-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Bonds Rally Back to Pre-ISM Prices Paid Lvls

EXECUTIVE SUMMARY

US

FED: A decline in U.S. services prices to a two year-low is due to lower commodity prices rather than Federal Reserve's historic monetary tightening, which so far has not impacted pricing much, Institute for Supply Management services chair Anthony Nieves told MNI Thursday, suggesting interest rates will have to move higher.

- The Fed's tightening "doesn't seem to be having much of an impact right now," he said. "It could be the lag but right now these interest rate increases haven't really impacted pricing all that much," he said.

- "What's driving down our price index month-over-month has nothing to do with the rates. It's more about the cost of fuel and other commodities that are softening a little bit, while some others are sideways or up," he said, adding that China's reopening will likely put upward pressure on commodities.

- Nieves said improved logistics, shorter lead times, and better capacity suggest China's reopening will not cause more problems in supply chains. "China's reopening will definitely help with pricing over time for sure," he said. The prices paid measure in February's ISM services report decreased by 2.2pt to 65.6, the lowest level since January 2021.

- Key reforms include moves to increase the range of centrally cleared trades as well as establishing guidelines for when authorities should intervene – and for how such actions must be kept separate from monetary policy.

- “I am optimistic that with continued reforms, we can make core markets resilient enough that interventions to support market functioning will be extraordinarily rare,” Logan said in prepared remarks at a Chicago Booth conference on market function. (See MNI: US Treasury Clearing To Limit Contagion, Create New Risks)

- When central banks do intervene it's important to make clear that it's doing so to help markets continue working rather than to stimulate economic activity, she said.

- “Bringing inflation back to 2% will likely require a period of below trend growth and some softening of labor market conditions,” said the report setting the stage for Chair Jerome Powell’s testimony next week. “Wage gains slowed over the second half of 2022, but they remain above the pace consistent with 2% inflation over the longer term.”

- A hot streak of data on jobs and inflation for January tempered hopes for a more rapid dissipation of price pressures. (See MNI INTERVIEW: Fed Could Hike Rates More Than Expected)

EUROPE

EU: Finance ministry deputies meeting in Brussels this week agreed a path forward on reform of the European Union’s fiscal rules in a compromise which acknowledges proposals by the European Commission but concedes that key contentious points remain to be clarified, paving the way for legislative proposals, EU officials told MNI.

- The hold-all nature of the agreed text is designed to accommodate wide areas of disagreement between states over the reform and means that negotiations on the actual content of a definitive fiscal reform deal over the coming months are unlikely to be any easier than expected.

- However, the agreement will allow the Commission to come forward with legislative proposals for overhauling the Stability and Growth Pact, most likely in April, reducing the risk that the old rules will come back into force next year following the expiry of a waiver enacted to help states cope with the effects of Covid and the Ukraine war.

- The text of the conclusions highlights the key points of the Commission’s orientations paper of last November 2022, on the central role of fiscal-structural plans, the use of reference paths for debt reduction, the possibility of country-specific escape clauses and the need for greater flexibility

US TSYS: Market Roundup: Bonds March Steadily Higher

Tsys finish near late session highs, yield curves bull flattening - completely reversing the prior session move: 2s10s -6.376 at -89.840. Bonds lead the rally early, similar drift in EGBs with no new inflation metric surprises overnight.

- Tsys pared gains briefly after higher than expected ISM Services composite of 55.1 (54.5 est), components: Business: 56.3; Prices Paid: 65.6 (-2.2); New Orders: 62.6 (+2.2); Employment 54.0 (+4.0).

- Tsys quickly rebounded with Bonds to early Wednesday levels (pre-ISM prices paid driven sell-off). Short end, however, lagged the move: Fed funds implied hike steady for Mar'23 at 31.2bp, but gained in May'23 cumulative 59.4bp (+2.0) to 5.170%, Jun'23 77.0bp (+2.1) to 5.345%. Fed terminal climbed to 5.480% high in Oct'23, but receded to 5.450% at the close.

- Salient events later in the week:

- Fed Chair Powell semi-annual mon-pol report to Congress, Tue 1000ET

- Fed Chair Powell report to Congress: House Fncl Srvcs, Wed 1000ET

- ADP employment data for Feb (106k prior, 200k est), Wed 0815ET

- NFP employment data for Feb (517k prior, 200k est), Fri 0830ET

OVERNIGHT DATA

- US FEB FINAL S&P SERVICES PMI 50.6 (FLASH 50.5); JAN 46.8

- US ISM FEB SERVICES BUSINESS INDEX 56.3

- US ISM FEB SERVICES PRICES 65.6

- US ISM FEB SERVICES EMPLOYMENT INDEX 54

- US ISM FEB SERVICES NEW ORDERS 62.6

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 349.85 points (1.06%) at 33351.55

- S&P E-Mini Future up 61.75 points (1.55%) at 4046.25

- Nasdaq up 221.5 points (1.9%) at 11683.67

- US 10-Yr yield is down 9.4 bps at 3.9615%

- US Jun 10-Yr futures are up 19.5/32 at 111-3.5

- EURUSD up 0.0038 (0.36%) at 1.0635

- USDJPY down 0.92 (-0.67%) at 135.83

- WTI Crude Oil (front-month) up $1.63 (2.09%) at $79.80

- Gold is up $17.44 (0.95%) at $1853.44

- EuroStoxx 50 up 54.21 points (1.28%) at 4294.8

- FTSE 100 up 3.07 points (0.04%) at 7947.11

- German DAX up 250.75 points (1.64%) at 15578.39

- French CAC 40 up 63.9 points (0.88%) at 7348.12

US TREASURY FUTURES CLOSE

- 3M10Y -8.763, -89.349 (L: -90.577 / H: -79.993)

- 2Y10Y -6.376, -89.94 (L: -90.609 / H: -83.202)

- 2Y30Y -8.033, -97.81 (L: -99.638 / H: -89.556)

- 5Y30Y -5.049, -37.131 (L: -38.974 / H: -31.376)

- Current futures levels:

- Jun 2-Yr futures up 2.625/32 at 101-22.75 (L: 101-19.375 / H: 101-24.25)

- Jun 5-Yr futures up 8.5/32 at 106-21 (L: 106-12 / H: 106-23.75)

- Jun 10-Yr futures up 18/32 at 111-02 (L: 110-15.5 / H: 111-03.5)

- Jun 30-Yr futures up 1-26/32 at 124-28 (L: 122-30 / H: 124-31)

- Jun Ultra futures up 2-29/32 at 135-27 (L: 133-01 / H: 136-01)

US 10YR FUTURE TECHS: (M3) Fresh Bear Cycle Low

- RES 4: 113-12+ 50-day EMA

- RES 3: 112-28 High Feb 16

- RES 2: 112-15+ 20-day EMA

- RES 1: 111-23+/112-03 High Feb 28 / 24

- PRICE: 111-02 @ 1500ET Mar 3

- SUP 1: 110-12+ Low Mar 02

- SUP 2: 110-06 3.00 proj of the Jan 19 - Jan 30 - Feb 2 price swing

- SUP 3: 109-31+ Lower 2.0% Bollinger Band

- SUP 4: 109-12 3.382 proj of the Jan 19 - Jan 30 - Feb 2 price swing

Treasury futures traded lower again Thursday, reinforcing and extending the current bear cycle. The move lower maintains the bearish price sequence of lower lows and lower highs and note that moving average studies are in a bear-mode position. This reflects current market sentiment. Sights are on 110-06, a Fibonacci projection. On the upside, resistance is seen at 112-03, the Feb 24 high. Short-term gains would likely be a correction.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.008 at 94.928

- Jun 23 +0.005 at 94.450

- Sep 23 +0.010 at 94.30

- Dec 23 +0.020 at 94.450

- Red Pack (Mar 24-Dec 24) +0.045 to +0.105

- Green Pack (Mar 25-Dec 25) +0.085 to +0.10

- Blue Pack (Mar 26-Dec 26) +0.085 to +0.095

- Gold Pack (Mar 27-Dec 27) +0.095 to +0.115

SHORT TERM RATES

NY Federal Reserve/MNI

- O/N +0.00028 to 4.55957% (-0.00214/wk)

- 1M +0.00771 to 4.70914% (+0.07428/wk)

- 3M -0.00171 to 4.98400% (+0.03057/wk)*/**

- 6M +0.00485 to 5.31571% (+0.08057/wk)

- 12M -0.01957 to 5.69443% (+0.05572/wk)

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 4.96243% on 2/27/23

- Daily Effective Fed Funds Rate: 4.58% volume: $108B

- Daily Overnight Bank Funding Rate: 4.57% volume: $295B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.150T

- Broad General Collateral Rate (BGCR): 4.52%, $463B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $446B

- (rate, volume levels reflect prior session)

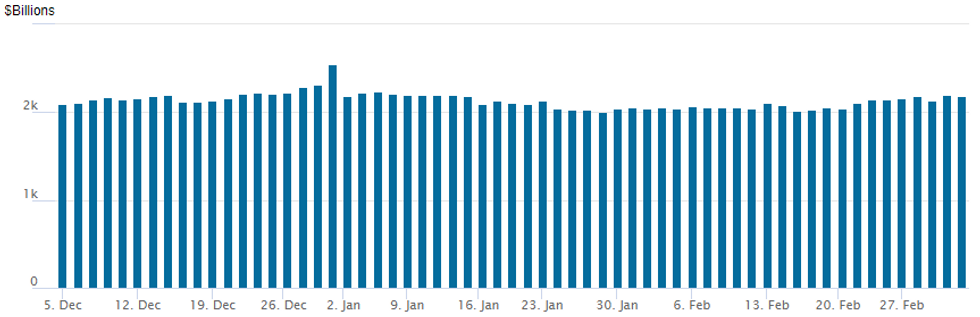

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage slips to $2,186.150B w/ 103 counterparties vs. prior session's $2,192.355B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/03/2023 | 0100/0900 |  | CN | National People's Congress opens | |

| 06/03/2023 | 0730/0830 | *** |  | CH | CPI |

| 06/03/2023 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2023 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2023 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2023 | 1000/1100 |  | EU | ECB Lane Lecture at Trninty College | |

| 06/03/2023 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2023 | 1500/1000 | ** |  | US | Factory New Orders |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 06/03/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.