-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Anticipating 25Bp Hike From the Fed Wednesday

EXECUTIVE SUMMARY

US

US TSY: Treasury Secretary Janet Yellen said Tuesday the U.S. banking system is stabilizing, while Treasury remains committed to ensuring the ongoing health and competitiveness of America's regional banks.

- "The situation is stabilizing. And the U.S. banking system remains sound. The Fed facility and discount window lending are working as intended to provide liquidity to the banking system. Aggregate deposit outflows from regional banks have stabilized," she said, according to excerpts of a speech to be delivered to the American Bankers Association.

- "Let me be clear: the government’s recent actions have demonstrated our resolute commitment to take the necessary steps to ensure that depositors’ savings and the banking system remain safe," she added. (See: MNI FED WATCH: 25BP Hike Likely Unless Banking Crisis Worsens)

UK

BOE: The MNI Markets team expects 3 members of the MPC to vote for unchanged rates, 3 members to vote for a 25bp hike and 3 members to determine their vote based on the outcome of the February inflation data (which the MPC received on Friday morning). In our view, it is not necessarily the headline data but services inflation that will determine the votes of Bailey, Broadbent and Pill.

- If services inflation was to show another notable deceleration in the February data, we would expect to see rates left on hold this week. However, if the January slowdown in services inflation was to be reversed, the MNI Markets team thinks these members would vote for a 25bp hike. This will tip the balance of the MPC into either a hold or a hike.

EUROPE

SWITERLAND: The combined operations of UBS and Credit Suisse are now too big for Switzerland, a former member of the board of the Swiss financial market supervisory authority told MNI, adding that the authorities should explain why they did not activate previously prepared plans for an emergency at CS.

- Credit Suisse and UBS were already “borderline too big” for Switzerland before the announcement of UBS’s USD3.25 billion takeover, Yvan Lengwiler, who sat on the board of FINMA from 2012 to 2019, said in an interview, leaving the new bank “clearly too big for the country.”

- “This is a major problem,” he said. “We have a massive too-big-to-fail problem now, and we have less diversification. I think there must be a medium-term strategy to shrink UBS to a more manageable size, because otherwise I'm not sure that Switzerland is the right home for this bank" (see MNI: Swiss Will Have To Step In Over Credit Suisse-Wyplosz). For more see MNI Policy main wire at 0816ET.

- With no further monetary policy assessments scheduled before June, the SNB, which had stated in December that additional rate rises “cannot be ruled out,” had until recently been widely seen to be on course for a 50bps rise. But market uncertainty following the collapse of SVB in the U.S. and Credit Suisse at home will likely render policymakers more cautious, with currency interventions possibly playing a greater role in the near term.

- Updates will also be published to December’s conditional forecast, which put inflation at 2.4% for 2023 and 1.8% for 2024, with growth falling back from 2.0% in 2022 to just 0.5% this year. For more see MNI Policy main wire at 1026ET.

US TSYS: Yields Gain Ahead Expected 25Bp Hike From Fed

- Front month US Treasury futures are near late session lows after the close (10Y yield at 3.5923%, 2Y yield at 4.1749% vs. 3.9126% overnight low), yield curves bear flattening (2s10s -8.305 at -58.091).

- The main focus on Wednesday's FOMC policy announcement, 25bp hike widely anticipated. Otherwise there was little reaction to a surge in latest existing home sales data earlier: +14.5% to 4.58M SAAR vs. estimate of 4.2M +5%, while futures held near midday lows after $12B 20Y bond auction (912810TQ1) reopen tailed slightly: 3.909% high yield vs. 3.905% WI; 2.53x bid-to-cover vs. prior month's 2.54x.

- Indirect take-up 67.03% vs. 75.3% prior month; direct bidder take-up 21.06% vs. 17.97% prior; primary dealer take-up climbs to 11.93% vs. 6.73%.

- From a technical perspective, front month 10Y futures remain volatile as the price continues to pull away from yesterday’s high of 116-24. TYM3 currently at 114-07 (-28), above next support at 114-01+, the Mar 17 low and firmer support is seen at 113-12, the 50-day EMA.

- A break of this average is required to signal a stronger reversal. A move higher higher would once again refocus attention on the key resistance zone between 116-24, yesterday’s high and 116-28+, the Jan 19 high. This zone is a bull trigger.

OVERNIGHT DATA

- US NAR: FEB EXISTING HOME SALES +14.5% TO 4.58M SAAR

- US NAR'S YUN: BUYERS TOOK ADVANTAGE OF LOWER RATES

- US NAR: FEB INCREASE IN SINGLE FAMILY HOME SALES LARGEST EVER

- US MAR PHILADELPHIA FED NONMFG INDEX -12.8

- US REDBOOK: MAR STORE SALES +2.9% V YR AGO MO

- US REDBOOK: STORE SALES +3.2% WK ENDED MAR 18 V YR AGO WK

- CANADA FEB CPI 5.2% YOY VS FORECAST 5.4%, PRIOR 5.9%

- CANADA FEB CPI INFLATION +0.4% M/M, +5.2% YoY

- CANADA FEB CPI 5.2% YOY VS FORECAST 5.4%, PRIOR 5.9%

MARKETS SNAPSHOT

Key late session market levels:

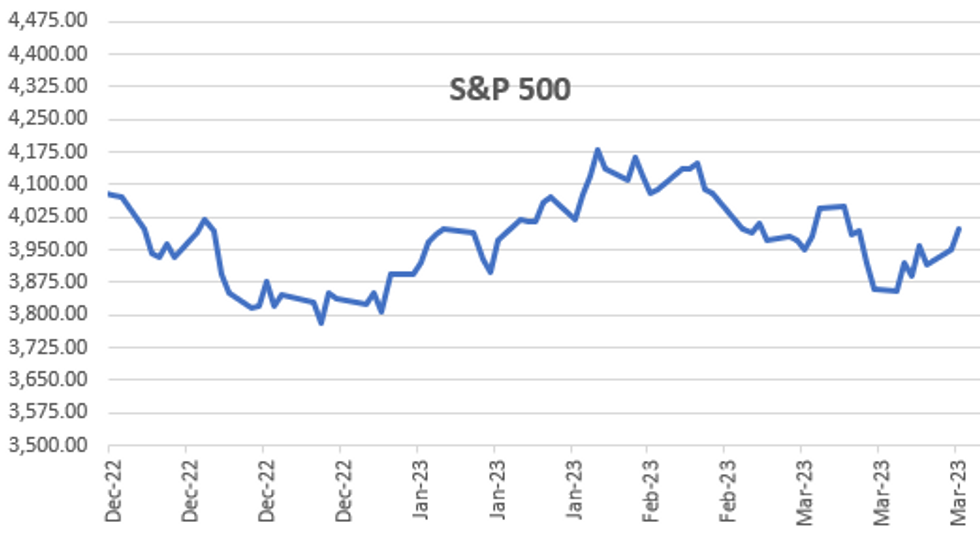

- DJIA up 240.58 points (0.75%) at 32483.42

- S&P E-Mini Future up 45.5 points (1.14%) at 4028.25

- Nasdaq up 165.5 points (1.4%) at 11840.97

- US 10-Yr yield is up 10.6 bps at 3.5904%

- US Jun 10-Yr futures are down 28/32 at 114-7

- EURUSD up 0.0045 (0.42%) at 1.0766

- USDJPY up 1.13 (0.86%) at 132.46

- WTI Crude Oil (front-month) up $1.69 (2.5%) at $69.33

- Gold is down $40.61 (-2.05%) at $1938.03

- EuroStoxx 50 up 62.18 points (1.51%) at 4181.6

- FTSE 100 up 132.37 points (1.79%) at 7536.22

- German DAX up 261.96 points (1.75%) at 15195.34

- French CAC 40 up 99.77 points (1.42%) at 7112.91

US TREASURY FUTURES CLOSE

- 3M10Y +2.237, -114.128 (L: -129.054 / H: -112.47)

- 2Y10Y -7.821, -57.607 (L: -60.997 / H: -48.374)

- 2Y30Y -12.437, -44.144 (L: -46.602 / H: -28.51)

- 5Y30Y -8.022, -0.737 (L: -1.93 / H: 10.552)

- Current futures levels:

- Jun 2-Yr futures down 15.875/32 at 103-3.625 (L: 103-02.125 / H: 103-21.875)

- Jun 5-Yr futures down 23.75/32 at 108-30.75 (L: 108-27.25 / H: 109-31)

- Jun 10-Yr futures down 28.5/32 at 114-6.5 (L: 114-02 / H: 115-14.5)

- Jun 30-Yr futures down 1-10/32 at 130-04 (L: 129-27 / H: 131-28)

- Jun Ultra futures down 1-17/32 at 140-12 (L: 139-31 / H: 142-17)

US 10YR FUTURE TECHS: Bearish Retracement Extends

- RES 4: 117-14+ High Aug 29 / 30 2022 (cont)

- RES 3: 117-00 61.8% of the Aug - Oct 2022 bear leg (cont)

- RES 2: 116-28+ High Jan 19 and key resistance

- RES 1: 115-14+/116-28+ Intraday high / High Mar 20

- PRICE: 114-07 @ 1520ET Mar 21

- SUP 1: 114-01+ Low Mar 17

- SUP 2: 113-12 50-day EMA

- SUP 3: 112-21 Low Mar 13

- SUP 4: 111-28+ 76.4% retracement of the Mar 2 - 20 rally

Treasury futures faded through Tuesday trade. The next support lies at 114-01+, the Mar 17 low and firmer support is seen at 113-12, the 50-day EMA. A break of this average is required to signal a stronger reversal. A move higher higher would once again refocus attention on the key resistance zone between 116-24, yesterday’s high and 116-28+, the Jan 19 high. This zone is a bull trigger.

EURODOLLAR FUTURES CLOSE

- Jun 23 -0.265 at 94.815

- Sep 23 -0.435 at 95.135

- Dec 23 -0.405 at 95.390

- Mar 24 -0.355 at 95.740

- Red Pack (Jun 24-Mar 25) -0.285 to -0.13

- Green Pack (Jun 25-Mar 26) -0.105 to -0.085

- Blue Pack (Jun 26-Mar 27) -0.075 to -0.06

- Gold Pack (Jun 27-Mar 28) -0.08 to -0.065

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00500 to 4.56057% (-0.00029/wk)

- 1M +0.02700 to 4.77929% (+0.00158/wk)

- 3M +0.07057 to 5.01771% (+0.01928/wk)*/**

- 6M +0.15786 to 5.00657% (-0.04572/wk)

- 12M +0.29328 to 4.99671% (-0.03743/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.15371% on 3/9/23

- Daily Effective Fed Funds Rate: 4.58% volume: $92B

- Daily Overnight Bank Funding Rate: 4.57% volume: $277B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.288T

- Broad General Collateral Rate (BGCR): 4.52%, $506B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $489B

- (rate, volume levels reflect prior session)

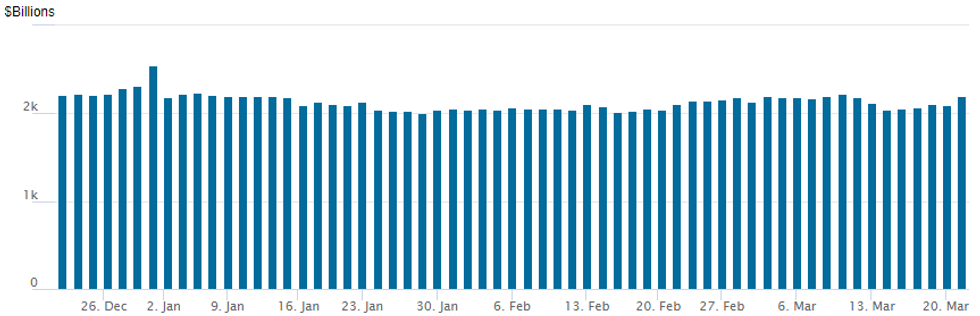

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,194.631B w/ 104 counterparties vs. prior session's $2,.098.393B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $1.2B Republic Service 2Pt Launched

- Date $MM Issuer (Priced *, Launch #)

- 03/21 $1.2B #Republic Services $400M 6Y +120, $800M 11Y +145

- 03/21 $650M #Brown-Forman 10Y +120

- 03/21 $500M #Duke Energy Indiana WNG 30Y +170

- 03/21 $500M #Indiana Michigan Power WNG 30Y +190

- 03/21 $500M #Extra Space Storage5Y +200

- 03/21 $Benchmark Metropolitan Life 10Y +158

- 03/21 $Benchmark NiSource 5Y +160

- 03/21 $Benchmark Republic of Panama tap 2035 +287.5, 31Y +350a

EGBs-GILTS CASH CLOSE: German Short-End Underperforms

The German short end underperformed across the global core FI space Tuesday, with 2Y Schatz yields rising the most in a single day since 2008 (just under 26bp).

- The price action saw few headline drivers and was mostly steady through the session - it mainly reflected a resumption of Monday's retracement from panicked extremes following the weekend's UBS-Credit Suisse tie-up.

- Such has been the magnitude of recent moves: though up over 50bp from Monday's lows, German 2Y yields remain 80bp below the month's highs.

- Periphery spreads tightened alongside an equity relief rally.

- Central bank hike expectations continued to retrace higher from the past week's lows, with end-year ECB pricing up 25bp on the session.

- BoE pricing rose by 15bp though as our preview of Thursday's meeting points out, tomorrow's CPI will likely determine whether we get a hike or a hold.

- Later Wednesday, the Federal Reserve decision takes centre stage.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 25.6bps at 2.617%, 5-Yr is up 21bps at 2.312%, 10-Yr is up 16.7bps at 2.292%, and 30-Yr is up 11.1bps at 2.319%.

- UK: The 2-Yr yield is up 5.4bps at 3.278%, 5-Yr is up 4.8bps at 3.216%, 10-Yr is up 5.7bps at 3.367%, and 30-Yr is up 2bps at 3.842%.

- Italian BTP spread down 3.9bps at 182.4bps / Greek down 7.2bps at 191bps

FOREX: Pressure On Core Fixed Income Weighs On Japanese Yen

- Pressure on core fixed income on Tuesday mainly reflected a resumption of Monday's retracement from panicked extremes following the weekend's UBS-Credit Suisse tie-up. Higher core yields played into a weaker Japanese Yen, with USDJPY posting a notable bounce from 131.04 overnight lows to 132.60 as we approach Wednesday’s APAC crossover.

- With the German short end notably underperforming (2Y Schatz yields rising just under 26bp), the Euro has been a relative outperformer across G10, along with the Swiss Franc.

- EURUSD moved above resistance at 1.0760, the Mar 15 high and a clear break of this level in coming sessions would strengthen the current bull theme. This would signal scope for gains towards 1.0803 next, the Feb 14 high. On the downside, key short-term support has been defined at 1.0516, the Mar 15 low, where a break is required to reinstate a bearish technical threat.

- AUD and NZD make up the poorest performers in G10 alongside the Yen following the RBA minutes release overnight, which raised the prospect of a pause to the rate hike cycle. The RBA minutes showed the board took uncertainty surrounding the economic outlook into consideration, and could keep rates unchanged at upcoming meetings in order to judge the impact of the tightening cycle so far.

- In emerging markets, HUF (+1.96%) and MXN (+1.07%) have had the most notable rallies/recoveries against the greenback after their sharp selloffs across both last week and early on Monday’s session.

- Wednesday’s docket commences with UK CPI, seen as a key data point before the BOE decision on Thursday. ECB president Lagarde is then due to speak at ECB and Its Watchers conference, in Frankfurt. Focus then quickly turns to the March FOMC rate decision/statement.

Wednesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/03/2023 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 22/03/2023 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 22/03/2023 | 0700/0700 | *** |  | UK | Producer Prices |

| 22/03/2023 | 0845/0945 |  | EU | ECB Lagarde Address at ECB and its Watchers Conference | |

| 22/03/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/03/2023 | 0930/0930 | * |  | UK | ONS House Price Index |

| 22/03/2023 | 0930/1030 |  | EU | ECB Lane in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 22/03/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/03/2023 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 22/03/2023 | 1345/1445 |  | EU | ECB Panetta in Debate at ECB and its Watchers Conference | |

| 22/03/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/03/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 22/03/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.