-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Fed Remains Wary of Lingering Inflation

- MNI INTERVIEW: Fed Could Cut By May, Inflation Lingers-Kaplan

- MNI INTERVIEW2: Fed Assets To Settle Near USD7T Post QT-Kaplan

- MNI INTERVIEW: US Service Growth Resilient, Prices Too - ISM

- MNI FED: Kashkari Says Fed Can Be Patient With Rate Cut

- MNI UFED: Fed's Goolsbee Says Rates On Normalization Path

- MNI FED: Fed’s Bostic Says Workforce Rebound Helping On Inflation

- MNI SLOOS – Standards Tighten Further But Notably Less Than Recently

- MNI US DATA: ISM Services Stronger Than Expected Across All Items, Especially Prices

US

FED INTERVIEW (MNI): Fed Could Cut By May, Inflation Lingers-Kaplan

Federal Reserve officials will wait until May or later to begin cutting interest rates because they’ll want to see more benign inflation figures before kickstarting a monetary easing cycle, former Dallas Fed President Robert Kaplan told MNI. “They need to see continuing evidence that the improvement in inflation is going to be durable and sustainable. It’s prudent to take a little more time,” Kaplan said in an interview. “I still haven’t ruled out that this could happen in May if you get continued inflation reports that suggest progress.”

FED INTERVIEW2 (MNI): Fed Assets To Settle Near USD7T Post QT-Kaplan

The Federal Reserve’s balance sheet is likely to stabilize at around USD7 trillion when it finally terminates its QT program, a major increase from pre-pandemic levels that reflects the central bank’s increasing involvement in the functioning of money markets, former Dallas Fed President Robert Kaplan told MNI.

“The Fed has got a much bigger footprint – it’s very much in the plumbing of interbank lending markets,” Kaplan said. “My guess is they’ll have a hard time running the balance sheet much below USD7 trillion, with a dramatically larger balance sheet – much larger than GDP growth. This time, the balance sheet just got a lot bigger, but because of the plumbing implications they may not have a choice.”

NEWS

US FED (MNI): Kashkari Says Fed Can Be Patient With Rate Cut. Minneapolis Federal Reserve President Neel Kashkari said Monday that the FOMC can be patient with loosening monetary policy in part because the neutral interest rate may be higher than thought, in comments which put an official who at times has expressed some off-consensus views more in line with Chair Jerome Powell.

US FED (MNI): Fed's Goolsbee Says Rates On Normalization Path

U.S. interest rates are set to come down this year if inflation reports stay as good as they've been over the past several months, Chicago Fed President Austan Goolsbee said Monday. "We've had seven months of really quite good inflation reports right around or even below the Fed's target. So if we just keep getting more data like what we have gotten, we should well be on the path to normalization," Goolsbee told Bloomberg Television in an interview.

US FED (MNI): Fed’s Bostic Says Workforce Rebound Helping On Inflation

A recovery in the U.S. labor force has contributed to a faster-than-expected decline in inflation, Atlanta Fed President Raphael Bostic said Monday, in a speech that did not directly address the outlook for monetary policy. “More recently, the surprises in labor force participation have been to the upside. For example, women have returned to the labor market in force, and have enjoyed some of their highest participation rates in U.S. history,” Bostic said in prepared remarks.

US INTERVIEW (MNI): US Service Growth Resilient, Prices Too - ISM

Activity in the U.S. service sector expanded sharply in January and is likely to sustain the current pace in coming months, that could help fuel ongoing price pressures that will make it hard for the Federal Reserve to cut interest rates, Institute for Supply Management chair Anthony Nieves told MNI Monday.

US (MNI): Biden Administration Officials To Travel To China For Economic Talks

New York Times reporting that a high-level Biden administration delegation of Treasury Department officials will travel to Beijing, China this week for a series of economic talks with Chinese officials, understood to be the first meeting of a US-China economic working group formed in September last year.

US (MNI): Ukraine Aid Hangs In Balance As Republicans Line Up Against Border Bill

The future of continued aid to Ukraine appear even more uncertain after a raft of rank-and-file Republicans lawmakers have issued statements in opposition to the US-Mexico border security bill, unveiled yesterday by Senate negotiators.

SECURITY (MNI): Blinken In Middle East For Fifth Trip To Region Since Outbreak Of War

US Secretary of State Antony Blinken has arrived in Riyadh, Saudi Arabia for his fifth trip to the Middle East since the outbreak of the war between Israel and Hamas.

US TSYS Fed Speakers Continue to Temper Mkts Rate Cut Expectation

- Tsys under pressure all day with Mar'24 10Y futures at 110-25 (-28) - pre-Dec FOMC levels as 10Y yield climbs to 4.1637%. Carry over weakness after Fed Chairman Powell's 60 Minutes interview on Sunday underscored more cautious view re: rate cuts: "IT'S UNLIKELY FED WILL HAVE CONFIDENCE TO CUT IN MARCH ... FOMC RATE FORECASTS LIKELY NOT CHANGED MUCH SINCE DEC" Bbg.

- Fed speakers towed the line Monday, MN Fed President Kashkari re: rate cuts, Fed has time to assess before doing so, economic data is not "unambiguously positive".

- Tsy futures extended lows after stronger than expected ISM Services across all items, especially prices. ISM Services bounced more than expected in January to 53.4 (cons 52.0) after 50.5 in Dec – joint highest since Sept. Prices paid far stronger than expected 64.0 (cons 56.7) after 56.7 – highest since Feb’23 after the strongest monthly increase since mid-2012. It builds on a +7.7pt jump in manufacturing prices paid to the highest since Apr’23.

- As a result, projected rate cut chances continued to retreat: March 2024 chance of 25bp rate cut currently -16.4% vs. -18.3% this morning w/ cumulative of -4.1bp at 5.283%, May 2024 at -56.2% vs. -57.1% w/ cumulative -19.1bp at 5.133%, while June 2024 -81.9% from -82.4% (105% pre-NFP for comparison) w/ cumulative -39.6bp at 4.930%. Fed terminal at 5.32% in Feb'24.

- Tuesday focus: no data, but several Fed speakers are scheduled: Cleveland Fed Mester economic outlook at 1200ET, MN Fed Kashkari moderated Q&A, livestreamed at 1300ET, Boston Fed Collins open remarks labor conference, livestreamed, no Q&A at 1400ET, Philly Fed Harker on Fed role in the economy, text, Q&A at 1900ET.

OVERNIGHT DATA

US DATA (MNI): ISM Services Stronger Than Expected Across All Items, Especially Prices. ISM Services bounced more than expected in January to 53.4 (cons 52.0) after 50.5 in Dec – joint highest since Sept. Prices paid far stronger than expected 64.0 (cons 56.7) after 56.7 – highest since Feb’23 after the strongest monthly increase since mid-2012. It builds on a +7.7pt jump in manufacturing prices paid to the highest since Apr’23.

US DATA (MNI): PMI Revised Lower, Softest Charge Inflation Since May 2020. S&P Global service and composite PMIs were revised down in the final January print. Within the details, only a marginal rise in services output prices led to the weakest increase in overall charge inflation since May 2020. Full release here.

- Services: 52.5 in Jan final (flash 52.9) from 51.4 in Dec

- Composite: 52.0 in Jan final (flash 52.3) from 50.9 in Dec

FED SLOOS (MNI): Standards Tighten Further But Notably Less Than Recently

Lending standards continue to tighten, but a softer pace than in the October survey almost completely across the board at. Commercial & industrial and CRE in particular see a moderation in the pace of tightening, with the lowest readings since mid-2022 for C&I and mid-to-late 2022 for CRE.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA down 186.06 points (-0.48%) at 38466.97

- S&P E-Mini Future down 4.5 points (-0.09%) at 4975.75

- Nasdaq up 1.7 points (0%) at 15630.75

- US 10-Yr yield is up 14 bps at 4.1598%

- US Mar 10-Yr futures are down 28/32 at 110-25

- EURUSD down 0.0045 (-0.42%) at 1.0743

- USDJPY up 0.32 (0.22%) at 148.7

- WTI Crude Oil (front-month) up $0.52 (0.72%) at $72.80

- Gold is down $13.7 (-0.67%) at $2026.06

- European bourses closing levels:

- EuroStoxx 50 up 0.72 points (0.02%) at 4655.27

- FTSE 100 down 2.68 points (-0.04%) at 7612.86

- German DAX down 14.15 points (-0.08%) at 16904.06

- French CAC 40 down 2.3 points (-0.03%) at 7589.96

US TREASURY FUTURES CLOSE

- 3M10Y +13.032, -123.052 (L: -136.28 / H: -121.892)

- 2Y10Y +3.78, -31.041 (L: -37.329 / H: -29.744)

- 2Y30Y +2.078, -12.784 (L: -20.567 / H: -10.907)

- 5Y30Y -1.614, 22.105 (L: 17.786 / H: 24.414)

- Current futures levels:

- Mar 2-Yr futures down 6/32 at 102-11.125 (L: 102-10.25 / H: 102-16.75)

- Mar 5-Yr futures down 17.25/32 at 107-10 (L: 107-08 / H: 107-26.75)

- Mar 10-Yr futures down 27.5/32 at 110-25.5 (L: 110-22.5 / H: 111-21.5)

- Mar 30-Yr futures down 1-26/32 at 120-3 (L: 119-30 / H: 121-31)

- Mar Ultra futures down 2-17/32 at 126-14 (L: 126-08 / H: 128-31)

US 10Y FUTURE TECHS: (H4) Sell-Off Firmer Through Bear Trigger

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 111-24/113-06+ 20-day EMA / High Feb 1

- PRICE: 110-27+ @ 1410 ET Feb 5

- SUP 1: 110-22+ Intraday Low

- SUP 2: 110-16 Low Dec 13

- SUP 3: 109-31+ Low Dec 11 and a key short-term support

- SUP 4: 109-17 50.0% of the Oct 19 - Dec 27 bull phase

Treasuries extended the Friday sell off across Monday trade, pushing futures pieces to new pullback lows of 110-22+ - below the bear trigger of 110-26. The move lower defines an initial key resistance at 113-06+, the Feb 1 high, where a break is required to reinstate a bullish theme and expose the bull trigger at 113-12, the Dec 27 high. On the downside, a continuation lower would strengthen the bearish threat and expose 110-16, the Dec 13 low.

SOFR FUTURES CLOSE

- Mar 24 -0.030 at 94.770

- Jun 24 -0.065 at 95.120

- Sep 24 -0.090 at 95.505

- Dec 24 -0.110 at 95.845

- Red Pack (Mar 25-Dec 25) -0.14 to -0.125

- Green Pack (Mar 26-Dec 26) -0.14 to -0.135

- Blue Pack (Mar 27-Dec 27) -0.135 to -0.13

- Gold Pack (Mar 28-Dec 28) -0.135 to -0.13

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M +0.00038 to 5.32249 (-0.01436 total last wk)

- 3M +0.02567 to 5.31613 (-0.02697 total last wk)

- 6M +0.09044 to 5.18654 (-0.06130 total last wk)

- 12M +0.16653 to 4.85933 (-0.10618 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.00), volume: $1.849T

- Broad General Collateral Rate (BGCR): 5.31% (+0.00), volume: $689B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.00), volume: $676B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.01), volume: $270B

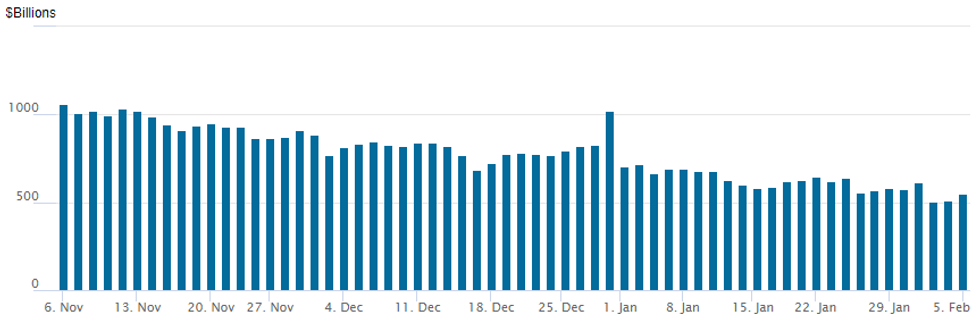

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage rebounds to $552.289B vs. $513.422B on Friday - the lowest level since mid-2021. Compares to recent cycle low of $503.548B on Thursday, February 1.

- Meanwhile, the number of counterparties holds steady at 80 from 74 last Thursday (compares to 65 on January 16, the lowest since July 7, 2021).

PIPELINE: $17.725B Corporate Debt to Price Monday

- Date $MM Issuer (Priced *, Launch #

- 2/5 $4.5B #Cigna $1B +5Y +90, $750M +7Y +100, $1.25B 10Y +110, $1.5B 30Y +125

- 2/5 $3B #Texas Instruments $650M 3Y+35, $650M 5Y+50, $100M 10Y+70, $750M 30Y+85, $350M 39Y+92

- 2/5 $2.55B #GM Financial $1.2B 3Y +115, $350M 3Y SOFR+135, $1B 7Y +165

- 2/5 $2B #Starbucks $1B 3Y +60, $500M 7Y +80, $500M 10Y +90

- 2/5 $1.5B *ERAC Finance $750M 5Y +90, $750M +10Y +105

- 2/5 $1.5B #Morgan Stanley 15NC10 +180

- 2/5 $1.175B #Becton Dickinson $625M 5Y +75, $550M 10Y +95

- 2/5 $1B #Deutsche Bank 4NC3 +145

- 2/5 $500M *Cencora WNG 10Y +98

- 2/5 $Benchmark Paraguay 7Y 8%a, 12Y 6.25%a

- 2/5 $Benchmark Couche-Tard 10Y, 30Y investor calls

- 2/5 $1.5B Ardonagh $500M 7NC3, $1B 8NC3 investor calls

- 2/5 $Benchmark Bahrain 7Y Sukuk, 12Y Bond investor calls

- Expected Tuesday:

- 2/6 $Benchmark EIB 10Y SOFR+52a

- 2/6 $Benchmark KDB 3Y SOFR+69a, 5Y SOFR+80a

- 2/6 $Benchmark Export Development Canada 5Y SOFR+43a

EGBs-GILTS CASH CLOSE: US-Driven Selloff Continues

Carrying on from last week's theme, upside surprises in US data saw German and UK yields rise sharply Monday.

- German /UK 10Y yields are up 16.7bp/26.2bp respectively in the past two sessions.

- The sell-off has been largely driven by the strong US payrolls Friday and today's upside surprise in US ISM Services price/activity metrics, along with hawkishly-perceived comments by Federal Reserve officials.

- European data was inconsequential, with final Europe Services PMIs in line with final.

- The German curve closed bear steeper with the UK's fairly flat, with 2Y through 10Y yields up in parallel by around 9bp.

- Periphery EGB spreads fell marginally, mostly mirroring the uptick in Eurozone equities as the euro fell against the USD.

- The early highlight Tuesday is German factory orders.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.4bps at 2.613%, 5-Yr is up 7.1bps at 2.237%, 10-Yr is up 7.5bps at 2.316%, and 30-Yr is up 8.1bps at 2.52%.

- UK: The 2-Yr yield is up 8.8bps at 4.509%, 5-Yr is up 8.9bps at 3.998%, 10-Yr is up 8.9bps at 4.007%, and 30-Yr is up 6.5bps at 4.617%.

- Italian BTP spread down 0.7bps at 156.8bps / Spanish down 1.5bps at 91.2bps

FOREX USD Index Extends Advance Amid Further Hawkish Fed Re-Pricing

- Further hawkish re-pricing in the US extended on Monday, assisting further greenback strength following Friday’s above-estimate payrolls report. This prompted the USD index (+0.47%) to briefly trade at the highest level since Nov 14 at 104.60.

- Initial weakness for equities weighed on the likes of AUD and EUR, although GBP is the weakest performing major currency to start the week.

- GBPUSD traded sharply lower Friday and extended the pullback through Monday trade. The pair has breached support at 1.2597, the Jan 17 low and the base of a range that has been in place since mid-January. A clear range breakout would strengthen a bearish condition and pave the way for weakness towards 1.2500, the Dec 13 low.

- Focus is also on AUD, as we approach the overnight decision from the RBA, where the central bank is unanimously expected to leave rates unchanged at 4.35%. The meeting statement is likely to acknowledge the softer data but sound cautious pointing out that the inflation fight has not yet been won and that significant uncertainties persist.

- From a trend perspective, a bearish theme in AUDUSD continues to dominate and the latest sell-off reinforces this condition. The break to fresh cycle lows last week confirms a resumption of the downtrend and signals scope for weakness towards 0.6453, the Nov 17 low.

- Perhaps surprisingly given its continued sensitivity to core rates the Japanese yen is not among the poorest performers in G10 on Monday, as the early weakness for major equity indices likely weighed on Cross/JPY. However, USDJPY’s impressive rally in the aftermath of the US data did briefly extend to a new 2024 high of 148.89, before moderating 30 pips lower ahead of the APAC crossover.

- The trend outlook is unchanged and remains bullish, with bulls next focused on 149.16, a Fibonacci retracement. For reference, notable levels further out include 149.75 and 150.78, the November 22 and 17 highs respectively.

- German factory orders, UK construction PMI and Eurozone retail sales highlight the European docket on Tuesday.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/02/2024 | 0001/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 06/02/2024 | 0030/1130 | *** |  | AU | Retail trade quarterly |

| 06/02/2024 | 0330/1430 | *** |  | AU | RBA Rate Decision |

| 06/02/2024 | 0700/0800 | ** |  | DE | Manufacturing Orders |

| 06/02/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 06/02/2024 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 06/02/2024 | 0900/1000 | ** |  | EU | ECB Consumer Expectations Survey |

| 06/02/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/02/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/02/2024 | 1200/1200 |  | UK | Asset Purchase Facility Quarterly Report | |

| 06/02/2024 | 1330/0830 | * |  | CA | Building Permits |

| 06/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 06/02/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/02/2024 | 1700/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 06/02/2024 | 1745/1245 |  | CA | BOC Governor speech/press conference in Montreal | |

| 06/02/2024 | 1800/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 06/02/2024 | 1800/1300 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/02/2024 | 1900/1400 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 2145/1045 | *** |  | NZ | Quarterly Labor market data |

| 06/02/2024 | 0000/1900 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.