-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Surprise Surge US Job Gains

EXECUTIVE SUMMARY

MNI: Fed's Bowman: 75BP Hikes On Table Until Inflation Falls

MNI BRIEF: Blowout July US Jobs Report Raises 75bp Hike Chance

US

FED: Federal Reserve Governor Michelle Bowman said Saturday there's a case for continuing 75 basis-point rate increases until inflation slows in a meaningful way and she needs "unambiguous evidence" before marking down her price forecasts.

- Following the recent hike to 2.25%-2.5%, "similarly-sized increases should be on the table until we see inflation declining in a consistent, meaningful, and lasting way," Bowman told the Kansas Bankers Association. "I support continued increases until inflation is on a consistent path to significantly decline."

- There have been "few, if any, concrete indications" supporting the idea that inflation now at a "concerningly high" 9.1% was going to peak earlier this year, she said. "I see a significant risk of high inflation into next year for necessities including food, housing, fuel, and vehicles," she said, and other supply issues also seem likely to persist. For more see MNI Policy main wire, Saturday 1215ET.

US: U.S. employers added 528,000 workers in July, significantly above market expectations for a slowdown to 250,000 from June's 398,000 pace after revisions, as the unemployment rate dropped a tenth to 3.5% after flattening out at 3.6% for six months. Average hourly earnings rose 0.5%, a tenth faster than in June.

- An overheated labor market is the key reason cited by Fed policymakers for raising interest rates briskly to bring demand and supply back into balance. (See: MNI STATE OF PLAY: Powell Signals 75bp Sept Fed Hike Possible)

- Job gains were widespread, led by leisure and hospitality (96,000), professional and business services (89,000) and health care (70,000), the Bureau of Labor Statistics said.

- The household survey showed a 179,000 gain in the number of employed people in July. The labor force participation rate fell a tenth to 62.1% and the employment-population ratio gained a tenth to 60.0%.

US TSYS: What Recession?

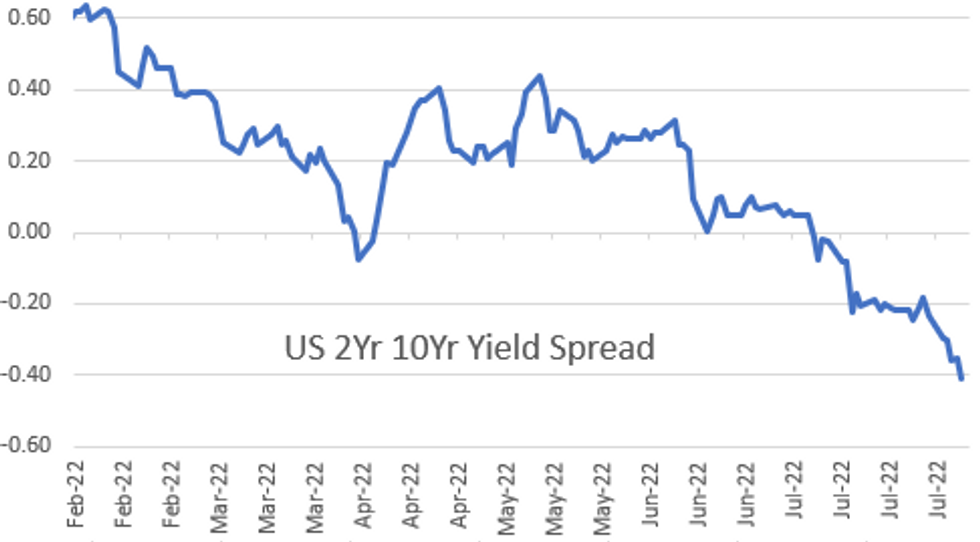

Rates trading weaker after the bell, just off midday session lows after FI markets gapped lower on stronger than expected jobs gains for July: +528k vs. +250k est, unemployment rate dropped a tenth to 3.5% after flattening out at 3.6% for six months. Average hourly earnings rose 0.5%, a tenth faster than in June. Better than expected data spurred heavy selling across the board but particularly in shorts to intermediates as yield curves extend inversion to new 22 year lows (2s10s -44.034).

- Heavy short end selling included 5Y Blocks as strong data spurs recession position unwinds as payrolls close gap with pre-pandemic levels, 75bp rate hike in September getting priced in again.

- Some faded the deep curve inversions w/ Block buying over 15,000 TUU2, 2s10s currently -5.686 at -41.947. Currently, 2-Yr yield is up 20.2bps at 3.2442%, 5-Yr is up 17.9bps at 2.9709%, 10-Yr is up 14.8bps at 2.836%, and 30-Yr is up 9.9bps at 3.0638%.

- Cross asset update: Stocks marginally lower/off lows (SPX eminis -15.0 at 4137.25 vs. 4104.25 low); Spot Gold weaker -16.10 at 1775.18; Crude weaker (WTI -0.39 at 88.15).

- Data: Slow start to next week, nothing scheduled for Monday except US Tsy bill auctions ($54B 13W, $42B 26W). Tuesday picks up with Nonfarm Productivity (-4.6% est) and Unit Labor Costs (9.8% est), US Tsy $34B 52W bill and $42B 3Y Note auctions.

OVERNIGHT DATA

- US JUL NONFARM PAYROLLS +528K; PRIVATE +471K, GOVT +57K

- US PRIOR MONTHS PAYROLLS REVISED: JUN +398K; MAY +386K

- US JUL UNEMPLOYMENT RATE 3.5%

- US JUL AVERAGE HOURLY EARNINGS +0.5% Vs JUN +0.4%; +5.2% YOY

- US JUL AVERAGE WEEKLY HOURS 34.6 HRS

- CANADA JULY JOBS -30.6K VS FORECAST +15K, JUNE -43.2K

- CANADA JULY JOBLESS RATE REMAINS AT 4.9% VS FORECAST 5%

- CANADA'S JULY JOBLESS RATE REMAINS AT LOWEST SINCE 1976

- CANADA HOURLY WAGES +5.2% YOY; PERMANENT WORKERS +5.4%

- CANADA JUL IVEY PURCHASING MANAGERS INDEX 49.6 SA

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 14.29 points (-0.04%) at 32715.8

- S&P E-Mini Future down 21.5 points (-0.52%) at 4131.75

- Nasdaq down 121.6 points (-1%) at 12599.41

- US 10-Yr yield is up 14.8 bps at 2.836%

- US Sep 10Y are down 43.5/32 at 119-12

- EURUSD down 0.0069 (-0.67%) at 1.0177

- USDJPY up 2.21 (1.66%) at 135.1

- WTI Crude Oil (front-month) up $0.12 (0.14%) at $88.66

- Gold is down $18.76 (-1.05%) at $1772.55

- EuroStoxx 50 down 29.21 points (-0.78%) at 3725.39

- FTSE 100 down 8.32 points (-0.11%) at 7439.74

- German DAX down 88.75 points (-0.65%) at 13573.93

- French CAC 40 down 41.04 points (-0.63%) at 6472.35

US TSY FUTURES CLOSE

- 3M10Y +7.129, 29.101 (L: 18.582 / H: 35.896)

- 2Y10Y -4.767, -41.028 (L: -44.034 / H: -35.579)

- 2Y30Y -9.903, -18.252 (L: -20.758 / H: -7.328)

- 5Y30Y -7.862, 9.117 (L: 7.008 / H: 18.323)

- Current futures levels:

- Sep 2Y down 13/32 at 104-18.5 (L: 104-17.5 / H: 104-31.75)

- Sep 5Y down 31.5/32 at 112-9.25 (L: 112-06.5 / H: 113-09)

- Sep 10Y down 1-11/32 at 119-12.5 (L: 119-07.5 / H: 120-24.5)

- Sep 30Y down 2-14/32 at 141-08 (L: 140-19 / H: 143-27)

- Sep Ultra 30Y down 2-31/32 at 155-28 (L: 154-26 / H: 159-05)

US 10Y FUTURES TECH: (U2) Approaching Trendline Support

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-26+ 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-12 @ 1500ET Aug 05

- SUP 1: 119-05 50-day EMA

- SUP 2: 118-30+ Trendline support drawn from the Jun 16 low

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries traded lower Friday and in the process cleared a number of S/T support levels. The trend direction remains up though and recent weakness is considered corrective. The contract is approaching support at the 50-day EMA, which intersects at 119-05. Just below this level is a trendline support at 118-30+. A break of this zone would threaten the uptrend. A reversal higher would refocus attention on the bull trigger at 122-02, the Aug 2 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.110 at 96.540

- Dec 22 -0.195 at 96.035

- Mar 23 -0.240 at 96.095

- Jun 23 -0.245 at 96.270

- Red Pack (Sep 23-Jun 24) -0.24 to -0.215

- Green Pack (Sep 24-Jun 25) -0.215 to -0.195

- Blue Pack (Sep 25-Jun 26) -0.195 to -0.17

- Gold Pack (Sep 26-Jun 27) -0.165 to -0.145

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00243 to 2.31200% (-0.00957/wk)

- 1M -0.00328 to 2.36943% (+0.00714/wk)

- 3M +0.00342 to 2.86671% (+0.07842/wk) * / **

- 6M +0.03286 to 3.42557% (+0.09571/wk)

- 12M -0.01914 to 3.85986% (+0.15257/wk)

- * Record Low 0.11413% on 9/12/21; ** New 3.5Y high: 2.80586% on 7/27/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $280B

- Secured Overnight Financing Rate (SOFR): 2.29%, $981B

- Broad General Collateral Rate (BGCR): 2.27%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.27%, $384B

- (rate, volume levels reflect prior session)

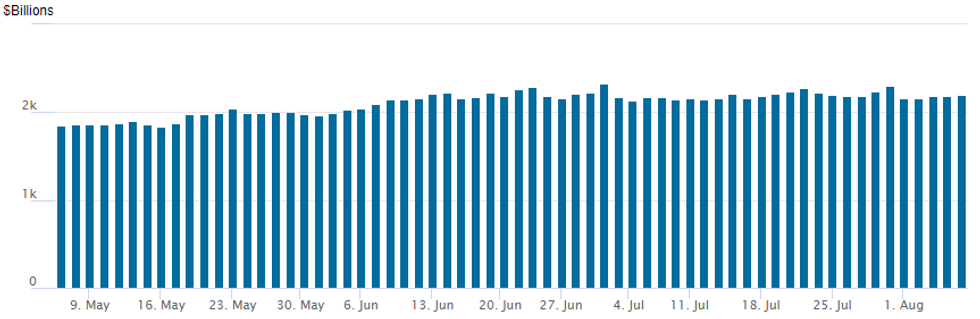

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inched higher to $2,194.927B w/ 97 counterparties vs. $2,191.546B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: Corporate Issuance Over $60B/Wk

First week of August finished with $60.9B total

- Date $MM Issuer (Priced *, Launch #)

- 08/05 No new US$ issuance Friday

- $22.3B Priced Thursday

- 08/04 $10B *Meta Platforms $2.75B 5Y +75, $3B 10Y +115, $2.75B 30Y +145, $1.5B 40Y +165

- 08/04 $4.75B *HSBC $2.25B 6NC5 +245, $2.5B 11NC10 +275

- 08/04 $2.5B *Lloyds Banking Grp $1.25B each: 4NC3 +175, 11NC10 +230

- 08/04 $1.25B *Benchmark Standard Chartered perpNC5.5 7.5%

- 08/04 $1.5B *Charter 7NC3 6.375%

- 08/04 $800M *Citizens Bank 6NC5 +180

- 08/04 $750M *Waste Connections +10Y +153 upsized from $500M

- 08/04 $750M *Ashtead 10Y +295

FOREX: USDJPY Soars Back Above 135.00 Following Stellar Payrolls

- The significant beat in US non-farm payrolls (+528k) plus a small upward two-month revision sees US jobs close the gap with pre-pandemic levels. In line with soaring front-end yields, the US Dollar sharply rallied following the release.

- Despite being off its best levels, the USD index remains up 0.9% on Friday, as the market places a greater likelihood to continued aggressive tightening in September.

- While, greenback gains were broad based following the release, the Japanese Yen was the main victim, extending a string of highly volatile trading sessions.

- Despite briefly trading around 132.50 overnight, USDJPY had recovered back above 133 before the data and the release sparked a huge gap higher, with price action gaining momentum above the week’s highs at 134.55. Relentless demand saw the pair rally another big figure, breaching the 20-day EMA resistance and notably more than 500 pips above the Tuesday low print at 135.50. Price has since moderated to the 135.00 mark, however the pair remains up 1.6% for the session as markets reassert bullish sentiment.

- Overall weakness in equities naturally weighed on the likes of AUD and NZD, retreating around 1%, however a smaller adjustment was seen in the Euro.

- EURUSD feel from 1.0230 down to 1.0142 shortly after the data, however, downside momentum failed to emerge as EURJPY broke above the best levels of the week. Indeed, EURUSD has since pared a good portion of the move and sits just 50 pips below pre-announcement levels.

- Next week’s calendar remains quiet ahead of Wednesday’s important US July CPI print.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/08/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.