-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - CAD Slips as Trump Looks to Tariffs

MNI China Daily Summary: Tuesday, November 26

MNI ASIA OPEN: Election Focus, Winner Up For Grabs?

EXECUTIVE SUMMARY:

- MNI INTERVIEW: BOE Negative Rates May Hit Banks, Lending-Miles

- MNI INSIGHT: Lockdown May Mean BOE Sees 'W-Shaped' Recovery

- MNI INTERVIEW: Trichet-China May Join Poor Nation Debt Plan

- MNI BRIEF: ECB's Schnabel Says ECB Not Yet At Reversal Rate

- U.K. TO RAISE TERROR THREAT LEVEL TO `SEVERE' (after France, Vienna attacks)

- BOC: CANADA RETURNING TO NORMAL SCHEDULE OF BIWEEKLY BILL AUCTIONS

- BOC: AUCTIONS WILL BE LARGER TO HELP MARKET FUNCTIONING

- OPEC AND RUSSIA ARE STUDYING DEEPER OIL CUTS AS ONE OF THE OPTIONS TO ADDRESS WEAKER OIL MARKETS IN EARLY 2021, Rtrs

US

US: MNI Nov Fed Meeting/Election Preview

- The November FOMC meeting is considered largely a placeholder for action at the December FOMC or beyond, but the Nov. 3 presidential and congressional elections could significantly alter the FOMC's outlook on monetary stimulus requirements.

- So for this meeting preview, we have decided to add in sell-side election previews, including (where applicable) what it will mean for the Fed outlook - including implications for fiscal policy and rates/Tsys [see pages 5-6 in PDF for our summary table, and pages 11-19 for summarized notes].

- Additionally, if the situation warrants, we will circulate a brief update prior to Thursday's FOMC decision, with any changes to sell-side views spurred by the election outcome. PLEASE CLICK HERE TO ACCESS PREVIEW:

- https://marketnews.com/mni-fed-preview-high-stakes-election-for-fed

- (or contact sales@marketnews.com)

EUROPE

UK: A move to negative rates by the Bank of England could squeeze bank and building society margins, hit funding and curtail lending, former Monetary Policy Committee member David Miles told MNI. "I am very sceptical as to whether negative interest rates are a valuable thing to try and implement," Miles said in an interview, "What I am sceptical about is the actual impact if you did implement it. I suspect that at best it is negligible, but there is a fairly significant risk that it is actually perverse." For more see 11/03 main wire at 1229ET.

BOE: The Bank of England Monetary Policy Committee could factor in estimates of the likely impact of the UK's newly-announced month-long national lockdown into projections contained in Thursday's Monetary Policy Report, possibly turning its modal projection for a roughly lopsided V-shaped recovery into a W.

ECB/CHINA: China is likely to eventually join other sovereign lenders including the Paris Club in working out debt relief for poorer nations, as attempts to negotiate with borrowers by itself will be rejected by other creditors, former European Central Bank President Jean-Claude Trichet told MNI, warning that failure to reach a deal could lead to defaults. For more see 11/03 main wire at 1230ET.

ECB: A further cut in interest rates would be possible before the European Central Bank reached the point at which they would no longer be effective or even cause harm, Executive Board member Isabel Schnabel said Tuesday, adding that no decisions have been taken by the Governing Council on this issue.

OVERNIGHT DATA

- US SEP FACTORY ORDERS +1.1%; EX-TRANSPORT NEW ORDERS +0.5%

- US SEP DURABLE ORDERS +1.9%

- US SEP NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +1.0%

- US ISM-NY CURRENT CONDITIONS INDEX 65.1 OCT

- US ISM-NY CURRENT CONDITIONS INDEX 65.1 OCT

- US ISM-NY 6-MONTH OUTLOOK INDEX 62.9 OCT

- US REDBOOK: OCT STORE SALES +1.2% V SEP THROUGH OCT 31 WK

- US REDBOOK: OCT STORE SALES +2.0% V YR AGO MO

- US REDBOOK: STORE SALES +3.2% WK ENDED OCT 31 V YR AGO WK

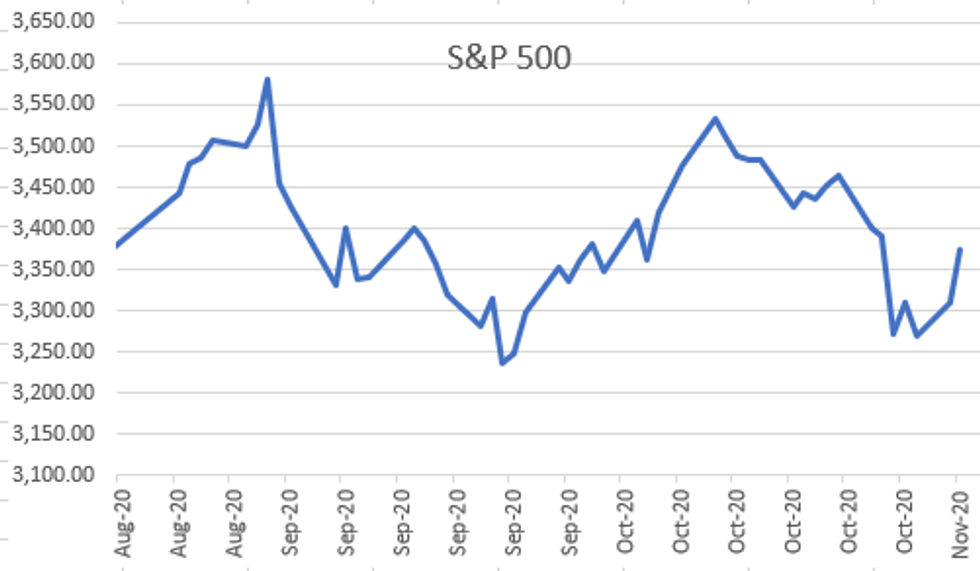

MARKETS SNAPSHOT

- DJIA up 554.98 points (2.06%) at 26925.05

- S&P E-Mini Future up 62.25 points (1.89%) at 3338.75

- Nasdaq up 203.7 points (1.9%) at 10957.61

- US 10-Yr yield is up 3.4 bps at 0.8773%

- US Dec 10Y are down 6/32 at 138-3.5

- EURUSD up 0.0062 (0.53%) at 1.1715

- USDJPY down 0.12 (-0.11%) at 104.76

- WTI Crude Oil (front-month) up $0.89 (2.42%) at $38.03

- Gold is up $11.19 (0.59%) at $1898.99

- European bourses closing levels:

- EuroStoxx 50 up 79.18 points (2.62%) at 3070.77

- FTSE 100 up 131.8 points (2.33%) at 5745.83

- German DAX up 300.7 points (2.55%) at 11981.44

- French CAC 40 up 114.47 points (2.44%) at 4780.61

US TSY SUMMARY: Risk Pared Ahead Election Results

Tsy futures still trading weaker but are well off late morning lows by the bell, yield curves mostly steeper but off highs. First half risk-on tone scaled back in second half (equities off highs (ESZ0 +56.0) as uncertainty over who will win election (not to mention how long results will take).

- Moderate volumes, TYZ0 just over 1.1M, markets have FOMC policy annc on Thu and October employment data to contend with Friday.

- Strong risk-on tone carried over from overnight through much of the first half, knock-on bid in US equities after German DAX staged another strong rally. Contributing factor for US shares is Biden/Harris win will bring fiscal stimulus to those in need quicker than a Trump/Pence re-election will.

- Dec-Ultra-Bond Block buy just after 1300ET added impetus to rally w/ futures bought at 214-12, well through the 214-07 post-time offer.

- Earliest results will start will start filtering out soon after polls close around 1900ET, while some states are prevented in counting mail-in ballots until after the close as well. It's going to be a long night.

- The 2-Yr yield is up 1.2bps at 0.1663%, 5-Yr is up 1.6bps at 0.3909%, 10-Yr is up 3.6bps at 0.8789%, and 30-Yr is up 3.4bps at 1.6501%.

US TSY FUTURES CLOSE: Risk-On Scaled Back Ahead US Election

Tsy futures still trading weaker but are well off late morning lows by the bell, moderate volumes, TYZ0 just over 1.1M.

- 3M10Y +3.071, 78.26 (L: 75.471 / H: 79.785)

- 2Y10Y +2.761, 71.065 (L: 68.951 / H: 72.392)

- 2Y30Y +2.587, 148.183 (L: 145.593 / H: 150.697)

- 5Y30Y +1.943, 125.926 (L: 123.501 / H: 127.703)

- Current futures levels:

- Dec 2Y -0.75/32 at 110-12.25 (L: 110-12 / H: 110-13.12)

- Dec 5Y -2/32 at 125-17.25 (L: 125-14.5 / H: 125-19.75)

- Dec 10Y down 6.5/32 at 138-3 (L: 137-30.5 / H: 138-11)

- Dec 30Y down 21/32 at 172-3 (L: 171-18 / H: 172-28)

- Dec Ultra 30Y down 1-9/32 at 214-16 (L: 213-13 / H: 216-02)

US EURODLR FUTURES CLOSE: Steady To Weaker After the Bell

Futures trading steady in the short end to modestly weaker out the strip, little off session lows. Lead quarterly holding steady since 3M LIBOR set +0.00462 to 0.22475% (+0.00900/wk). Currently:

- Dec 20 steady at 99.755

- Mar 21 -0.005 at 99.785

- Jun 21 -0.005 at 99.790

- Sep 21 -0.010 at 99.785

- Red Pack (Dec 21-Sep 22) -0.01 to -0.005

- Green Pack (Dec 22-Sep 23) -0.015 to -0.005

- Blue Pack (Dec 23-Sep 24) -0.025 to -0.015

- Gold Pack (Dec 24-Sep 25) -0.03 to -0.02

US DOLLAR LIBOR

Latest settles

- O/N +0.00087 at 0.08200% (+0.00062/wk)

- 1 Month -0.00287 to 0.13763% (-0.00262/wk)

- 3 Month +0.00462 to 0.22475% (+0.00900/wk)

- 6 Month -0.00212 to 0.24388% (+0.00175/wk)

- 1 Year +0.00162 to 0.33400% (+0.00387/wk)

US TSYS: Short Term Rates

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.09% volume: $58B

- Daily Overnight Bank Funding Rate: 0.08%, volume: $146B

- Secured Overnight Financing Rate (SOFR): 0.11%, $956B

- Broad General Collateral Rate (BGCR): 0.07%, $352B

- Tri-Party General Collateral Rate (TGCR): 0.07%, $314B

- (rate, volume levels reflect prior session)

- Tsy 4.5Y-7Y, $6.001B accepted vs. $15.429B submission

- Next scheduled purchase:

- Fri 11/06 1100-1120ET: Tsy 0Y-2.25Y, appr $12.825B

PIPELINE: Issuers remain sidelined into the US Presidential Election

FOREX: All Eyes on the Polls as Dollar Hits Reverse

Markets moved further to price in a Biden victory and potential blue sweep Tuesday, with early voting patterns suggesting turnout could be among the best in over 100 years. The market responded to the perceived higher likelihood of a Biden victory by selling the greenback notably, buying up equities and steepening the Treasury curve.

- Commodities were a notable beneficiary, with WTI and Brent crude futures rallying sharply, adding over 2.5% to support the likes of AUD, CAD and NOK further, which sat in the top half of the G10 table.

- Despite markets pricing in the further likelihood of a smooth Biden victory, currencies are still acutely aware of the risk of volatility. The very front end of the vol curve for USD vs. JPY, EUR, GBP has risen to its highest level since the depths of the COVID crisis, heightening the focus on Tuesday's results.

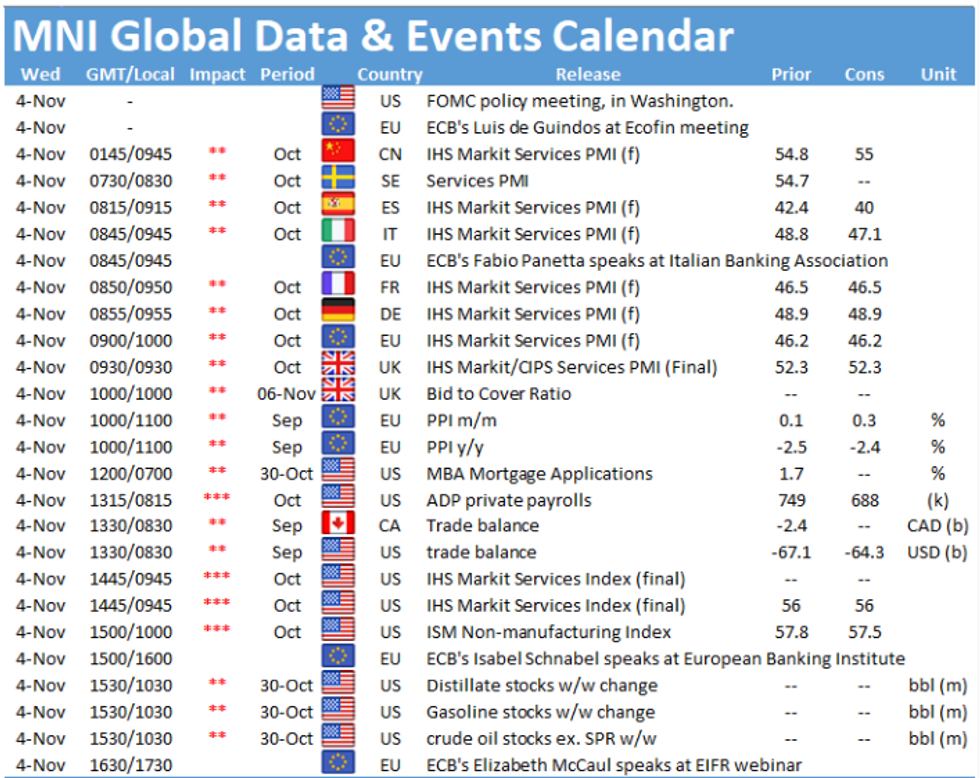

- The fallout of the election, Chinese Caixin PMI, US ADP Employment Change and ISM Services numbers are the Wednesday focus

EGBs-GILTS CASH CLOSE: Going With The Risk-On Flow

EGBs have broadly traded within ranges, with Gilts moderately weaker on a decidedly risk-on day (equities up 2+%) ahead of US election results and in anticipation of the BoE on Thursday.

- Periphery spreads tighter too, led by Greece.

- Apart from the US elections overnight, Brexit headlines to be watched (FT's splash that "Barnier to signal lack of Brexit breakthrough on key issues" had minimal impact on Gilts).

- A bit of data coming on Weds morning, namely Oct Spain / Italy Oct Svcs/Composite PMI, and Oct Spain unemployment.

- Closing Levels / 10-Yr Periphery EGB Spreads:

- Germany: The 2-Yr yield is up 1.1bps at -0.794%, 5-Yr is up 1.8bps at -0.807%, 10-Yr is up 2bps at -0.62%, and 30-Yr is up 1.6bps at -0.214%.

- UK: The 2-Yr yield is up 3.2bps at -0.042%, 5-Yr is up 4bps at -0.038%, 10-Yr is up 5.3bps at 0.272%, and 30-Yr is up 5.2bps at 0.84%.

- Italian BTP spread down 3.4bps at 135.4bps

- Spanish bond spread down 3.1bps at 73bps

- Portuguese PGB spread down 3.2bps at 70.2bps

- Greek bond spread down 5bps at 151.7bps

UP TODAY

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.