-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Did AAA Downgrade Warning Kickstart Debt Talks?

- MNI INTERVIEW: Fed Needs Better QE Guardrails- Fed Adviser

- MNI INTERVIEW: Wages Minor Part Of US Inflation-Fed’s Wozniak

- MNI FED: Barkin: Manufacturers Still Looking To Combat Squeezed Margins

- MNI INTERVIEW: Deposits To Continue To Leave US Banks-Schnabl

- MNI: Fitch Puts US On Negative Ratings Watch

- MNI: DBRS Morningstar Places United States Under Review With Negative Implications

US TSYS: Markets Roundup: Debt Deal Optimism After US AAA Rating Warning

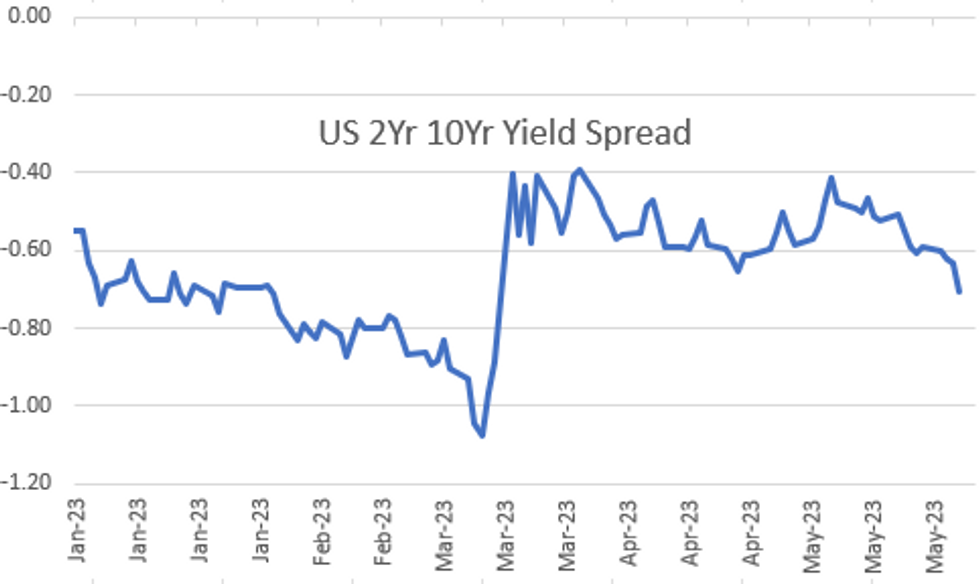

Treasury futures traded steadily weaker since late morning amid generally positive word from debt ceiling negotiators that a deal can be agreed upon by as early as tomorrow.- Treasury 10Y futures finishing near late session lows at 112-16.5 after breaching several levels of support: next focus on 111-31 76.4% retracement of the Mar 2 - 24 rally. At the moment, 10Y yield has climbed .0774 to 3.8193%, highest in two weeks. Curves extended inversion, 2s10s falling to -73.245, the lowest since March 15.

- Overnight volatility: rates surged overnight, reacting to negative ratings watch warnings from agencies Fitch and DBRS Morningstar if the US defaults on their debt obligations. House speaker McCarthy quick to respond with optimism that a deal can be struck in time.

- Fast two-way post data: Treasury futures trading lower after weekly claims came out less than expected (229k 245k est; claims 1.8M est), GDP higher than expected (+1.3% vs. 1.1% est).

- More notable upside revisions came from other domestic demand (non-resi investment and government) plus a sizeable boost in changes in inventories (albeit still dragging -2.1pp annualized on the quarter), offset by the previous boost from net trade being revised away (latest contribution exactly 0.00pps).

- Reminder, Friday sees early close ahead Monday's Memorial Day Holiday, Floor closes at 1300ET, Globex at 1600ET. Markets closed Monday, Globex re-open at 1700ET.

US

FED: The Federal Reserve needs clear guardrails around how it uses quantitative easing in future amid heightened scrutiny over the limits of its legal powers and recent policy errors, Christina Skinner, who has advised the Fed and the Bank of England, told MNI.

- With large-scale asset purchases becoming a more regular feature of monetary policy, Skinner said it would be a good idea to provide the same kind of framework that the Fed has given for meeting its inflation goal. The QE framework could cover things such as the potential stock and flow of asset purchases, the duration of any program and financial metrics for shifting to QT, she said.

- “It seems easy to grow the balance sheet, very difficult to shrink it, and so if that in fact is true then QE is a little bit of a troubling one-way ratchet. That’s definitely something that central banks need to think about and explain,” said Skinner, assistant professor at the Wharton business school at the University of Pennsylvania. For more see MNI Policy main wire at 1330ET.

FED: A hot post-pandemic job market complicates the Federal Reserve’s job of bringing down inflation but wages are only a small contributor to price pressures thus far, meaning policymakers can still pull off a soft landing, Minneapolis Fed Vice President Abigail Wozniak told MNI.

- “The early evidence suggests that wages are only part of the story and probably a smallish part of the story of the ongoing inflation that we are experiencing – or certainly the inflation that we’ve experienced to date,” she said. That means the central bank can still rein in inflation without a major spike in a jobless rate still hovering around 50-year lows, she told MNI’s FedSpeak Podcast.

- “This certainly means that it is a possibility. There’s still a path for that,” said Wozniak, who serves as director of the Minneapolis Fed’s Opportunity and Inclusive Growth Institute. Wozniak, a labor economist, said it’s encouraging strong hiring conditions have benefited lowest-paid workers the most in this recovery. For more see MNI Policy main wire at 1211ET.

FED: Barkin ('24 voter) on liaison programs more useful as timely indicator than data (one month delayed and revised three times). Manufacturing roundtables are saying still inventory rebalancing going on with demand turned up or down depending on it, it's still challenging to attract mfg workers. Hearing stories of people saying I still have margins that are squeezed, I need to go back and get more price.

- Further reiterating the difficulty in attracting labor: *BARKIN: LABOR DEMAND IN SKILLED TRADES STILL 'CRAZY HOT' - bbg. It comes after the Richmond Fed mfg index showed a notable moderation in prices paid but the average growth rate of prices received only edging down slightly.

US: Deposits at U.S. commercial banks will continue to slip lower as the Federal Reserve leaves rates high and the March bank crisis lifted funding costs for banks permanently, said New York University Stern School of Business Professor Philipp Schnabl in an interview.

- "I would expect more outflows. As long as we have higher rates we tend to see that this will continue," said Schnabl, a former New York Fed visiting scholar. So far the core deposit outflows are roughly in line with past estimates, he said, pointing to his 2016 paper with co-authors.

- Given the average deposit spread beta of 0.61, a 100 bp increase in the fed funds rate is expected to induce a 365 bps outflow of deposits and a 249 bps reduction in lending. These estimates imply that a typical 400 bps Fed hiking cycle induces a 1,458 bps reduction in deposits and a 995 bps reduction in lending relative to keeping rates unchanged, he said. For more see MNI Policy main wire at 0856ET.

US: Fitch has placed the US on negative ratings watch, as the deadline for an increase in the debt-ceiling approaches (June 1) and they see US governance as weaker than other AAA rated nations. While the ratings agency sees the probability of default as “very low”, it would reduce the US to AA- in the case that it occurs (in line with Ireland and South Korea).

- Fitch is forecasting a deficit of 6.5% of GDP in 2023 widening to 6.9% in 2024. They note that public finances in the US have “modestly underperformed expectations”.

- A deal is still expected before the end of the month and while brinkmanship in debt-ceiling negotiations is not unusual, it does increase the risks. Increased political partisanship in the US is not helping the situation.

- For the initial market reaction to the news see Risk Appetite Weakens As Fitch Places US On Negative Rating Watch and for the comments following the last Biden-McCarthy meeting see Debt: No Agreement Yet, But Talks Continue.

US: "DBRS, Inc. (DBRS Morningstar) placed the United States of America’s Long-Term Foreign and Local Currency – Issuer Ratings of AAA Under Review with Negative Implications. In addition, DBRS Morningstar placed the United States of America’s Short-Term Foreign and Local Currency – Issuer Ratings of R-1 (high) Under Review with Negative Implications."

- "The Under Review with Negative Implications reflects the risk of Congress failing to increase or suspend the debt ceiling in a timely manner. If Congress does not act, the U.S. federal government will not be able to pay all of its obligations."

- "While we still expect Congress to raise the debt ceiling before Treasury runs out of available resources, there is a risk of Congressional inaction as the X-date approaches. DBRS Morningstar would consider any missed payment of interest or principal as a default. In such a scenario, the relevant U.S. Issuer Ratings would be downgraded to “Selective Default.”"

- "Even if Congress ends up increasing the debt ceiling prior to the X-date, the prospect of repeated debt ceiling standoffs in a polarized political environment may lead DBRS Morningstar to judge that U.S. credit risk has increased to a level that is no longer consistent with a AAA rating."

- Click for full release.

OVERNIGHT DATA

- US JOBLESS CLAIMS +4K TO 229K IN MAY 20 WK

- US PREV JOBLESS CLAIMS REVISED TO 225K IN MAY 13 WK

- US CONTINUING CLAIMS -0.005M to 1.794M IN MAY 13 WK

- Following a significant revision to Massachusetts claims to adjust for previously reported fraudulent claims announced just a few minutes before the national release, the latest trend has left the four-week average at 232k having dipped from ~240k in late March/early April.

- It remains above the 218k averaged through 2019 as a benchmark, but the main takeaway is a surprise decline from recent levels. In non-seasonally adjusted terms, the 202k is very much in line with typical non-pandemic years for the time of year having previously been seen at the higher end. Continuing claims saw a smaller improvement, dipping from 1799k to 1794k (cons 1800k).

- US Q1 GDP +1.3%

US DATA: Real GDP Revisions Stronger Than Expected, Core PCE Prices Little Changed. Real GDP growth was revised up by more than expected in the 2nd Q1 release, up from 1.06% to 1.27% annualized (cons 1.1%). Personal consumption saw a small upward revision from 3.70% to 3.76%, still the strongest since 2Q21 and so solid but no real change from the initial Q1 release.

- More notable upside revisions came from other domestic demand (non-resi investment and government) plus a sizeable boost in changes in inventories (albeit still dragging -2.1pp annualized on the quarter), offset by the previous boost from net trade being revised away (latest contribution exactly 0.00pps)

- Looking at underlying trends, final sales to private domestic purchasers were revised up to 2.85% annualized for also the strongest since 2Q21, similar to personal consumption. On prices, the GDP price index was revised up from 4.0% to 4.2% although the core PCE deflator saw a much smaller increase from 4.94 to 4.96%.

- US NAR APR PENDING HOME SALES INDEX 78.9 V 78.9 IN MAR

- US NAR APR PENDING HOME SALES +0.0% MOM; -20.3% YOY

- US MAY KANSAS CITY FED MANUFACTURING INDEX -1; EST.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 38.03 points (-0.12%) at 32757.71

- S&P E-Mini Future up 36.5 points (0.88%) at 4162

- Nasdaq up 229.4 points (1.8%) at 12712.22

- US 10-Yr yield is up 7.7 bps at 3.8193%

- US Jun 10-Yr futures are down 28/32 at 112-17.5

- EURUSD down 0.003 (-0.28%) at 1.072

- USDJPY up 0.61 (0.44%) at 140.07

- Gold is down $16.26 (-0.83%) at $1941.04

- EuroStoxx 50 up 5.9 points (0.14%) at 4269.64

- FTSE 100 down 56.23 points (-0.74%) at 7570.87

- German DAX down 48.33 points (-0.31%) at 15793.8

- French CAC 40 down 24.19 points (-0.33%) at 7229.27

US TREASURY FUTURES CLOSE

- 3M10Y +8.795, -152.302 (L: -171.5 / H: -152.108)

- 2Y10Y -7.356, -71.153 (L: -73.245 / H: -63.37)

- 2Y30Y -13.78, -53.176 (L: -53.176 / H: -38.72)

- 5Y30Y -7.429, 8.948 (L: 8.948 / H: 20.07)

- Current futures levels:

- Jun 2-Yr futures down 10.125/32 at 102-2.125 (L: 102-01.25 / H: 102-11.875)

- Jun 5-Yr futures down 24.25/32 at 107-24.75 (L: 107-24.25 / H: 108-16)

- Jun 10-Yr futures down 28/32 at 112-17.5 (L: 112-17 / H: 113-12.5)

- Jun 30-Yr futures down 1-04/32 at 125-14 (L: 125-12 / H: 126-16)

- Jun Ultra futures down 1-01/32 at 133-4 (L: 133-00 / H: 134-06)

(M3) Bear Trend Extends

- RES 4: 115-18+/116-16 High May 16 / 11

- RES 3: 114-05/114-22 High May 19 / 50-day EMA

- RES 2: 113-30+ Low Apr 19 and a recent breakout level

- RES 1: 113-25 High May 24

- PRICE: 112-17+ @ 1540ET May 25

- SUP 1: 112-16.5 Low May 25

- SUP 2: 111-31 76.4% retracement of the Mar 2 - 24 rally

- SUP 3: 111-20+ Low Mar 10

- SUP 4: 110-12+ Low Mar 2

Treasury futures traded softer Thursday, extending the recent break below 113-30+, the Apr 19 low and key support. This reinforces a bearish theme. The focus is on 112-30 next, 61.8% of the Mar 2 - 24 rally. On the upside, initial firm resistance is seen at 113-30+ ahead of the 50-day EMA, at 114-22. A break of the average is required to signal a potential reversal.

SOFR FUTURES CLOSE

- Jun 23 -0.063 at 94.675

- Sep 23 -0.115 at 94.770

- Dec 23 -0.175 at 95.055

- Mar 24 -0.225 at 95.480

- Red Pack (Jun 24-Mar 25) -0.245 to -0.19

- Green Pack (Jun 25-Mar 26) -0.17 to -0.14

- Blue Pack (Jun 26-Mar 27) -0.135 to -0.13

- Gold Pack (Jun 27-Mar 28) -0.125 to -0.09

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.02499 to 5.13579 (+.04206/wk)

- 3M +0.03373 to 5.22528 (+.06181/wk)

- 6M +0.03801 to 5.23818 (+.09165/wk)

- 12M +0.03133 to 5.00248 (+.12482/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 to 5.06286%

- 1M +0.01914 to 5.16000%

- 3M +0.03871 to 5.46314% */**

- 6M +0.03200 to 5.56414%

- 12M +0.08886 to 5.62257%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.46314% on 5/25/23

- Daily Effective Fed Funds Rate: 5.08% volume: $126B

- Daily Overnight Bank Funding Rate: 5.07% volume: $279B

- Secured Overnight Financing Rate (SOFR): 5.05%, $1.401T

- Broad General Collateral Rate (BGCR): 5.03%, $587B

- Tri-Party General Collateral Rate (TGCR): 5.03%, $578B

- (rate, volume levels reflect prior session)

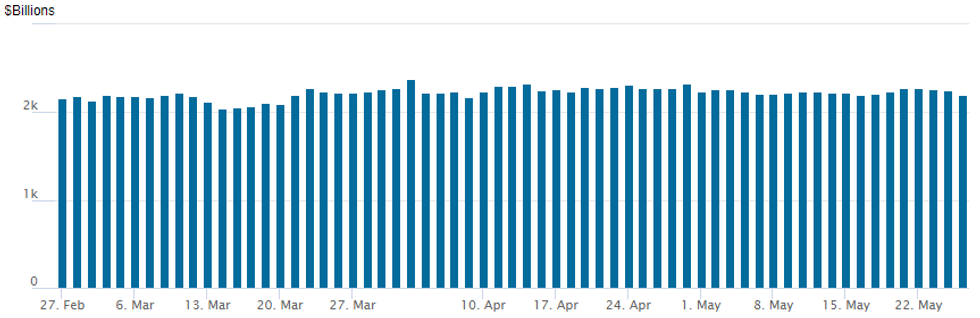

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage falls to $2,197.638B w/ 106 counterparties, compares to prior $2,250.709B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: KFW, JPM Led Midweek Corporate Bond Issuance

$8.525B Priced Wednesday, running total for the week just over $20.5B- Date $MM Issuer (Priced *, Launch #)

- 05/24 $4B *KFW 5Y SOFR+34

- 05/24 $2.5B *JP Morgan 11NC10 +162.5

- 05/24 $1.125B *MFB (Hungarian Dev Bank) 5Y +295

- 05/24 $900M *Banque Saudi Fransi 5Y Sukuk +105

EGBs-GILTS CASH CLOSE: Gilts Remain Under Pressure

Gilts dropped sharply and underperformed for another session Thursday, as the implications of April's high UK CPI reading continued to be digested.

- The UK curve bear flattened once again, with weakness focused on the 2-5Y segment as another 18bp of hikes were added to the implied BoE path (that' 65bp this week).

- Bunds weakened as well, with modest yield rises accelerating just ahead of the cash close, though with no apparent trigger (10Y jumped 3bp in the last 25 minutes of the session).

- Adding to the bearish tone was apparent progress on the US debt limit impasse, which pushed Treasury yields and the USD higher.

- ECB commentary (including Knot, Villeroy, and Nagel) wasn't impactful, and revised GDP numbers showing Germany falling into technical recession had little bearing either.

- Periphery spreads traded mixed, moving in Bunds' favour (despite the latter's sell-off) just before the cash close.

- UK retail sales data highlights the docket first thing Friday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.8bps at 2.902%, 5-Yr is up 6.2bps at 2.531%, 10-Yr is up 5bps at 2.522%, and 30-Yr is up 3.7bps at 2.664%.

- UK: The 2-Yr yield is up 18.4bps at 4.556%, 5-Yr is up 19.2bps at 4.328%, 10-Yr is up 16bps at 4.374%, and 30-Yr is up 10.6bps at 4.65%.

- Italian BTP spread up 1bps at 187.6bps / Greek down 4.3bps at 138.4bps

FOREX: NZD Extends Post-RBNZ Weakness, USDJPY Pierces 140.00 Handle

- Overall greenback strength continues to prevail across currency markets with the USD index extending its winning streak to four sessions, up 0.35% on Thursday. The index is now roughly 3.25% off the May lows as the greenback reasserts itself against its G10 counterparts.

- NZD remains at the bottom of the G10 pile, showing good downside momentum following the significant moves following the RBNZ on Wednesday. Price is now through the year’s lows which turns the focus to the psychological 0.60 mark, a good pivot dating back to September last year.

- USDCNH has touched another fresh year-to-date high as the pair settles above the 7.09 amrk amid the general greenback appreciation and ongoing concerns over domestic growth. State-owned Chinese media outlets have once again pushed back on the idea of further sharp depreciation pressures for the yuan, with analysts cited in the report continuing to point to China’s positive economic fundamentals and expectations surrounding the end of the Fed’s easing cycle

- Japanese yen weakness has also once again been consistent over the course of the US session with USDJPY steadily moving higher since the release of US data. Bullish conditions remain intact, and a fresh trend high reinforces the current theme. The 140.01 high print as of writing places the pair at the highest level since November 23, 2022.

- With 140.00 the next obvious psychological barrier to overcome, major resistance does not come in until 140.62, the bull channel top drawn from the Jan 16 low.

- Tokyo Core CPI highlights the APAC docket on Friday before UK retail sales for April hit the wires. Attention will then turn to US Core PCE Price index data, durable goods, personal income and U/Mich sentiment figures.

Friday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/05/2023 | 2330/0830 | ** |  | JP | Tokyo CPI |

| 26/05/2023 | 0130/1130 | ** |  | AU | Retail Trade |

| 26/05/2023 | 0600/0700 | *** |  | UK | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 26/05/2023 | 0600/0800 | ** |  | SE | PPI |

| 26/05/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/05/2023 | 0740/0940 |  | EU | ECB Lane Panels Dubrovnik Econ Conference | |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 26/05/2023 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 26/05/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/05/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 26/05/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/05/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 26/05/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.