-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Fed Daly, Mester Keep Rate Cut Hopes Alive

- MNI: Fed's Mester: Cutting Too Early Risks Undoing Progress

- MNI BRIEF: Fed's Daly - Cutting Rates Too Soon Would Be Risky

- MNI POLICY: BOC Secondary Debt Buys Curb Political Blowback

- MNI US DATA: Openings Almost In Line After Revisions, Quits A Little Higher Unrounded

US

FED (MNI): Fed's Mester: Cutting Too Early Risks Undoing Progress: Cutting interest rates too soon and allowing high inflation to stick around is a risk not worth taking, Federal Reserve Bank of Cleveland President Loretta Mester said Tuesday, adding she sees higher inflation this year than the median FOMC projection.

- "At this point, I think the bigger risk would be to begin reducing the funds rate too early. And with labor markets and economic growth both being very solid, we do not need to take that risk," she said in remarks prepared for a National Association for Business Economics event in Cleveland. (See: MNI POLICY: Fed's Rate Cut Timeline Shaken By Inflation Bumps)

- Keeping rates high for too long while inflation expectations continued to decline would effectively tighten policy and risk hurting the labor market, she said. But moving rates down "too soon or too quickly without sufficient evidence to give us confidence that inflation is on a sustainable and timely path back to 2% would risk undoing the progress we have made on inflation."

FED BRIEF (MNI): Fed's Daly - Cutting Rates Too Soon Would Be Risky: San Francisco Federal Reserve President Mary Daly said Tuesday that there's little urgency to lower interest rates amid solid economic and job growth and it would be risky to loosen prematurely with inflation still a concern.

- “The risk of cutting interest rates too soon is a real risk,” she said. "There is a path where interest rates start to adjust this year but we’re just not there yet." (MNI POLICY: Fed's Rate Cut Timeline Shaken By Inflation Bumps)

- "There is no urgency to cut the rate," she said during a panel talk, adding the Fed's dot plot for three cuts this year remains reasonable but that is “a projection, not a promise.” Lingering lingering inflation is “a toxic tax on everyone," Daly said.

NEWS

US (MNI): Johnson Likely To Target Energy Policy Wins In New Ukraine Aid Package: House Speaker Mike Johnson (R-LA) confirmed on Sunday that he expects to move a Ukraine aid package with “some important innovations” after the House of Representatives returns on April 9.

POLICY (MNI): BOC Secondary Debt Buys Curb Political Blowback: The Bank of Canada’s recent debate about sticking with its pandemic-era shift toward buying more government debt in secondary markets versus at auctions of new securities is likely aimed in part at blunting political criticism around financing deficits with the central bank's balance sheet.

US-JAPAN (MNI): Biden & Kishida Agree On Tech Subsidy Rules: Nikkei reporting that Japanese PM Fumio Kishida and US President Joe Biden are set to 'agree on subsidy rules for strategic products including chips and batteries'. The headline comes just hours after the news broke that the Japanese gov't intends to provide up to JPY590bn (USD3.9bn) in subsidies to the chip venture Rapidus in order to bolster the firm founded in 2022 as a joint operation by the Japanese gov't and eight domestic firms including Toyota and Sony.

SECURITY (MNI): Israel Presents New Ceasefire Proposal To Hamas: The office of Israeli Prime Minister Benjamin Netanyahu has confirmed that Israel has drafted a new ceasefire/hostage release proposal and presented it to Hamas. Netanyahu's office said: "As part of the talks, with the helpful mediation of Egypt, the mediators formulated an up-to-date proposal to be addressed by Hamas."

US TSYS Rate Cut Hopes Kept Alive

- Treasuries continued to retreat Tuesday on heavy volumes (TYM4 >1.9M) as Europe returned from extended Easter holiday weekend. Treasury curves broadly steepened: 2s10s +6.013 to -33.801 (highest since March 21) as short end rates outperformed.

- Intermediate to long end rates held near the middle of the day's range following this morning's slightly higher than expected JOLTS job openings at 8.756m (cons 8.73m) in Feb after an downward revised 8.748m (initial 8.86m) in Jan. The ratio to unemployed fell to 1.36x, helped by the strong 0.33m rise in unemployment in Feb.

- Fed speakers supported short end rates on the day: Cleveland Fed Mester ('24 voter but retiring in June) won't rule out a rate cut in June, while SF Fed Daly said three rate cuts in 2024 is still a "reasonable baseline".

- In turn, projected rate cut pricing rebounded from morning lows: May 2024 steady at -6.7% w/ cumulative -1.7bp at 5.312%; June 2024 -59.7% vs -53.3% earlier w/ cumulative rate cut -16.6bp at 5.163%. July'24 cumulative at -24.6bp vs -23.6bp earlier, Sep'24 cumulative -41.9 vs. -40.0bp.

- Wednesday Data Calendar: ADP Jobs, S&P Global US Services/Composite PMIs (final), ISM Services and multiple Fed Speakers through the session. Main focus, however, is on Friday's March employment report, current job gain estimate at +205k.

OVERNIGHT DATA

US DATA (MNI): Openings Almost In Line After Revisions, Quits A Little Higher Unrounded: Slightly higher than expected JOLTS job openings at 8.756m (cons 8.73m) in Feb after an downward revised 8.748m (initial 8.86m) in Jan.

- The ratio to unemployed fell to 1.36x, helped by the strong 0.33m rise in unemployment in Feb.

- It is back to the 1.35x it dropped to in Oct, in what was a quick trip having averaged 1.44x through Jul-Jan as its trend decline from a high of 2 in 1H22 has stalled. For context, it averaged 1.2 averaged in 2019 and 1.0 in 2017-18.

- Quit rates meanwhile lift from some particularly low readings, helped by upward revisions.

- Quits rate: 2.21% from 2.19 (initial 2.15). It averaged 2.33 in 2019, 2.20 in 2017-18.

- Private quits: 2.44% from 2.42 (initial 2.37). It averaged 2.59 in 2019, 2.45 in 2017-18.

US FEB FACTORY ORDERS +1.4%; EX-TRANSPORT NEW ORDERS +1.1%

US FEB DURABLE ORDERS +1.3%

US FEB NONDEFENSE CAP GOODS ORDERS EX AIRCRAFT +0.7%

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 382.66 points (-0.97%) at 39184.8

- S&P E-Mini Future down 39.5 points (-0.75%) at 5256

- Nasdaq down 175.3 points (-1.1%) at 16222.39

- US 10-Yr yield is up 5 bps at 4.3591%

- US Jun 10-Yr futures are down 5.5/32 at 109-24

- EURUSD up 0.0018 (0.17%) at 1.0761

- USDJPY down 0.05 (-0.03%) at 151.6

- WTI Crude Oil (front-month) up $1.49 (1.78%) at $85.20

- Gold is up $21.89 (0.97%) at $2273.22

- European bourses closing levels:

- EuroStoxx 50 down 41.42 points (-0.81%) at 5042

- FTSE 100 down 17.53 points (-0.22%) at 7935.09

- German DAX down 209.36 points (-1.13%) at 18283.13

- French CAC 40 down 75.76 points (-0.92%) at 8130.05

US TREASURY FUTURES CLOSE

- 3M10Y +6.526, -100.999 (L: -111.311 / H: -96.471)

- 2Y10Y +5.805, -34.009 (L: -39.181 / H: -32.302)

- 2Y30Y +6.495, -19.499 (L: -25.135 / H: -17.877)

- 5Y30Y +2.67, 15.249 (L: 12.75 / H: 16.491)

- Current futures levels:

- Jun 2-Yr futures up 1.125/32 at 102-2.75 (L: 102-00.75 / H: 102-03.375)

- Jun 5-Yr futures down 1/32 at 106-13.75 (L: 106-08 / H: 106-18.75)

- Jun 10-Yr futures down 5.5/32 at 109-24 (L: 109-14.5 / H: 110-03)

- Jun 30-Yr futures down 24/32 at 117-24 (L: 117-05 / H: 118-26)

- Jun Ultra futures down 26/32 at 125-12 (L: 124-16 / H: 126-21)

US 10Y FUTURE TECHS: (M4) Approaching The Bear Trigger

- RES 4: 112-04+ High Mar 8 and bull trigger

- RES 3: 111-24 High Mar 12

- RES 2: 111-10+ High Mar 13

- RES 1: 110-29+/31+ 50-day EMA / High Mar 27

- PRICE: 109-23+ @ 1530 ET Apr 2

- SUP 1: 109-24+ Low Mar 18 and the bear trigger

- SUP 2: 109-14+ Low Nov 28

- SUP 3: 109-12+ 1.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 4: 108-25+ 2.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

A sharp sell-off in Treasuries Monday highlights a resumption of the recent bearish threat and the end of the corrective phase between Mar 18 - 27. Sights are on key short-term support at 109.24+, the Mar 18 low and bear trigger. A break of this support would confirm a resumption of the downtrend that started late Dec last year. This would open 109-12+, a Fibonacci projection. Key short-term resistance is at 110-31+, the Mar 27 high.

SOFR FUTURES CLOSE

- Jun 24 +0.025 at 94.850

- Sep 24 +0.025 at 95.085

- Dec 24 +0.020 at 95.355

- Mar 25 +0.020 at 95.610

- Red Pack (Jun 25-Mar 26) -0.01 to +0.015

- Green Pack (Jun 26-Mar 27) -0.025 to -0.01

- Blue Pack (Jun 27-Mar 28) -0.03 to -0.025

- Gold Pack (Jun 28-Mar 29) -0.045 to -0.03

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00008 to 5.32404 (-0.00470/wk)

- 3M +0.00601 to 5.30812 (+0.00989/wk)

- 6M +0.01970 to 5.25134 (+0.03353/wk)

- 12M +0.04545 to 5.07241 (+0.07259/wk)

- Secured Overnight Financing Rate (SOFR): 5.35% (+0.01), volume: $2.023T

- Broad General Collateral Rate (BGCR): 5.33% (+0.01), volume: $674B

- Tri-Party General Collateral Rate (TGCR): 5.33% (+0.01), volume: $656B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $93B

- Daily Overnight Bank Funding Rate: 5.32% (-0.01), volume: $226B

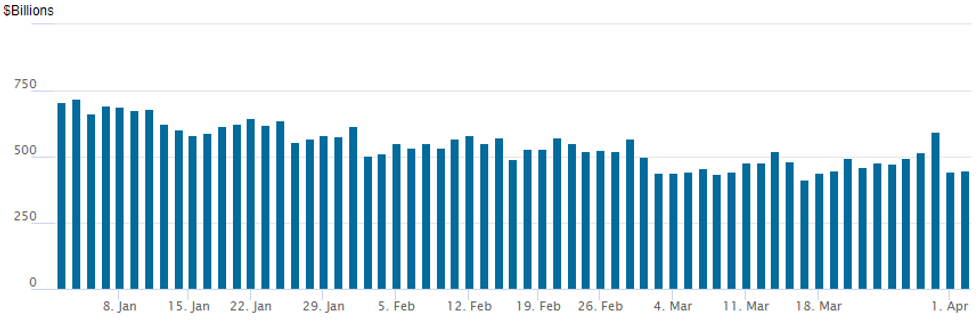

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs up to $448.424B vs $441.903B Monday. Compares to mid-March low of $413.877B - the lowest level since May 2021.

- Meanwhile, the latest number of counterparties slips to 73 vs. 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021)

PIPELINE $4.25B TotalEnergies Capital Launched

$10.45B to Price Tuesday

- Date $MM Issuer (Priced *, Launch #)

- 4/2 $4.25B #TotalEnergies Capital $1.25B 10Y +80, $1.75B 30Y +100, $1.25B 40Y +115

- 4/2 $3.5B #Enbridge $750M 3Y +75, $750M 5Y +95, $1.2B 10Y +128, $800M 30Y +145 (3Y SOFR dropped)

- 4/2 $1.2B #MassMutual $850M 3Y +60, $350M 3Y SOFR+74

- 4/2 $1.5B #Amphenol $450M 3Y +57, $450M 5Y +72, $600M 10Y +90

- 4/2 $Benchmark Development Bank of Kazakhstan 3Y investor calls

- Rolled to Wednesday:

- 4/3 $Benchmark DBJ 5Y SOFR+59a

- 4/3 $Benchmark World Bank 2Y +19, 7Y +49

- 4/3 $Benchmark Kingdom of Belgium 30Y +40a

- 4/3 $Benchmark Ontario Teachers Finance 5Y +65a

EGBs-GILTS CASH CLOSE: US-Led Rout Overshadows Softer Euro Inflation

The German and UK curves steepened sharply as long-end bonds sold off Tuesday following a 4-day weekend for European markets.

- The overriding bearish dynamic emanated from Treasuries which had sold off Monday on solid US data and a patient stance on rate cutting from Fed Chair Powell.

- European data was mixed: solid final PMIs were offset by softer-than-expected Italian and French inflation prints on Friday and German HICP a touch softer than expected today.

- That sets Eurozone-wide HICP up to come in below consensus tomorrow on the headline measure, which probably kept the short-end from selling off in line with US counterparts (2024 Fed rate cut expectations have pulled back 4bp since Mar 28, with the ECB equivalent increasing 2bp).

- The German curve twist steepened, with the UK's bear steepening.

- BTPs easily underperformed, with 10Y spreads to Bunds more than 5bp wider, versus counterparts on the periphery which closed slightly tighter.

- Dutch inflation data early Wednesday provides the final signal for the Eurozone-wide read later in the morning, which is the session focus.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 1bps at 2.839%, 5-Yr is up 6.1bps at 2.382%, 10-Yr is up 10.2bps at 2.4%, and 30-Yr is up 12.5bps at 2.58%.

- UK: The 2-Yr yield is up 6.8bps at 4.24%, 5-Yr is up 11.5bps at 3.938%, 10-Yr is up 15.2bps at 4.085%, and 30-Yr is up 15.3bps at 4.576%.

- Italian BTP spread up 5.7bps at 144bps / Spanish bond spread down 0.2bps at 86.2bps

FOREX Greenback Turns Lower Across US Hours, EURCHF Extending Bounce

- After touching the best levels of the year at 105.10 overnight, the USD index has turned lower over the course of the Tuesday session, currently down around 0.25%. Moves have been eating into the greenback’s post ISM advance on Monday and have been underpinned by weaker durable goods data and poor revisions offsetting the slightly better February JOLTS job openings.

- The dollar’s turnaround comes amid CFTC data, covering positioning as of the Tuesday close, indicating markets swung their net USD position short for the first time since 2021, potentially exposing the currency to corrective recoveries on weaker-than-expected US economic data releases.

- Weakness for major equity benchmarks has done little to impact the G10 currency space Tuesday, evidenced by AUD being one of the best performers and rising 0.35%. Despite this, the reversal lower on Mar 21 reinstated a bearish threat and has exposed 0.6478, the Mar 5 low. Clearance of this level would open the key support and bear trigger at 0.6443, the Feb 13 low.

- CHF is the poorest performer in G10 Tuesday, prompting EUR/CHF to recover well off pullback lows printed late last week. This keeps the cycle high and bull trigger well within range at 0.9820, a level that could come into play should ECB rate cut pricing follow the lead of the Fed gyrations so far this week. OIS markets currently price ~93bps of rate cuts from the ECB for this year.

- The JPY remains notably quiet as markets continue to grapple with the still wide yield differentials compared to G10 counterparts and the potential for the BOJ to intervene in the currency. USDJPY trades within 40 pips of 152.00, a key multi-decade resistance zone that continues to cap the pairs topside momentum.

- Eurozone inflation readings take centre-stage on Wednesday, before US ADP and ISM Services data. Fed Chair Powell is due to speak at Stanford's Business, Government, and Society Forum, although the focus for global markets remains firmly on Friday’s US employment report.

WEDNESDAY DATA CALENDAR

| 03/04/2024 | 0700/0300 | * |  | TR | Turkey CPI |

| 03/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 03/04/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 03/04/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 03/04/2024 | 1215/0815 | *** |  | US | ADP Employment Report |

| 03/04/2024 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 03/04/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/04/2024 | 1600/1200 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.