-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Debt Limit Looming

EXECUTIVE SUMMARY

US

US: The Treasury Department will probably run out of money to pay the nation’s bills between July and September unless Congress takes action, the Congressional Budget Office said Wednesday, acknowledging uncertainty due to the upcoming tax season.

CBO projects that, if the debt limit is not raised or suspended, the government’s ability to issue additional debt—other than to replace maturing securities—will be exhausted between July and September 2023. "The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections. In particular, income tax receipts in April could be more or less than CBO estimates," CBO said.

"If those receipts fell short of estimated amounts—for example, if capital gains realizations in 2022 were smaller or if U.S. income growth slowed by more in early calendar year 2023 than CBO projected—the extraordinary measures could be exhausted sooner, and the Treasury could run out of funds before July," CBO added. After hitting the USD31.4 trillion borrowing cap on Jan. 19, Treasury Secretary Janet Yellen said the Treasury can keep up payments on debt, federal benefits and make other outlays at least through early June using cash receipts and extraordinary cash management measures.

EUROPE

ECB: The European Central Bank could be the first major central bank to cut interest rates, as falling energy prices, the lagging effect of previous monetary policy tightening, and a disinflationary impact from China’s post-Covid reopening drive both headline and core inflation closer to negative territory over the next two years, a senior Moody’s economist told MNI

- March’s Eurosystem staff macroeconomic projections could see the ECB’s headline inflation forecast for 2023 revised down from the 6.3% foreseen in December, though there will be an upward revision to the 4.2% core inflation figure, Kamil Kovar, lead economist for eurozone forecasting at the ratings agency, said in an interview. March’s GDP growth number for 2023 will be broadly in line with the 0.5% foreseen at the end of last year, he said.

- Moody’s expects European rate-setters to hike by 50bps in March and 25bps in May, before concluding the tightening cycle as early as June at a peak of 3.25% Kovar said. For more see MNI Policy main wire at 0747ET.

US TSYS: Retail Sales Surge Green Lights Longer Period of Rate Hikes

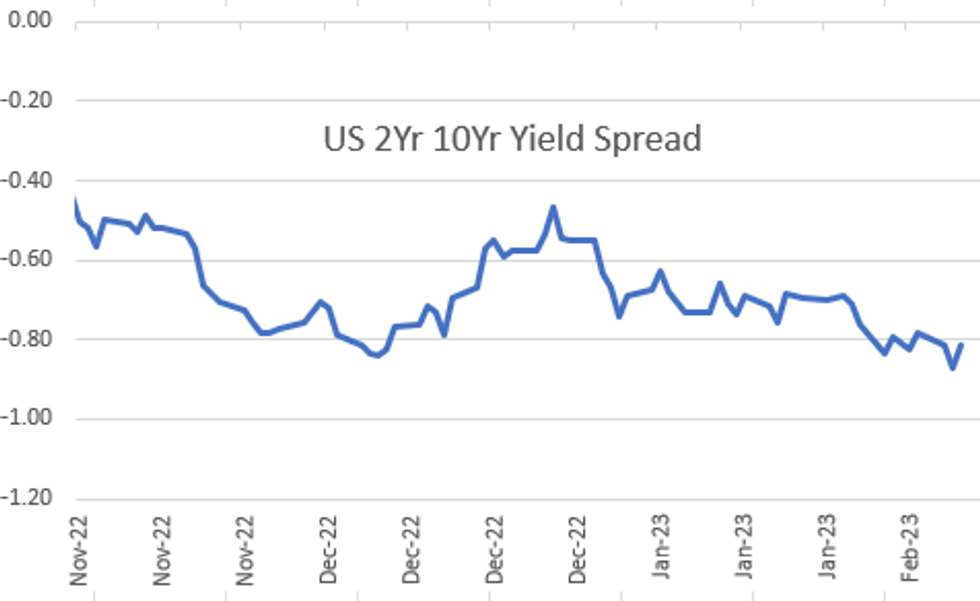

Bonds hold weaker levels/near lows after the bell, 2s10s curve well off this morning's 40-year inverted low in 2s10s from -91.943 to -80.405 in the first half, unconfirmed talk of large fund driven unwind in play.

- Tsys had sold off after this morning's higher than expected Jan Retail Sales (3.0% vs. +1.9% forecasted, ex-auto/gas at +2.6% vs. -0.4% in Dec the strongest print since March 2021) 2s10s extended inversion amid brief speculation over larger rate hikes over extended period from the Fed.

- Pricing larger hikes is moderating, however, with short end outperforming, while pricing in longer period of hikes remains. Fed funds implied hike for Mar'23 steady at 26.8bp, May'23 cumulative steady 47.3bp to 5.052%, Jun'23 at 61.4bp to 5.194%, while terminal rate has slipped to 5.24% in Aug'23 from 5.29% this morning.

- Robust overall volumes, TYH3 >1.6M, rate locks weighing w/ $24B Amgen 8pt mega-deal and $5B MUFG 5pt launched in second half.

- Tsy futures held weaker/near midday lows after $15B 20Y bond auction (912810TQ1) comes out nearly on the screws: 3.977% high yield vs. 3.975% WI; 2.54x bid-to-cover vs. prior month's 2.83x.

- Tsy Mar/Jun futures roll also underway ahead first notice date of Tuesday, February 28.

OVERNIGHT DATA

- US JAN RETAIL SALES +3.0%; EX-MOTOR VEH +2.3%

- US DEC RETAIL SALES REVISED -1.1%; EX-MV -0.9%

- US JAN RET SALES EX GAS & MTR VEH & PARTS DEALERS +2.6% V DEC -0.4%

- US JAN RET SALES EX MTR VEH & PARTS DEALERS +2.3% V US JAN -0.9%

- US JAN RET SALES EX AUTO, BLDG MATL & GAS +2.7% V DEC -0.6%

- US NY FED EMPIRE STATE MFG INDEX -5.8 FEB

- US NY FED EMPIRE MFG NEW ORDERS -7.8 FEB

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -6.6 FEB

- US NY FED EMPIRE MFG PRICES PAID INDEX 45.0 FEB

- US NY FED EMPIRE STATE MFG INDEX -5.8 FEB

- US NY FED EMPIRE MFG NEW ORDERS -7.8 FEB

- US NY FED EMPIRE MFG EMPLOYMENT INDEX -6.6 FEB

- US NY FED EMPIRE MFG PRICES PAID INDEX 45.0 FEB

- US JAN INDUSTRIAL PROD +0.0%; CAP UTIL 78.3%

- US DEC IP REV TO -1.0%; CAP UTIL REV 78.4%

- US JAN MFG OUTPUT +1.0%\

- US NAHB HOUSING MARKET INDEX 42 IN FEB

- US NAHB FEB SINGLE FAMILY SALES INDEX 46; NEXT 6-MO 48

- CANADA DEC WHOLESALE SALES -0.8%; EX-AUTOS -0.8%

- DEC WHOLESALE INVENTORIES +0.5%: STATISTICS CANADA

- CANADIAN DEC MANUFACTURING SALES -1.5% MOM

- CANADA DEC FACTORY INVENTORIES +0.1%; INVENTORY-SALES RATIO 1.71

MARKETS SNAPSHOT

Key late session market levels

- DJIA down 54.55 points (-0.16%) at 34035.24

- S&P E-Mini Future down 0.5 points (-0.01%) at 4145

- Nasdaq up 61.5 points (0.5%) at 12021.76

- US 10-Yr yield is up 6.9 bps at 3.8126%

- US Mar 10-Yr futures are down 10.5/32 at 112-0

- EURUSD down 0.0057 (-0.53%) at 1.0681

- USDJPY up 1.03 (0.77%) at 134.19

- Gold is down $18.81 (-1.01%) at $1835.49

- EuroStoxx 50 up 41.28 points (0.97%) at 4280.04

- FTSE 100 up 43.98 points (0.55%) at 7997.83

- German DAX up 125.78 points (0.82%) at 15506.34

- French CAC 40 up 87.05 points (1.21%) at 7300.86

US TREASURY FUTURES CLOSE

- 3M10Y +6.449, -97.887 (L: -109.358 / H: -97.31)

- 2Y10Y +5.783, -81.832 (L: -91.943 / H: -80.405)

- 2Y30Y +6.884, -77.713 (L: -90.436 / H: -75.346)

- 5Y30Y +3.448, -19.193 (L: -27.019 / H: -17.463)

- Current futures levels:

- Mar 2-Yr futures down 0.625/32 at 101-31 (L: 101-26.875 / H: 102-01.5)

- Mar 5-Yr futures down 5.75/32 at 107-9.25 (L: 107-05 / H: 107-20)

- Mar 10-Yr futures down 10.5/32 at 112-0 (L: 111-31 / H: 112-18)

- Mar 30-Yr futures down 26/32 at 126-5 (L: 126-00 / H: 127-19)

- Mar Ultra futures down 45/32 at 137-4 (L: 136-26 / H: 139-16)

US 10YR FUTURE TECHS: (H3) Falls Further Below Trendline Support

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-06+ 20-day EMA

- RES 1: 114-00+ 50-day EMA

- PRICE: 112-06 @ 15:39 GMT Feb 15

- SUP 1: 112-00 Low Feb 15

- SUP 2: 111-28 / 28+ Low Dec 30 / 61.8% Oct - Jan Upleg

- SUP 3: 111-01+ 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Treasury futures remain bearish and have extended losses below trendline support on the back of the US CPI release Tuesday. The low of the day at 112-00 marks the weakest for the contract since early January, opening medium-term losses toward levels not seen since November. This strengthens the current bearish theme and exposes 111-28, the Dec 30 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-25+. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 +0.013 at 94.948

- Jun 23 +0.035 at 94.595

- Sep 23 +0.035 at 94.515

- Dec 23 +0.010 at 94.715

- Red Pack (Mar 24-Dec 24) -0.075 to -0.03

- Green Pack (Mar 25-Dec 25) -0.07 to -0.065

- Blue Pack (Mar 26-Dec 26) -0.06 to -0.045

- Gold Pack (Mar 27-Dec 27) -0.065 to -0.045

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00243 to 4.56186% (+0.00257/wk)

- 1M +0.01143 to 4.60143% (+0.02343/wk)

- 3M +0.00500 to 4.87657% (+0.00714/wk)*/**

- 6M +0.02186 to 5.18029% (+0.05315/wk)

- 12M +0.08529 to 5.58443% (+0.09986/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.87657% on 2/15/23

- Daily Effective Fed Funds Rate: 4.58% volume: $105B

- Daily Overnight Bank Funding Rate: 4.57% volume: $287B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.216T

- Broad General Collateral Rate (BGCR): 4.52%, $466B

- Tri-Party General Collateral Rate (TGCR): 4.52%, $455B

- (rate, volume levels reflect prior session)

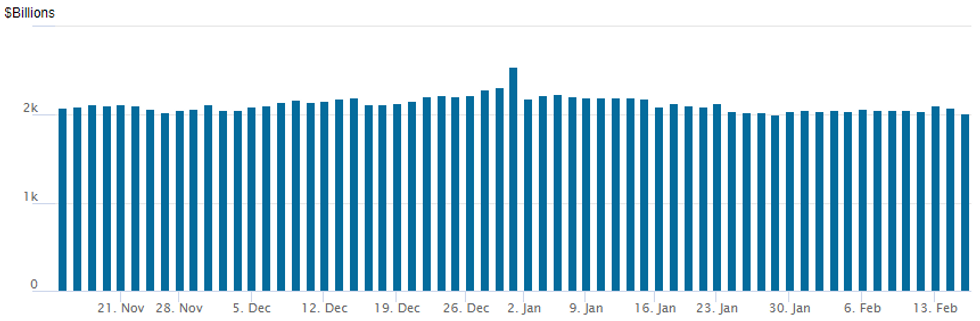

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage declines to $2,011.998B w/ 96 counterparties vs. prior session's $2,076.548B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $24B Amgen 8Pt "Mega-Jumbo" Debt Deal

Total high-grade issuance at $30B on the day- Date $MM Issuer (Priced *, Launch #)

- 02/15 $24B #Amgen $2B 2Y +65, $1.5B 3NC1 +115, $3.75B 5Y +115, $2.75B 7Y +135, $4.25B 10Y +150, $2.75B 20Y +165, $4.25B 30Y +185, $2.75B 40Y +200

- 02/15 $5B #MUFG $1.65B 3NC2 +108, $600M 3NC2 SOFR+94, $1B 6NC5 +138, $500M 8NC7 +153, $1.25B 11NC10 +163

- 02/15 $1B #Gov of Sharjah +9Y +280

EGBs-GILTS CASH CLOSE: Gilts Outperform On Soft UK CPI

Gilts easily outperformed Bunds Wednesday, with European curves steeper and yields finishing well off session lows.

- UK yields fell sharply early on soft core CPI (2Y yields fell more than 14bp at the low) but stabilised and closed only slightly lower on the session, with strong US retail sales data contributing to the rebound.

- German yields were led lower early by Gilts, but retraced and finished higher across the curve. The 10Y Bund yield saw its highest close since Jan 2.

- EGB weakness mirrored a continued rise in ECB hike expectations (terminal depo rate now seen close to 3.70%, up 3bp) ahead of Pres Lagarde's appearance just after the cash close.

- BTPs underperformed, with spreads widening further after a 30Y syndication announcement in late afternoon (as had been anticipated by MNI).

- Thursday sees French and Spanish bond auctions, and multiple ECB speakers.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.5bps at 2.883%, 5-Yr is up 2.4bps at 2.529%, 10-Yr is up 3.7bps at 2.475%, and 30-Yr is up 5.6bps at 2.434%.

- UK: The 2-Yr yield is down 3.7bps at 3.793%, 5-Yr is down 8.4bps at 3.426%, 10-Yr is down 3.4bps at 3.487%, and 30-Yr is down 2bps at 3.87%.

- Italian BTP spread up 7bps at 185.6bps / Spanish up 3.6bps at 96.3bps

FOREX: USD Index Set To Close With 0.65% Advance

- The USD index (+0.65%) briefly traded above the 1.04 mark on Wednesday for the first time since January 06. Although late equity gains have moderately trimmed the advance, the index looks to consolidate just below session highs approaching the end of the US session. Upward pressure on US yields continues to underpin the strength in the greenback.

- AUD and GBP continue to be the day’s worst performing majors, both declining around 1.25%. AUD trades heavily on the back of local equity weakness and softer stock markets in China and Hong Kong.

- GBPUSD has stabilised back above the 1.20 mark for now, however, today’s weakness is a result of CPI falling short of forecast across both headline and core measures, resulting in a print of 1.1990.

- Cable maintains a sell-on-rallies theme and recent weakness reinforces a S/T bearish theme and signals scope for a continuation. Sights are on the 200-dma at 1.1947. A move through this level would expose key support at 1.1842, the Jan 6 low.

- After topping the key short-term level marking the 50-day EMA on Tuesday, USDJPY’s break above 132.77 suggests scope for an extension higher that would expose 134.77, the Jan 6 high.

- EURUSD sits close to its 50-day EMA approaching the APAC crossover, a key support level, of which a break would strengthen the bearish cycle. A close below may signal a move that exposes 1.0634 initially, the Jan 9 low. Below here, attention would turn to 1.0484, the Jan 6 low and a key support.

- Consumer inflation expectations and employment data for Australia highlight Thursday’s APAC calendar. Focus then shifts to US PPI data.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 16/02/2023 | 0915/1015 |  | EU | ECB Panetta in Discussion at Centre for European Reform | |

| 16/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 16/02/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/02/2023 | 1330/0830 | *** |  | US | PPI |

| 16/02/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 16/02/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/02/2023 | 1345/0845 |  | US | Cleveland Fed's Loretta Mester | |

| 16/02/2023 | 1500/1600 |  | EU | ECB Lane Dow Lecture at NIES London | |

| 16/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 16/02/2023 | 1600/1100 |  | CA | BOC Governor Macklem at House of Commons hearing | |

| 16/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 16/02/2023 | 1700/1700 |  | UK | BOE Pill Fireside Chat at Warwick University Think Tank | |

| 16/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 16/02/2023 | 1830/1330 |  | US | St. Louis Fed's James Bullard | |

| 16/02/2023 | 1945/2045 |  | EU | ECB de Guindos Students Discussion | |

| 16/02/2023 | 2100/1600 |  | US | Fed Governor Lisa Cook | |

| 16/02/2023 | 2255/1755 |  | CA | BOC Deputy Beaudry speaks on "The importance of the Bank of Canada’s 2% inflation target" | |

| 16/02/2023 | 2315/1815 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.