-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsy Bear Cycle Extends

EXECUTIVE SUMMARY

MNI INTERVIEW: Banks Face Mounting Risks As Fed Hikes -Hoenig

FED Barkin: Will Do What It Takes To Lower Inflation

US

FED: U.S. bank balance sheets could come under rising pressure as the Federal Reserve lifts interest rates and asset values decline because lenders are not as well capitalized as regulators maintain, former Kansas City Fed President Thomas Hoenig told MNI.

- Hoenig, also ex-vice chair of the FDIC, said in the latest episode of MNI’s FedSpeak podcast that improvements to bank capital regulation since the last financial crisis were not enough to make him comfortable about the state of the banking system.

- “If the Federal Reserve raises rates sufficiently, to or above 4% by the end of the year and they stick to quantitative tightening, then I think you will have downward pressures on asset values of all kinds. I think that’s where the banks will feel the effects. It’s not just in the shadow banks because the largest commercial banks and some of the largest regional banks fund the shadow banking sector and that will come back on their balance sheet.” For more see MNI Policy main wire at 1100ET Friday.

Little new from Richmond Fed’s Barkin (’24 voter) in the main body of his appearance in Maryland although there could be more targeted questions in the subsequent media Q&A ahead.

- Fed Funds implied hikes broadly holding at early AM levels with 63bp priced for Sep, 120bp to year-end and 135bp to a terminal 3.69% at the Mar’23 FOMC.

- Bloomberg headlines below:

- FED WILL DO WHAT IT TAKES TO LOWER INFLATION TO 2%, FED IS `VERY SERIOUSLY' FOCUSED ON INFLATION

- THERE IS A RISK OF RECESSION ON PATH TO 2% INFLATION

- EXPECT YIELDS TO RISE, TIGHTER FINANCIAL CONDITIONS AS B/SHEET SHRINKS

US Tsys: 30YY At 4-Wk Highs, Yield Curves Bear Steepen

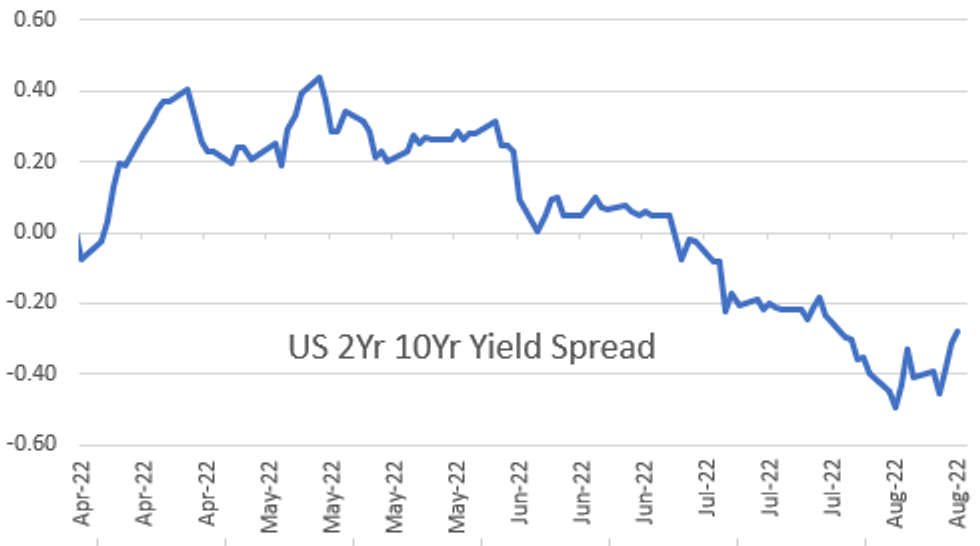

Tsy futures holding narrow range near lows by the close, 30YY tapped 3.2339% high earlier - highest since July 11, currently 3.2213%. Yield curves bear steepened w/2s10s +4.141 at -28.004 - August 1 level.

- Initial cross-over weakness from EGBs followed higher than expected German PPI overnight (+5.3%, +37.2% YoY due to surge in energy prices); UK retail sale up 0.3% last month, but the cost of those sales increased more rapidly by 1.3%.

- Little react to Richmond Fed Barkin this morning as he reiterates the Fed is "very seriously" focused on inflation and will do "what it takes" to lower it to 2% despite "risk of recession on path to 2%". No new ground there, trading desks set sights on next Fri's annual eco-summit in Jackson Hole, Fed Chair Powell scheduled at 1000ET.

- After a decent start, trade volume thinned out in the second half (TYU2 just over 1M), no Tsy or corporate supply, though Tsy Sep/Dec rolls generating some volume (Dec takes lead Wed, Aug 31). Sep options also expire next week Friday could start to generate some two-way hedging on the day.

- Technicals for TYU2 currently trading 118-03 (-24.0), Treasuries maintain a softer tone and the contract has traded lower today. 118-05, 50.0% of the Jun 14 - Aug 2 bull cycle, has been cleared and this signals scope for an extension towards 117-14+ next, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the current bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

- Currently, 6.2bps at 3.259%, 5-Yr is up 8bps at 3.1071%, 10-Yr is up 9.9bps at 2.9813%, and 30-Yr is up 8.2bps at 3.2188%.

OVERNIGHT DATA

CANADA JUN RETAIL SALES +1.1%; SALES EX-AUTOS/PARTS +0.8%

CANADA JUN RETAIL SALES EX-AUTOS/PARTS-GASOLINE +0.2%

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 298 points (-0.88%) at 33701.07

- S&P E-Mini Future down 55.75 points (-1.3%) at 4231

- Nasdaq down 251.4 points (-1.9%) at 12714.42

- US 10-Yr yield is up 9.9 bps at 2.9813%

- US Sep 10Y are down 22/32 at 118-5

- EURUSD down 0.005 (-0.5%) at 1.0037

- USDJPY up 0.96 (0.71%) at 136.86

- WTI Crude Oil (front-month) up $0.2 (0.22%) at $90.70

- Gold is down $10.99 (-0.62%) at $1747.55

- EuroStoxx 50 down 47.06 points (-1.25%) at 3730.32

- FTSE 100 up 8.52 points (0.11%) at 7550.37

- German DAX down 152.89 points (-1.12%) at 13544.52

- French CAC 40 down 61.57 poins (-0.94%) at 6495.83

US TSY FUTURES CLOSE

- 3M10Y +7.913, 29 (L: 18.121 / H: 32.088)

- 2Y10Y +4.166, -27.979 (L: -34.428 / H: -27.665)

- 2Y30Y +2.485, -4.232 (L: -10 / H: -3.182)

- 5Y30Y +0.398, 10.99 (L: 8.367 / H: 13.27)

- Current futures levels:

- Sep 2Y down 0.75/32 at 104-19.375 (L: 104-17.625 / H: 104-22.375)

- Sep 5Y down 10.25/32 at 111-22.25 (L: 111-18.75 / H: 112-02.75)

- Sep 10Y down 22/32 at 118-5 (L: 118-01 / H: 118-29.5)

- Sep 30Y down 62/32 at 138-16 (L: 138-07 / H: 140-17)

- Sep Ultra 30Y down 78/32 at 150-15 (L: 150-05 / H: 153-05)

US 10YR FUTURE TECHS: (U2) Bear Cycle Extends

- RES 4: 122-02 High Aug 2 and key resistance

- RES 3: 120-29 High Aug 4

- RES 2: 119-31/120-22 High Aug 15 / 10

- RES 1: 119-13+ 20-day EMA

- PRICE: 118-02+ @ 16:15 BST Aug 19

- SUP 1: 118-00 Round number support

- SUP 2: 117-14+ Low Jul 21 and key near-term support

- SUP 3: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 4: 116-26+ Low Jun 29

Treasuries maintain a softer tone and the contract has traded lower today. 118-05, 50.0% of the Jun 14 - Aug 2 bull cycle, has been cleared and this signals scope for an extension towards 117-14+ next, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the current bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.003 at 96.660

- Dec 22 -0.020 at 96.085

- Mar 23 -0.015 at 96.075

- Jun 23 -0.025 at 96.145

- Red Pack (Sep 23-Jun 24) -0.06 to -0.035

- Green Pack (Sep 24-Jun 25) -0.09 to -0.08

- Blue Pack (Sep 25-Jun 26) -0.125 to -0.10

- Gold Pack (Sep 26-Jun 27) -0.13 to -0.125

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.00328 to 2.32114% (+0.00628/wk)

- 1M +0.01857 to 2.38671% (-0.00529/wk)

- 3M -0.02629 to 2.95771% (+0.03614/wk) * / **

- 6M +0.04000 to 3.54757% (+0.03828/wk)

- 12M +0.02015 to 4.01586% (+0.05686/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.98400% on 8/18/22

- Daily Effective Fed Funds Rate: 2.33% volume: $91B

- Daily Overnight Bank Funding Rate: 2.32% volume: $285B

- Secured Overnight Financing Rate (SOFR): 2.28%, $973B

- Broad General Collateral Rate (BGCR): 2.26%, $398B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $385B

- (rate, volume levels reflect prior session)

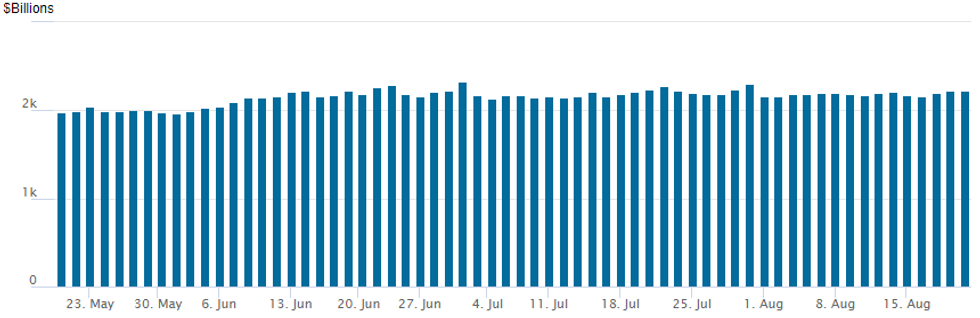

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,221.680B w/ 98 counterparties vs. $2,218.161B prior session. Record high still stands at $2,329.743B from Thursday June 30.

PIPELINE: $35.5B Total High-Grade Supply on Wk; $158.85B Total for Month

- Date $MM Issuer (Priced *, Launch #)

- 08/19 No new issuance Friday after $35.5B total on week

- $6.25B Priced Thursday

- 08/18 $2.5B *Credit Suisse $1.25B 2Y +155, 2Y SOFR, $1.25B 5Y +205

- 08/18 $1.5B *Synchrony Bank $900M 3Y +220, $600M 5Y +260

- 08/18 $1.25B *MetLife $750M 3Y +83, $500M 7Y +135

- 08/18 $500M *Entergy Louisiana 30Y Green +162.5

- 08/18 $500M *Comerica 11NC10 +245

EGBs-GILTS CASH CLOSE: Bearish End To An Ugly Week

A tumultuous week for the space ended with further weakness in both the UK and German curves, with the short-end / belly once again bearing the brunt of upward central bank hike repricing.

- Bear steepening replaced the bear flattening earlier in the week, and it was Germany's turn to underperform the UK in contrast to recent sessions.

- However, Gilts had been underperforming most of the session after stronger-than-expected retail sales data, and the short end remained under pressure: UK yields were up 14+bp at one point to a fresh post-2008 high before fading.

- Periphery spreads widened, but trade was orderly following a jump at the open.

- Key events next week include flash PMI data and the Jackson Hole symposium.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 8.1bps at 0.824%, 5-Yr is up 12.2bps at 1.042%, 10-Yr is up 12.8bps at 1.23%, and 30-Yr is up 11bps at 1.404%.

- UK: The 2-Yr yield is up 7.1bps at 2.525%, 5-Yr is up 9.4bps at 2.276%, 10-Yr is up 10.1bps at 2.411%, and 30-Yr is up 9bps at 2.714%.

- Italian BTP spread up 4.2bps at 227bps / Greek up 2.3bps at 247.1bps

FOREX: USD Index Set Close At Five-Week Highs, GBP Plummets

- Broad greenback strength that built momentum late Thursday has extended into Friday’s trading session. The USD Index (+0.55%) looks set to close above 1.08 at a five-week high after advancing around 2.3% this week.

- As the US Dollar rally gathered pace, notable moves down in NZD (-1.37%) and GBP (-0.94%) gained traction throughout the day.

- The Kiwi was largely playing catch up to the dollar move after relatively outperforming on Thursday. Weaker domestic trade figures and retreating equities, however, weighed on the local currency which has also seen AUDNZD rally back above 1.11, closing in on the August highs.

- The UK’s higher than expected retail sales data did little to cast aside the UK's bleak growth prospects. The break of 1.2000 in cable has seen significant follow through, while underpinning the EURGBP bid that sees the cross rising close to a half a percent.

- GBPUSD briefly pierced the 1.1800 mark in late trade on Friday and technical focus is on the cycle low from July at 1.1760, which is also the bear trigger. Below here we have 1.1673, the 1.00 projection of the May 27 - Jun 14 - 16 price swing.

- In similar vein, the higher US yields prompted USDJPY to print fresh highs for the week at 137.23 before moderating around 30 pips ahead of the close.

- EURUSD price action remains heavy and despite consolidating in European trade around 1.0075, the pair has slowly grinded south since, gravitating towards parity. Overall, both fundamental and technical prospects for the Euro remain weak with eyes on 0.9952, the Jul 14 low as the key bear trigger.

- A very light data docket on Monday will place focus on Tuesday’s release of European Flash PMIs.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2022 | 0115/0915 |  | CN | PBOC LPR announcement | |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/08/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.