-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Discounting Latest Fed Speak

EXECUTIVE SUMMARY

US

FED: Federal Reserve Bank of Richmond President Thomas Barkin said Friday steady quarter-point interest rate increases until inflation is on a sustainable path back to 2% provides the best flexibility for the Fed to respond to incoming data.

- "I’m not a person who thinks the way to operate monetary policy is to move quickly to a terminal rate and then pause. That theory to me requires more confidence and understanding the neutral rate and understanding lagged effects than I have," he told reporters after a talk at the Rosslyn Business Improvement District.

- "I like the 25bp path because I believe it gives us the flexibility to respond to the economy as it comes in. That means I’m comfortable raising rates potentially more often to a higher level if inflation were to come in hot and I'm comfortable backing off if not."

- The FOMC raised interest rates by 25 bps earlier this month and is expected to do so again in March, taking the fed funds rate target to 4.75%-5%. For more see MNI Policy main wire at 1035ET.

- "We'll have to continue to raise the federal funds rate until we start to see a lot more progress" on reaching the 2% inflation objective, she said at a Tennessee Bankers Association Credit Conference. "I don't think anyone can argue that inflation is much too high."

- "I don't think we're seeing what we need to be seeing, especially with inflation," she added. "Those numbers are jumping around a little bit. We're seeing some progress and lowering inflation at the end of last year, but some of the data that we're seeing early this year is is not dropping consistently."

EUROPE

ECB: Further cuts to remuneration on government deposits at the European Central Bank risk a return of last year’s collateral shortages, two Eurosystem debt management offices told MNI, although concerns over a near-term “cliff edge” were offset by a belief that further changes will likely proceed gradually, giving markets time to adjust.

- Last week the ECB set a ceiling for remuneration at the euro short-term rate (€STR) minus 20 basis points from May, saying it would allow for an orderly reduction of such deposits - with policymakers adjusting the regime “as necessary."

- Any further remuneration rate reductions will affect liquidity of short-dated securities, an official at one eurozone national Treasury said. This could prompt a scarcity of collateral similar to that seen before ECB’s September announcement that it would pay government deposits at €STR, the official said, adding that there could also be implications for issuance. For more see MNI Policy main wire at 0957ET.

US TSYS: Tapped Out on Pricing in Hikes For Now

Tapped out on the week's hawkish Fed speak, Tsys modestly higher after the bell, well off early lows that saw 30YY tap3.9662% high, currently 3.8756% (-.0385). Yield curves hold flatter as short end continues to underperform as central bank policy messaging got a little uncertain after Fed Governor Michelle Bowman said "Your guess as good as mine as to what happens next in the economy."

- Tsys opened weaker, carry-over from Thu's hawkish Fed comments from Mester and Bullard (don't count out 50bp hike if necessary), but whipsawed off lows after ECB Villeroy comments (ECB in restrictive territory, action after March "less urgent").

- Rates settled into higher range by midmorning after Richmond Fed Barkin said steady quarter-point interest rate increases until inflation is on a sustainable path back to 2% provides the best flexibility for the Fed to respond to incoming data.

- Fed funds implied hike for Mar'23 at 28.2bp, May'23 cumulative 52.0bp to 5.101%, Jun'23 66.4bp to 5.245%, terminal at 5.29% in Aug'23.

- Second half trade rather quiet ahead an extended holiday weekend, markets closed Monday for Presidents Day holiday, data resumes Tuesday. No scheduled Fed speakers ahead Feb FOMC minutes release on Wednesday at 1400ET.

OVERNIGHT DATA

- US JAN. INDEX OF LEADING ECONOMIC INDICATORS FALLS 0.3%

US DATA: Leading Index Continues To Signal Recession Over Next 12 Months: The Conference Board Leading Index fell -0.3% M/M in January as expected, following a -0.8% drop in December.

- The annual growth rate ticked up slightly but the trajectory of the 6-monnthgrowth rate continues to signal a recession over the next 12 months.

- From the press release (here: https://www.conference-board.org/topics/us-leading...): "Among the leading indicators, deteriorating manufacturing new orders, consumers' expectations of business conditions, and credit conditions more than offset strengths in labor markets and stock prices to drive the index lower in the month. "

- "The contribution of the yield spread component of the LEI also turned negative in the last two months, which is often a signal of recession to come."

- US JAN IMPORT PRICES -0.2%

- US JAN EXPORT PRICES +0.8%; NON-AG +0.8%; AGRICULTURE -0.2%

- Notably different story when stripping out oil though, with import prices ex-petroleum stronger than expected, rising 0.24 % M/M (cons -0.3%) after only a modestly downward revised 0.7% M/M in Dec.

- In doing so it continued to buck the deflation trend having seen seven months of declining import prices through May-Nov.

- The partial bounce in the past two months is consistent with January's firming in both underlying core consumer goods and producer prices.

- CANADA JAN INDUSTRIAL PRICES +0.4% MOM; EX-ENERGY +0.4%

- CANADA JAN RAW MATERIALS PRICES -0.1% MOM; EX-ENERGY +0.9%

- FOREIGN HOLDINGS OF CANADA SECURITIES +21.2B CAD IN DEC

- CANADIAN HOLDINGS OF FOREIGN SECURITIES -2.3B CAD IN DEC

MARKETS SNAPSHOT

Key late session market levels:

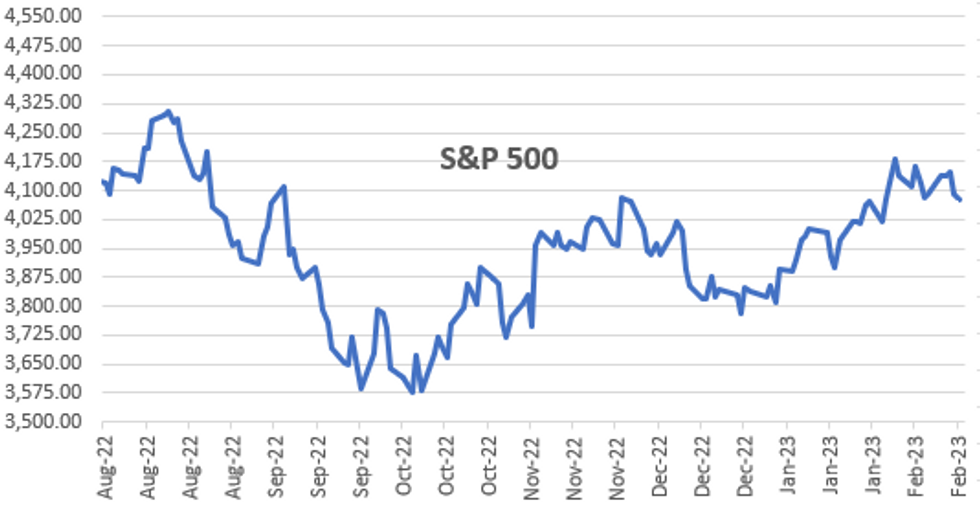

- DJIA up 113.39 points (0.34%) at 33808.47

- S&P E-Mini Future down 11.5 points (-0.28%) at 4087.25

- Nasdaq down 69.2 points (-0.6%) at 11785.46

- US 10-Yr yield is down 3.8 bps at 3.8225%

- US Mar 10-Yr futures are up 3.5/32 at 112-0

- EURUSD up 0.0022 (0.21%) at 1.0697

- USDJPY up 0.18 (0.13%) at 134.12

- WTI Crude Oil (front-month) down $1.95 (-2.48%) at $76.54

- Gold is up $6.52 (0.36%) at $1842.88

- EuroStoxx 50 down 22.32 points (-0.52%) at 4274.92

- FTSE 100 down 8.17 points (-0.1%) at 8004.36

- German DAX down 51.64 points (-0.33%) at 15482

- French CAC 40 down 18.44 points (-0.25%) at 7347.72

US TREASURY FUTURES CLOSE

- 3M10Y -3.837, -99.689 (L: -100.467 / H: -89.424)

- 2Y10Y -1.741, -79.873 (L: -81.309 / H: -77.802)

- 2Y30Y -1.09, -74.101 (L: -76.899 / H: -71.834)

- 5Y30Y +0.959, -15.249 (L: -18.404 / H: -13.745)

- Current futures levels:

- Mar 2-Yr futures down 0.125/32 at 102-0 (L: 101-26.125 / H: 102-00.25)

- Mar 5-Yr futures up 2/32 at 107-11.25 (L: 106-27 / H: 107-11.75)

- Mar 10-Yr futures up 4/32 at 112-0.5 (L: 111-08.5 / H: 112-01)

- Mar 30-Yr futures up 8/32 at 125-26 (L: 124-14 / H: 125-28)

- Mar Ultra futures up 10/32 at 135-31 (L: 134-03 / H: 136-03)

US 10YR FUTURE TECHS: (H3) Near-Term Weakness Extends

- RES 4: 115-22+ High Feb 3

- RES 3: 115-00 Round number resistance

- RES 2: 114-06+ 20-day EMA

- RES 1: 114-00+ 50-day EMA

- PRICE: 111-28 @ 16:01 GMT Feb 17

- SUP 1: 111-10 Lower 2.0% Bollinger Band

- SUP 2: 111-08+ Low Feb 17

- SUP 3: 110-21+ 2.0% 10-dma envelope

- SUP 4: 109-22 Low Nov 3

Near-term weakness extends across Treasury futures, putting prices at new pullback lows of 111-08+. This puts the contract through the early January lows, opening medium-term losses toward levels not seen since November. The strengthening bearish theme exposes 109-22 over the medium-term, the Nov 3 low. Key short-term resistance is seen at the 50-day EMA which intersects at 113-25+. A break of this EMA would ease bearish pressure.

EURODOLLAR FUTURES CLOSE

- Mar 23 -0.025 at 94.923

- Jun 23 -0.050 at 94.565

- Sep 23 -0.055 at 94.485

- Dec 23 -0.030 at 94.730

- Red Pack (Mar 24-Dec 24) +0.005 to +0.055

- Green Pack (Mar 25-Dec 25) +0.035 to +0.050

- Blue Pack (Mar 26-Dec 26) +0.020 to +0.025

- Gold Pack (Mar 27-Dec 27) +0.020 to +0.020

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00128 to 4.55686% (-0.00243/wk)

- 1M -0.00657 to 4.59129% (+0.01329/wk)

- 3M +0.01443 to 4.91529% (+0.04586/wk)*/**

- 6M +0.06257 to 5.24300% (+0.11586/wk)

- 12M +0.06972 to 5.64286% (+0.15829/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.91529% on 2/17/23

- Daily Effective Fed Funds Rate: 4.58% volume: $105B

- Daily Overnight Bank Funding Rate: 4.57% volume: $286B

- Secured Overnight Financing Rate (SOFR): 4.55%, $1.244T

- Broad General Collateral Rate (BGCR): 4.53%, $463B

- Tri-Party General Collateral Rate (TGCR): 4.53%, $456B

- (rate, volume levels reflect prior session)

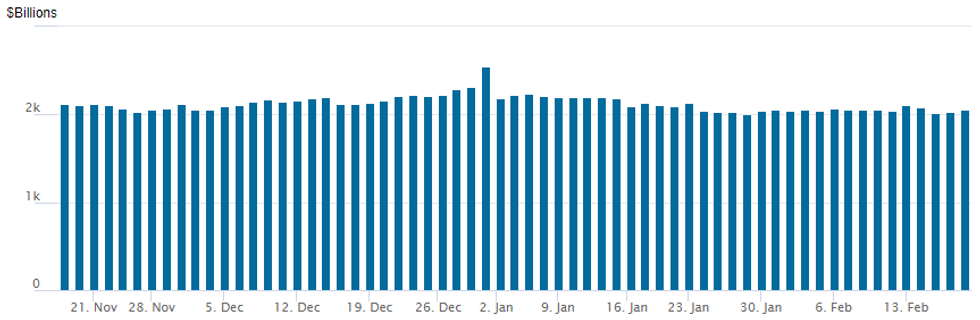

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,059.662B w/ 98 counterparties vs. prior session's $2,032.457B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new issuance Friday, however, $30B total priced Wednesday, thanks to Amgen's $24B 8pt "mega" issuance to help finance it's $28B acquisition of Horizon Pharmaceuticals. Amgen issuance the seventh largest bond issuance on record, topping $22B Cigna offering in 2018.

- Date $MM Issuer (Priced *, Launch #)

- 02/15 $24B *Amgen $2B 2Y +65, $1.5B 3NC1 +115, $3.75B 5Y +115, $2.75B 7Y +135, $4.25B 10Y +150, $2.75B 20Y +165, $4.25B 30Y +185, $2.75B 40Y +200

- 02/15 $5B *MUFG $1.65B 3NC2 +108, $600M 3NC2 SOFR+94, $1B 6NC5 +138, $500M 8NC7 +153, $1.25B 11NC10 +163

- 02/15 $1B *Gov of Sharjah +9Y +280

- Record Issuance Holders:

- 8/11/13 $49B Verizon

- 1/13/16 $46B AB InBev

- 9/04/18 $40B CVS over 9 tranches

- 11/12/19 $30B AbbVie jumbo 10-part

- 3/9/2022 $30B ATT/Discovery 11pt via Magallanes inc

- 4/30/20 $25B Boeing 7pt

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2023 | 0300/1100 |  | CN | PBOC LPR | |

| 20/02/2023 | 0700/0800 | *** |  | SE | Inflation report |

| 20/02/2023 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2023 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2023 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.