-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CAD Slips as Trump Looks to Tariffs

MNI China Daily Summary: Tuesday, November 26

MNI BRiEF: Riksbank Puts Neutral Rate In 1.5 To 3.0% Range

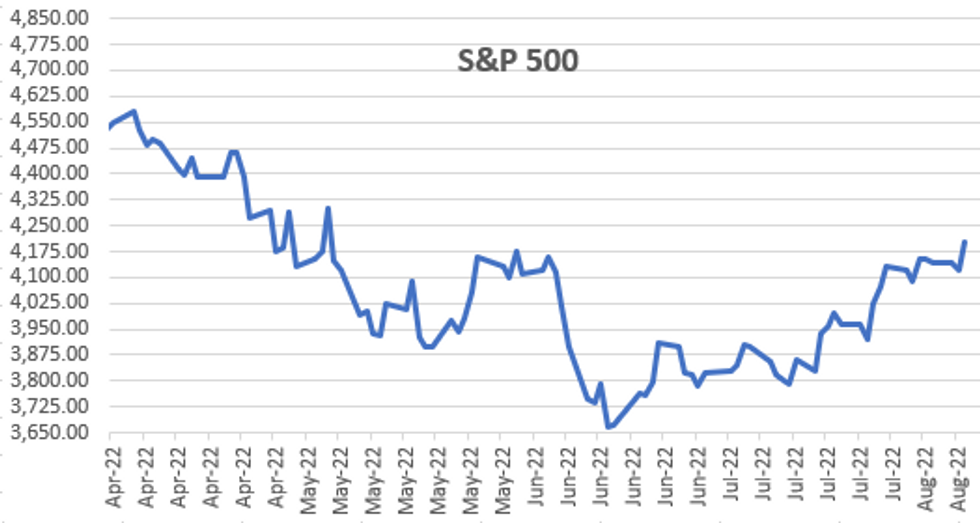

MNI ASIA OPEN: Stocks Surge on Flat July Inflation Read

EXECUTIVE SUMMARY

- MNI BRIEF: Fed Must Keep Hiking After New CPI Report-Kashkari

- MNI BRIEF: U.S. CPI Flat On Month, Up 8.5% In Year To July

- US DATA: Broad CPI Moderation Outside Of Shelter See Fed Rate Path Cut

- US DATA: Unrounded Monthly CPI Negative For First Time Since May 2020

- US DATA: Shelter Strength Stands Out In Otherwise Softer CPI Report

- Chicago Fed Evans: WE DO NOT EXPECT THAT WE'RE FINISHED WITH RATE HIKES, Bbg

US

FED: The Federal Reserve needs to keep pressing ahead with rate hikes after a report Wednesday showing inflation was slower than investors expected because price gains are likely to remain above 2% for a long time, Minneapolis President Neel Kashkari said.

- "I was certainly happier to see inflation surprise to the downside" after a series of upside surprises, Kashkari said during a talk at the Aspen Economic Strategy Group. "It doesn't change my path" laid out in June calling for a policy rate of 3.9% at the end of this year and 4.4% at the end of next year, he said. That remains true even with a recession being possible in the near term, he said.

US DATA: U.S. consumer prices stabilized in July as energy prices fell, leaving the yearly gain in the CPI at 8.5%, below market expectations for an 8.7% gain, the Labor Department said on Wednesday.

- Core inflation climbed 0.3% on the month and 5.9% on a year-over-year basis. Energy prices tumbled 4.6% last month while the owners' equivalent rent measure of housing costs surged 0.6%.

- St. Louis Fed President James Bullard on Tuesday told MNI's FedSpeak podcast: https://marketnews.com/mni-interview-bullard it was too soon to say whether U.S. inflation has peaked given that previous such calls had proven premature.

US TSYS: Hawkish Hike Expectations Evaporate on Flat July Inflation

Tsy futures trading mixed after the bell, yield curves steeper but off highs on exceptionally wide range. Tsys initially surged across the board after flat July CPI read (0.2% est vs. 1.3% in June), Core 0.3%; Y/Y 8.5%, Core Y/Y 5.9%.

- Markets still have a lot of data to absorb between now and September 16, the next FOMC policy annc. Nevertheless, Bonds quickly pared gains after the release/traded weaker from midday on while short end continued to outperform as Sep rate hike expectations snapped from strong 75bp conviction to 50bp (off immediate high of 96.76, Sep Eurodollar futures trading 96.63 +0.075 after the bell).

- Appearing at Aspen Economic Strategy Group event, MN Fed Kashkari said the Fed needs to keep pressing ahead with rate hikes even after today's downside inflation surprise. "It doesn't change my path" laid out in June calling for a policy rate of 3.9% at the end of this year and 4.4% at the end of next year, he said. That remains true even with a recession being possible in the near term, he said.

- Meanwhile, Tsy futures gained slightly after strong $35B 10Y note auction (91282CFF3) stopped through: 2.755% high yield vs. 2.762% WI; 2.53x bid-to-cover vs. last month's 2.34x. Indirect take-up climbs to 74.52% vs. last month's 61.33% high; direct bidder take-up recedes to 15.56 from 17.97%, primary dealer take-up falls to 9.92% vs. 20.07%.

- Cross asset update: Stocks surged post-data (SPX eminis at 4205.0 +82.50); Spot Gold turned weaker at 1789.83 -4.46; Crude firmer (WTI +1.11 at 91.61).

- Data on tap for Thursday: PPI Final Demand MoM (0.3% est vs. 1.1% prior), weekly claims (265k est vs. 260k prior), continuing claims (1.45M vs. 1.416M prior).

- Currently, 2-Yr yield is down 4.9bps at 3.2203%, 5-Yr is down 3.6bps at 2.925%, 10-Yr is up 0.7bps at 2.7846%, and 30-Yr is up 4.5bps at 3.0343%.

OVERNIGHT DATA

- US JUL CPI 0.0%, CORE 0.3%; CPI Y/Y 8.5%, CORE Y/Y 5.9%

- US JUL ENERGY PRICES -4.6%

- US JUL OWNERS' EQUIVALENT RENT PRICES 0.6%

- Unrounded % M/M (SA): Headline -0.019%; Core: 0.313% (from 0.706%)

- Unrounded % Y/Y (NSA): Headline 8.525%; Core: 5.911% (from 5.917%)

- Core CPI inflation sees a notable miss in July at +0.3% M/M (cons 0.5%) but one stronger internal reading was no material let up in OER/rents, broadly in line with analyst expectations seen by MNI beforehand, at the second strongest sequential prints of the cycle.

- OER +0.63% M/M (from 0.70%) and primary rents 0.70% (from +0.78).

- Total shelter of +0.54% was again weighed down by second monthly decline in lodging (-2.74 after -2.82).

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 467.02 points (1.43%) at 33240.83

- S&P E-Mini Future up 80.25 points (1.95%) at 4204.75

- Nasdaq up 343.4 points (2.7%) at 12837.08

- US 10-Yr yield is up 0.7 bps at 2.7846%

- US Sep 10Y are up 8/32 at 119-23.5

- EURUSD up 0.009 (0.88%) at 1.0303

- USDJPY down 2.1 (-1.56%) at 132.95

- WTI Crude Oil (front-month) up $1.14 (1.26%) at $91.63

- Gold is down $4.66 (-0.26%) at $1789.62

- EuroStoxx 50 up 33.98 points (0.91%) at 3749.35

- FTSE 100 up 18.96 points (0.25%) at 7507.11

- German DAX up 165.96 points (1.23%) at 13700.93

- French CAC 40 up 33.44 points (0.52%) at 6523.44

US TSY FUTURES CLOSE

- 3M10Y +7.096, 18.423 (L: 3.475 / H: 19.743)

- 2Y10Y +5.845, -43.802 (L: -58.244 / H: -37.498)

- 2Y30Y +9.405, -18.936 (L: -32 / H: -10.199)

- 5Y30Y +8.225, 10.835 (L: -2.455 / H: 17.156)

- Current futures levels:

- Sep 2Y up 4.25/32 at 104-21.75 (L: 104-16.875 / H: 104-30.625)

- Sep 5Y up 10/32 at 112-17.25 (L: 112-04.5 / H: 113-05)

- Sep 10Y up 8/32 at 119-23.5 (L: 119-11 / H: 120-22)

- Sep 30Y down 14/32 at 141-30 (L: 141-23 / H: 144-02)

- Sep Ultra 30Y down 1-06/32 at 156-14 (L: 155-26 / H: 159-15)

US 10Y FUTURES TECH: (U2) Monitoring Key Short-Term Support

- RES 4: 123-13+ 1.764 proj of the 14 - 23 - 28 price swing

- RES 3: 122-29+ High Mar 31

- RES 2: 122-25+ 2.0% 10-dma envelope

- RES 1: 120-29/122-02 High Aug 4 / High Aug 02

- PRICE: 119-18+ @ 11:32 BST Aug 10

- SUP 1: 119-11+ Trendline support drawn from the Jun 16 low

- SUP 2: 119-07+ 50-day EMA

- SUP 3: 117-14+ Low Jul 21 and key near-term support

- SUP 4: 116-11 Low Jun 28

Treasuries continue to trade closer to recent lows. The trend direction is unchanged and remains up and the latest move lower is still considered corrective. The contract is however trading just above support at the 50-day EMA, which intersects at 119-07+. There is also a trendline support at 119-11+. A break of this zone would threaten the uptrend. A reversal higher would refocus attention on the bull trigger at 122-02.

US EURODOLLAR FUTURES CLOSE

- Sep 22 +0.080 at 96.635

- Dec 22 +0.075 at 96.095

- Mar 23 +0.055 at 96.120

- Jun 23 +0.035 at 96.250

- Red Pack (Sep 23-Jun 24) +0.030 to +0.060

- Green Pack (Sep 24-Jun 25) +0.055 to +0.065

- Blue Pack (Sep 25-Jun 26) +0.035 to +0.055

- Gold Pack (Sep 26-Jun 27) -0.005 to +0.025

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00171 to 2.31629% (+0.00429/wk)

- 1M +0.02029 to 2.40043% (+0.03100/wk)

- 3M +0.00171 to 2.92271% (+0.05600/wk) * / **

- 6M -0.00386 to 3.54657% (+0.12100/wk)

- 12M +0.00728 to 3.99814% (+0.13828/wk)

- * Record Low 0.11413% on 9/12/21; ** New 24Y high: 2.91157% on 8/8/22

- Daily Effective Fed Funds Rate: 2.33% volume: $90B

- Daily Overnight Bank Funding Rate: 2.32% volume: $283B

- Secured Overnight Financing Rate (SOFR): 2.29%, $947B

- Broad General Collateral Rate (BGCR): 2.26%, $386B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $377B

- (rate, volume levels reflect prior session)

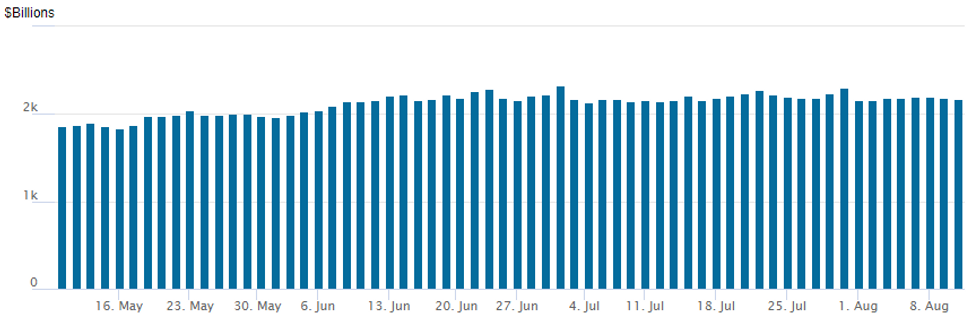

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,177.646B w/ 96 counterparties vs. $2,186.568B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $700M Texas Instruments 2Pt Launch

Texas Instruments 2pt reduces size of debt issuance by $300M to $700M- Date $MM Issuer (Priced *, Launch #)

- 08/10 $700M #Texas Instruments $400M WNG 10Y +90, $300M 30Y +110

- 08/10 $650M #Kimco 10Y +190

EGBs-GILTS CASH CLOSE: Post-US CPI Rally Fades, But BTPs Outperform

The German curve bull steepened Wednesday with the UK twist flattening as a softer-than-expected US July inflation print pulled down global yields.

- Rates retraced somewhat from session lows immediately after the US CPI release.

- Overall though curves held their re-steepening (UK 2s10s finished above zero after inverting earlier in the session) and yields finished lower with the exception of the UK short-end.

- BTPs outperformed on the more dovish central bank tightening outlook and risk-on tone, but bucking the broader trend were GGBs whose spreads widened for another session.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 5.9bps at 0.546%, 5-Yr is down 3.2bps at 0.656%, 10-Yr is down 3.3bps at 0.888%, and 30-Yr is down 2.7bps at 1.127%.

- UK: The 2-Yr yield is up 2bps at 1.947%, 5-Yr is down 2bps at 1.8%, 10-Yr is down 2bps at 1.951%, and 30-Yr is down 0.9bps at 2.336%.

- Italian BTP spread down 2.7bps at 211.3bps / Greek up 2.5bps at 230.8bps

FOREX: Greenback Plummets Following Lower July US CPI

- The USD index is seen 1.1% lower on Wednesday following the negative surprise for July US inflation data. The month-on-month headline unrounded was negative for the first time since May 2020 and the M/m core unrounded was the lowest since Sept 2021.

- The kneejerk reaction was a significantly lower greenback across the board, however, the main beneficiary in the immediate aftermath was the Japanese Yen. USDJPY crashed 230 pips to 132.69 shortly after the release and despite a sharp pullback to 133.30, pressure on the pair extended over the next few hours all the way down to 132.03, comfortably below the lows registered prior to Friday’s jobs numbers.

- In similar vein, EURUSD saw immediately strength and finally broke out of the 1.0100-1.0300 range it had been consolidating in for the past sixteen sessions. Key channel top resistance was briefly breached above 1.0352 coinciding with the horizontal breakdown area between 1.0341/50.

- Unyielding support for US equity benchmarks continued to underpin the likes of AUD and NZD who look set to register gains of close to 2% as we approach the APAC crossover.

- Worth noting there has been a decent bounce in the greenback in late trade as Fed rhetoric from both Evans and Kashkari hinted that today’s data should not alter their expected trajectories for rates. USDJPY relief rally was supported by US 10-yr yields rising back to pre-CPI announcement levels with the curve remaining steeper. The pair now roughly a full point off the day’s lows at 132.03.

- Similar EURUSD selling sees the pair trade back to the 1.0300 mark, however, with major equities remaining close to the highs, there has been less of a pullback in antipodean FX and CAD that remain closer to their best levels of the day against the greenback.

- Bank Holiday in Japan on Thursday with little data due throughout the APAC session. Less significant PPI and jobless claims highlight the US docket tomorrow.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/08/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.