-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Offcl Opinions on Policy Moves Differ

- MNI INTERVIEW: Fed Pause Was Error, Must Hike Near 7% - Lacker

- MNI INTERVIEW: Inflation Drop Warrants Fed Pause - Ex IMF Econ

- MNI: Fed's Barkin Supports Slower Hikes, Can Do More If Needed

- MNI: Fed’s Waller-Bank Strains Could Warrant Less Tightening

- MNI: Fed Says Core Services Inflation Not Yet Easing-Report

- MNI INTERVIEW: U.S. Sentiment Turns Up On Disinflation - UMich

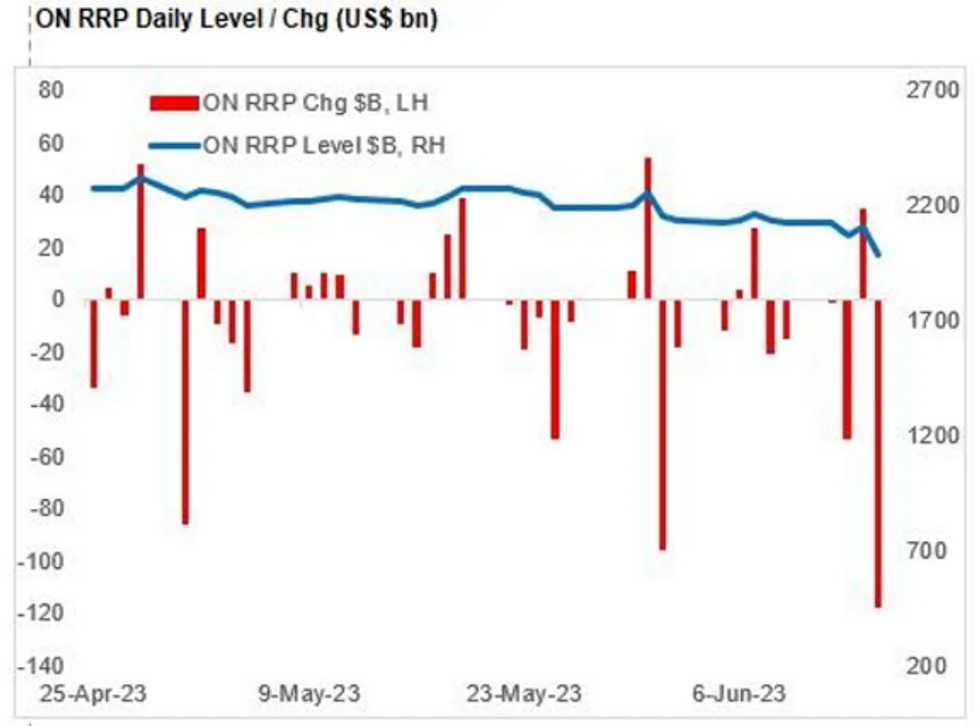

- MNI ON RRP Drop Thursday May Have Been Illusory, But Trend Is Down

US

FED: The Federal Reserve must raise interest rates a lot more in order to bring inflation back to target and this week's pause was misguided given stubborn prices, former Richmond Fed President Jeffrey Lacker told MNI.

- The Fed by its own admission says key measures like core inflation and core services excluding housing are barely coming down, Lacker said in an interview Friday.

- “They’re not being realistic about how high a real federal funds rate they’re going to need to bring inflation down. I think they’re going to need to go close to 7%, if not above,” Lacker, long known as a policy hawk, said in an interview.

- “They’ve only brought the real fed funds rate a smidge above zero so far," Lacker said. "Powell highlighted the extent to which inflation – especially supercore– hasn’t come down, and overall core, that hasn’t come down. Pausing slows that process down and delays the achievement of that.” For more see MNI Policy main wire at 1329ET.

FED: U.S. inflation pressures are abating sufficiently to allow the Federal Reserve to be patient in figuring out whether to raise interest rates further, making this week’s pause a warranted move, former IMF chief economist Simon Johnson told MNI.

- The Fed kept rates on hold Wednesday for the first time since it started to hike in March of 2022, in a range of 5%-5.25%, although officials also raised their projections for peak rates to imply at least two additional increases this year.

- “The inflation numbers will recede – we’re still seeing echoes from the supply shocks. I think those are going to become less intense, which would support the view that interest rates are already at the right level for now, and a level that’s consistent with returning to the Fed’s medium term inflation target,” Johnson, a professor at MIT and co-author of the new book ‘Power and Progress’ said in the latest episode of MNI’s FedSpeak Podcast.

- “So I think they should be patient.” (See MNI INTERVIEW: Fed Done Hiking, Inflation To Drop-Ex-Staffer)

FED: Slowing the pace of interest rate increases gives the Fed more time to assess data, and the Fed can "do more" if slowing demand isn't translating into lower inflation, Federal Reserve Bank of Richmond President Thomas Barkin said Friday after the FOMC opted not to raise rates again at its June meeting.

- "With forward-looking real rates now positive across the curve, we have been moderating the pace of those increases. Think of it as slowing your boat as you approach the dock. That gives us time to assess the data on demand and inflation and determine what more we might need to do," he said in remarks prepared for the Maryland Government Finance Officer Association.

- "I am still looking to be convinced of the plausible story that slowing demand returns inflation relatively quickly to that target. If coming data doesn’t support that story, I’m comfortable doing more." For more see MNI Policy main wire at 0900ET.

FED: Tighter credit conditions due to recent regional banking strains could reduce some of the need for additional monetary tightening, Federal Reserve Governor Christopher Waller said Friday in uncharacteristically dovish remarks.

- “Recent strains in the banking sector may lead to a tightening of price and nonprice conditions for lending. If that is the case, then it might reduce the need for at least some further tightening of monetary policy to lower inflation. The Fed could tighten policy too much if it ignored such a development,” Waller said in prepared remarks to a conference in Norway. (See MNI INTERVIEW: Fed 'Skip' Heralds Premature Pause-Ex-Staffer)

- Waller -- who in a May 24 speech focused on a lack of progress slowing inflation -- still said financial stability concerns shouldn't get in the way of the Fed’s resolve to pursue its monetary policy mandate. “The Fed’s job is to use monetary policy to achieve its dual mandate, and right now that means raising rates to fight inflation,” he said. But he also made clear that financial stresses are a concern for policymakers, who opted this week to keep rates on hold for the first time since the start of rate hikes in March 2022. For more see MNI Policy main wire at 0745ET.

FED: A key measure of service sector inflation has not yet shown significant signs of easing, the Federal Reserve said Friday in its semi-annual Monetary Policy Report to Congress.

- "Within core services prices, housing services inflation has been high, but the monthly changes have started to ease in recent months, consistent with the slower increases in rents for new tenants that have been observed since the second half of last year," the report said.

- "For other core services, price inflation remains elevated and has not shown signs of easing, and prospects for slowing inflation may depend in part on a further easing of tight labor market conditions." Fed Chair Jerome Powell will present the report to the relevant House and Senate committees in hearings next week.

US TSYS: Weaker Rates Discount Rising UofM Sentiment, Lower 1Y Inflation Exp

- Treasury futures remain weaker, but off morning lows after futures inexplicably reversed a post UofM sentiment data rally, front month 10Y futures slipped to 112-24.5 low, trades above technical support (112-12+, Low Jun 14) at 113-00, yield 3.7730% +.0565.

- No particular headline driver for the reversal as it appeared FI longs took the post UofM rally (sentiment 63.9 vs. 60.0 est, 59.2 prior while 1Y inflation exp falls to 3.3% vs. 4.1% est) as an opportunity to scale back risk ahead the long holiday weekend.

- The 2s10s curve tapped -98.341 low, lowest since March 8 43 year inverted low of appr -110.0, this as short end rates price in projected 25bp hike in one of the next 3 FOMC meets.

- Chances of a 25bp hike next at the July 26 FOMC is approximately 70% with Fed funds implied at 17.6bp. Probability of a 25bp hike over the two meetings that follow remain above 80%: September cumulative at +21.3bp to 5.293%, November cumulative 20.3bp to 5.282%. while December cumulative holds at 11.8bp to 5.197%. At the moment, Fed terminal at 5.290% in Oct'23.

- Mixed policy opinions with the Fed out of blackout: Slowing the pace of interest rate increases gives the Fed more time to assess data, and the Fed can "do more" if slowing demand isn't translating into lower inflation, Richmond Fed Barkin said Friday.

- Conversely, the Federal Reserve must raise interest rates a lot more in order to bring inflation back to target and this week's pause was misguided given stubborn prices, former Richmond Fed President Jeffrey Lacker told MNI earlier.

OVERNIGHT DATA

- UMICH JUN. PRELIM CONS SENTIMENT 63.9 (60.0 EXP., 59.2 MAY)

- UMICH JUN. PRELIM CURR COND 68.0 (65.1 EXP., 64.9 MAY)

- UMICH JUN. PRELIM EXPECTATIONS 61.3 (55.2 EXP., 55.4 MAY)

- UMICH JUN. PRELIM 1Y INFL EXPECTATIONS 3.3% (4.1% EXP; 4.2% MAY)

- UMICH JUN. PRELIM 5-10Y INFL EXPECTATIONS 3.0% (3.0% EXP, 3.1% MAY)

US DATA: Decreased worries about inflation are making consumers more optimistic about the economy, a sign that the Federal Reserve's monetary tightening campaign is having its desired effect, the head of the University of Michigan's Survey of Consumers told MNI.

- "We had a pretty strong increase in sentiment from last month to this month and we saw it across every demographic and this improvement in short run inflation expectations is also across the board. This isn't usually the case," said Joanne Hsu in a phone interview Friday. "It's a consensus on improved expectations over the economy as well as improvements in inflation."

- The University of Michigan's preliminary June reading on the overall index of consumer sentiment came in at 63.9 up 7.9% on the month and above expectations for 60. The perception of current conditions increased 4.8% to 68.0 and the expected index increased 10.6% to 61.3. For more see MNI Policy main wire at 1416ET.

MARKETS SNAPSHOT

Key late session market levels:- DJIA down 23.35 points (-0.07%) at 34384.73

- S&P E-Mini Future down 4.25 points (-0.1%) at 4466.75

- Nasdaq down 50.5 points (-0.4%) at 13731.65

- US 10-Yr yield is up 4.7 bps at 3.7633%

- US Sep 10-Yr futures are down 11.5/32 at 113-3

- EURUSD down 0.0002 (-0.02%) at 1.0943

- USDJPY up 1.48 (1.06%) at 141.78

- WTI Crude Oil (front-month) up $1.18 (1.67%) at $71.80

- Gold is up $1.11 (0.06%) at $1959.17

- EuroStoxx 50 up 29.7 points (0.68%) at 4394.82

- FTSE 100 up 14.46 points (0.19%) at 7642.72

- German DAX up 67.51 points (0.41%) at 16357.63

- French CAC 40 up 97.74 points (1.34%) at 7388.65

US TREASURY FUTURES CLOSE

- 3M10Y +4.454, -147.005 (L: -156.892 / H: -142.855)

- 2Y10Y -1.92, -95.293 (L: -98.341 / H: -92.563)

- 2Y30Y -5.323, -86.586 (L: -89.865 / H: -80.567)

- 5Y30Y -6.119, -13.782 (L: -15.741 / H: -7.125)

- Current futures levels:

- Sep 2-Yr futures down 4.5/32 at 102-4.25 (L: 102-00 / H: 102-09)

- Sep 5-Yr futures down 10.25/32 at 107-25.75 (L: 107-18.25 / H: 108-05.75)

- Sep 10-Yr futures down 11.5/32 at 113-3 (L: 112-24.5 / H: 113-16.5)

- Sep 30-Yr futures down 11/32 at 127-14 (L: 126-26 / H: 128-01)

- Sep Ultra futures down 7/32 at 136-21 (L: 135-25 / H: 137-08)

US 10YR FUTURE TECHS: (U3) Bear Threat Remains Present

- RES 4: 115-19 High May 18

- RES 3: 115-00 High Jun 1 and a key resistance

- RES 2: 114-06+ / 114-23 High Jun 6 / 50-day EMA

- RES 1: 114-00 High Jun 13

- PRICE: 113-00 @ 1445 ET Jun 16

- SUP 1: 112-12+ Low Jun 14

- SUP 2: 112-00 Low Mar 10

- SUP 3: 111-14+ Low Mar 9

- SUP 4: 110-27+ Low Mar 2 and key support

Treasury futures remain in a downtrend and this week’s move lower confirmed a resumption of the trend. Support at 112-29+, the May 26 / 30 low has been cleared. This signals scope for the 112-00 handle, the Mar 10 low. Further out, bearish price action suggests scope for a move towards 110-27+, the Mar 2 low and a key support. Short-term gains are considered corrective. Initial firm resistance is at 114-00, the Jun 13 high.

SOFR FUTURES CLOSE

- Jun 23 -0.010 at 94.785

- Sep 23 -0.015 at 94.695

- Dec 23 -0.025 at 94.820

- Mar 24 -0.065 at 95.115

- Red Pack (Jun 24-Mar 25) -0.115 to -0.09

- Green Pack (Jun 25-Mar 26) -0.11 to -0.09

- Blue Pack (Jun 26-Mar 27) -0.075 to -0.05

- Gold Pack (Jun 27-Mar 28) -0.045 to -0.035

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.01430 to 5.07629 (-.06141/wk)

- 3M -0.00933 to 5.20684 (-.04254/wk)

- 6M +0.00084 to 5.28937 (+.00326/wk)

- 12M +0.01092 to 5.23032 (+.08215/wk)

US DOLLAR LIBOR: Latest settlements:

- O/N -0.01100 to 5.06514%

- 1M +0.01028 to 5.15657%

- 3M -0.00371 to 5.51000 */**

- 6M +0.03757 to 5.66600%

- 12M -0.00186 to 5.87700%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.54443% on 6/9/23

- Daily Effective Fed Funds Rate: 5.07% volume: $128B

- Daily Overnight Bank Funding Rate: 5.06% volume: $292B

- Secured Overnight Financing Rate (SOFR): 5.06%, $1.527T

- Broad General Collateral Rate (BGCR): 5.04%, $630B

- Tri-Party General Collateral Rate (TGCR): 5.04%, $604B

- (rate, volume levels reflect prior session)

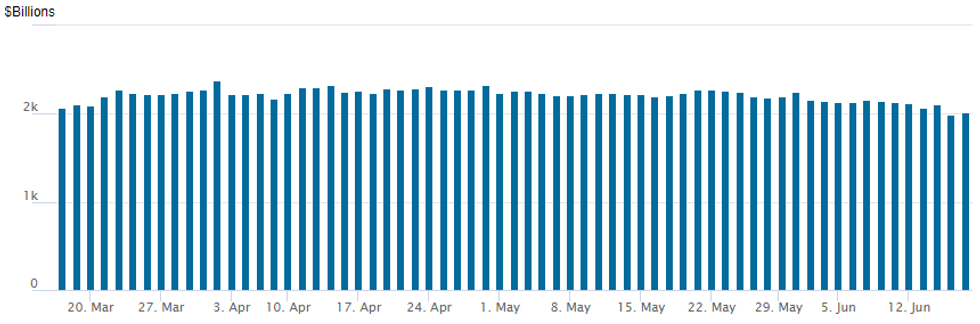

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage back of $2T after falling below the number for first time since June 2, 2022 yesterday. Current figure $2,011.556B w/ 104 counterparties, compared to $1,992.140B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

US: The decline in the overnight reverse repo facility this week is clearly linked to take-up of rising Fed bill issuance - but there may be obscuring short-term factors at play.

- The $117B fall in ON RRP yesterday brought the total below $2T for the first time since April 2022 and marked a $262B fall in the month so far.

- The Treasury's General Account (TGA) at the Fed meanwhile is up $86B over the same period.

- With net bill issuance nearing $200B so far in June, the data suggest that the "benign" scenario for reserve scarcity may be playing out, with bill purchases being made from funds parked at the ON RRP facility, rather than being siphoned off from bank reserves.

- However, JPMorgan points out that there could be seasonal factors at play, with a similar drawdown in ON RRP on June 15 in 2021 and 2022 ($74B in 2021 and $61B in 2022). That coincides with the tax deadline when money market fund assets tend to decline. As such, ON RRP's drop may be somewhat exaggerated, and could rebound in the subsequent days.

- However, the overall trend is still almost certainly lower.

PIPELINE

- Date $MM Issuer (Priced *, Launch #)

- 06/16 No new issuance Friday after only $8.675B total priced on the week

- $1.075B Priced Thursday

- 06/15 $575M *Peco Energy WNG 10Y +150a

- 06/15 $500M *Bank of China NY 3Y +45

EGBs-GILTS CASH CLOSE: Peripheries End Week On A High Note

The German curve bull flattened Friday with the UK's bear flattening.

- BTP spreads led periphery tightening, falling 6bp on the day to the lowest in over a year. Greece was not far behind.

- This came amid a risk-on move more broadly (European equities gained on the day), but also as ECB hike pricing was relatively flat on the day as traders assessed Thursday's communications added to today's largely hawkish speakers (incl Holzmann, Runsch, Rehn, Villeroy).

- The morning saw Gilts outperforming as an BOE/Ipsos inflation attitudes survey showed expectations falling back, but UK yields resumed their march higher in the afternoon.

- The short-end/belly underperformed with attention turning to the Bank of England decision next week, which comes a day after a seemingly crucial UK CPI reading. BoE hike pricing was pulled back slightly Friday (3-4bp) to end a hawkish week, but 25bp is still 100% priced for next Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.3bps at 3.123%, 5-Yr is down 2.3bps at 2.582%, 10-Yr is down 3bps at 2.474%, and 30-Yr is down 3.4bps at 2.546%.

- UK: The 2-Yr yield is up 3.8bps at 4.945%, 5-Yr is up 3.9bps at 4.574%, 10-Yr is up 2.8bps at 4.412%, and 30-Yr is up 2.3bps at 4.525%.

- Italian BTP spread down 6.3bps at 156.3bps / Greek down 5.1bps at 130.6bps

FOREX: USDJPY Approaches 142.00 Into The Close, Rising 1.10%

- Higher US yields and no surprises from the Bank of Japan continued to pressure the Japanese yen on Friday with USDJPY rising to a fresh trend high of 141.89 approaching the week’s close. This helped the USD index edge a little higher, stemming the significant overall pressure on the greenback in the aftermath of Wednesday’s FOMC decision.

- Price action extends USDJPY’s intra-day rally to 1.10% as of writing, and the week’s advance to around 1.75%. Yen weakness was initially fuelled by the overnight unchanged decision from the Bank of Japan. As a reminder, the board on Friday decided unanimously to keep yield curve control policy and pledged to continue patiently with monetary easing amid high economic and financial market uncertainty. The BOJ also kept the forward guidance for the policy rates and pledged to take additional easing measures if necessary.

- The USDJPY trend condition remains bullish and attention remains on key resistance at the top of a bull channel drawn from the Jan 16 low, which has now been pierced at 141.45. A sustained break of this hurdle would be bullish and open 142.25 the high on Nov 21, 2022.

- Additionally, EURJPY has traded sharply higher as this week’s bull run extended and sees the pair print as high as 155.22. Price has recently cleared key resistance at 151.61, the May 2 high and an important bull trigger for the pair, confirming a resumption of the longer-term uptrend.

- A generally optimistic tone for risk has supported the likes of GBP and CAD, the best performers in G10 on Friday. As a reminder, GBP strength comes hot on the heels of stronger-than-expected UK jobs and wage data on Tuesday, which triggered the biggest selloff in short-dated Gilts in over 8 months. The more hawkish BOE pricing has been underpinning the whole move with the technical outlook for cable improving significantly on the breach of 1.2680 an important medium-term technical break.

- Juneteenth Independence Day holiday in the US on Monday should keep volatility contained. Highlights next week include UK CPI and flash Eurozone PMI. On the central bank slate, the Bank of England, Norges Bank and then SNB will decide on rates.

Monday-Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/06/2023 | 1100/1300 |  | EU | ECB Lane Fireside Chat | |

| 19/06/2023 | 1140/1340 |  | EU | ECB Schnabel at Euro50 Group Conference | |

| 19/06/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 19/06/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 20/06/2023 | 0115/0915 | *** |  | CN | Loan Prime Rate |

| 20/06/2023 | 0600/0800 | ** |  | DE | PPI |

| 20/06/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 20/06/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 20/06/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/06/2023 | 1030/0630 |  | US | St. Louis Fed's James Bullard | |

| 20/06/2023 | 1230/0830 | *** |  | US | Housing Starts |

| 20/06/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/06/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/06/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.