-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Curves Extending Inversion

- MNI PODCAST: FedSpeak - Too Much Emphasis on a Soft Landing

- MNI INTERVIEW: Risk Election Makes Fed Pause-Ex Fed's Tracy

- MNI Inflation Breakevens Proving Resilient To Higher Commodity Prices

US

FED: Joseph Tracy, former senior adviser to Fed presidents Robert Kaplan and Bill Dudley, says at least two more interest rate hikes are needed to slow the economy and regain price stability -- and a mild recession is likely.

- Inflation has fallen due to transitory effects so far, but will be hard to wring out of the system from here on out, says Tracy, nonresident senior fellow at the American Enterprise Institute.

- The Fed's desire to avoid causing a recession around the presidential election could provide an incentive to leave policy unchanged. Listen to the podcast here.

FED: At least two more interest rate hikes and most likely a mild recession are needed to rein in inflation, but next year's presidential election could cause the Federal Reserve to hesitate, Joseph Tracy, former senior adviser to Fed presidents Robert Kaplan and William Dudley, said in an interview.

- Real U.S. interest rates are currently just north of 50 basis points, based on the difference between the effective fed funds rate and trimmed mean PCE inflation, which is not high enough to bring inflation back to 2%, Tracy told MNI's FedSpeak podcast.

- "Policy is really not that restrictive, which I think is also part of the reason why the U.S. economy has remained fairly resilient. Essentially up to now the Fed has just been taking away accommodation," said Tracy, a nonresident senior fellow at the American Enterprise Institute. "It would take pushing that real interest rate up well above 1% to start having some kind of a bite in terms of slowing the economy down." For more see MNI Policy main wire at 0824ET.

US: Surveyed measures of inflation expectations have surprised to the upside of late, especially last week’s U.Mich preliminary July survey with the 1Y ahead rising to 3.4% (cons 3.1) from 3.3%, stalling what had been a fast trend lower, and the 5-10Y ahead pressing another tenth higher to 3.1% (cons 3.0) for the top end of its tight range seen since Aug’21 and just one tenth off a high since 2011.

- However, market measures such as 5Y breakevens have continued to be particularly well behaved from the Fed’s perspective, despite a lift in commodity prices off recent lows over the past six weeks. At 2.14%, the 5Y breakeven remains within a handful of basis points off post-pandemic lows.

- Today has been a good example, with the 5Y breakeven pushing 1bp lower despite commodity prices rising 0.6% per Bloomberg’s BCOM index, with wheat in particular lifted 8+% today after the Russian Defence Ministry saying it will consider all ships travelling to Ukrainian ports on the Black Sea as potential carriers of military cargoes from tomorrow.

US TSYS Back Near Early Session Highs

- Treasury futures have drifted back to the upper half of the session range, curves flatter with short end rates underperforming. After the bell, 2s10s is back below -100 at -101.738, -3.256.

- Rather decent volumes (TYU3>1.2M) for an inside range day after Tsys traded firmer overnight after lower than expected UK CPI data (0.1% MoM vs. 0.4% est) saw front month Sep'23 10Y futures hit 113-06.5 high.

- Treasury futures pared early session gains, with 10s see-sawing to session low of 112-21 by midday: likely due to some deal-tied hedging pressure: rate locks on expected corporate issuance ($6.75B Morgan Stanley 4-tranche for instance) and/or pre-auction short sets ahead Tsy's $12B 20Y bond auction re-open at 1300ET.

- The sale traded near in-line with WI: 4.036% high yield vs. 4.037% WI; 2.68x bid-to-cover vs. prior month's 2.87x. Indirect take-up 68.75% vs. 74.58% last month; direct bidder take-up 21.68% vs. 17.62% prior; primary dealer take-up 9.57% vs. 7.79%.

- Projected rate hike expectations gain slightly: July 26 FOMC is 96% w/ implied rate of +24bp to 5.318%. September cumulative of +27bp at 5.347%, November cumulative of 32.2bp at 5.399%, and December cumulative of 26.8bp at 5.346%. Fed terminal holding at 5.405% in Nov'23.

OVERNIGHT DATA

- US MBA: MARKET COMPOSITE +1.1% SA THRU JUL 14 WK

- US MBA: REFIS +7% SA; PURCH INDEX -1% SA THRU JULY 14 WK

- US MBA: 30-YR CONFORMING MORTGAGE RATE 6.87% VS 7.07% PREV

- US JUN HOUSING STARTS 1.434M; PERMITS 1.440M

- US MAY STARTS REVISED TO 1.559M; PERMITS 1.496M

- US JUN HOUSING COMPLETIONS 1.468M; MAY 1.518M (REV)

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 157.39 points (0.45%) at 35109.28

- S&P E-Mini Future up 9.25 points (0.2%) at 4597.25

- Nasdaq down 10.9 points (-0.1%) at 14343.28

- US 10-Yr yield is down 4.3 bps at 3.7424%

- US Sep 10-Yr futures are up 7.5/32 at 112-31.5

- EURUSD down 0.0031 (-0.28%) at 1.1198

- USDJPY up 0.81 (0.58%) at 139.64

- WTI Crude Oil (front-month) down $0.3 (-0.4%) at $75.45

- Gold is down $1.11 (-0.06%) at $1977.50

- EuroStoxx 50 down 7.45 points (-0.17%) at 4362.28

- FTSE 100 up 134.51 points (1.8%) at 7588.2

- German DAX down 16.56 points (-0.1%) at 16108.93

- French CAC 40 up 7.76 points (0.11%) at 7326.94

US TREASURY FUTURES CLOSE

- 3M10Y -5.253, -167.469 (L: -172.688 / H: -162.714)

- 2Y10Y -3.238, -101.72 (L: -101.738 / H: -95.743)

- 2Y30Y -4.705, -92.264 (L: -92.301 / H: -83.487)

- 5Y30Y -2.419, -13.801 (L: -14.563 / H: -7.061)

- Current futures levels:

- Sep 2-Yr futures down 0.375/32 at 101-28 (L: 101-26.5 / H: 102-00.125)

- Sep 5-Yr futures up 2.75/32 at 107-24.75 (L: 107-19.5 / H: 108-00.25)

- Sep 10-Yr futures up 7/32 at 112-31 (L: 112-21 / H: 113-06.5)

- Sep 30-Yr futures up 28/32 at 127-21 (L: 126-22 / H: 127-24)

- Sep Ultra futures up 1-11/32 at 136-13 (L: 134-31 / H: 136-14)

US 10Y FUTURE TECHS: (U3) Initial Gilt Support Fades Through US Hours

- RES 4: 114-06+ High Jun 6

- RES 3: 114-00 High Jun 13

- RES 2: 113-09+ 50-day EMA and a key resistance point

- RES 1: 113-08 High Jul 18

- PRICE: 112-31 @ 1400ET Jul 19

- SUP 1: 112-07+ Low Jul 13

- SUP 2: 111-03+/110-05 Low Jul 11 / 6 and the bear trigger

- SUP 3: 110-00 Low Nov 9 2022 (cont)

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Support provided for Treasuries from the soft UK inflation release faltered into US hours, with Treasuries fading into the London close. Nonetheless, prices remain close to recent highs of 113-08 - the best level since June 29. The contract has cleared the 20-day EMA and attention turns to a key resistance area at the 50-day EMA, at 113-09+. A clear break of this average would strengthen a bullish theme. Key support and the bear trigger has been defined at 110-05, the Jul 6 low.

SOFR FUTURES CLOSE

- Sep 23 +0.005 at 94.605

- Dec 23 steady00 at 94.680

- Mar 24 -0.010 at 94.995

- Jun 24 -0.015 at 95.390

- Red Pack (Sep 24-Jun 25) -0.015 to +0.010

- Green Pack (Sep 25-Jun 26) +0.025 to +0.040

- Blue Pack (Sep 26-Jun 27) +0.040 to +0.045

- Gold Pack (Sep 27-Jun 28) +0.035 to +0.040

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00900 to 5.26357 (+.03363/wk)

- 3M +0.00738 to 5.33352 (+.02363/wk)

- 6M -0.00130 to 5.39914 (+.02360/wk)

- 12M -0.01469 to 5.28580 (+.03179/wk)

- Daily Effective Fed Funds Rate: 5.08% volume: $106B

- Daily Overnight Bank Funding Rate: 5.07% volume: $264B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.482T

- Broad General Collateral Rate (BGCR): 5.04%, $600B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $591B

- (rate, volume levels reflect prior session)

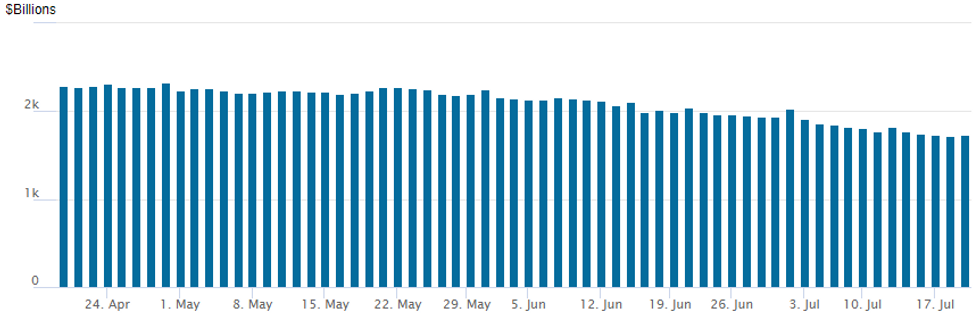

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation bounces to $1,732.804B , w/ 97 counterparties, compared to $1,716.862B (lowest since early April May'22) in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.2B Heico Launched

- Date $MM Issuer (Priced *, Launch #)

- 07/19 $6.75B #Morgan Stanley $1.2B 2Y +73, $800M 2Y SOFR+78, $2.25B 6NC5 +147, $2.5B 11NC10 +167

- 07/19 $1.2B #Heico Corp $600M 5Y +130, $600M 10Y +165

- 07/19 $Benchmark Concentrix 3Y +250a, 5Y +275a, 10Y +325a

- Expected to issue Thursday:

- 07/20 $Benchmark Province of Manitoba 10Y SOFR+75a

EGBs-GILTS CASH CLOSE: UK Short End Soars On Downside CPI Surprise

The UK short end rallied sharply Wednesday as the highly anticipated June inflation report delivered a downside surprise, with Bunds initially following suit but closing weaker.

- UK headline and core CPI both came in 2 tenths below expected, with the rates strip erasing nearly a full 25bp hike from the implied BoE path.

- The UK curve bull steepened, with 2Y yields at one point 23bp lower (which would have been the biggest one-day drop since March).

- Yields retraced higher over the course of the session as equities soared and commodity prices rose, leaving Gilt gains diminished and the Bund rally reversed.

- Eurozone core CPI was revised up 0.1pp in the final, but only a marginal increase when unrounded, and had little lasting impact.

- Periphery spreads were mixed, with Greece outperforming after a solid 5Y GGB auction.

- Attention first thing Thursday will be on German producer prices.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 1.6bps at 3.074%, 5-Yr is up 3.2bps at 2.515%, 10-Yr is up 4.9bps at 2.438%, and 30-Yr is up 4.4bps at 2.469%.

- UK: The 2-Yr yield is down 18.1bps at 4.91%, 5-Yr is down 16bps at 4.31%, 10-Yr is down 11.6bps at 4.215%, and 30-Yr is down 10bps at 4.377%.

- Italian BTP spread up 1.7bps at 164.2bps / Greek down 4.2bps at 138.5bps

FOREX Sterling Consolidates Post CPI Weakness Amid Greenback Bounce

- GBP remains softer against all others in G10 following a broadly lower-than-expected June inflation report. Headline CPI slowed to 7.9% Y/Y, the slowest rate of inflation in a year, missing forecasts by 0.3ppts in the process. Core inflation was also soft, helping drive a step lower in GBPUSD from ~1.3020 to lows of 1.2868. Price has such edged back above the 1.29 handle but broadly is consolidating session declines of around 0.9%.

- After hovering around the 100 mark early this week, the USD index took a step higher on Wednesday, gaining 0.40% with the greenback higher against most others in G10.

- Worth noting an extension of the USDJPY recovery seen on Tuesday following the comments from the Bank of Japan governor on maintaining easy monetary policy. USDJPY (+0.60%) stealthily climbed to a high of 139.99 amid the general greenback advance.

- AUDUSD (-0.50%) weakness today has now erased the entirety of the Jul13 rally. A low of 0.6750 today matches closely with the 20-day EMA at 0.6746. A break below here would mark a notable downside shift in short-term technical momentum.

- Australian employment data for June highlights the APAC docket on Thursday before US jobless claims and Philly Fed Manufacturing later in the session.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/07/2023 | 0130/1130 | *** |  | AU | Labor Force Survey |

| 20/07/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2023 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/07/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/07/2023 | 1230/0830 | ** |  | US | Jobless Claims |

| 20/07/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 20/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 20/07/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 20/07/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 20/07/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 20/07/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.