-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Disinflation Rising, Curves Bear Steepen

- MNI INTERVIEW: Disinflation Stall Could Push Fed To 6% Or More

- MNI BRIEF: Economies Slowing, Inflation Lower -IMF Adrian

- MNI BOC WATCH: 2nd Hawkish Hold On Sticky Core, Emerging Slack

- MNI BOC: Concerned About Increased Inflationary Risks, Sees Economy Weakening

- MNI New Home Sales Continue To Pick Up As Existing Sales Dive

US

FED: Stubborn U.S. inflation pressures could force the Federal Reserve to consider raising interest rates to 6% or more by early next year, former New York Fed economist Matthew Raskin told MNI.

- While a continued improvement in the inflation outlook and softer growth could allow the Fed to keep rates at a 22-year high of 5.25%-5.5%, there is also a decent possibility that resilient economic activity and price pressures will force a resumption of hikes after a multi-month pause.

- “It will depend importantly on whether the rise in long-term interest rates that we’ve seen over recent months and the tightening of broader financial conditions persist,” said Raskin, a former senior policy adviser who spent 15 years in the Fed system, told MNI's FedSpeak Podcast. “The chances are good that they’re done, but I do put decent odds on further hikes. The conversation will probably center on whether they’ve got 50 basis points or more to go. It probably opens up 6% as the next logical terminal rate for the cycle.” For more see MNI Policy main wire at 1209ET.

IMF: Global economies are losing momentum but inflation is moving lower, reflecting the tightening cycle of the central banks, Tobias Adrian Director, Monetary and Capital Markets Department at the IMF told an MNI webcast Wednesday.

- Speaking from Washington, Adrian addressed the IMF's latest financial stability report. He said stability risks remain elevated, but acute stress in the banking system had subsided, but the weak tail of banks was still large.

- One concern Adrian highlighted was a further repricing lower of equities, despite declines already this year, as further tightening of financial conditions weighed.

CANADA

BOC: The Bank of Canada left its key lending rate at the highest since 2001 at 5% for a second meeting on Wednesday citing signs that ten prior moves are opening up slack in the economy while officials remain prepared to tighten again if core inflation remains sticky.

- "With clearer signs that monetary policy is moderating spending and relieving price pressures, Governing Council decided to hold," officials led by Governor Tiff Macklem said in a statement. "Council is concerned that progress towards price stability is slow and inflationary risks have increased, and is prepared to raise the policy rate further if needed."

- The Bank's outlook pointed to stagnating conditions by cutting the 2024 growth forecast to 0.9% from 1.2% while boosting the inflation forecast half a point to 3%, and officials remain more concerned about upside inflation risks and want to see further moderation in stubborn core prices. Officials left out explicit guidance about a firm pause in rates or a shift to a high-for-long policy as other central banks signal an end of tightening and hope for a rare soft landing rather than a recession. For more see MNI Policy main wire at 1001ET.

- BoC revises 2024 inflation forecast up to +3% from +2.5%. Growth revised down to +0.9% in 2024 from +1.2%. Inflation is forecast to return to the +2% target around mid 2025.

- The Bank sees signs that supply and demand are re-balancing. The economy is predicted to move into excess supply in the fourth quarter and throughout most of 2024. Past interest rate hikes are working through the economy as demand has softened for housing, durable goods, and many services.

US TSYS Bonds Extend Late Session Lows

- Curves bear steepening to new session highs (2Y10Y tapped -16.571 - highest since mid 2022) as bonds continue to extend session lows: USM3 -1-01 at 108-03.5.

- Intermediates already soft after the $52B 5Y note auction tailed (4.899% high yield vs. 4.882% WI), extended lower following recent headlines from Reuters carrying comments from Israeli Prime Minister Benjamin Netanyahu stating, "we are preparing for a ground invasion [of Gaza]. Rates had consolidated earlier on Israel-Gaza Invasion Delay headlines from WSJ.

- Tsy Dec'23 10Y futures slipped to 105-20 low (-23.5), nearing initial technical support of 105-10.5 (Oct 19 low). Meanwhile, 10Y yield marked 4.9570% high vs. Monday's 16Y high of 5.0187%.

- Cross asset summary: US$ index climbing (DXY +.450 at 106.520), VIX +2.05 at 21.02, SPX Eminis -62.25 at 4209.00, West Texas Crude +1.46 at 85.20 while Gold climbs +12.23 at 1983.20.

- Reminder: equity earnings resume after the bell Mattel Inc, Whirlpool Corp, O'Reilly Automotive, Wyndham Hotels, IBM, Baker Hughes, Sun Communities, Meta Platforms, United Rentals and Raymond James.

- Big data drop Thursday: Wkly Claims, GDP, PCE, Durables, Tsy 7Y Sale.

OVERNIGHT DATA

US DATA: New home sales accelerated to a much-stronger-than-expected 759k in September (vs 680k expected and 676k prior revised), for the highest sales figure since Feb 2022.

- 58k of the 83k increase came from the South region, with all 4 major regions seeing higher sales activity.

- Months of supply fell to 6.9, the lowest since Feb 2022, down 0.8 from Aug. On the year, median prices fell to $419k from $477k, and vs the Oct 2022 peak of $497k (but a little higher than the mid-2023 lows).

- Home sales across the board started falling from pandemic highs over 2021, with the drop accelerating as interest rates found their footing ahead of the Fed's first hike in March 2022. (See chart).

- While Existing home sales continue to plummet however (lowest since 2010 in Sept), as homeowners are unwilling to move and refinance lest they give up their low-rate fixed mortgages, New home sales have pulled higher.

- This divergence has helped boost homebuilder activity, with single family home permits continuing to grow at a robust pace.

- New home sales is also an input into the Atlanta Fed's GDPNow model for Q3, which comes ahead of Thursday's initial Q3 release.

- US MBA: MARKET COMPOSITE -1.0% SA THRU OCT 20 WK

- US MBA: REFIS +2% SA; PURCH INDEX -2% SA THRU OCT 20 WK

- US MBA: UNADJ PURCHASE INDEX -22% VS YEAR-EARLIER LEVEL

- US MBA: 30-YR CONFORMING MORTGAGE RATE 7.90% VS 7.70% PREV

The Mortgage Bankers Association's weekly release showed further deterioration in US housing market activity in the week to Oct 20:

- The market composite index dropped -1.0%, vs -6.9% prior, to the lowest level since 1995.

- The home purchase application index also fell to the lowest level since 1995, down -2.2% vs -5.6% prior. The unadjusted purchase index is down 22% from the year-earlier level.

- Mortgage rates (30Y fixed) hit a post-2000 high, up 0.2pp on the week to 7.9% - the 7th consecutive weekly increase

- One brighter spot was the tick-up in the refinancing index (+1.8% vs -9.9% prior), from the lowest levels since January posted the week prior.

MARKETS SNAPSHOT

- Key late session market levels

- DJIA down 110.4 points (-0.33%) at 33031.27

- S&P E-Mini Future down 64 points (-1.5%) at 4207.5

- Nasdaq down 328.4 points (-2.5%) at 12811.05

- US 10-Yr yield is up 12.6 bps at 4.9485%

- US Dec 10-Yr futures are down 21.5/32 at 105-22

- EURUSD down 0.0023 (-0.22%) at 1.0567

- USDJPY up 0.1 (0.07%) at 150.01

- WTI Crude Oil (front-month) up $1.56 (1.86%) at $85.28

- Gold is up $10.64 (0.54%) at $1981.66

- European bourses closing levels:

- EuroStoxx 50 up 7.98 points (0.2%) at 4073.35

- FTSE 100 up 24.64 points (0.33%) at 7414.34

- German DAX up 12.24 points (0.08%) at 14892.18

- French CAC 40 up 21.42 points (0.31%) at 6915.07

US TREASURY FUTURES CLOSE

- 3M10Y +9.772, -52.673 (L: -65.988 / H: -51.297)

- 2Y10Y +11.902, -17.421 (L: -29.079 / H: -16.177)

- 2Y30Y +13.576, -4.016 (L: -16.979 / H: -2.099)

- 5Y30Y +5.258, 16.674 (L: 12.086 / H: 18.535)

- Current futures levels:

- Dec 2-Yr futures down 2.75/32 at 101-4.5 (L: 101-03.875 / H: 101-08.125)

- Dec 5-Yr futures down 11/32 at 104-4 (L: 104-03 / H: 104-18.25)

- Dec 10-Yr futures down 22/32 at 105-21.5 (L: 105-20 / H: 106-18)

- Dec 30-Yr futures down 1-16/32 at 108-16 (L: 108-11 / H: 110-16)

- Dec Ultra futures down 2-05/32 at 111-12 (L: 111-04 / H: 114-06)

US 10Y FUTURE TECHS (Z3) Trend Signals Remain Bearish

- RES 4: 109-20 High Sep 19

- RES 3: 108-17+ 50-day EMA

- RES 2: 108-16 High Oct 12

- RES 1: 107-03 20-day EMA

- PRICE: 106-00 @ 1200 ET Oct 25

- SUP 1: 105-10+ Low Oct 19 and the bear trigger

- SUP 2: 104-26 2.00 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 104-16+ 2.0% 10-dma envelope

- SUP 4: 103-20+ Low Jun’07

Treasuries remain above their recent lows. The trend condition is bearish and recent gains are considered corrective. Last week’s move lower resulted in a break of 106-03+, the Oct 4 low, that confirmed a resumption of the downtrend. The move down has exposed 104-26, a Fibonacci projection. Key short-term trend resistance is at 108-16, the Oct 12 high. Initial firm resistance is at 107-03, the 20-day EMA.

SOFR FUTURES CLOSE

- Dec 23 steady at 94.560

- Mar 24 -0.010 at 94.625

- Jun 24 -0.030 at 94.815

- Sep 24 -0.040 at 95.065

- Red Pack (Dec 24-Sep 25) -0.085 to -0.055

- Green Pack (Dec 25-Sep 26) -0.115 to -0.095

- Blue Pack (Dec 26-Sep 27) -0.13 to -0.115

- Gold Pack (Dec 27-Sep 28) -0.145 to -0.13

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00114 to 5.32605 (-0.00560/wk)

- 3M +0.00789 to 5.38749 (-0.01098/wk)

- 6M +0.01031 to 5.45583 (-0.01365/wk)

- 12M +0.01175 to 5.39586 (-0.04249/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $83B

- Daily Overnight Bank Funding Rate: 5.32% volume: $229B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.387T

- Broad General Collateral Rate (BGCR): 5.30%, $565B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $535B

- (rate, volume levels reflect prior session)

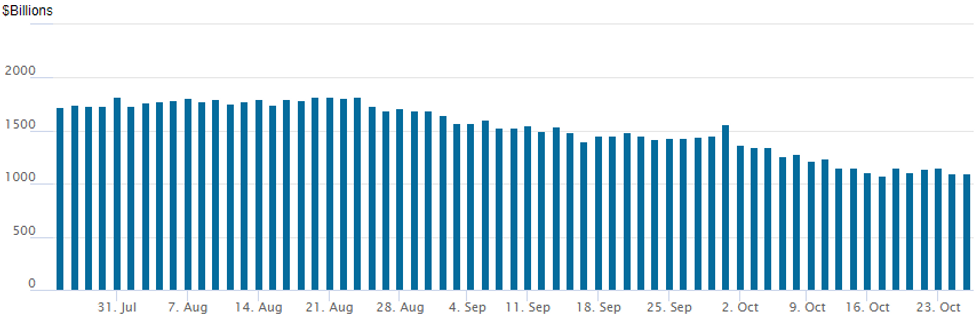

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

The NY Fed Reverse Repo operation usage inches up to $1,100.617B w/97 counterparties vs. $1,097.875B in the prior session -- very close to last Tuesday's $1,082.399B - the lowest level since mid-September 2021. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE $1.75B Truist Financial 6NC5 Launched

- Date $MM Issuer (Priced *, Launch #)

- 10/25 $1.75B #Truist Financial 6NC5 +225

- 10/25 $1B #BGK (Bank Gospodarstwa Krajowego) 5Y +138

- 10/25 $750M Mamoura 10.5Y +110

EGBs-GILTS CASH CLOSE: Gilts Underperform Bunds On ECB Eve

European core FI weakened Wednesday, with Gilts slightly underperforming Bunds ahead of the ECB decision Thursday.

- A negative tone for core FI was set early by stronger-than-expected German IFO report, and somewhat less bad-than-anticipated Euro lending data (and prior to the European open, strong Australian CPI).

- Italian (E4bln), German (E2bln), and UK (GBP3bln) supply also weighed.

- While weakness was orderly throughout the session, GIlts and Bunds extended losses in the last hour of trade after a WSJ report emerged that Israel had agreed to delay an invasion of Gaza - alleviating the risk-off tone and boosting European equities to session highs.

- The German and UK curves bear steepened. Italy led periphery weakness, but spreads closed off session wides.

- GGBs outperformed, with yields up but not as much as for Bunds.

- Attention Thursday is entirely on the ECB decision and communications - our preview is here.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.9bps at 3.125%, 5-Yr is up 4.5bps at 2.769%, 10-Yr is up 6.1bps at 2.889%, and 30-Yr is up 7.4bps at 3.126%.

- UK: The 2-Yr yield is up 5.5bps at 4.844%, 5-Yr is up 5.4bps at 4.569%, 10-Yr is up 7.1bps at 4.61%, and 30-Yr is up 6bps at 5.062%.

- Italian BTP spread up 2.7bps at 202.6bps / Greek down 3.6bps at 139.2bps

FOREX USD Advances Amid Geopolitical Tensions, Antipodean FX Suffers

- Ongoing tensions in the middle east continue to undermine risk sentiment and underpin the US dollar. The USD index stands 0.20% higher as we approach the APAC crossover, extending on Tuesday’s strong price action. Cycle highs for the index remain around 85 pips above current levels.

- The higher US yields (steeper curve) and weakness for equities has prompted particular weakness for higher beta currencies such as the antipodeans, with both AUD and NZD falling over 0.5%, and some weakness for emerging markets FX.

- AUDUSD reversed the entirety of the CPI-inspired run higher, retreating over 50 pips from the session high of 0.6400 in early European trade. The pair gathered momentum through the Tuesday NY lows of 0.6344 and has since narrowed the gap substantially with the Monday and weekly lows of 0.6289.

- The pullback in AUD, shows how US yields remain a more influential factor for the currency relative to domestic developments, with intraday price action closely following the creep higher in long-end TSY yields.

- With price action largely mimicking that of the broad USD index, EURUSD has edged lower in sympathy, spending the majority of Wednesday trade consolidating below 1.0600. Price action reinforces a bearish theme and suggests that recent gains have been a correction. A continuation lower signals scope for 1.0496, the Oct 13 low. The key support and bear trigger lies at 1.0448, the Oct 3 low.

- Another very narrow trading range for USDJPY results in the pair oscillating either side of 150.00. Key resistance remains at the recent 150.16 high (Oct 3) and will be eyed for a further bullish technical development.

- While Chair Powell is delivering some opening remarks later today, he is unlikely to mention monetary policy given the blackout period for communications. Focus turns to the ECB decision and press conference on Thursday, as well as a raft of US data. This includes third quarter GDP, core PCE price index, durable goods and weekly jobless claims.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/10/2023 | 0030/1130 | ** |  | AU | Trade price indexes |

| 26/10/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 26/10/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Deposit Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Main Refi Rate |

| 26/10/2023 | 1215/1415 | *** |  | EU | ECB Marginal Lending Rate |

| 26/10/2023 | 1230/0830 | *** |  | US | Jobless Claims |

| 26/10/2023 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 26/10/2023 | 1230/0830 | * |  | CA | Payroll employment |

| 26/10/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 26/10/2023 | 1230/0830 | *** |  | US | GDP |

| 26/10/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 26/10/2023 | 1245/1445 |  | EU | Press conference post- governing council meeting of ECB | |

| 26/10/2023 | 1300/0900 |  | US | Fed Governor Christopher Waller | |

| 26/10/2023 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 26/10/2023 | 1415/1615 |  | EU | ECB's Lagarde presents monetary policy decisions via Podcast | |

| 26/10/2023 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 26/10/2023 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 26/10/2023 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 26/10/2023 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 26/10/2023 | 1645/1745 |  | UK | BoE's Cunliffe Speaks at Fed Conference | |

| 26/10/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.