-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI ASIA OPEN: Global Tightening Larger Than Sum of Parts

EXECUTIVE SUMMARY

US

FED: The Federal Reserve's aggressive interest rate increases are gradually working their way through the economy but additional tightening is needed to make sure price pressures are brought under control, and policy will need to be tight for a while, Fed Vice Chair Lael Brainard said Monday.

- “Monetary policy will be restrictive for some time to ensure that inflation moves back to target over time,” Brainard said in prepared remarks to the National Association for Business Economics. “It will take time for the cumulative effect of tighter monetary policy to work through the economy broadly and to bring inflation down.”

- Brainard didn’t reveal her preference for the path of rate hikes but said “market and policymaker surveys indicate additional increases through the end of this year and into next year.” For more see MNI Policy main wire at 1358ET.

FED: There is no sign the Federal Reserve will hesitate to keep raising interest rates despite financial disruptions caused in part by its aggressive monetary tightening, even as officials keep a close eye on market function and possible contagion from volatility in UK gilts.

- Speculation is rife that recent market turmoil could force the Fed to reconsider its resolve to keep raising interest rates, after three consecutive 75 basis point increases and with another expected next month.

- Yet Fed policymakers are convinced that the U.S. banking system is much stronger and resilient than it was ahead of the global financial crisis of 2007-2009. And they see tighter financial conditions as a part of the goal of intense monetary policy actions, not a negative side-effect to be suppressed. For more see MNI Policy main wire at 1049ET.

FED: Federal Reserve Bank of Chicago President Charles Evans on Monday called for the Fed to raise its benchmark interest rate to above 4.5% by early next year and hold it there for some time to bring supply and demand back into balance and ensure that inflation expectations remain in check.

- It's possible to return inflation to the Fed's 2% objective without causing the economy to shed a lot of jobs, he added.

- "I see the nominal funds rate rising to a bit above 4.5% early next year and then remaining at this level for some time while we assess how our policy adjustments are affecting the economy," he said. "When you factor in inflation expectations and the reductions in our balance sheet, we’ll be at something equivalent to nearly a 2% real funds rate at this time." For more see MNI Policy main wire at 0900ET.

US TSYS: FI Off Lows, Germany Debt Scheme Denied

Tsys and stock indexes rebounded off session lows after headline hit that Germany denies backing "joint EU debt for loans to ease energy crisis" Rtrs -- FI and stocks sold off early on headline German WOULD back the debt scheme.

- Otherwise, quiet session on VERY light volumes (TYZ2<445k; USZ2<85k) due to Columbus Day US bank holiday - full session for Globex, however, while holiday's in Japan, Korea, and Canada contributing to thin markets.

- No data on the day (focus on Sep FOMC minutes Wednesday and CPI Thursday) while Chicago Fed Evans and Fed VC Brainard both made comments on policy at Chicago Fed NABE bank conf on the day. Little react to Evans, but Brainard came off slightly dovish: "the combined effect of concurrent global tightening is larger than the sum of its parts" while the "Federal Reserve takes into account the spillovers of higher interest rates, a stronger dollar, and weaker demand from foreign economies into the United States".

- The 2-Yr yield is unchanged at 4.3078%, 5-Yr is unchanged at 4.1423%, 10-Yr is unchanged at 3.8814%, and 30-Yr is unchanged at 3.8417%.

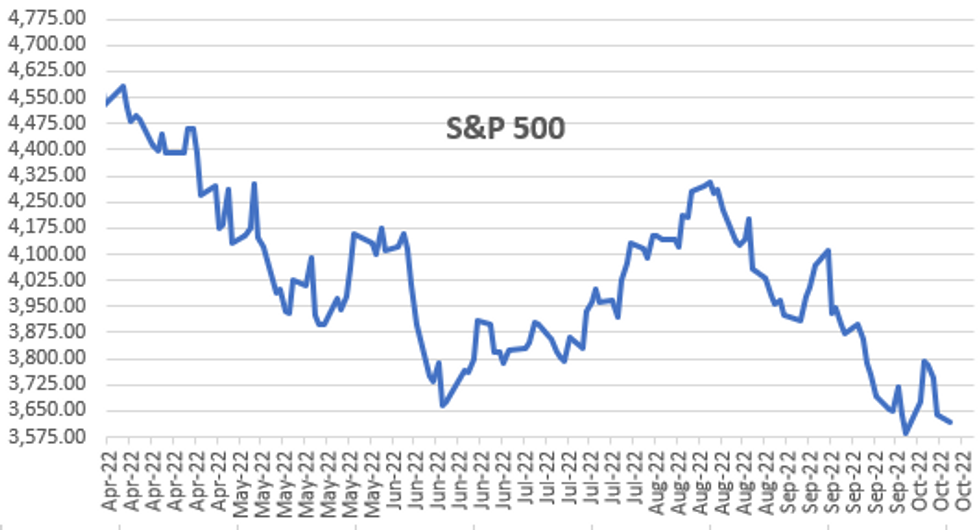

MARKETS SNAPSHPOT

Key late session market levels:

- DJIA down 74.8 points (-0.26%) at 29221.9

- S&P E-Mini Future down 27 points (-0.74%) at 3626.25

- Nasdaq down 100.2 points (-0.9%) at 10552.06

- US 10-Yr yield is unchanged 0 bps at 3.8814%

- US Dec 10Y are down 12/32 at 111-3.5

- EURUSD down 0.0041 (-0.42%) at 0.9703

- USDJPY up 0.44 (0.3%) at 145.69

- WTI Crude Oil (front-month) down $1.66 (-1.79%) at $90.97

- Gold is down $25.17 (-1.49%) at $1669.62

- EuroStoxx 50 down 18.58 points (-0.55%) at 3356.88

- FTSE 100 down 31.78 points (-0.45%) at 6959.31

- German DAX down 0.06 points (0%) at 12272.94

- French CAC 40 down 26.39 points (-0.45%) at 5840.55

US TSY FUTURES CLOSE

- 3M10Y +0, 50.126 (L: 50.126 / H: 50.126)

- 2Y10Y +0, -43.269 (L: -43.269 / H: -43.269)

- 2Y30Y +0, -47.241 (L: -47.241 / H: -47.241)

- 5Y30Y +0.176, -30.411 (L: -30.411 / H: -30.411)

- Current futures levels:

- Dec 2Y down 0.75/32 at 102-15.75 (L: 102-13.625 / H: 102-18.5)

- Dec 5Y down 4.5/32 at 106-29.5 (L: 106-21.5 / H: 107-06.75)

- Dec 10Y down 12/32 at 111-03.5 (L: 110-22.5 / H: 111-21.5)

- Dec 30Y down 1-06/32 at 124-11 (L: 123-21 / H: 125-26)

- Dec Ultra 30Y down 2-01/32 at 133-03 (L: 132-09 / H: 135-10)

US 10Y FUTURE TECHS: (Z2) Approaching The Bear Trigger

- RES 4: 116-11 50.0% retracement of the Aug 2 - Sep 28 bear leg

- RES 3: 115-09+ 50-day EMA

- RES 2: 114-31+ 38.2% retracement of the Aug 2 - Sep 28 bear leg

- RES 1: 113-11/30 20-day EMA / High Oct 4 and the bull trigger

- PRICE: 111-03 @ 19:07 BST Oct 10

- SUP 1: 110-22+/110-19 Low Oct 7 / Low Sep 28 and the bear trigger

- SUP 2: 110-00 Psychological Support

- SUP 3: 109-23+ Low Nov 30 2007 (cont)

- SUP 4: 108.27+ 3.0% 10-dma envelope

Treasuries remain soft and the contract has traded lower once again today. The reversal last week from 113-30, the Oct 4 high, marks the end of the correction between Sep 28 - Oct 4. Moving average studies remain in a bear mode position and attention is on the key support and bear trigger at 110-19, Sep 28 low. A break would confirm a resumption of the primary downtrend. Price needs to break above 113-30 to reinstate a short-term bullish theme.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.055 at 95.135

- Mar 23 -0.055 at 95.060

- Jun 23 -0.050 at 95.090

- Sep 23 -0.035 at 95.195

- Red Pack (Dec 23-Sep 24) -0.025 to -0.015

- Green Pack (Dec 24-Sep 25) -0.03 to -0.02

- Blue Pack (Dec 25-Sep 26) -0.055 to -0.04

- Gold Pack (Dec 26-Sep 27) -0.08 to -0.06

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- 1M +0.00314 to 3.31671% (+0.17086 total last wk)

- 3M +0.01043 to 3.91914% (+0.15400 total last wk) * / **

- 6M +0.04272 to 4.42743% (+0.15271 total last wk)

- 12M +0.05371 to 5.0500% (+0.21572 total last wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 3.91914% on 10/10/22

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/10/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 11/10/2022 | 2330/1030 |  | AU | Westpac-MI Consumer Sentiment | |

| 11/10/2022 | 0030/1130 |  | AU | NAB Business Survey | |

| 11/10/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 11/10/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 11/10/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 11/10/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 11/10/2022 | - |  | EU | ECB Panetta IMF/World Bank Annual Meetings | |

| 11/10/2022 | 1245/1445 |  | EU | ECB Lane Keynote Speech | |

| 11/10/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 11/10/2022 | 1530/1130 |  | US | Philadelphia Fed's Patrick Harker | |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/10/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 11/10/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 11/10/2022 | 1800/1900 |  | UK | BOE Cunliffe Panels IIF Annual Meeting | |

| 11/10/2022 | 1800/2000 |  | EU | ECB Lane NY Fed Fireside Chat | |

| 11/10/2022 | 1835/1935 |  | UK | BOE Bailey in Conversation w. Tim Adams at IIF Meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.