-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: US Yields Tick Up, JGBs Steady

MNI: PBOC Net Drains CNY248 Bln via OMO Tuesday

MNI ASIA OPEN: 2YY Nears 16Y Highs

EXECUTIVE SUMMARY

US

FED: The Fed must keep raising interest rates to put inflation on the path to its 2% target, according to Timothy Fiore of the Institute for Supply Management, whose factory price index has risen 12 percentage points over the last two months.

- Fiore's concern comes even with the US central bank already lifting the fed funds rate 450 basis points in the last year to a range of 4.5% to 4.75%. "Is that enough to get the 2% inflation target? I don't think so," Fiore told MNI on Wednesday. Fed officials are signaling more rate rises and a longer pause, while ex-Fed policymakers expect even higher interest rates. (See: MNI INTERVIEW: Fed Could Hike Rates More Than Expected-Hoenig)

- "Given that we're not having large scale layoffs and demand is coming back, it raises the question of whether you want to get inflation over with right away and shorten that cycle and make it really painful or do we want to bring it down over a longer period of time," he said. "It looks like we're going to be living with it, with interest rates that are maybe still marginally accommodative and are not restrictive." For more see MNI Policy main wire at 1340ET.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Wednesday he sees the need for more rate increases amid high inflation and then likely holding them steady well into next year.

- "I think we will need to raise the federal funds rate to between 5 and 5.25% and leave it there until well into 2024," he said in prepared remarks. "This will allow tighter policy to filter through the economy and ultimately bring aggregate supply and aggregate demand into better balance and thus lower inflation."

- Bostic's remarks for a longer pause echo those of Boston Fed's President Susan Collins' who Friday said the fed funds rate will remain at a sufficiently restrictive level for perhaps an "extended" period of time. "We must determine when inflation is irrevocably moving lower," he said. "We’re not there yet." For more see MNI Policy main wire at 1001ET.

JAPAN

BOJ: Former Bank of Japan governor Masaaki Shirakawa has highlighted the risks to Japan's inflation outlook from long-standing employment practices, as he called for global policymakers to give more consideration to supply-side factors in an article in the International Monetary Fund's latest Finance & Development Magazine.

- “Monetary policy should not be guided by supply-side considerations, but it shouldn’t ignore them either,” he wrote in the March edition set for release on Wednesday. “Debates about monetary policy often assume that monetary easing and tightening arrive alternately in a relatively short space of time. If this were so, it would justify the traditional view that monetary easing affects only the demand side.”

- He used Japan's approach to employment as an example of a supply-side issue with consequences for monetary policy. For more see MNI Policy main wire at 1202ET.

US TSYS: High ISM Prices Paid Helps Push 2YY Over 4.9%

Tsys near session lows following volatile first half. Bonds discounted a rally that followed balanced BOE Gov Bailey policy comments overnight, contrasting with more hawkish central bank stances. Tsy sell-off accelerated after midmorning ISM data, particularly jump in prices paid to 51.3 from 44.5 prior (46.5 est).

- Modest react to MN Fed Kashkari stating "overtightening policy definitely a risk", but stressed undertightening to combat inflation is worse than overtightening. Kashkari leaning toward raisng terminal dot to 5.4%.

- Federal Reserve Bank of Atlanta President Raphael Bostic said Wednesday he sees the need for more rate increases amid high inflation and then likely holding them steady well into next year. "I think we will need to raise the federal funds rate to between 5 and 5.25% and leave it there until well into 2024," he said in prepared remarks.

- Yield curves bear steepened as 2s drew technical buying after TUM3 hit 101-20.62 low (101-22.38 last), 2YY hit 4.9014% -- highest since May 2007.

- STIR: Fed funds implied hikes off earlier highs: Mar'23 30.5bp vs. 31.9bp high, May'23 cumulative 57.6bp vs. 58.5bp (+2.4) to 5.154%, Jun'23 76.9bp (+2.4) to 5.347%, terminal at 5.465% in Oct'23 vs. 5.50% earlier high.

OVERNIGHT DATA

- US MBA: REFIS -6% SA; PURCH INDEX -6% SA THRU FEB 24 WK

- US MBA: UNADJ PURCHASE INDEX -44% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.71% VS 6.62% PREV

- US MBA: MARKET COMPOSITE -5.7% SA THRU FEB 24 WK

- US JAN CONSTRUCT SPENDING -0.1%

- US JAN PRIVATE CONSTRUCT SPENDING +0.0%

- US JAN PUBLIC CONSTRUCT SPENDING -0.6%\

- US ISM FEB MANUF PURCHASING MANAGERS INDEX 47.7

- US ISM FEB MANUF PRICES PAID INDEX 51.3

- US ISM FEB MANUF NEW ORDERS INDEX 47

- US ISM FEB MANUF EMPLOYMENT INDEX 49.1

- US ISM FEB MANUF PRODUCTION INDEX 47.3

- US ISM FEB MANUF SUPPLIER DELIVERY INDEX 45.2

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 70.01 points (-0.21%) at 32582.49

- S&P E-Mini Future down 24.25 points (-0.61%) at 3950.5

- Nasdaq down 86.9 points (-0.8%) at 11367.03

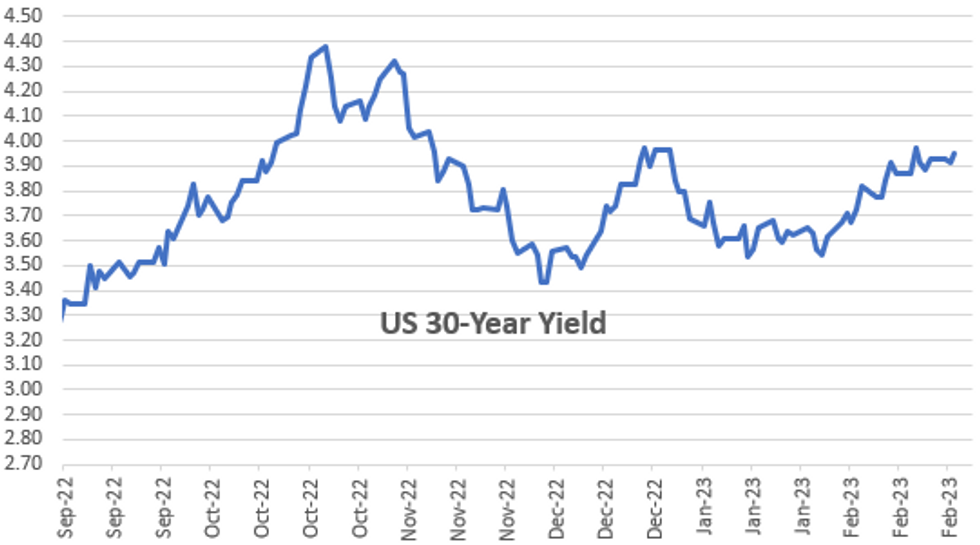

- US 10-Yr yield is up 7.1 bps at 3.9905%

- US Jun 10-Yr futures are down 20.5/32 at 111-0.5

- EURUSD up 0.0081 (0.77%) at 1.0657

- USDJPY down 0.01 (-0.01%) at 136.18

- WTI Crude Oil (front-month) up $0.62 (0.8%) at $77.66

- Gold is up $11.78 (0.64%) at $1838.51

- EuroStoxx 50 down 22.63 points (-0.53%) at 4215.75

- FTSE 100 up 38.65 points (0.49%) at 7914.93

- German DAX down 60.12 points (-0.39%) at 15305.02

- French CAC 40 down 33.68 points (-0.46%) at 7234.25

US TREASURY FUTURES CLOSE

- 3M10Y +6.402, -86.839 (L: -96.025 / H: -85.015)

- 2Y10Y +0.573, -89.63 (L: -91.199 / H: -87.164)

- 2Y30Y -3.14, -93.732 (L: -95.126 / H: -89.054)

- 5Y30Y -4.244, -31.166 (L: -32.095 / H: -26.359)

- Current futures levels:

- Jun 2-Yr futures down 6.375/32 at 101-21.25 (L: 101-20.625 / H: 101-27.125)

- Jun 5-Yr futures down 13/32 at 106-20.75 (L: 106-17.75 / H: 107-00.5)

- Jun 10-Yr futures down 20/32 at 111-1 (L: 110-30 / H: 111-19.5)

- Jun 30-Yr futures down 1-03/32 at 124-4 (L: 123-28 / H: 125-12)

- Jun Ultra futures down 19/32 at 134-15 (L: 133-26 / H: 135-24)

US 10YR FUTURE TECHS: (M3) Trend Needle Points South

- RES 4: 113-19+ 50-day EMA

- RES 3: 113-03 High Feb 15

- RES 2: 112-27+ 20-day EMA

- RES 1: 112-03 High Feb 24

- PRICE: 111-00 @ 1410 ET Mar 1

- SUP 1: 110-30 Low Mar 1

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 110-03+ Lower 2.0% Bollinger Band

- SUP 4: 108-26+ Low Oct 21 (cont)

Downside pressure on Treasury futures accelerated Wednesday, keeping prices within the clear downtrend posted across February. Recent weakness maintains the current bearish sequence of lower lows and lower highs. Potential is seen for a move towards the 111.00 handle next, a Fibonacci projection. Moving average studies are in a bear mode position, highlighting current market sentiment. Initial resistance is seen at 112-03, the Feb 24 high.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.015 at 94.913

- Jun 23 -0.050 at 94.420

- Sep 23 -0.060 at 94.275

- Dec 23 -0.075 at 94.415

- Red Pack (Mar 24-Dec 24) -0.125 to -0.10

- Green Pack (Mar 25-Dec 25) -0.12 to -0.115

- Blue Pack (Mar 26-Dec 26) -0.11 to -0.095

- Gold Pack (Mar 27-Dec 27) -0.09 to -0.085

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00385 to 4.55714% (-0.00457/wk)

- 1M +0.00357 to 4.67300% (+0.03814/wk)

- 3M +0.01014 to 4.98114% (+0.02771/wk)*/**

- 6M +0.02471 to 5.28814% (+0.05300/wk)

- 12M +0.00457 to 5.68614% (+0.04743/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.57% volume: $103B

- Daily Overnight Bank Funding Rate: 4.57% volume: $269B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.230T

- Broad General Collateral Rate (BGCR): 4.52%, $462B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $444B

- (rate, volume levels reflect prior session)

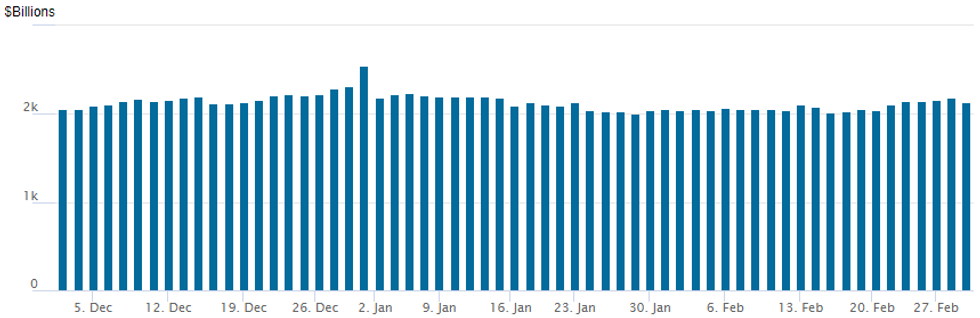

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,188.035B w/ 107 counterparties vs. prior session's $2,162.435B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $2.5B Morocco 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/01 $2.5B #Morocco 5Y +195, 10.5Y +260

- 03/01 $2B *Bank of England 3Y +13

- 03/01 $2B #Sumitomo Trust $1B 3Y +110, $500M 3Y SOFR+112, $500M 5Y +128

- 03/01 $1.5B #Five Corners $800M 10Y +180, $700M 30Y +205

- 03/01 $1.3B #Simon Property $650M each: 10Y +165, 30Y +195

- 03/01 $750M #Eversource WNG 5Y +123

- 03/01 $500M #KeySpan Gas 10Y +200

- 03/01 $Benchmark EBRD 5Y SOFR+35a

- 03/01 $Benchmark L Bank 3Y SOFR+28a

- 03/01 $Benchmark Stanley Black & Decker 3NC1 +165, 5Y +175

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/03/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 02/03/2023 | 1000/1100 | *** |  | IT | HICP (p) |

| 02/03/2023 | 1000/1100 | *** |  | EU | HICP (p) |

| 02/03/2023 | 1000/1100 | ** |  | EU | Unemployment |

| 02/03/2023 | 1230/1330 |  | EU | ECB Schnabel at MMCG Meeting | |

| 02/03/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 02/03/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/03/2023 | 1330/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/03/2023 | 1500/1500 |  | UK | BOE Pill Speech at Wales Week | |

| 02/03/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 02/03/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/03/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/03/2023 | 2100/1600 |  | US | Fed Governor Christopher Waller | |

| 03/03/2023 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 02/03/2023 | 2300/1800 |  | US | Minneapolis Fed's Neel Kashkari | |

| 03/03/2023 | 2350/0850 | ** |  | JP | Tokyo CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.