-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Sights On Jackson Hole Summit

EXECUTIVE SUMMARY

US

FED: Consumer expectations for inflation have shown tentative signs they may turned down from peaks reached earlier this summer but the easing provides little comfort since the moves are primarily due to a fall in gas prices that may still prove volatile, regional Fed bank economists and outside advisers told MNI.

- "It seems like there may be some evidence that we're past a peak, but in an absolute sense, these short term inflation expectations measures are still very high," said Ed Knotek, a senior vice president and associate research director at the Cleveland Fed.

- As households’ expectations about future inflation can influence realized inflation, the turn in survey respondents' price expectations in the Indirect Consumer Inflation Expectations measure, the University of Michigan's Survey of Consumers, and the New York Fed's Survey of Consumer Expectations from very high levels is positive, even if predicated heavily on gas prices.

- "There is no immediate urgency about this, as banks still have an ample cushion of reserve balances. However, getting an early start might give the Fed a better sense of how much that spread will ultimately have to widen in order to reposition the RRP facility as a backstop for the market rather than as an everyday source of investment capacity."

- An IORB tweak is more likely to happen in September if they go 50bp rather than 75bp, since uncertain market pricing is currently above 50bp but well below 75bp, so a half point plus 5bp IORB tweak would bring IORB up by 55bp. * If the Fed goes 75bp, the Fed could "nudge the RRP rate down in relative terms rather than nudge the IORB up", with IORB up by 75bp but ON RRP to 70bp.

- That being said, "while we think balance sheet normalization will ultimately require a wider IORB-RRP spread, it is not clear that the Fed has come to that conclusion", with the July meeting minutes signaling that a technical adjustment is not on FOMC members' radar yet.

- In other words, "the Committee is in broad agreement to hike rates to at least the 3.25%-3.50% range before the end of the year" and TD is "of the view that the terminal rate is still above that level."

- Powell's speech "won't ... bring a significant departure from his recent statements, likely emphasizing the Fed's data dependence and the need to hike further to bring inflation under control."

- TD expects Powell to emphasize the recent easing of financial conditions and "suggest that the Fed may need to tighten policy further if financial conditions remain insufficiently restrictive."

- Current policy-wise, he may reiterate that - addressing the symposium's theme of "reassessing constraints on the economy and policy" - the FOMC needs to bring inflation back to 2% "even if the labor market must slow and growth runs below potential, in order to achieve better economic outcomes in the long run".

- If Powell does signal intentions for the September FOMC, "we think he will favor 50 bp, at least gently, without removing the possibility of a 75bp increment."

- UBS' core view is for a 50bp September raise; they point out though that Powell "will likely argue that this lower pace of hikes does not imply a capitulation on inflation but a move to further ongoing toughening. This could still be meaning fully restrictive policy but at a pace that allows for more evaluation of how inflation and the real economy respond. At this juncture Chair Powell likely won't want to ease financial conditions and could use the opportunity to suggest the terminal rate is higher than expectations."

FED: KC Fed Updates to Friday's Annual Eco-Summit in Jackson Hole

The KC Federal Reserve just announced the summit agenda for the Jackson Hole Economic Symposium: Reassessing Constraints on the Economy and Policy will be released at 2000ET Thursday evening.

- KC Fed adds "this year’s theme will explore the emergence of economic constraints during the pandemic and how supply considerations have returned to center stage. Bottlenecks and shortages have limited economic supply even as historic levels of fiscal and monetary accommodation have led to a surge in demand, resulting in an imbalance that has pushed inflation up globally. Additionally, the extraordinary and often innovative global policy response to the pandemic invites questions on what constraints bind macroeconomic policy, such as concerns over fiscal sustainability and the ultimate size of central bank balance sheets."

- Chairman Powell will discuss the Fed's economic outlook at 1000ET (0800 local), text is expected but no Q&A. Powell's appearance will also be livestreamed:

- www.youtube.com/KansasCityFed

US TSYS: Finishing Near Lows

Tsys drifting near second half lows after the bell, 30YY at 3.2381% after tapping 3.2661% high earlier, last seen July 10. No obvious headline driver for continued weakness since rates extended session lows around 1000ET.

- Volume picked up in second half as Sep/Dec Tsy futures rolling picks up ahead the Aug 31 First Notice date (Dec takes lead.

- Coming into the session, however, Tsys tracked overnight price action in EGBs, as Tsys scaled off overnight highs (30YY tapped 3.1828% low) yield curves flatter with short end underperformed, 2s10s slipped to 33.136 inverted low currently at -29.492 (-3.112).

- Domino effect from soaring European energy prices (gas appr 10% higher, coal +5.1%) coupled with ongoing Russia/Ukraine war effect on gas prices and China growth slow-down is weighed on Euro, Sterling and short end EGBs on prospect of higher rates to contain inflation.

- Technicals for TYU2 currently trading 117-25 (-10.5), Treasuries maintain a softer tone and the contract is trading at its recent lows. 118-05, 50.0% of the Jun 14 - Aug 2 bull cycle, has been cleared and this signals scope for an extension towards 117-14+ next, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the current bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

- Muted midday trade w/ focus on this week's annual Jackson Hole Economic Symposium: Reassessing Constraints on the Economy and Policy on Friday, August 26 as Chairman Powell discusses the Fed's economic outlook at 1000ET (0800 local), text is expected but no Q&A.

OVERNIGHT DATA

CHICAGO FED JULY NATIONAL ACTIVITY INDEX AT 0.27 - up from downward revised -0.25 (cons -0.25)

MARKETS SNAPSHOT

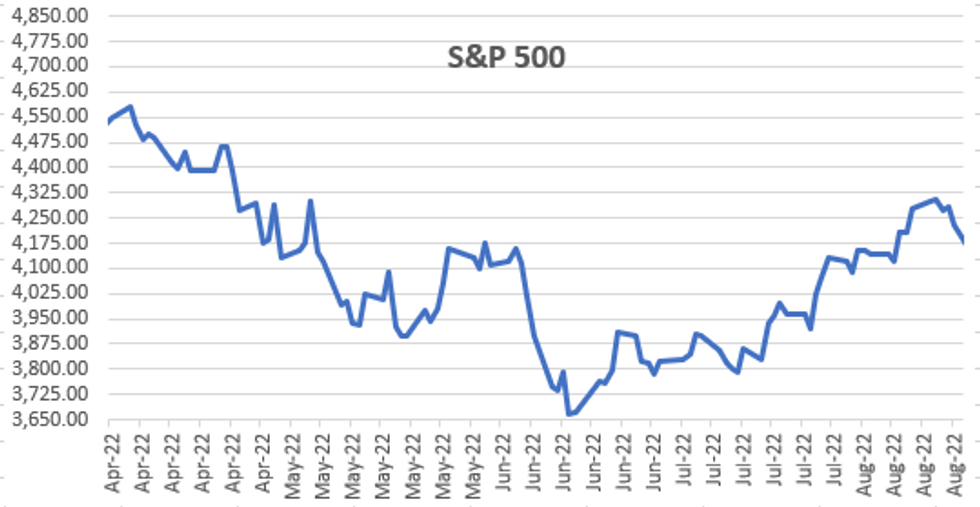

Key late session market levels- DJIA down 650.2 points (-1.93%) at 33024.2

- S&P E-Mini Future down 91.75 points (-2.17%) at 4135.25

- Nasdaq down 320.6 points (-2.5%) at 12371.8

- US 10-Yr yield is up 6.1 bps at 3.0331%

- US Sep 10Y are down 13/32 at 117-22.5

- EURUSD down 0.0098 (-0.98%) at 0.9934

- USDJPY up 0.53 (0.39%) at 137.51

- WTI Crude Oil (front-month) down $0.54 (-0.59%) at $90.23

- Gold is down $10.11 (-0.58%) at $1737.03

European bourses closing levels:

- EuroStoxx 50 down 72.1 points (-1.93%) at 3658.22

- FTSE 100 down 16.58 points (-0.22%) at 7533.79

- German DAX down 313.95 points (-2.32%) at 13230.57

- French CAC 40 down 117.09 points (-1.8%) at 6378.74

US TSY FUTURES CLOSE

- 3M10Y -0.085, 27.994 (L: 24.062 / H: 30.091)

- 2Y10Y -3.323, -29.703 (L: -33.136 / H: -27.4)

- 2Y30Y -6.343, -8.81 (L: -11.928 / H: -3.392)

- 5Y30Y -4.964, 6.658 (L: 4.854 / H: 11.942)

- Current futures levels:

- Sep 2Y down 3.375/32 at 104-15.75 (L: 104-14.625 / H: 104-20.875)

- Sep 5Y down 8.75/32 at 111-12.25 (L: 111-09.75 / H: 111-27.25)

- Sep 10Y down 11/32 at 117-24.5 (L: 117-21.5 / H: 118-14)

- Sep 30Y down 16/32 at 137-31 (L: 137-25 / H: 139-04)

- Sep Ultra 30Y down 11/32 at 150-2 (L: 149-14 / H: 151-10)

US 10YR FUTURE TECHS: (U2) Bear Cycle Extends

- RES 4: 122-02 High Aug 2 and key resistance

- RES 3: 120-29 High Aug 4

- RES 2: 119-31/120-22 High Aug 15 / 10

- RES 1: 118-14/119-09+ Intraday high / 20-day EMA

- PRICE: 117-22+ @ 19:48 BST Aug 22

- SUP 1: 117-14+ Low Jul 21 and key near-term support

- SUP 2: 117-07 61.8% retracement of the Jun 14 - Aug 2 bull cycle

- SUP 3: 116-26+ Low Jun 29

- SUP 4: 116-11 Low Jun 28

Treasuries maintain a softer tone and the contract has traded lower today. 118-05, 50.0% of the Jun 14 - Aug 2 bull cycle, has been cleared and this signals scope for an extension towards 117-14+ next, the Jul 21 low. Price has recently cleared a trendline support drawn from the Jun 14 low and this reinforces the current bearish theme. Initial firm resistance is at 119-31, the Aug 15 high.

US EURODOLLAR FUTURES CLOSE

- Sep 22 -0.033 at 96.625

- Dec 22 -0.070 at 96.015

- Mar 23 -0.110 at 95.960

- Jun 23 -0.120 at 96.020

- Red Pack (Sep 23-Jun 24) -0.125 to -0.105

- Green Pack (Sep 24-Jun 25) -0.10 to -0.075

- Blue Pack (Sep 25-Jun 26) -0.065 to -0.05

- Gold Pack (Sep 26-Jun 27) -0.045 to -0.03

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N -0.00400 to 2.31714% (+0.00628 total last wk)

- 1M +0.04072 to 2.42743% (-0.00529 total last wk)

- 3M +0.02200 to 2.97971% (+0.03614 total last wk) * / **

- 6M +0.01800 to 3.56557% (+0.03828 total last wk)

- 12M +0.01628 to 4.03214% (+0.05686 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 2.98400% on 8/18/22

- Daily Effective Fed Funds Rate: 2.33% volume: $94B

- Daily Overnight Bank Funding Rate: 2.32% volume: $289B

- Secured Overnight Financing Rate (SOFR): 2.28%, $960B

- Broad General Collateral Rate (BGCR): 2.26%, $393B

- Tri-Party General Collateral Rate (TGCR): 2.26%, $383B

- (rate, volume levels reflect prior session)

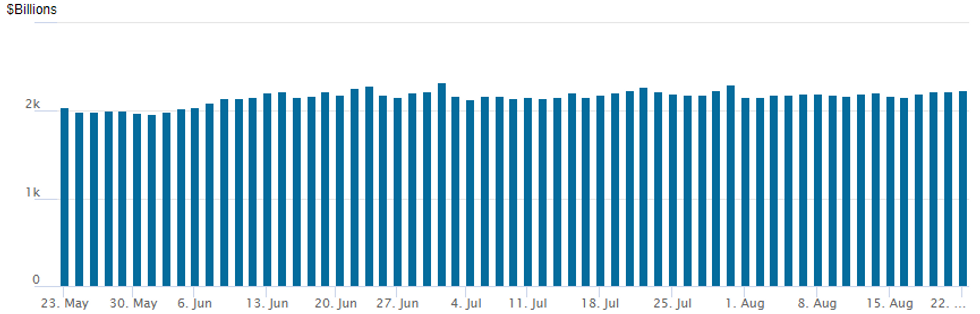

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage inches higher to $2,235.665B w/ 100 counterparties vs. $2,221.680B prior session. Record high still stands at $2,329.743B from Thursday June 30.

EGBs-GILTS CASH CLOSE: Selling Resumes On Energy Concerns

Bunds and Gilts picked up Monday where they left off last week: selling off, with an early rally reversing in the afternoon.

- There was relatively more market attention paid to FX (with EURUSD crashing through parity) and equities as European energy/power prices soared anew, heightening economic concerns.

- Gilts underperformed; UK short end weakness picked up later in the session as DMO announced a possible 2 or 3Y tender operation Thursday - 2Y yields hit a fresh post-2008 high.

- Periphery spreads widened amid the broader risk-off move; Italy underperformed, with the spread to Bunds at a fresh post-July high.

- While the Fed's weekend Jackson Hole event is the week's focus, lots of attention Tuesday on Eurozone, UK, and US PMI data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 7.1bps at 0.895%, 5-Yr is up 7.9bps at 1.121%, 10-Yr is up 7.6bps at 1.306%, and 30-Yr is up 4.7bps at 1.451%.

- UK: The 2-Yr yield is up 10.5bps at 2.63%, 5-Yr is up 10.5bps at 2.381%, 10-Yr is up 10.3bps at 2.514%, and 30-Yr is up 12.5bps at 2.839%.

- Italian BTP spread up 5.7bps at 232.7bps / Greek up 3.2bps at 250.3bps

FOREX: EURUSD Sinks To Fresh Cycle Low Below 0.9950

- EURUSD (-1.03%) has come under further pressure on Monday as weakness across equity markets and higher core yields strengthen the renewed bullish momentum for the greenback seen over the past two weeks. The pair is now trading comfortably back below the psychologically significant parity mark and has sunk to a fresh cycle low of 0.9926 as of writing.

- The European energy crisis and ongoing fears regarding the growth outlook continue to act as strong fundamental headwinds for the single currency.

- Furthermore, the technical bear trigger at 0.9952 has been breached. The next notable support resides at 0.9883, the 1.764 projection of the Jun 9 - 15 - 27 price swing while further out, scope is seen for a move towards the channel base at 0.9734.

- The dollar index has risen 0.8% on Monday, extending above the 1.0900 mark and narrowing the gap with the July highs at 1.0929. Most G10 currencies have also fallen victim to the greenback rally, with USDCNH notably rising 0.5% on the back of China’s reference lending rates being lowered. The PBOC action prompted a much stronger showing from Aussie, which spent the majority of Monday in positive territory and despite giving up these gains, remains a relative outperformer with AUDUSD close to unchanged for the session at 0.6870.

- USDJPY looks set to extend its winning streak to five sessions. This comes despite a slightly weaker session overnight for the pair before the overall USD bid, sparked a 100-pip bounce to 137.65 highs. The nearest objective on the topside is 137.96, the Jul 22 high.

- Tuesday’s focus will be on the European flash PMI’s scheduled for the early European session. The market’s attention then turns to Jackson Hole and associated commentary from Fed Chair Powell at the end of the week.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.