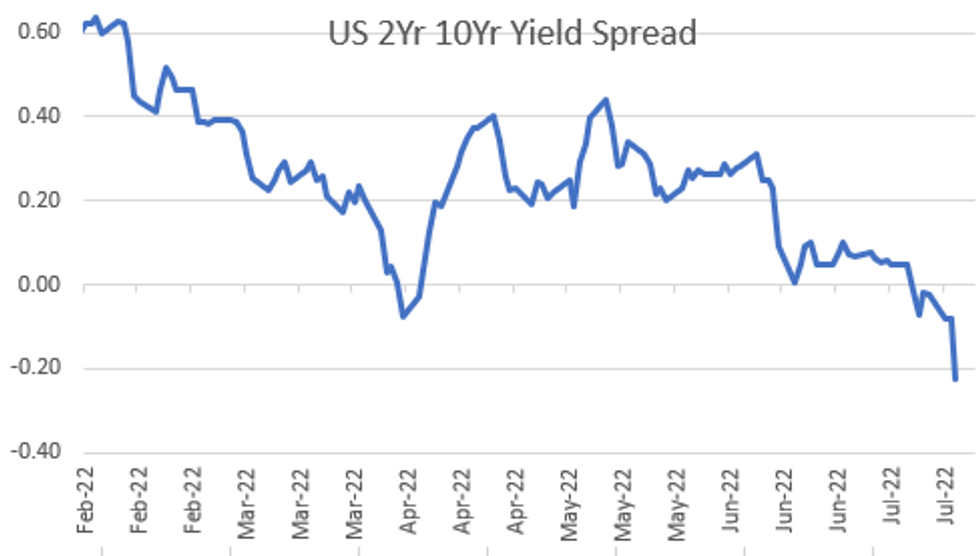

US TSYS: HOT CPI, Curve Inversions and Growing Chance of 100Bp Hike

A lot to unpack Wednesday: heavy selling on higher than expected June CPI data: CPI for Services (60% of the whole) is +0.9% MoM, +6.2% YoY; CPI for Goods (40%) is +2.1% MoM +13.6% YoY; Housing related prices were up 0.8% in June. Owners’ Equivalent Rent was +0.7% MoM, +5.5% YoY, highest since 1990.

- Short end rates remained under heavy sell pressure while the long end started to bounce soon after, 30Y bonds had extended session highs by midmorning: broad 30YY range from 3.2256% high to 3.0643% low. Decent $19B 30Y auction re-open (912810TG3) stop through: 3.115% high yield vs. 3.135% WI added to the bounce.

- Trading desks struggled for a good reason to explain the price action as curves extended inversion to new 16+ year lows (21s10s -14.257 to 22.506). Certainly debatable, was a theory over peaking inflation and whether the Fed may be near the end of hawkish policy had spurred the bounce in intermediates to long end.

- Explaining Inversion: heavy short end selling persisted on strong chance of 100bp hike at end of the month. Underscored late: lead quarterly Eurodollar futures EDU2 futures gapped lower, well past earlier CPI session lows to 96.34 (-34.5) after Atlanta Fed Bostic comments of "concerning" CPI while, "everything is in play" the Fed is "not wedded to any specific course of Fed action".

- Chances of a 100bp rate hike at the end of the month jumped from single digits to close to 75% after the move. Note, Fed goes into media blackout at midnight Friday -- going to hear more pop-up comments from Fed speakers by then.

OVERNIGHT DATA

- US JUN CPI 1.3%, CORE 0.7%; CPI Y/Y 9.1%, CORE Y/Y 5.9%

- Unrounded % M/M figures: Headline 1.322%; Core: 0.706%

- Unrounded % Y/Y figures: Headline 9.06%; Core: 5.917%

- US EIA:CUSHING STOCKS +0.32M TO 21.6M BARRELS IN JUL 08 WK

- US EIA:DISTILLATE STOCKS +2.67M TO 113.8M IN JUL 08 WK

- US EIA:GASOLINE STOCKS +5.82M TO 224.9M IN JUL 08 WK

- US EIA:CRUDE OIL STOCKS EX SPR +3.25M TO 427.1M JUL 08 WK

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 86.83 points (-0.28%) at 30899.29

- S&P E-Mini Future down 2 points (-0.05%) at 3822.25

- Nasdaq up 32.8 points (0.3%) at 11298.35

- US 10-Yr yield is down 6.1 bps at 2.9078%

- US Sep 10Y are up 8/32 at 118-29

- EURUSD up 0.0024 (0.24%) at 1.0061

- USDJPY up 0.45 (0.33%) at 137.32

- WTI Crude Oil (front-month) up $0.6 (0.63%) at $96.44

- Gold is up $8.21 (0.48%) at $1734.21

- EuroStoxx 50 down 33.08 points (-0.95%) at 3453.97

- FTSE 100 down 53.49 points (-0.74%) at 7156.37

- German DAX down 149.16 points (-1.16%) at 12756.32

- French CAC 40 down 43.96 points (-0.73%) at 6000.24

US TSY FUTURES CLOSE

- 3M10Y -25.89, 51.278 (L: 46.916 / H: 79.75)

- 2Y10Y -15.431, -23.679 (L: -24.6 / H: -4.624) ** 2006 inverted lows

- 2Y30Y -18.279, -7.305 (L: -8.128 / H: 11.828)

- 5Y30Y -8.656, 5.575 (L: 4.582 / H: 15.16)

- Current futures levels:

- Sep 2Y down 5.5/32 at 104-22.125 (L: 104-16.75 / H: 104-28.75)

- Sep 5Y down 1.5/32 at 112-5.75 (L: 111-18.25 / H: 112-14.75)

- Sep 10Y up 7.5/32 at 118-28.5 (L: 117-24 / H: 119-06)

- Sep 30Y up 28/32 at 140-7 (L: 137-18 / H: 140-12)

- Sep Ultra 30Y up 1-25/32 at 155-21 (L: 151-07 / H: 155-28)

US 10YR FUTURES TECHS: (U2) Bullish Focus

- RES 4: 121-28+ 1.382 proj of the 14 - 23 - 28 price swing

- RES 3: 121-10 1.236 proj of the 14 - 23 - 28 price swing

- RES 2: 120-19+ High May 26 and a key resistance

- RES 1: 119-05/120-16+ High Jul 7 / High Jul 6 and the bull trigger

- PRICE: 118-29+ @ 1546ET Jul 13

- SUP 1: 117-18/12 Low Jul 8 / 50.0% of the Jun 14 - Jul 6 rally

- SUP 2: 116-11 Low Jun 28 and a key near-term support

- SUP 3: 115-20 Low Jun 17

- SUP 4: 114-05+ Low Jun 14 and the bear trigger

Treasuries remain above 117-18, the Jul 8 low. The short-term trend condition is unchanged and remains bullish. Recent weakness is considered corrective. Key short-term support is at 116-11, the Jun 28 low where a break is required to strengthen a bearish threat and this would signal scope for a deeper retracement. On the upside, attention is on the short-term bull trigger at 120-16+, the Jul 6 high. A break would resume the uptrend.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.315 at 96.370 vs. 96.34 session low

- Dec 22 -0.250 at 96.005

- Mar 23 -0.130 at 96.255

- Jun 23 -0.080 at 96.485

- Red Pack (Sep 23-Jun 24) -0.05 to +0.015

- Green Pack (Sep 24-Jun 25) +0.030 to +0.070

- Blue Pack (Sep 25-Jun 26) +0.075 to +0.095

- Gold Pack (Sep 26-Jun 27) +0.105 to +0.110

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00700 to 1.56129% (+0.00072/wk)

- 1M +0.02771 to 1.99914% (+0.09943/wk)

- 3M +0.02900 to 2.51200% (+0.08900/wk) * / **

- 6M -0.00343 to 3.06100% (+.01257/wk)

- 12M +0.04743 to 3.73414% (+0.08928/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3Y high: 2.51200% on 7/13/22

- Daily Effective Fed Funds Rate: 1.58% volume: $98B

- Daily Overnight Bank Funding Rate: 1.57% volume: $275B

- Secured Overnight Financing Rate (SOFR): 1.54%, $941B

- Broad General Collateral Rate (BGCR): 1.51%, $364B

- Tri-Party General Collateral Rate (TGCR): 1.51%, $359B

- (rate, volume levels reflect prior session)

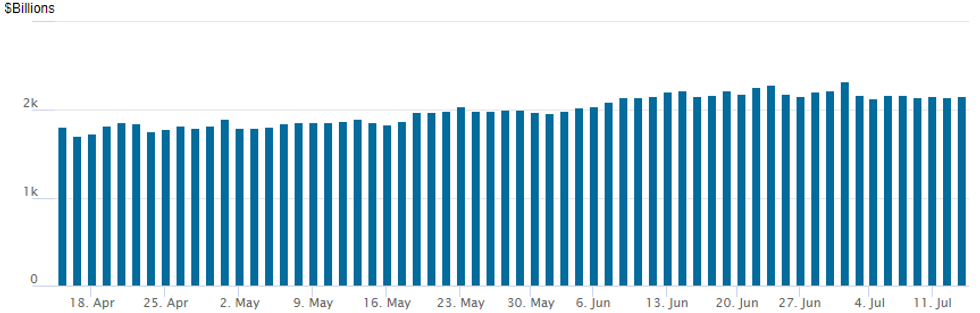

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,155.290B w/ 96 counterparties vs. $2,146.132B prior session. Record high stands at $2,329.743B from Thursday June 30.

PIPELINE: Issuers Sideline After CPI Induced Volatility

- Date $MM Issuer (Priced *, Launch #)

- 07/13 $Benchmark issuers sidelined after CPI-induced volatility

- $5.3B Priced Tuesday

- 07/12 $4B *World Bank5Y (IBRD) SOFR+40

- 07/12 $1.3B *Deutsche Bank 4NC3 +325a, 4NC3 SOFR

EGBs-GILTS CASH CLOSE: Short-End Shockwaves From Across The Atlantic

The German and UK curves twist flattened Wednesday as global bond markets assessed the latest shock upside surprise to US inflation data.

- Stronger-than-expected UK GDP set an initial bearish tone. And with traders eyeing a 100bp hike at the July Fed meeting post-CPI, and Bank of Canada delivering a surprise 100bp increase, BoE and ECB end-2022 rate hike pricing were boosted by 10-15bps.

- UK short-end/belly yields were flat but faded mid-session rises; in Germany Schatz underperformed with yields rising through the session, punctuated by US CPI. 30Y yields fell on both curves.

- Periphery spreads widened a little on the day. Thursday sees a no-confidence vote in Italy; MNI reports that there is a strong possibility the Draghi government will fall.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 10.3bps at 0.458%, 5-Yr is up 6.3bps at 0.836%, 10-Yr is up 1.3bps at 1.145%, and 30-Yr is down 2.6bps at 1.38%.

- UK: The 2-Yr yield is up 0.6bps at 1.798%, 5-Yr is down 0.1bps at 1.755%, 10-Yr is down 1.5bps at 2.06%, and 30-Yr is down 4.8bps at 2.522%.

- Italian BTP spread up 1.9bps at 200.1bps / Spanish up 1.3bps at 110.8bps

FOREX: US CPI Sparks Substantial Intra-Day Volatility

- The greenback was pulled in both direction on Wednesday, as opposing forces of higher-than-expected inflation readings and the potential knock-on effects to growth collided.

- Initial USD strength saw EURUSD come within close proximity of parity once more before the significant US data, however, strong demand saw the pair rise sharply back towards 1.01 approaching the CPI deadline.

- The upside surprises for June CPI, both headline and core, sparked a short-term wave of dollar buying and the USD index rallied just shy of 1% from pre-data levels as markets began to price in even bolder action from the Fed in July. Notably, this prompted EURUSD to briefly print fresh cycle lows below parity at 0.9998.

- However, the renewed optimism from USD bulls was extremely short-lived as the market immediately shifted their concerns to the US growth outlook. The US yield curve further inverted with 2s10s hitting the most inverted levels since 2000, substantially weighing on the USD and prompting a 1.02% reversal in the USD index and EURUSD to take out the pre-CPI highs above 1.01 to print 1.0122.

- Short-term price action dynamics were in full flow as the dollar regained its poise approaching the APAC crossover, bolstered by Bostic’s comments suggesting ‘everything is in play’ regarding future monpol decisions.

- Slightly outperforming on the day was CAD (+0.45%) following the BoC’s surprise 100 point rate hike. The clear underperformer in G10 was the Japanese Yen, falling 0.21% despite the weaker greenback.

- Aussie employment kicks off the Thursday data calendar, before the European Commission publish their EU Economic Forecasts. US PPI data will precede the Fed’s Waller, due to speak about the economic outlook at the Annual Rocky Mountain Economic Summit.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/07/2022 | 0110/0210 |  | UK | BOE Cunliffe in Conversation w. Bank of Indonesia | |

| 14/07/2022 | 0130/1130 | *** |  | AU | Labor force survey |

| 14/07/2022 | 0600/0800 | *** |  | SE | Inflation report |

| 14/07/2022 | 0600/0800 | * |  | DE | Wholesale Prices |

| 14/07/2022 | 0800/0400 |  | US | Treasury Secretary Janet Yellen | |

| 14/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 14/07/2022 | 1230/0830 | *** |  | US | PPI |

| 14/07/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 14/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 14/07/2022 | 1500/1100 |  | US | Fed Governor Christopher Waller | |

| 14/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 14/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.