-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Focus on Nov 2 FOMC

EXECUTIVE SUMMARY

US

FED: The November FOMC meeting is mainly about the message the Fed wants to send about its plans for December.

- A 4th consecutive 75bp hike is assured this time. A step-down to a 50bp hike at the following meeting looks like the path of least resistance for now – the question is, how strongly does the FOMC seek to express that view.

- In a close call, we expect only limited changes to the Statement – but anticipate that Chair Powell will signal that the Committee is currently eyeing either 50bp or 75bp in December, with the decision to be data-dependent.

FED: Federal Reserve officials are considering when to start slowing the pace of rate hikes from 75 basis points per meeting, but Chair Jerome Powell will be reluctant to lock in such an outcome for December at his press conference next week, former Fed officials and a current outside adviser told MNI.

- The Fed will be conscious that upside surprises to inflation and employment between now and the Dec 13-14 meeting could still necessitate another 75bp hike before the year is out, they noted.

- "Jay Powell has some scope for telegraphing a December slowing. But he can only go so far. He's speaking for the committee and he can't get too far ahead of the committee before the December meeting," former Atlanta Fed President Dennis Lockhart said in an interview. For more see MNI Policy main wire at 1222ET.

CANADA

BOC: The Bank of Canada must be cautious about further rate hikes that could torpedo the economy after already misreading the early pandemic rebound, a Senate Banking Committee member who will question Governor Tiff Macklem at a hearing Tuesday told MNI.

- “We want to ensure that his policy objective is not to drive the economy into the ground where we’ve got massive unemployment and it creates a lot of grief for people,” Senator Hassan Yussuff said in an interview Friday. “There is a worry among people that the aggressiveness at which the Bank has increased rates is going to do some severe damage if we’re not cautious.” Foe more see MNI Policy main wire at 1449ET.

CANADA: PM Trudeau has announced further measures to support Ukraine today, including the issuance of 5Y Ukraine Sovereignty Bonds.

- "The equivalent proceeds from this five-year bond will be channeled directly to Ukraine through the International Monetary Fund's (IMF) Administered Account" in order to "help the government continue operations, including providing essential services to Ukrainians, like pensions, and purchasing fuel before winter."

- "This builds on the Government of Canada's $2 billion in financial assistance to Ukraine this year"

- Official press release

Tsy Yields Grind Higher, Focus on Next Week's FOMC

Tsys remain weaker after the bell - near early session lows after some choppy first half trade. Tsys bounced after latest Employment Cost Index came out in-line w/ estimates at 1.2% (1.3% prior) but with a relatively larger moderation in private sector wages within, PCE in-line as well at +0.4%. (down-revision to core PCE weaker than expected but was all rounding).

- Futures reverse course, extend lows following 10Y Block sale at 0836:03: -8,700 TYZ2 111-05.5, sell through 111-07 post-time bid.

- Protracted round of support followed, yields fell from 4.1681% high to 4.0791% low in lead-up to U-Mich sentiment (1Y inflation exp up to 5% from 4.7% prior) while Much weaker than expected pending home sales in Sept (-10% M/M vs cons -4.0%), suggesting the slide in existing home sales isn't done yet.

- Tsy gradually retreated from midmorning highs through the second half with no obvious headline driver as 30YY climbed back around 4.1287%, yield curves bear flattening (2s10s -5.893 at -42.050).

- Deferred Eurodollar calendar spds extend inversion to new cycle lows this morning: indicating a larger ease in current hikes over the latter half of 2023: Mar'23/Jun'23 -0.095; Dec'22/Red Dec'23 at -0.415, Mar'23/Red Mar'24 at -0.725, Jun'23/Red Jun'24 at -0.815.

OVERNIGHT DATA

- US SEP PERSONAL INCOME +0.4%; NOM PCE +0.6%

- US SEP PCE PRICE INDEX +0.3%; +6.2% Y/Y

- US SEP CORE PCE PRICE INDEX +0.5%; +5.1% Y/Y

- US SEP UNROUNDED PCE PRICE INDEX +0.333%; CORE +0.451%

- US Q3 EMPL COST INDEX 1.2% V Q2 1.3%

- US Q3 EMPL COST INDEX Y/Y 5% V Q2 5.1%

- US Q3 BENEFIT PAYMTS 1% V Q2 1.2%; Q3 Y/Y 4.9%(Q2 4.8%)

- US: The Employment Cost Index, the broadest measure of U.S. labor costs, rose 1.2% last quarter after gaining 1.3% in the April-June period, the Labor Department said on Friday.

- The year-on-year rate eased to 5.0% from 5.1% in the previous quarter. Wages and salaries rose 1.3% after shooting up 1.4% in the previous quarter, and were up 5.1% year-on-year. Benefits gained 1.0% after rising 1.2%% in the prior quarter, and were up 4.9% over the 12-month period.

- The ECI is widely viewed by policymakers and economists as one of the better measures of labor market slack and a predictor of core inflation, as it adjusts for composition and job-quality changes. Current and former Fed officials are looking for nominal wages to cool to around 3.25% to 3.5%.

- US NAR SEP PENDING HOME SALES INDEX 79.5 V 88.5 IN AUG

- US NAR SEP PENDING HOME SALES -10.2% MOM; -31.0% YOY

- MICHIGAN OCT. CURRENT CONDITIONS AT 65.6 FROM 59.7 - bbg

- MICHIGAN OCT. 5-YR EXPECTED INFLATION AT 2.9% FROM 2.7%

- MICHIGAN OCT. 1-YR EXPECTED INFLATION AT 5% FROM 4.7% - bbg

- CANADIAN AUG GDP 0.1% VS 0.0% EXPECTED

- CANADA FLASH Q3 GDP +1.6% ANNUALIZED

- CANADA YOY GROSS DOMESTIC PRODUCT +4.0%

- CANADA FLASH ESTIMATE SEPT MOM GDP +0.1%

- CANADA AUG GROSS DOMESTIC PRODUCT +0.1% MOM

- CANADA AUG GOODS INDUSTRY GDP -0.3%, SERVICES +0.3%

- CANADA REVISED JUL GROSS DOMESTIC PRODUCT +0.1% MOM

MARKETS SNAPSHOT

Key late session market levels:

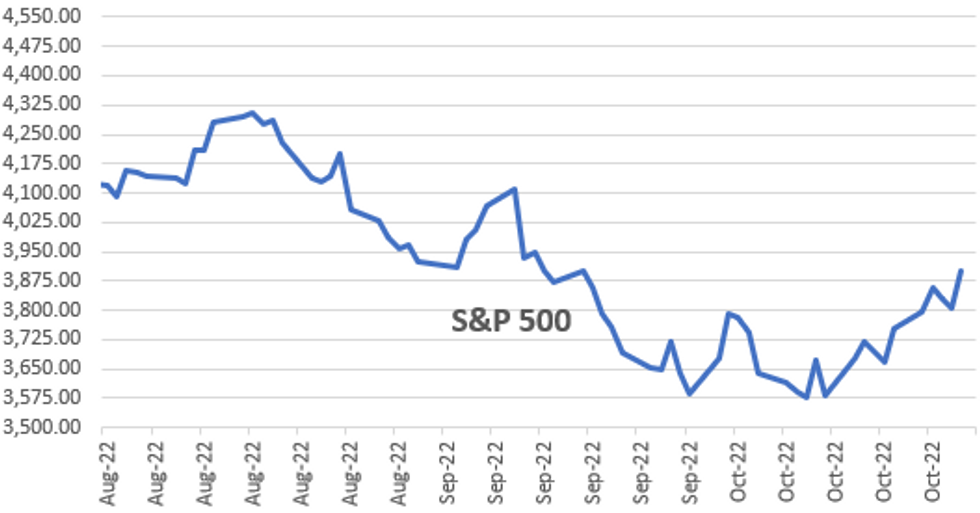

- DJIA up 811.21 points (2.53%) at 32847.13

- S&P E-Mini Future up 89 points (2.33%) at 3908.75

- Nasdaq up 288 points (2.7%) at 11081.52

- US 10-Yr yield is up 9.2 bps at 4.0102%

- US Dec 10Y are down 22.5/32 at 110-31.5

- EURUSD down 0.0005 (-0.05%) at 0.9959

- USDJPY up 1.12 (0.77%) at 147.41

- WTI Crude Oil (front-month) down $1.09 (-1.22%) at $87.99

- Gold is down $20.06 (-1.21%) at $1643.33

- EuroStoxx 50 up 8.51 points (0.24%) at 3613.02

- FTSE 100 down 26.02 points (-0.37%) at 7047.67

- German DAX up 32.1 points (0.24%) at 13243.33

- French CAC 40 up 29.02 points (0.46%) at 6273.05

US TSY FUTURES CLOSE

- 3M10Y +3.958, -9.942 (L: -14.924 / H: -2.757)

- 2Y10Y -5.687, -41.844 (L: -43.081 / H: -34.721)

- 2Y30Y -9.662, -29.368 (L: -31.131 / H: -17.716)

- 5Y30Y -8.018, -5.886 (L: -7.618 / H: 3.67)

- Current futures levels:

- Dec 2Y down 6.75/32 at 102-10.875 (L: 102-10.125 / H: 102-21.25)

- Dec 5Y down 15/32 at 106-28 (L: 106-25 / H: 107-18.25)

- Dec 10Y down 21.5/32 at 111-00.5 (L: 110-25.5 / H: 111-30)

- Dec 30Y down 1-04/32 at 121-07 (L: 120-29 / H: 122-20)

- Dec Ultra 30Y down 1-04/32 at 129-08 (L: 128-19 / H: 130-22)

US 10YR FUTURES TECHS: (Z2) Pulls Back From Thursday’s High

- RES 4: 113-09+ 50-day EMA

- RES 3: 112-22+ High Oct 6

- RES 2: 112-00 Round number resistance

- RES 1: 111-31 High Oct 27

- PRICE: 111-02+ @ 1400ET Oct 28

- SUP 1: 110-16 Low Oct 26

- SUP 2: 109-20/108-26+ Low Oct 25 / 21 and the bear trigger

- SUP 3: 108-06+ Low Oct 2007 (cont)

- SUP 4: 107.04 3.0% 10-dma envelope

Treasuries traded higher Thursday, extending recent gains. Despite the latest bull cycle, the primary trend remains down. MA studies are in a bear mode position and a broader price sequence of lower lows and lower highs is intact. The contract edged lower Friday and a stronger resumption of weakness would signal the end of the recent correction and refocus attention on 108-26+, the Oct 21 low. Initial resistance is at 111-31, Thursday’s high.

US EURODOLLAR FUTURES CLOSE

- Dec 22 -0.060 at 94.930

- Mar 23 -0.10 at 94.825

- Jun 23 -0.140 at 94.890

- Sep 23 -0.145 at 95.090

- Red Pack (Dec 23-Sep 24) -0.14 to -0.135

- Green Pack (Dec 24-Sep 25) -0.13 to -0.125

- Blue Pack (Dec 25-Sep 26) -0.13 to -0.12

- Gold Pack (Dec 26-Sep 27) -0.12 to -0.095

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00057 to 3.06386% (-0.01786/wk)

- 1M +0.01385 to 3.76771% (+0.18214/wk)

- 3M +0.02486 to 4.43957% (+0.08114/wk) * / **

- 6M +0.00257 to 4.93086% (+0.05586/wk)

- 12M -0.00343 to 5.36900% (-0.10657/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.43957% on 10/28/22

- Daily Effective Fed Funds Rate: 3.08% volume: $103B

- Daily Overnight Bank Funding Rate: 3.07% volume: $286B

- Secured Overnight Financing Rate (SOFR): 3.04%, $973B

- Broad General Collateral Rate (BGCR): 3.00%, $406B

- Tri-Party General Collateral Rate (TGCR): 3.00%, $387B

- (rate, volume levels reflect prior session)

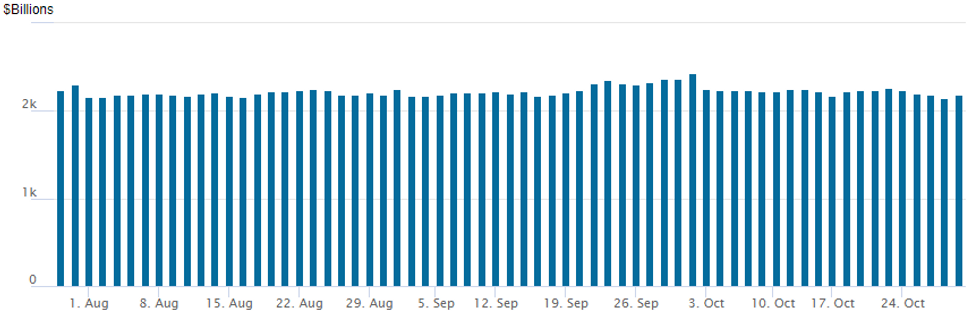

FED Reverse Repo Operation

NY Federal REeserve/MNI

NY Fed reverse repo usage rebounds to $2,183.290B w/ 99 counterparties vs. $2,152.485B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

PIPELINE: $2B Honeywell 3Pt Issuance, Launch

- Date $MM Issuer (Priced *, Launch #)

- 10/28 $2B #Honeywell $400M 2Y +40, $500M 5Y +75, $1.1B 10Y +110

- $7B Priced Thursday, $42.85B total for week

- 10/27 $5B *Barclays $1.5B 4NC3 +305, $1.5B 6NC5 +330, $2B 11NC10 +350

- 10/27 $2B *Goldman Sachs 2Y +137.5

- 10/27 $Benchmark FHLB 2Y +165a

FOREX: EURGBP Continues Bearish Grind Lower, JPY Consolidates Losses

- Despite the more optimistic price action across equity markets on Friday, the greenback has held onto gains with the USD index (+0.25%) extending on the prior day’s recovery. 111.135 resistance has held for now and the index has moderated a little ahead of the close.

- The Bank of Japan rate decision came and went with little surprise, with Governor Kuroda doubling down on policy by stating that markets should not expect rate hikes or an exit from easy policy anytime soon. The JPY was the weakest G10 currency on Friday, helping put USD/JPY back around Y147.50, where price action consolidated for much of the US session.

- GBP has outperformed its major counterparts as markets continue to factor in a more benign political/fiscal backdrop in the UK under a Sunak government. GBP most notable in the crosses with GBPJPY advancing 1.22% as well as EURGBP continuing its grind lower throughout the week.

- A short-term bear threat remains present for EURGBP following the strong reversal from 0.9266, Sep 26 high, resulting in the break of a number of key short-term support levels and this suggests scope for an extension lower near-term with sights on 0.8559 next, a Fibonacci retracement. Key short-term resistance has been defined at 0.8867.

- Worth noting the daylight-saving time shift for the Uk and Europe over the weekend which will affect the time difference for US data and especially the Fed decision on Wednesday. The November FOMC meeting appears mainly about the message the Fed wants to send about its plans for December.

- Other central bank decisions for Australia and the UK underpin a busy week that culminates in the release of October US non-farm payrolls.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/10/2022 | - |  | BR | Brazil Second-Round Runoff Election | |

| 31/10/2022 | 0030/1130 | ** |  | AU | Retail Trade |

| 31/10/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/10/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 31/10/2022 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/10/2022 | 0730/0830 | ** |  | CH | retail sales |

| 31/10/2022 | 0800/0900 |  | ES | Retail Sales | |

| 31/10/2022 | 0900/1000 | *** |  | IT | GDP (p) |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE Lending to Individuals |

| 31/10/2022 | 0930/0930 | ** |  | UK | BOE M4 |

| 31/10/2022 | 1000/1100 | *** |  | EU | HICP (p) |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 31/10/2022 | 1000/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 31/10/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 31/10/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 31/10/2022 | 1500/1600 |  | EU | ECB Lane Speech at Danmarks Nationalbank Conference | |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/10/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 31/10/2022 | 1900/1500 |  | US | Treasury Financing Estimates | |

| 01/11/2022 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.